Home Brewing Equipment Market Size

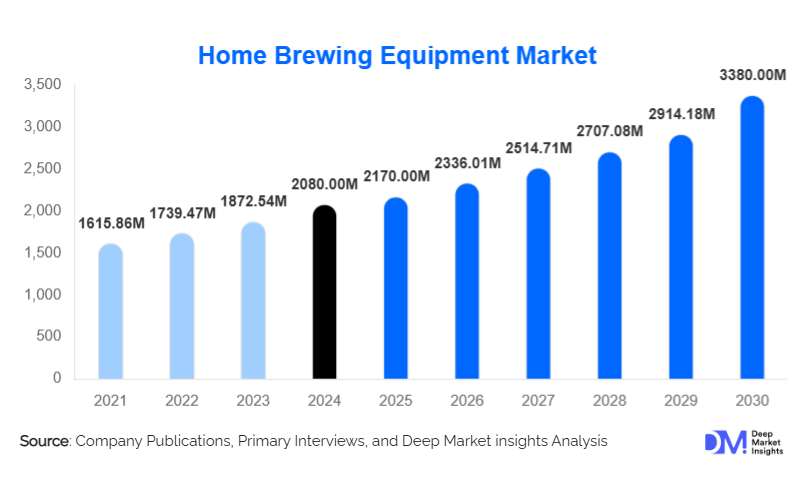

According to Deep Market Insights, the global Home Brewing Equipment Market size was valued at USD 2,080 million in 2023 and is projected to grow from USD 2,170 million in 2024 to reach USD 3,380 million by 2030, expanding at a CAGR of 7.65% during the forecast period (2024–2030). The Home Brewing Equipment Market growth is primarily driven by rising consumer interest in craft beverages, increasing demand for personalized brewing experiences, and the growing popularity of hobby-based beer, cider, and mead production worldwide.

Key Market Insights

- Rising craft beer culture worldwide is fueling demand for home brewing kits and advanced equipment.

- Compact and smart brewing systems are gaining popularity among urban consumers seeking convenience and automation.

- North America leads the market due to a strong homebrewing community and well-established craft beer culture.

- Europe remains a fast-growing market, driven by regulatory support for microbrewing and rising demand for artisanal beverages.

- Asia-Pacific is emerging as a high-potential region, fueled by increasing disposable income and expanding DIY hobby culture in countries like China, Japan, and India.

- Online retail channels are reshaping distribution, enabling consumers to access a wide range of equipment and ingredients directly.

What are the latest trends shaping the Home Brewing Equipment Market?

Smart and Automated Brewing Systems

Manufacturers are increasingly offering IoT-enabled and app-controlled brewing kits that automate fermentation, temperature control, and recipe customization. These systems appeal to tech-savvy and beginner brewers who prefer convenience without compromising quality. Automated brewing systems also allow recipe sharing across platforms, encouraging community engagement among homebrewers.

Rising Popularity of DIY Craft Beverages Beyond Beer

While beer remains dominant, consumer experimentation with mead, cider, kombucha, and hard seltzers is expanding the product scope. Brewing equipment manufacturers are diversifying product offerings to accommodate alternative beverages, creating new revenue streams and expanding their consumer base.

Which factors are the main growth drivers for the Home Brewing Equipment Market?

Increasing Demand for Personalized Beverages

Consumers are seeking more control over flavor, ingredients, and alcohol content. Home brewing offers a customizable experience, driving strong adoption among both enthusiasts and casual hobbyists. The growth of craft beer culture worldwide further boosts equipment demand.

Growing Online Retail Ecosystem

E-commerce platforms have become crucial in home brewing equipment sales, offering consumers access to a wider variety of products, global brands, and brewing communities. Subscription-based ingredient kits and recipe services are further strengthening consumer engagement.

What major restraints are limiting the growth of the global Home Brewing Equipment Market?

High Initial Equipment Costs

Professional-grade brewing kits and automated systems remain expensive, limiting adoption among price-sensitive consumers. Budget-conscious hobbyists often opt for low-cost DIY alternatives, restricting premium product penetration.

Regulatory and Licensing Barriers

Home brewing legality varies across regions, with strict regulations on production volumes and alcohol content in certain countries. This regulatory complexity continues to challenge market expansion, particularly in emerging economies.

What are the top growth opportunities in the Home Brewing Equipment Market?

Expansion in Emerging Markets

Rising disposable income, urbanization, and the popularity of DIY hobbies in Asia-Pacific and Latin America present strong opportunities. Equipment makers are targeting these regions with affordable starter kits and localized marketing strategies.

Integration of Sustainable Brewing Practices

Eco-conscious consumers are driving demand for energy-efficient brewing systems, reusable packaging, and organic ingredient kits. Companies investing in sustainable brewing equipment have the opportunity to capture a growing, environmentally aware segment.

Product Type Insights

Starter kits dominate the market, especially among beginner hobbyists exploring small-batch brewing. Automated brewing systems are growing rapidly due to their convenience and consistency, appealing to urban and tech-savvy consumers. Specialized fermenters and advanced equipment cater to experienced brewers seeking to replicate professional-level brewing at home. Ingredient kits and accessories also represent a strong recurring revenue stream.

Application Insights

The beer segment remains the largest application area, driven by global craft beer culture. Mead, cider, and kombucha brewing are gaining traction among niche hobbyists. Hard seltzer production is emerging as a fast-growing application, particularly in North America, reflecting changing consumer preferences for lighter, low-calorie alcoholic beverages.

Distribution Channel Insights

Online channels dominate sales, supported by e-commerce platforms, brewing forums, and direct-to-consumer websites. Specialty brewing stores remain important for personalized advice and premium product sales. General retail chains are beginning to introduce entry-level brewing kits, expanding market reach among casual consumers.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the market, supported by a strong craft beer culture, established homebrewing communities, and the presence of major equipment manufacturers. The U.S. is the largest market, with Canada following closely due to supportive regulations and hobbyist demand.

Europe

Europe is a key growth hub, with Germany, the U.K., and Italy leading adoption. The region benefits from historical brewing traditions and government support for microbrewing. Demand for sustainable brewing equipment is especially strong in Western Europe.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by rising disposable incomes, urban hobby trends, and social media influence. China and India are emerging as critical markets, while Japan and Australia remain strongholds of premium home brewing culture.

Latin America

Latin America shows rising adoption, particularly in Brazil and Mexico, where growing craft beer interest supports home brewing expansion. Economic factors and limited access to premium equipment pose challenges but also create opportunities for affordable kits.

Middle East & Africa

The market is in its early stages due to regulatory restrictions on alcohol production. However, South Africa is an exception, with an expanding craft beer scene supporting home brewing growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Home Brewing Equipment Market

- Brewers Edge

- Grainfather

- Speidel Tank

- SS Brewtech

- Blichmann Engineering

- Northern Brewer

- MoreBeer!

Recent Developments

- In May 2024, Grainfather launched a new smart brewing system with app integration for remote recipe control and fermentation tracking.

- In March 2024, SS Brewtech expanded its product portfolio with eco-friendly fermenters designed for energy efficiency and sustainability.

- In January 2024, Blichmann Engineering introduced a new series of compact brewing kits targeting urban consumers with limited space.