Home & Garden Pesticides Market Size

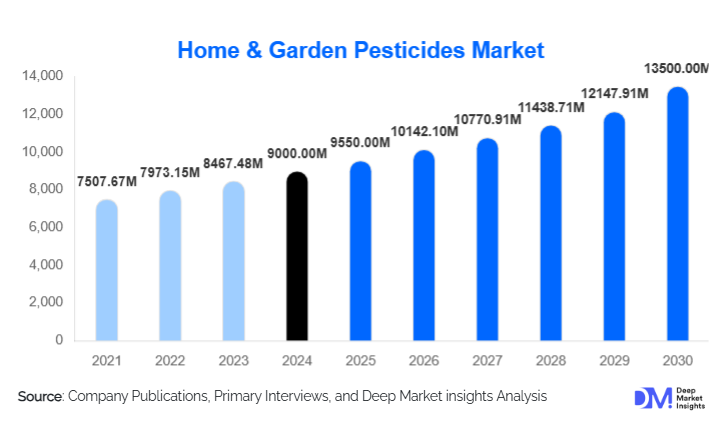

According to Deep Market Insights, the global Home & Garden Pesticides market size was valued at USD 9,000 million in 2024 and is projected to grow from USD 9,550 million in 2025 to reach USD 13,500 million by 2030, expanding at a CAGR of about 6.2% during the forecast period (2025–2030). The market growth is primarily driven by increasing home gardening and landscaping activities, rising consumer awareness of household pest risks, the growing adoption of eco-friendly pesticide formulations, and the expansion of urban green spaces globally.

Key Market Insights

- Home & garden pesticide usage is shifting toward eco-friendly and biopesticide-based solutions, as consumers increasingly prefer low-toxicity, natural, and sustainable pest-control options for residential gardens and lawns.

- Urban landscaping and residential outdoor living trends are expanding, with homeowner investment in lawns, garden beds, terraces, and patios driving sustained demand for herbicides, insecticides, and fungicides in the home & garden segment.

- North America dominates global demand, supported by a strong lawn-care culture, high disposable income, mature retail infrastructure, and a preference for garden/pest control solutions in residences.

- Asia-Pacific is the fastest-growing region, led by rising middle-class incomes, urban green-space development, increased homeowner DIY activity, and expanding e-commerce channels for garden-care products.

- Technology integration and professional service models are advancing, including smart pest-monitoring, app-based garden maintenance, and professional landscaping/maintenance firms in residential green spaces.

What are the latest trends in the Home & Garden Pesticides Market?

Eco-Friendly & Biopesticide Solutions on the Rise

Manufacturers are increasingly introducing botanical, microbial, and low-toxicity pesticide products tailored for residential use. Homeowners are more environmentally conscious, seeking formulations that pose minimal risk to pets, children, and the ecosystem. Retailers and brands are responding by prominently marketing “green” or “eco-safe” variants, often at a premium price. This trend is accelerating not only in mature markets such as North America and Europe but also in Asia-Pacific, where regulation and consumer awareness are evolving. Companies that develop or acquire biopesticide lines are gaining a competitive advantage and opening new premium segments.

Smart Garden & Professional Service Integration

The boundary between DIY home gardening and professional landscaping is blurring. Smart garden devices, sensor-based pest detection tools, app-enabled spray systems, and subscription-based garden care services are gaining traction. Homeowners increasingly outsource lawn and pest-control tasks to professional firms or adopt semi-professional products themselves. This shift enhances recurring usage and higher-value service bundles, expanding beyond one-time purchases of spray cans. The trend aligns with wider “smart home” adoption and outdoor living lifestyle upgrades in both developed and emerging markets.

Urban Green Infrastructure Boosting Residential Demand

Urbanization is fuelling the development of residential green spaces, terraces, balconies, communal gardens, green belts, and these areas require pest-control solutions adapted for non-agricultural settings. Municipalities and housing developments increasingly contract garden-maintenance services, which include pest control, creating new B2B pipelines for home & garden pesticide suppliers. Residential landscaping is no longer purely a hobby; it has become a lifestyle service, thereby increasing the addressable market for garden-care pest products.

What are the key drivers in the Home & Garden Pesticides Market?

Rising Home Gardening and Outdoor Living Culture

As more people spend time at home and invest in outdoor living (lawns, patios, gardens, terraces), maintaining plant health and preventing pest intrusion becomes a priority. DIY gardening is on the rise worldwide, and with it, demand for lawn and garden pest-control products. Landscaping services for residential green spaces are also expanding, further boosting demand for garden-pesticide solutions.

Health & Safety Awareness Driving Pest Control Usage

Growing concern about mosquitoes, rodents, ticks, molds, and other pests in residential environments is pushing homeowners to adopt proactive pest-control measures. The increased focus on public health, allergy mitigation, and pet safety has raised the bar for residential-use pesticide products. As a result, households are more willing to invest in effective and reliable pesticide formulations tailored to home and garden settings.

Innovation & Regulation Encouraging Safer Formulations

Regulatory pressure and consumer demand are prompting manufacturers to innovate in safer chemistries, improved formulations (ready-to-use sprays, granules, smart delivery systems), and improved packaging for residential markets. These innovations support growth not only by expanding product portfolios but also by giving consumers confidence in use. As conventional brands update or launch new variants, uptake among homeowners increases.

Restraints

Regulatory & Compliance Complexity

Pesticide registration, safety testing, and compliance are expensive and time-consuming. Residential-use products face strict guidelines in many jurisdictions (e.g., limited active ingredients, restrictions on usage indoors/outdoors). These regulatory hurdles raise entry barriers for new players and slow down product launches, which can dampen market expansion.

Consumer Resistance and Safety Concerns

Despite increasing demand, some homeowners remain hesitant to use chemical pesticides due to health, environmental, and residue concerns. Misuse or negative press (e.g., accidental poisoning, pet harm) can harm category perception. Unless manufacturers and retailers effectively communicate safety, convenience, and value, adoption of new products may stagnate.

What are the key opportunities in the Home & Garden Pesticides Market?

Eco-friendly & Biopesticide Product Expansion

The shift toward sustainable living offers a compelling growth opportunity. Brands that can bring biopesticide, microbial, and botanical solutions to the home-garden channel stand to benefit from premium positioning and strong consumer demand. This is especially relevant in regions where regulation is tightening on synthetic pesticides. Developing low-residue, safe-for-pets, child-friendly formulations enables access to new segments and builds brand trust. Companies can also differentiate by offering certified organic garden-pest solutions, supporting the broader “green living” trend among homeowners.

Smart Garden & Service-Based Models

Integrating digital tools, smart sensors, and service-bundled models into pest-control offerings is another big opportunity. Manufacturers and service providers can partner to offer subscription-based garden maintenance services that include pest monitoring, targeted treatment, and recurring product deliveries. The professional landscaping channel is also ripe: suppliers can tailor solutions for landscape contractors servicing high-end residential developments and urban green spaces. Leveraging technology (app-based scheduling, IoT sensors, data-driven pest alerts) enhances product value and fosters customer loyalty.

Growth in Emerging Urban Markets & Green Infrastructure Projects

Rapid urbanization, rising home-garden culture, and municipal investment in landscaping in emerging economies create strong upside potential. Regions such as Asia-Pacific and Latin America are seeing increased adoption of residential green spaces and DIY gardening. Moreover, public investments in parks, condo-gardens, and community green belts often include pest-control contracts, opening new channels for home-garden pesticide manufacturers. Companies that build distribution networks and tailor products for these markets can capture a significant share ahead of slower-moving competitors.

Product Type Insights

Within the product-type segmentation, herbicides lead the home & garden pesticides market, capturing the largest share (approximately 43% of the 2024 global market). The dominance of weed-control products in lawns and garden beds explains this strong position, as homeowners continuously manage unwanted vegetation. The recurring nature of weed control, combined with established product familiarity, supports steady demand. Meanwhile, product innovation in selective herbicides, “weed-&-feed” granular combos, and turf-safe formulations is accelerating uptake among residential consumers.

Application Insights

By application, the garden/lawn segment is the largest within the home & garden pesticide market, accounting for roughly 79% of the global market in 2024. This high share is driven by the prevalence of outdoor green spaces in residential settings, including lawns, flower beds, patios, and communal areas. Homeowners and landscaping services invest significantly in weed, insect, and fungal control to maintain aesthetics and plant health. Indoor/household applications account for a smaller share but are rapidly growing, particularly for insecticides and rodenticides targeted at indoor pests. The professional landscaping segment also contributes, especially for high-end homes and urban developments.

Formulation Insights

The liquid spray/concentrate formulation category leads the market, especially in the household and garden segments. Liquids offer ease of use, versatility (spray, drip, hose-end), and broad pest-control coverage, making them attractive for DIY consumers. Because of convenience, ready-to-use (RTU) liquids command strong retail shelf space and frequent usage. Granules, powders, and aerosol/fogger formats follow, but the dominance of liquids is a defining characteristic of the home-garden pesticide channel.

Distribution Channel Insights

Offline retail remains the dominant distribution channel for home & garden pesticides. Traditional brick-and-mortar outlets, such as garden centres, home improvement stores, hardware chains and supermarkets, continue to account for the bulk of sales due to consumer preference for physical inspection, immediate availability and local expert advice. However, e-commerce is growing rapidly, especially among younger homeowners and in emerging markets where direct-to-consumer garden-care brands are expanding online. Commercial/B2B channels (landscaping contractors, maintenance services, municipal procurement) also represent a significant and growing share of volume, particularly for bulk or professional-grade products.

End-Use Insights

The dominant end-use segment in the home & garden pesticide market is the residential homeowner (DIY) channel, supported by rising interest in home-gardening, outdoor living, and pest management in suburban and urban properties. This segment is growing fastest due to increasing consumer spend on garden maintenance, awareness of health/pest issues, and the ease of product availability. The professional landscaping and garden services segment is also gaining traction, especially in premium residential developments, urban green-space maintenance, and communal housing complexes. In addition, a rising export-driven demand for garden-care pesticides is seen as manufacturers in mature markets service globally expanding landscaping firms and private estates abroad, thereby diversifying their channel base.

| By Product Type | By Application | By Formulation | By Distribution Channel | By Technology |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market for home & garden pesticides, with the United States leading demand due to a strong lawn-care culture, high environmental awareness, and developed retail infrastructure. The region accounted for approximately 35–38% of global market revenue in 2024. The mature DIY market, widespread professional landscaping services, and established distribution networks underpin this dominance. Canadian demand also contributes, although at a smaller scale.

Europe

Europe is another major region, characterised by high regulation on pesticide use, strong consumer preference for eco-friendly formulations, and well-developed garden-care markets in countries such as Germany, France, and the UK. While growth is more moderate than in emerging regions, demand remains substantial and sophisticated, particularly for biopesticides and low-toxicity solutions.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the home & garden pesticides market. Rising incomes, rapid urbanization, increasing home-garden adoption, and improved retail/e-commerce infrastructure all contribute. Key markets include China and India, where residential green spaces, DIY gardening, and landscaping services are expanding. While per-capita usage remains lower than in mature regions, growth rates are strong and the region offers significant upside potential.

Latin America

Latin America, with countries such as Brazil and Mexico, is seeing growth in the home-garden pesticide market driven by rising residential lawn/garden ownership and growing interest in outdoor living. However, regulatory variability, distribution infrastructure challenges, and economic volatility somewhat constrain expansion compared to the Asia-Pacific.

Middle East & Africa

The Middle East & Africa region is smaller in absolute size but has emerging potential. Urban residential developments, landscaped villas, communal gardens, and municipal green-space investments in Gulf countries (UAE, Saudi Arabia) and South Africa are driving demand for garden-care pest-control products. While the current share is modest relative to other regions, momentum is building, and the region can become a meaningful niche market.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Home & Garden Pesticides Market

- Bayer

- BASF

- Syngenta

- Corteva

- FMC

- Scotts Miracle-Gro

- Central Garden & Pet

- SC Johnson & Son

- Spectrum Brands

- UPL

- Nufarm

- Adama (ChemChina)

- DuPont

- Sumitomo Chemical

- Willert Home Products

Recent Developments

- In mid-2025, a leading agrochemical firm announced the acquisition of a biopesticide startup specialising in botanical lawn-care solutions for homeowners, enabling faster entry into the eco-friendly segment.

- In early 2025, a garden-care brand launched an app-connected pest-monitoring device and bundled a pesticide subscription service for homeowners, blending product sales with digital services.

- In late 2024, several manufacturers expanded production capacity in Asia-Pacific under government incentives aimed at localising manufacturing of garden-care chemicals and reducing import dependence for emerging markets.