Home Saunas Market Size

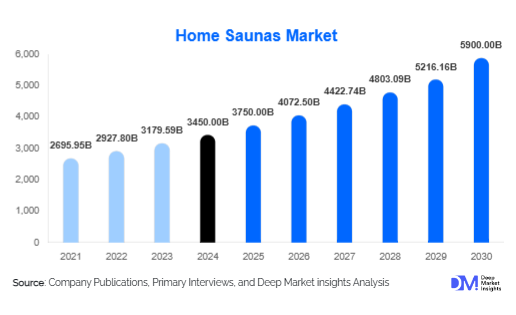

According to Deep Market Insights, the global home saunas market size was valued at USD 3,450 million in 2024 and is projected to grow from USD 3,750 million in 2025 to reach USD 5,900 million by 2030, expanding at a CAGR of 8.6% during the forecast period (2025–2030). The home saunas market growth is primarily driven by increasing health and wellness awareness, rising disposable incomes, and growing consumer preference for at-home wellness solutions. Innovations in infrared and hybrid sauna technologies, as well as IoT-enabled smart sauna systems, are further boosting market adoption globally.

Key Market Insights

- Infrared saunas dominate the market, offering energy efficiency, faster heating, and perceived health benefits, making them the preferred choice in North America and Europe.

- Residential households remain the largest end-user segment, accounting for over 55% of global revenue in 2024, as home-based wellness solutions gain popularity.

- North America and Europe together represent nearly 65% of global market share, supported by high disposable incomes, wellness-focused lifestyles, and technological adoption.

- Asia-Pacific is the fastest-growing region, driven by rising health awareness, disposable incomes, and urbanization in countries like China, India, and Japan.

- Technological integration is shaping the market, with smart saunas, IoT-enabled controls, and app-based monitoring systems becoming increasingly popular among consumers.

- Sustainability trends, including energy-efficient heaters, eco-friendly materials, and low-emission designs, are influencing product development and consumer preferences.

What are the latest trends in the home saunas market?

Smart and IoT-Enabled Sauna Integration

Manufacturers are increasingly integrating smart features and IoT connectivity into home saunas, enabling users to control temperature, humidity, lighting, and session duration via mobile apps. Advanced features include personalized wellness programs, remote monitoring, and energy-saving modes. These innovations appeal particularly to tech-savvy consumers in North America and Europe, helping differentiate products in a competitive market and driving higher adoption rates for premium and modular sauna units.

Compact and Modular Home Sauna Solutions

Prefabricated and modular saunas are gaining popularity due to their easy installation, space optimization, and cost-effectiveness. This trend is especially significant in urban markets where space constraints are a key concern. DIY modular kits and portable sauna designs are expanding the target audience, allowing consumers in apartments, condos, and smaller homes to adopt wellness practices previously reserved for large residential spaces. The modular segment accounted for 50% of the 2024 market, highlighting its strong growth trajectory.

What are the key drivers in the home saunas market?

Growing Wellness and Health Awareness

Consumers are increasingly investing in personal wellness routines, driving demand for home-based solutions such as saunas. Benefits, including stress reduction, detoxification, cardiovascular health, and muscle relaxation, are well recognized, particularly in high-income regions. This awareness is encouraging households to install private saunas rather than rely solely on spas or wellness centers, creating a sustainable growth driver for the market.

Rising Disposable Incomes and Urbanization

Higher disposable incomes and urban lifestyle trends are leading to increased purchases of luxury wellness products. Affluent urban households in North America and Europe are upgrading their homes with infrared, hybrid, and custom-built saunas. The growing middle class in Asia-Pacific is also contributing to higher adoption, with mid-range products tailored to space and affordability constraints.

Technological Advancements in Sauna Solutions

Innovations in electric and infrared heaters, app-controlled features, eco-friendly materials, and hybrid models are enhancing user experience and safety. These advancements are attracting health-conscious and tech-savvy consumers globally, boosting market growth. Integration of energy-efficient systems also helps reduce operational costs, further encouraging adoption.

What are the restraints for the global market?

High Initial Costs

Premium home saunas require significant upfront investment, particularly custom-built and hybrid models. This limits market penetration among price-sensitive consumers, especially in emerging economies, where cost remains a key barrier to adoption. Affordability issues may slow market expansion unless manufacturers provide mid-range and portable solutions.

Space and Installation Limitations

Urban homes often have limited space, which constrains the installation of traditional and modular saunas. Consumers may prefer compact or portable units, which offer less functionality than full-scale models. Addressing space challenges through innovative design remains a critical focus for manufacturers to sustain growth.

What are the key opportunities in the home saunas market?

Expansion in Emerging Markets

Asia-Pacific and LATAM regions offer significant growth potential due to rising disposable incomes, increasing health consciousness, and urbanization. Countries like China, India, and Brazil are experiencing growing demand for mid-range and premium home saunas. Early movers can establish brand recognition, cater to local preferences, and secure distribution networks to capture long-term growth opportunities.

Eco-Friendly and Energy-Efficient Products

Consumers increasingly value sustainable, low-emission home wellness solutions. Manufacturers can capitalize on this trend by producing energy-efficient heaters, using sustainably sourced woods, and promoting low-power designs. Governments in some regions provide incentives for eco-friendly appliances, further supporting adoption and market expansion.

Smart Wellness Solutions Integration

IoT-enabled and smart saunas, with app-controlled sessions, remote monitoring, and customizable wellness programs, present a key opportunity for product differentiation. Health-focused consumers in mature markets are willing to pay premium prices for connected experiences. Companies investing in AI-driven personalization and app-based features can gain competitive advantages and higher profit margins.

Product Type Insights

Infrared saunas dominate the market with a 45% share in 2024 due to faster heating, energy efficiency, and perceived health benefits. Traditional steam saunas are favored in Europe and North America for luxury installations, while hybrid saunas combining infrared and steam are gaining traction for customized wellness experiences. Prefabricated/modular saunas account for 50% of the market, driven by space optimization, cost-efficiency, and ease of installation.

Application Insights

Residential households are the largest end-use segment, contributing over 55% of market revenue in 2024. Hospitality and spa centers are increasingly incorporating home sauna-like solutions to enhance guest experience. Fitness and wellness centers represent a growing niche, offering high-end sauna experiences to gym-goers and wellness enthusiasts. Export-driven demand is notable from North America and Europe to emerging markets, reflecting global expansion opportunities.

Distribution Channel Insights

Online retail platforms dominate distribution due to convenience, wide reach, and comparative pricing. Specialty wellness stores continue to attract premium customers seeking expert guidance. Direct-to-consumer models allow manufacturers to control pricing, customization, and brand experience. Subscription-based and membership programs are emerging as innovative channels to engage repeat buyers and provide exclusive offers.

| By Type | By Heating Technology | By Product Form | By End-User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest regional market, accounting for 35% of global revenue in 2024. The U.S. leads demand due to high disposable income, wellness-focused lifestyle, and strong adoption of infrared and smart sauna technologies. Canada follows closely, with growing interest in residential and spa applications.

Europe

Europe holds 30% of the global market share, with Germany, Scandinavia, and the U.K. as key contributors. Demand is driven by a wellness-oriented population, preference for eco-friendly products, and high adoption of premium and modular saunas. The region is also witnessing growth in infrared and hybrid models.

Asia-Pacific

APAC is the fastest-growing region at a 10% CAGR. China and Japan are emerging as major growth hubs due to rising health awareness and disposable income. India is witnessing increasing adoption in luxury homes and hospitality sectors, while Australia shows steady demand for mid-range and premium sauna solutions.

Latin America

Brazil and Mexico are the largest markets in LATAM, driven by rising wellness awareness and urban middle-class growth. Outbound export demand from North America and Europe is boosting the adoption of premium saunas. Demand for portable and modular units is increasing in urban households.

Middle East & Africa

UAE and Saudi Arabia are key markets for luxury home saunas, supported by affluent consumers and high adoption in hospitality sectors. South Africa represents a growing residential market with interest in wellness products. Government incentives for eco-friendly appliances are contributing to adoption in the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Home Saunas Market

- Harvia Oyj

- TyloHelo Group

- EOS Saunatechnik GmbH

- Finlandia Sauna

- Klafs GmbH

- Finnleo Inc.

- Almost Heaven Saunas

- Health Mate Sauna

- Dynamic Saunas

- Sunlighten

- Thermory

- Sauna Works

- SaunaCore

- Amerec

- Helo Sauna

Recent Developments

- In May 2025, Harvia Oyj launched a new energy-efficient infrared sauna series in North America, targeting residential and small spa applications.

- In April 2025, TyloHelo introduced modular smart saunas with app-based controls, expanding its presence in the APAC market.

- In February 2025, Sunlighten rolled out hybrid sauna models integrating infrared and steam systems, catering to premium residential users in Europe and the Middle East.