Hot Dog Roller Grills Market Size

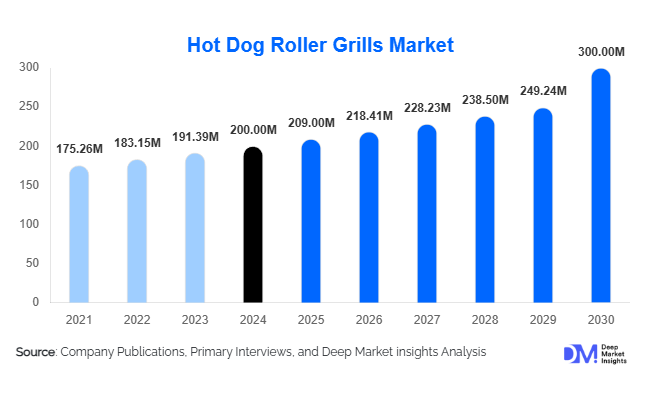

According to Deep Market Insights, the global hot dog roller grills market size was valued at USD 200 million in 2024 and is projected to grow from USD 209 million in 2025 to reach USD 300 million by 2030, expanding at a CAGR of 4.5% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for convenient foodservice equipment, the expansion of quick-service restaurants (QSRs) and mobile food services, and technological advancements in cooking equipment that enhance operational efficiency and energy savings.

Key Market Insights

- Quick-service restaurants and food trucks are leading adoption, leveraging hot dog roller grills to provide consistent, fast, and convenient meal options to on-the-go consumers.

- Electric roller grills dominate the market, offering ease of use, energy efficiency, and reliable cooking performance across commercial kitchens globally.

- North America holds the largest market share, driven by a high concentration of QSRs and a strong fast-food culture in the U.S. and Canada.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, increasing disposable income, and the proliferation of modern foodservice outlets in China, India, and Southeast Asia.

- Technological innovations, such as IoT-enabled controls, energy-saving heating systems, and modular designs, are transforming operational efficiency and product attractiveness.

- Customization opportunities allow brands to integrate logos, personalized settings, and design features, enhancing marketing and operational value for restaurants and vendors.

Latest Market Trends

Energy-Efficient and Smart Roller Grills

Manufacturers are increasingly introducing roller grills equipped with energy-efficient heating elements, programmable temperature controls, and IoT connectivity. These innovations allow operators to reduce energy consumption, monitor performance remotely, and maintain consistent cooking quality. The trend caters to sustainability-conscious QSRs and mobile food vendors aiming to minimize operational costs and carbon footprint. Some models also feature modular rollers, which enable cooking flexibility and ease of maintenance, making them attractive for multi-product foodservice setups.

Customization and Branding of Equipment

Brands are offering personalized roller grills with customizable aesthetics, digital displays, and corporate logos. This trend allows restaurants and food trucks to differentiate their outlets and reinforce brand identity. Customization also extends to operational features, such as adjustable roller speeds, temperature presets, and product-specific cooking configurations, enabling businesses to serve a variety of hot dogs, sausages, and similar foods efficiently.

Hot Dog Roller Grills Market Drivers

Rising Demand for Convenience Foods

As consumer lifestyles become increasingly fast-paced, the demand for ready-to-eat and quick-service food options has surged. Hot dog roller grills provide a practical solution, allowing establishments to serve consistent, high-quality products quickly. Their presence in food trucks, concession stands, and convenience stores highlights their role in meeting growing on-the-go food consumption trends globally.

Growth of Quick-Service Restaurants

The rapid expansion of QSRs across regions has driven the adoption of roller grills, as these establishments require efficient equipment to serve high customer volumes. Roller grills’ ability to maintain consistent temperature and evenly cook multiple products simultaneously makes them indispensable for restaurants, stadiums, and event venues, ensuring operational efficiency and reducing service wait times.

Technological Advancements in Equipment

Innovations such as digital temperature controls, modular roller designs, and energy-efficient heating elements have enhanced product performance. These improvements reduce energy costs, extend equipment life, and provide precise cooking, making roller grills more attractive to commercial operators seeking to optimize operations while delivering consistent food quality.

Market Restraints

High Initial Investment Costs

The upfront cost of high-quality hot dog roller grills can be a barrier for small and medium-sized foodservice operators. Businesses with limited budgets may hesitate to invest in advanced models, potentially slowing adoption in price-sensitive markets. While lower-cost alternatives exist, they often lack durability, efficiency, and advanced features.

Maintenance and Operational Challenges

Regular cleaning and maintenance are necessary to ensure equipment longevity and performance. Operational challenges, such as servicing roller mechanisms and replacing heating elements, may increase downtime and additional costs for operators. These factors can limit widespread adoption, particularly among smaller or mobile food businesses.

Hot Dog Roller Grills Market Opportunities

Expansion in Emerging Markets

Urbanization, rising disposable incomes, and the proliferation of fast-food culture in Asia-Pacific and Latin America present major opportunities. Foodservice operators in China, India, Brazil, and Mexico are increasingly seeking modern equipment to serve growing urban populations. Manufacturers can target these regions with affordable, efficient, and scalable roller grill solutions, capitalizing on evolving consumer eating habits.

Technological Integration

The integration of smart technology, including IoT-enabled controls, temperature monitoring, and energy-efficient designs, offers opportunities for innovation. Advanced roller grills not only optimize operations but also appeal to environmentally conscious operators seeking to reduce energy consumption and operational costs. New entrants and existing players can leverage technology to differentiate products and provide value-added services.

Customization and Branding

Offering personalized designs and functionality allows operators to strengthen brand identity. Restaurants, stadiums, and event vendors can enhance visibility and customer engagement through branded equipment, while also tailoring functionality for specific product types. This trend is gaining traction, especially among fast-food chains and mobile food vendors aiming to improve customer experience and loyalty.

Product Type Insights

Electric roller grills dominate the market, accounting for approximately 60% of global demand in 2024. Their consistent heating, energy efficiency, and ease of use make them the preferred choice for commercial foodservice operators. Gas roller grills remain a smaller segment, typically deployed in outdoor or mobile settings where electricity access is limited. The trend toward energy efficiency and digital controls is enhancing the adoption of electric models, particularly in high-volume quick-service and catering environments.

Application Insights

Quick-service restaurants represent the largest application segment, capturing more than 50% of the 2024 market share. The segment benefits from high-volume operations, the need for consistent product quality, and demand for speed and convenience. Mobile food vendors and concession operators are also growing rapidly, fueled by street food culture, sports events, and festivals. Emerging applications include catering services and convenience stores seeking compact, efficient cooking solutions for hot dogs and sausages.

Distribution Channel Insights

Direct sales account for roughly 50% of the global market, allowing manufacturers to build relationships with foodservice operators and provide tailored solutions. Online platforms and industrial suppliers are also increasingly important, particularly for smaller operators and mobile vendors seeking fast, convenient access to equipment. This multi-channel distribution strategy ensures market penetration across both large commercial buyers and smaller businesses.

End-Use Insights

The primary end-use segments driving demand are quick-service restaurants, food trucks, and convenience stores. QSRs remain the fastest-growing segment due to expansion in urban and semi-urban regions. Mobile food vendors are also creating new demand, particularly in regions with vibrant street food culture. Export-driven demand is increasing, with manufacturers supplying roller grills from North America, Europe, and China to emerging markets in the Asia-Pacific and Latin America. Rising global interest in convenient, ready-to-eat meals is expected to sustain long-term growth.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest market share at approximately 35% in 2024. High QSR penetration, strong fast-food culture, and urban population density drive sustained demand. The U.S. accounts for the majority of this share, with Canada also contributing significantly due to increasing adoption of food trucks and stadium concessions.

Europe

Europe represents a moderate share, with growing demand in Germany, France, and the U.K. driven by urban foodservice growth and modern street food trends. Adoption is supported by regulatory compliance, safety standards, and technological awareness in commercial kitchens.

Asia-Pacific

Emerging as the fastest-growing region, Asia-Pacific is driven by rising urbanization, disposable incomes, and QSR expansion in China, India, Japan, and Southeast Asia. The region is expected to witness double-digit growth during the forecast period as foodservice modernization accelerates.

Latin America

Brazil, Mexico, and Argentina are the primary contributors. Rising fast-food culture and urban street food demand support moderate growth. Exported roller grills from North America and Europe dominate this market segment.

Middle East & Africa

Demand in Middle East countries such as the UAE, Saudi Arabia, and Qatar is driven by high disposable income, luxury foodservice expansion, and growing QSR presence. Africa’s adoption is growing primarily in South Africa and Nigeria, supported by urbanization and emerging foodservice chains.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hot Dog Roller Grills Market

- Star Manufacturing

- Nemco Food Equipment

- Hatco Corporation

- APW Wyott

- Waring Commercial

- Vollrath

- Royal Catering

- Cuisinart Commercial

- Cadco

- Weston

- KitchenAid Commercial

- Nemco/Star (parent brands only)

- Buffalo Tools

- Avantco

- CookTek

Recent Developments

- In March 2025, Star Manufacturing launched a new line of energy-efficient electric roller grills with IoT-enabled controls for commercial kitchens.

- In January 2025, Nemco introduced customizable roller grill units for QSRs and stadiums, featuring modular rollers and temperature presets for multiple product types.

- In February 2025, Hatco Corporation expanded its global footprint in Asia-Pacific, focusing on energy-saving models for emerging QSR chains in India and China.