Hotel Lock Market Size

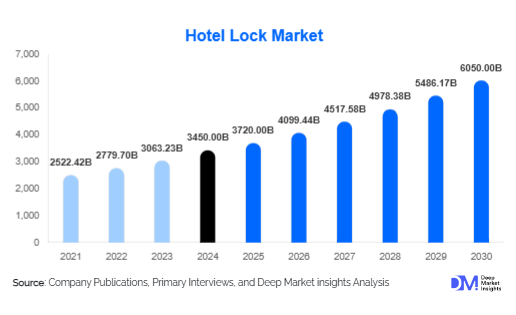

According to Deep Market Insights, the global hotel lock market size was valued at USD 3,450 million in 2024 and is projected to grow from USD 3,720 million in 2025 to reach USD 6,050 million by 2030, expanding at a CAGR of 10.2% during the forecast period (2025-2030). The hotel lock market growth is primarily driven by rising demand for secure, technology-driven access solutions, the adoption of IoT-enabled smart locks, and the increasing modernization of hospitality infrastructure across both developed and emerging economies.

Key Market Insights

- Smart hotel locks are rapidly replacing mechanical systems, driven by the hospitality sector’s focus on guest convenience, digital integration, and enhanced security.

- RFID and mobile-based hotel locks account for over 55% of deployments in 2024, supported by widespread adoption among mid- to high-end hotels.

- Luxury hotels lead demand for biometric and smartphone-enabled locks, creating opportunities for premium solutions with integrated digital ecosystems.

- Asia-Pacific is the fastest-growing market, with China and India experiencing large-scale hotel chain expansions and smart city investments.

- North America and Europe together represent over 50% of global market revenues, due to early technology adoption and stringent security regulations.

- Integration with property management systems (PMS) and IoT platforms is emerging as a key differentiator for lock manufacturers.

What are the latest trends in the hotel lock market?

IoT-Integrated Smart Locks

The hotel industry is moving rapidly toward IoT-integrated smart locks that seamlessly connect with cloud-based property management systems. These solutions allow for real-time monitoring, predictive maintenance, and guest-friendly digital check-in experiences. Mobile key technology, where guests use smartphones to unlock rooms, is gaining traction globally. This not only enhances operational efficiency for hotels but also reduces reliance on plastic keycards, aligning with sustainability goals. Hotels are also adopting analytics-driven platforms that monitor access data to improve security and optimize staffing.

Biometric and Contactless Solutions

The adoption of biometric hotel locks, particularly fingerprint and facial recognition systems, is rising across luxury properties. The COVID-19 pandemic accelerated demand for contactless guest experiences, pushing hoteliers to upgrade to keyless entry systems that reduce touchpoints. Biometric authentication provides both heightened security and a seamless user experience, aligning with growing consumer expectations for convenience. Increasing integration with mobile apps further extends control to guests, enabling them to customize access preferences or grant digital access to companions.

What are the key drivers in the hotel lock market?

Expansion of Global Hospitality Infrastructure

Rising investments in hotel construction, especially in Asia-Pacific, the Middle East, and Africa, are fueling demand for advanced hotel locking systems. Global tourism growth, coupled with government-backed hospitality projects, is encouraging new hotels to adopt smart lock systems from the ground up. Renovations of existing hotels in Europe and North America are also contributing to higher replacement demand for outdated locking solutions.

Growing Demand for Contactless and Mobile Access

Guest expectations for contactless experiences have significantly increased. Hotel operators are embracing smartphone-enabled locks and mobile apps that eliminate the need for physical keys or cards. This trend reduces operational costs associated with lost or demagnetized keycards while improving guest satisfaction. The added convenience of mobile integration is now a standard for mid-range and luxury hotels worldwide.

Enhanced Security Regulations and Standards

Governments and hotel associations are implementing stricter security protocols, compelling operators to upgrade to locks with advanced encryption, anti-cloning, and real-time monitoring. This is driving the adoption of RFID, biometric, and IoT-enabled hotel locks, especially in regions with high tourism volumes and heightened security risks.

What are the restraints for the global market?

High Upfront Costs of Smart Locks

The installation of biometric, RFID, or IoT-enabled smart locks requires substantial investment, particularly for large hotel chains with thousands of rooms. High upfront capital expenditure often deters budget hotels and smaller operators from adopting the latest systems. Additionally, integration costs with existing property management systems can increase overall expenses, slowing adoption in cost-sensitive markets.

Cybersecurity and Data Privacy Risks

While digital hotel locks provide convenience, they are vulnerable to hacking and unauthorized access if not properly secured. Concerns around guest data privacy, potential breaches, and cyberattacks pose a significant challenge. Manufacturers and hotel operators need to continually invest in secure encryption protocols and compliance frameworks, which adds complexity and cost.

What are the key opportunities in the hotel lock industry?

Emerging Demand in Asia-Pacific

Asia-Pacific is witnessing the fastest expansion of hotel infrastructure, particularly in China, India, and Southeast Asia. Government-backed tourism projects and rising middle-class travel are fueling new hotel developments, creating a strong opportunity for hotel lock manufacturers to expand their footprint. The adoption of mobile-based smart locks is expected to outpace traditional RFID systems in this region.

Integration with Smart Hospitality Ecosystems

The opportunity to integrate hotel locks with broader smart hospitality platforms is immense. Locks that sync with energy management systems, guest apps, and digital concierge services offer a comprehensive value proposition. This creates opportunities for technology partnerships between lock manufacturers, IoT companies, and hospitality software providers, enabling end-to-end guest experience management.

Green and Sustainable Lock Solutions

Growing environmental awareness is pushing hotels to adopt eco-friendly access systems. Smart locks that minimize the use of plastic keycards and utilize low-energy Bluetooth or RFID modules align with sustainability objectives. Manufacturers offering recyclable materials and energy-efficient lock systems are likely to attract eco-conscious hotels, especially in Europe and North America.

Product Type Insights

RFID locks dominate the global hotel lock market, accounting for nearly 40% of the market share in 2024. They are widely adopted due to their cost-effectiveness, ease of integration, and enhanced security compared to magnetic stripe locks. Mobile-based locks, while still emerging, are projected to grow at the fastest CAGR (over 13%) during 2025-2030, driven by rising smartphone penetration and demand for digital experiences. Biometric locks remain niche but are gaining traction in luxury hotels as part of premium guest offerings. Mechanical locks continue to decline, representing less than 10% of market share, as hotels modernize toward smart solutions.

Application Insights

Luxury hotels account for 35% of global revenues in 2024, as they prioritize premium guest experiences and advanced security systems. Mid-range hotels follow closely, increasingly adopting RFID and smartphone-enabled locks to improve operational efficiency and guest satisfaction. Budget hotels still rely on basic keypad or mechanical locks, but are beginning to explore cost-effective RFID solutions. Resorts and boutique hotels are focusing on aesthetic and tech-integrated locks that align with brand identity, offering differentiated guest experiences.

Distribution Channel Insights

Direct sales dominate, contributing nearly 45% of total revenues in 2024, as major hotel chains engage directly with OEMs for large-scale installations. Online platforms are gaining prominence, especially among independent and boutique hotels that seek flexibility in procurement. System integrators are increasingly playing a role in upgrading legacy systems, particularly in North America and Europe, where older infrastructure requires modernization.

| By Product Type | By Technology | By End-Use (Hotel Category) | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for 28% of global market revenues in 2024, led by the U.S. where hotel chains prioritize digital transformation and mobile integration. Replacement demand from older properties and strong adoption of IoT-based locks drive growth. Canada follows with steady adoption, particularly in luxury and resort hotels.

Europe

Europe contributes 24% of global revenues in 2024. Countries such as Germany, France, and the U.K. are leading adopters of smart lock systems due to strict security standards and strong tourism infrastructure. Scandinavia is emerging as a hub for sustainable lock adoption, emphasizing eco-friendly and digital-first guest experiences.

Asia-Pacific

Asia-Pacific is the fastest-growing region, projected to expand at a 12.5% CAGR during 2025-2030. China, India, and Japan are leading demand, driven by large-scale hotel construction and smart city initiatives. Southeast Asia and Australia also represent high-potential markets due to booming tourism sectors.

Latin America

Latin America is witnessing gradual adoption, led by Brazil and Mexico. Market growth is supported by rising international tourism and investments in resort infrastructure. However, budget constraints among smaller hotels limit widespread deployment of advanced lock systems.

Middle East & Africa

The Middle East, particularly the UAE and Saudi Arabia, is investing heavily in luxury hospitality projects, creating demand for biometric and IoT-enabled locks. Africa, led by South Africa and Kenya, is gradually modernizing hotel infrastructure, with mid-range hotels increasingly adopting RFID-based solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hotel Lock Market

- ASSA ABLOY Global Solutions

- Salto Systems

- Dormakaba Group

- Onity (Carrier Global)

- MIWA Lock Co.

- Allegion Plc

- Samsung SDS

- Be-Tech Asia Limited

- CISA (Ingersoll Rand)

- Godrej & Boyce

- SmartKey Systems

- Hune Hotel Lock

- KABA Ilco

- Keycard Lock Systems Inc.

- Digilock

Recent Developments

- In June 2025, ASSA ABLOY launched a new generation of IoT-based hotel locks with AI-driven access monitoring and predictive maintenance capabilities.

- In May 2025, Dormakaba announced a partnership with a leading property management software provider to integrate smart locks with cloud-based hotel management systems.

- In March 2025, Salto Systems expanded its mobile access solutions in Asia-Pacific, targeting mid-range hotels in India and Southeast Asia.