Hookah (Shisha) Tobacco Market Size

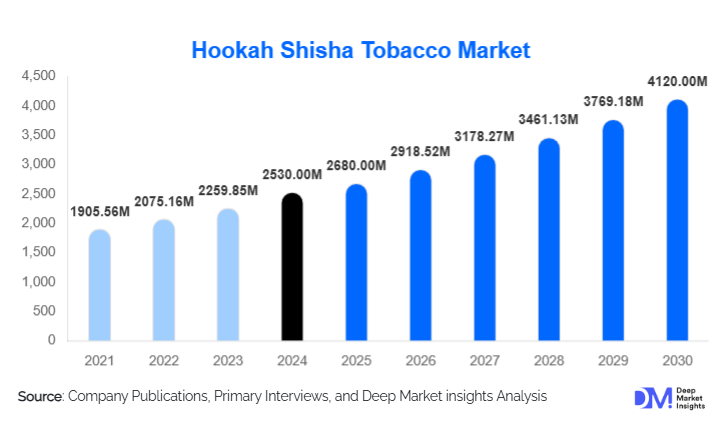

According to Deep Market Insights, the global hookah (shisha) tobacco market size was valued at USD 2,530 million in 2024 and is projected to grow from USD 2,680 million in 2025 to reach USD 4,120 million by 2030, expanding at a CAGR of 8.9% during the forecast period (2025–2030). The market growth is primarily driven by the increasing social acceptance of hookah culture, the expansion of premium and flavored tobacco varieties, and the growing popularity of lounge-based and home-based shisha consumption across major urban centers worldwide.

Key Market Insights

- Rising demand for premium and exotic flavors such as tropical fruit blends, herbal, and fusion varieties is reshaping consumer preferences in developed markets.

- Middle Eastern and North African (MENA) regions remain core consumption hubs, supported by cultural traditions and high per capita tobacco spending.

- Europe leads in regulatory evolution, with countries balancing consumer demand with health-driven restrictions and labeling standards.

- Asia-Pacific is the fastest-growing regional market, driven by increasing youth participation, café culture, and social media influence.

- Technological innovation in hookah devices, including heat management systems and e-shisha alternatives, is driving modernization of the traditional smoking experience.

- Online retail and specialty stores are rapidly expanding their distribution reach, enabling global access to diverse flavor profiles and premium brands.

Latest Market Trends

Premiumization and Flavor Innovation

Manufacturers are investing heavily in premium flavor development to attract global consumers seeking novel and sophisticated experiences. Flavor trends are shifting toward natural, herbal, and fusion blends that combine traditional fruit notes with exotic elements such as spices, desserts, and beverages. Major brands are also introducing limited-edition flavors and customizable blends to appeal to evolving palates. Premium packaging, cleaner ingredients, and branding associated with lifestyle and social sophistication are redefining the shisha experience across lounges and retail spaces.

Shift Toward Herbal and Nicotine-Free Alternatives

Rising health awareness among consumers is encouraging the growth of herbal and nicotine-free shisha products. These alternatives use natural molasses bases and herbal infusions to replicate the sensory experience of traditional hookah without nicotine exposure. Several manufacturers are launching organic and chemical-free product lines targeting health-conscious millennials and Gen Z consumers. This trend is expected to broaden the market’s consumer base and mitigate regulatory pressures on traditional tobacco-based shisha products.

Hookah Tobacco Market Drivers

Growing Social Acceptance and Café Culture

The increasing popularity of hookah lounges, rooftop cafés, and social smoking spaces is fueling market expansion. Urbanization and lifestyle shifts, particularly in emerging economies, are driving social consumption of shisha as a leisure activity. Hookah lounges have evolved into experiential venues offering food, music, and themed ambiance that attract younger demographics. This cultural shift is boosting demand for premium tobacco blends and aesthetic hookah apparatus across markets such as the Middle East, Europe, and Southeast Asia.

Expansion of E-Commerce and Global Brand Penetration

Online retail platforms are transforming distribution dynamics by enabling direct consumer access to international shisha brands. E-commerce growth has facilitated the entry of small and artisanal producers into the global market, promoting diversity in product offerings. Digital marketing and influencer-driven promotions are also amplifying brand visibility among younger audiences. Subscription-based shisha box models and flavor sampling kits are emerging as innovative sales strategies that enhance consumer engagement and retention.

Market Restraints

Stringent Tobacco Regulations

Increasingly strict tobacco control policies, including labeling requirements, advertising bans, and indoor smoking restrictions, pose significant challenges for the hookah tobacco market. Regulatory discrepancies between regions create compliance complexities for international manufacturers. Additionally, rising public health campaigns against tobacco consumption may limit growth potential in certain Western markets, prompting a shift toward herbal and non-tobacco alternatives.

Health Concerns and Awareness Campaigns

Mounting scientific evidence linking hookah smoking to respiratory and cardiovascular risks is leading to heightened consumer awareness. Anti-smoking initiatives and taxation policies targeting flavored tobacco are expected to dampen demand among health-conscious users. Despite the cultural and social appeal of hookah, the increasing perception of health risks could restrain market expansion in the long term, particularly in countries with strong anti-tobacco advocacy movements.

Hookah Tobacco Market Opportunities

Herbal and Functional Shisha Innovations

Opportunities lie in the development of herbal, caffeine-infused, and wellness-oriented shisha products. Companies are exploring functional ingredients such as adaptogens, CBD extracts, and botanical infusions to align with wellness trends. This diversification offers potential to tap into non-smoker segments and expand shisha’s positioning as a lifestyle product rather than a traditional tobacco item.

Rising Demand in Emerging Markets

Emerging economies in Asia-Pacific, Eastern Europe, and Latin America present substantial growth potential due to expanding middle-class populations and rising disposable incomes. Governments in certain regions are also relaxing trade barriers on imported tobacco products, creating opportunities for international brand penetration. Localized flavor innovation, cultural integration, and brand collaborations with entertainment venues are likely to drive long-term market expansion.

Product Type Insights

Flavored shisha tobacco dominates the market, accounting for a significant revenue share due to its wide appeal and variety. Popular categories include fruit-based flavors (apple, grape, mint), dessert-inspired blends (vanilla, chocolate), and fusion flavors (mint-melon, tropical spice). Unflavored tobacco caters to traditional consumers seeking a pure smoking experience, while herbal and nicotine-free variants are gaining momentum among health-conscious segments.

Distribution Channel Insights

Specialty stores and hookah lounges remain the primary sales channels, offering immersive product experiences. However, online platforms are witnessing exponential growth, driven by convenience, flavor availability, and direct-to-consumer models. Supermarkets and hypermarkets also contribute to retail sales in developed markets, providing visibility for mass-market brands. Emerging distribution trends include subscription boxes and social media–driven direct purchases.

| By Product Type | By Flavor Category | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

Middle East & Africa

The Middle East remains the largest regional market, led by Saudi Arabia, the UAE, Egypt, and Lebanon. Hookah smoking is deeply ingrained in regional culture, supported by high brand loyalty and widespread availability. Ongoing diversification into luxury shisha lounges and flavor innovation continues to sustain growth in this region.

Europe

Europe represents a mature and lucrative market, with Germany, France, and the U.K. at the forefront of demand. Regulatory frameworks are evolving, but demand remains robust due to the growing café culture and presence of Middle Eastern diaspora populations. The premium flavored tobacco segment, particularly fruit and dessert-based varieties, dominates sales across European urban centers.

Asia-Pacific

Asia-Pacific is projected to record the fastest CAGR during the forecast period, driven by rising youth adoption, urban café expansion, and online retail proliferation. India, China, Japan, and Indonesia are emerging as key contributors. The influence of global travel, social media, and Western lifestyle trends is expanding the regional consumer base.

North America

The North American market is steadily growing, with the U.S. leading due to increasing acceptance of hookah as a social leisure activity. The market is characterized by strong brand competition, flavored product innovation, and the expansion of upscale shisha lounges in major cities such as New York, Los Angeles, and Toronto.

Latin America

Latin America is an emerging market, with Brazil, Mexico, and Argentina witnessing a rising hookah culture among younger demographics. Rapid urbanization, nightlife expansion, and growing disposable income are boosting market penetration, though regulatory barriers remain a concern.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hookah Tobacco Market

- Al Fakher Tobacco

- Fumari

- Starbuzz Tobacco

- Azure Tobacco

- Adalya Tobacco

- Social Smoke

- Al-Waha Tobacco

Recent Developments

- In August 2025, Al Fakher announced the launch of a new organic, nicotine-free shisha line targeting wellness-conscious consumers in Europe and the Middle East.

- In June 2025, Starbuzz introduced a limited-edition fusion flavor series, combining tropical fruit profiles with herbal infusions to appeal to Gen Z consumers.

- In April 2025, Fumari expanded its distribution network into Southeast Asia through strategic partnerships with regional e-commerce platforms.