Home Theater Projector Market Size

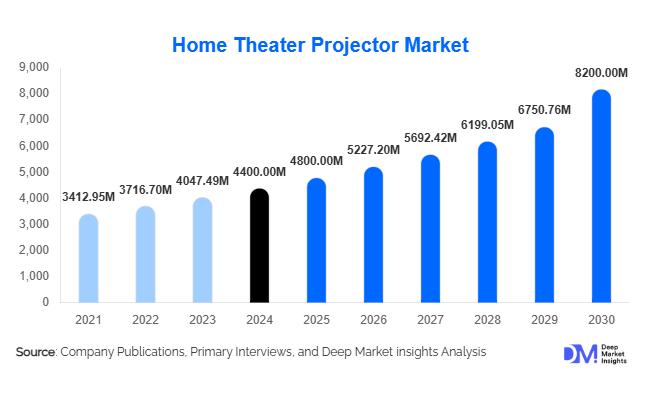

According to Deep Market Insights, the global home theater projector market size was valued at USD 4,400 million in 2024 and is projected to grow from USD 4,800 million in 2025 to reach USD 8,200 million by 2030, expanding at a CAGR of 8.9% during the forecast period (2025–2030). Market growth is being driven by the rapid adoption of 4K and laser-based projectors, the increasing popularity of ultra-short throw systems for urban households, and rising consumer demand for premium home entertainment experiences powered by streaming and gaming content.

Key Market Insights

- 4K projectors dominate the resolution segment, accounting for nearly 40% of the global market revenue in 2024, supported by the growing availability of UHD content.

- Laser projectors are the fastest-growing light source segment, capturing more than 30% of market share in 2024, driven by their durability, brightness, and low maintenance.

- DLP technology leads the projector engine market with a 40–45% share, favored for its compact design, high contrast, and gaming performance.

- Asia-Pacific is the largest regional market, contributing about 35% of global revenues in 2024, with China and India emerging as the fastest-growing demand centers.

- North America maintains a strong demand for premium models, with U.S. consumers leading the adoption of high-end 4K and laser projectors.

- Ultra-short throw (UST) projectors are surging, supported by urban space constraints and consumer preference for compact, living-room-friendly setups.

Latest Market Trends

Shift Toward Ultra-Short Throw Projectors

UST projectors are gaining popularity as they allow 100+ inch displays from just a few inches away from the wall or screen, making them ideal for compact urban homes. Consumers prefer UST solutions for their ease of installation, space efficiency, and premium aesthetic integration with modern interiors. This segment is expected to show double-digit growth over the next five years, supported by falling costs and the introduction of 4K laser-based UST projectors.

Smart & Gaming Integration

Smart home compatibility, built-in streaming apps, and voice assistant integration are increasingly becoming standard features. Projectors with ultra-low latency, high refresh rate support, and HDMI 2.1 connectivity are also being marketed toward gamers. This convergence of home theater and gaming ecosystems is attracting younger demographics and extending the use cases for projectors beyond movie watching.

Premiumization Through Laser & LED Hybrid Light Sources

The replacement of traditional mercury lamps with laser or hybrid LED-laser sources is reshaping the market. These technologies deliver over 20,000 hours of operation, higher color accuracy, and consistent brightness. As manufacturing costs decline, premium light sources are becoming more accessible in mid-range projectors, further accelerating adoption.

Home Theater Projector Market Drivers

Technological Advancements in Resolution and Light Sources

The transition from lamp-based projectors to laser and LED units has significantly improved lifespan and performance. Simultaneously, 4K projectors are becoming mainstream, with 8K devices beginning to enter niche premium markets. These innovations enhance the value proposition compared to large-screen televisions.

Rising Streaming and Gaming Adoption

Consumers are investing in immersive home entertainment to complement their streaming subscriptions. The rise of online gaming, coupled with consoles supporting 4K HDR output, is fueling demand for projectors that can deliver cinema-like visuals with responsive gameplay experiences.

Urbanization and Space Constraints

Smaller living spaces in cities are driving demand for short-throw and UST projectors, which provide a large display without requiring extensive installation space. This trend is particularly strong in APAC and European metropolitan areas.

Market Restraints

High Cost of Premium Models

While entry-level projectors remain affordable, high-performance models with 4K resolution, laser light sources, and UST capabilities often cost several thousand dollars. This price barrier limits mass adoption, particularly in emerging economies.

Ambient Light Limitations

Projectors are highly sensitive to viewing environments. Bright living rooms with ambient light require higher-lumen projectors, increasing costs for consumers. Without proper screens and controlled lighting, user experience suffers, restraining adoption in casual-use households.

Home Theater Projector Market Opportunities

Affordable Premium Projectors for Emerging Markets

Rapidly growing middle classes in Asia-Pacific and Latin America are looking for premium experiences at accessible price points. Brands that localize pricing strategies and expand online retail channels will capture significant demand in these high-growth regions.

Integration with Smart Ecosystems

There is strong potential for projectors that seamlessly integrate with smart home systems, voice assistants, and IoT platforms. Offering built-in streaming apps and automated calibration features can differentiate products and appeal to tech-savvy consumers.

Eco-Friendly and Sustainable Designs

Regulatory pressure to eliminate mercury lamps is creating opportunities for eco-friendly projector designs. Manufacturers investing in energy-efficient, recyclable, and low-maintenance solutions will appeal to environmentally conscious consumers and align with global sustainability standards.

Product Type Insights

Mid-range projectors dominate the market, accounting for 35–45% of global sales in 2024, as consumers balance affordability with features like 4K resolution and laser sources. High-end projectors are seeing faster revenue growth, driven by premium buyers in North America and Asia-Pacific, while entry-level devices remain critical for expanding penetration in price-sensitive markets.

Application Insights

Residential home theater applications account for over 55% of the global market, as streaming and gaming drive household demand. Gaming-focused projectors with ultra-low latency and high refresh rates are the fastest-growing sub-application, while luxury home installations and hybrid entertainment spaces are fueling premium adoption.

Distribution Channel Insights

Online retail dominates global projector sales, with e-commerce platforms providing easy comparisons, promotions, and direct-to-consumer (D2C) offerings. Specialty AV retailers remain important for premium installations, while professional integrators serve the luxury residential and commercial segments. Direct OEM sales channels are gaining traction as brands expand digital-first strategies.

| By Product Type | By Technology / Display Engine | By Resolution | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America represents 25–30% of the global market, led by the U.S., with strong demand for premium 4K and laser projectors. Consumers prioritize smart home integration and high-performance gaming projectors. Canada is seeing slower but steady growth, with emphasis on mid-range products.

Europe

Europe contributes about 20–25% of revenues, with Germany, the U.K., and France leading. Demand is split between premium projectors for affluent buyers and mid-range models for broader adoption. Urban households in Europe are driving UST projector sales, supported by space-saving requirements.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing regional market, holding a 30–35% share in 2024. China and India are leading the growth, driven by rising disposable incomes, urbanization, and e-commerce expansion. Japan and South Korea drive high-end adoption with strong demand for laser and 4K projectors.

Latin America

Latin America represents 5–10% of the market, with Brazil and Mexico leading demand. Entry and mid-range projectors dominate, but increasing interest in home streaming and gaming is opening opportunities for affordable premium models.

Middle East & Africa

The region accounts for 5–8% of the global market, led by the UAE and Saudi Arabia. Premium adoption is driven by high-income consumers and luxury home installations. South Africa contributes to regional demand through mid-range projector sales for home entertainment.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Home Theater Projector Market

- Epson

- Sony Corporation

- BenQ Corporation

- Optoma Technology

- ViewSonic Corporation

- LG Electronics

- Samsung Electronics

- Panasonic Corporation

- JVC (JVCKENWOOD Corporation)

- Canon Inc.

- Acer Inc.

- XGIMI Technology

- Hisense Group

- Vivitek Corporation

- Christie Digital Systems

Recent Developments

- In June 2025, Epson launched its new 4K laser projector lineup targeting mid-range households, with improved color gamut and HDR support at competitive pricing.

- In May 2025, BenQ introduced a gaming-optimized projector series featuring ultra-low latency and HDMI 2.1 support for next-gen consoles.

- In March 2025, LG announced the expansion of its CineBeam UST series in Asia-Pacific, focusing on compact, design-friendly models for urban consumers.