Home Plastic Flower Pots and Planters Market Size

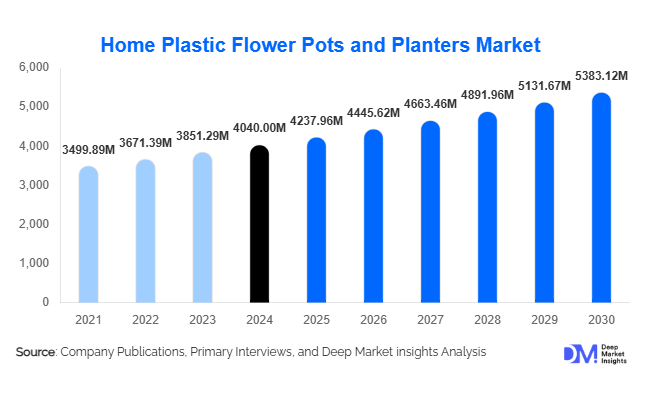

According to Deep Market Insights, the global home plastic flower pots and planters market size was valued at USD 4,040 million in 2024 and is projected to grow from USD 4,237.96 million in 2025 to reach USD 5,383.12 million by 2030, expanding at a CAGR of 4.9% during the forecast period (2025–2030). The market growth is primarily driven by rising urban gardening trends, increasing consumer preference for aesthetically pleasing home décor, and the cost-effectiveness and durability of plastic planters for indoor and outdoor applications.

Key Market Insights

- Plastic planters are becoming a preferred choice for urban households and residential gardening, owing to their lightweight nature, affordability, and versatility in sizes and designs.

- Technological innovations, including self-watering and smart planters with integrated sensors, are gaining traction among tech-savvy consumers.

- North America dominates the global demand, led by the U.S. and Canada, driven by home décor trends and a strong gardening culture.

- Asia-Pacific is the fastest-growing region, with China and India showing high adoption of compact, space-saving planters for urban households.

- Europe demonstrates increasing interest in eco-friendly planters, focusing on recycled and biodegradable plastics for sustainable home gardening solutions.

- Distribution channels are shifting, with e-commerce platforms gaining prominence alongside traditional retail and garden specialty stores.

Latest Market Trends

Urban Gardening Driving Growth

Urbanization and limited outdoor space have encouraged the adoption of home gardening, making plastic flower pots and planters a practical choice. Consumers are investing in vertical gardens, balcony planters, and decorative indoor pots. The convenience, lightweight design, and durability of plastic planters support high adoption rates among urban households. Additionally, trends toward aesthetically coordinated interiors and sustainable gardening solutions are driving innovations in planter design, including vibrant colors, unique shapes, and self-watering systems that simplify maintenance.

Eco-Friendly and Recycled Materials

Growing environmental awareness has led manufacturers to adopt recycled and biodegradable plastics. Eco-conscious consumers are increasingly prioritizing products with minimal environmental impact. Planters made from recycled polypropylene and high-density polyethylene (HDPE) are gaining traction due to their durability and reduced carbon footprint. Companies are also incorporating design features to improve longevity and encourage reuse, aligning with global sustainability initiatives and consumer expectations.

Market Drivers

Rising Home Décor and Gardening Trends

The surge in home décor and DIY gardening projects has significantly boosted demand for plastic flower pots and planters. Consumers are focusing on personalizing living spaces, both indoors and outdoors, using vibrant and versatile planters. Social media and home design influencers have further popularized creative gardening solutions, increasing adoption across all age groups.

Affordability and Versatility

Plastic planters are cost-effective compared to ceramic or terracotta alternatives, offering durability and resistance to weather conditions. Their versatility in shape, color, and size makes them suitable for a variety of applications, from small indoor pots to large outdoor planters. This affordability allows broader market penetration across both residential and commercial sectors.

Technological Integration

Smart planters equipped with self-watering systems, moisture sensors, and app connectivity are gaining popularity. These innovations address consumer demand for convenience and efficiency, enhancing plant care and reducing maintenance efforts. The integration of technology differentiates premium offerings and attracts tech-savvy urban consumers.

Market Restraints

Environmental Concerns

The production and disposal of plastic planters contribute to plastic pollution, posing challenges for sustainable growth. Despite recycling initiatives, environmental concerns remain a restraint for market adoption, particularly in regions with strict environmental regulations.

Competition from Alternative Materials

Consumers are increasingly opting for eco-friendly alternatives like ceramic, terracotta, and biodegradable composites. These alternatives, while often more expensive, appeal to environmentally conscious buyers and could reduce the market share of traditional plastic planters.

Market Opportunities

Smart and Self-Watering Planters

The integration of sensors, automated watering systems, and smart garden technologies presents a major opportunity. Companies can target tech-savvy urban households seeking convenience and minimal maintenance, expanding the premium segment of the market.

Urban and Vertical Gardening

With limited living space in urban regions, vertical gardening and balcony gardening are becoming increasingly popular. Plastic planters, being lightweight and versatile, are ideal for such applications. Manufacturers can innovate compact, modular designs to cater to urban households, offices, and commercial spaces.

Expansion in Emerging Markets

Rising disposable incomes in Asia-Pacific, Latin America, and parts of the Middle East provide significant growth potential. Consumers in these regions are embracing home gardening and decorative planters, particularly in urban centers. Strategic investments and localized product designs can capture these high-growth markets effectively.

Product Type Insights

Round and rectangular plastic planters dominate the global market due to their universal application and design flexibility. These planters are preferred for indoor and outdoor gardening, offering versatility in size, color, and style. Specialty products, including self-watering, vertical, and modular planters, are growing in demand, catering to specific consumer needs and urban gardening trends.

Application Insights

The residential segment is the leading application, accounting for over 55% of the 2024 market share. Urban households, apartments, and villas are adopting plastic planters to enhance living spaces. Commercial applications, including offices, hotels, and public landscaping projects, are steadily growing as businesses increasingly prioritize greenery and aesthetics for employee well-being and customer appeal.

Distribution Channel Insights

E-commerce platforms dominate the sales landscape, allowing consumers to access diverse designs, read reviews, and compare prices conveniently. Traditional retail stores and garden specialty shops continue to play a significant role, particularly for bulk purchases and commercial buyers. The rise of direct-to-consumer sales and online marketplaces is reshaping market dynamics, improving accessibility and transparency.

End-Use Insights

The residential sector drives maximum demand, particularly among urban middle-class households seeking compact and decorative planters. The commercial segment, including offices, hotels, and municipal landscaping projects, is expanding steadily. Export-driven demand is notable from countries with manufacturing strengths, supplying planters to regions with high urban gardening adoption.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounted for 28% of the global market in 2024, led by the U.S. and Canada. High urban gardening adoption, strong disposable incomes, and an affinity for home décor drive market demand. The region favors technologically advanced and premium-quality plastic planters.

Europe

Europe contributed approximately 25% of the global market in 2024, with Germany, the U.K., and France leading. Eco-friendly and recycled planters are highly preferred, reflecting strong environmental awareness and urban gardening trends.

Asia-Pacific

Asia-Pacific is the fastest-growing region, particularly in China and India. Rising urbanization, increasing disposable income, and growing awareness of home gardening drive demand. Affordable and space-saving planters dominate this region’s market.

Latin America

Brazil and Mexico are emerging markets with growing adoption of home gardening solutions. Outbound and domestic gardening trends are boosting demand for decorative and functional plastic planters.

Middle East & Africa

Urbanized areas in the Middle East, led by the UAE and Saudi Arabia, are witnessing rising demand for premium planters. In Africa, urban households and commercial establishments are gradually adopting plastic planters for indoor and outdoor greenery.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Home Plastic Flower Pots and Planters Market

- Lechuza

- Bloem

- Gardman

- Poetic Product

- Garland Manufacturing

- Algreen Products

- Heathco

- Patio Décor

- Bloem Garden Products

- Plastia

- BioGreen

- Jardinico

- GreenTech

- FloraFlex

- ProDirect

Recent Developments

- In March 2025, Lechuza expanded its premium self-watering planter range to include smart sensors for automated plant care.

- In January 2025, Bloem launched recycled polypropylene planters targeting eco-conscious urban consumers in Europe and North America.

- In November 2024, Algreen Products introduced modular vertical gardening solutions in the Asia-Pacific region, addressing urban space constraints.