High-Pressure Rice Cooker Market Size

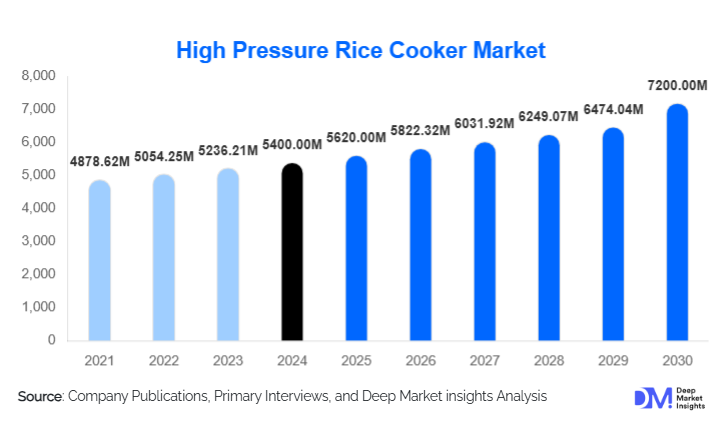

According to Deep Market Insights, the global high-pressure rice cooker market size was valued at approximately USD 5,400 million in 2024 and is projected to reach around USD 5,620 million in 2025, growing further to about USD 7,200 million by 2030, expanding at a CAGR of roughly 3.6% during the forecast period (2025–2030). The market’s growth is being propelled by rising demand for time-efficient cooking solutions, increasing adoption of smart and connected kitchen appliances, improving disposable incomes in emerging markets, and the expansion of distribution channels, including e-commerce platforms across Asia, North America, and Europe.

Key Market Insights

- Ordinary (non-smart) high-pressure rice cookers currently dominate in value share, particularly in price-sensitive regions, due to their more affordable cost and simpler design.

- Smart/connected high-pressure rice cookers are the fastest-growing subsegment, as consumers favor app control, recipe guides, and sensor-based cooking features.

- Asia-Pacific accounts for the majority of demand, with China, India, Japan, South Korea, and Southeast Asian nations representing the biggest markets for both basic and premium units.

- Offline retail still commands the largest share of sales, driven by consumer preference for seeing and testing kitchen appliances in person, though online channels are rapidly growing.

- Residential users form the core demand base, with households accounting for the bulk of unit sales; commercial users (restaurants, hotels) represent a smaller but high-value segment.

- Technological integration, like IoT, fuzzy logic controls, and energy-efficient designs, is reshaping differentiation among competitive offerings.

Latest Market Trends

Smart Kitchen Integration & IoT Adoption

Increasingly, manufacturers are embedding connectivity features into high-pressure rice cookers such as mobile app control, voice assistant compatibility (e.g., Alexa / Google Home), recipe libraries, and sensor-based cooking modes. These smart cookers appeal to tech-savvy consumers who want convenience, remote monitoring, and customization. Brands are investing in software platforms and user experience to build customer loyalty. The smart sub-segment is growing at a faster rate than traditional models.

Premiumization & Multi-Functionality

Consumers are gravitating toward models that do more than just cook rice: steaming, slow cooking, baking, “keep warm” modes, multiple grain types, and more. Premium features such as induction heating, advanced pot materials (stainless steel, special coatings), better insulation, and more precise controls allow higher margins and differentiation. As consumers become more discerning, premiumization is a key trend in mature markets and among affluent buyers in emerging ones.

Channel Diversification & E-Commerce Growth

While offline retail remains dominant, online sales are surging, particularly in Asia and North America. Brands are pushing D2C (direct-to-consumer) sales, flash sales, bundled offerings, and after-sales support via online platforms. This shift reduces distribution margins and increases competition, but also broadens reach into smaller towns and remote areas. Reviews, ratings, and digital marketing are becoming critical in influencing purchase decisions.

Market Drivers

Urbanization, Busy Lifestyles, and Time Constraints

With dual-income families, urban living, and reduced time for meal preparation, consumers increasingly favor appliances that speed up staple cooking. High-pressure rice cookers halve or cut significantly the time compared to conventional rice cookers, making them appealing to busy households. This shift has been particularly visible in Asia, but is also influencing adoption in developed markets.

Technological Innovation & Material Advances

Advances in microcontrollers, sensors, heating elements, and materials (better insulations, pot coatings) have enhanced product performance, reliability, and safety. These improvements justify premium pricing and better user experience, pushing more consumers toward upgraded units over legacy models.

E-commerce & Improved Distribution Networks

The spread of e-commerce and better logistics allows brands to penetrate deeper into secondary and tertiary markets. This reduces reliance on physical retail, cuts distribution friction, and enables targeted marketing. Consumers can now compare models, read reviews, and buy directly from brand websites or marketplaces, fueling faster growth.

Market Restraints

High Upfront Cost & Price Sensitivity

Smart and premium high-pressure rice cookers are significantly more expensive than basic models or non-pressure cookers. In markets with tight consumer budgets, the price premium may deter adoption, especially in rural or lower-income segments. The cost of materials, electronic components, and certifications adds to the challenge.

Safety & Regulatory Complexity

Because high-pressure appliances must reliably seal, relieve pressure safely, and meet electrical safety standards, rigorous certification is required in each market. Differing regional standards (UL, CE, local pressure vessel rules) complicate design and compliance. Consumers in some regions remain cautious about safety, slowing adoption.

Market Opportunities

Smart / Connected Kitchen Ecosystem Expansion

Household appliances are becoming interconnected; high-pressure rice cookers can become nodes in the smart kitchen ecosystem. Integrating with voice assistants, home automation systems, recipe cloud services, and remote diagnostics offers additional value and recurring engagement. For new entrants, software and platform strength may be a differentiator.

Untapped Emerging Markets & Rural Penetration

Many regions, small towns, and rural centers in India, Southeast Asia, and Africa remain underpenetrated. Tailoring lower-cost models, financing or installment payment schemes, and localized service networks can unlock significant new demand. As disposable incomes rise, these segments may constitute major growth pools.

Innovation in Energy Efficiency & Sustainable Materials

With rising electricity costs and environmental awareness, consumers and regulators are pushing toward more energy-efficient appliances. Innovations in insulation, efficient heating, better pot materials, and recyclable or sustainable components offer manufacturers room to differentiate and command more premium pricing. Models that meet or exceed regional energy efficiency standards will gain acceptance more readily.

Product Type Insights

Within the high-pressure rice cooker space, ordinary (non-smart) models still command the greatest share, particularly in price-sensitive and mass markets. These models focus on reliability and core cooking performance. The smart/connected models are the fastest-growing type, appealing in urban and developed markets with features like app control, multi-mode profiles, and sensor intelligence. Premium models with advanced heating, inner pot materials, and connected functionality cater to higher-end users seeking top performance and convenience. As smart features become more affordable, the share of smart models is expected to grow steadily.

Capacity Insights

The 3–5 liter capacity segment is the dominant category globally, matching the typical needs of average households (3 to 6 persons). This segment benefits from a good balance between cost, utility, and kitchen space. Smaller (5 L and commercial units) are used in big families or foodservice settings; growth there is slower in unit terms but higher in per-unit revenue due to premium pricing.

Distribution Channel Insights

Offline retail (appliance stores, specialty kitchenware shops, supermarkets) continues to dominate sales, because many consumers prefer to inspect the product firsthand and seek after-sales service locally. However, online channels (e-commerce, brand websites, marketplace platforms) are expanding rapidly. Brands are embracing D2C strategies, offering bundled warranties, installation service, and digital support to reduce reliance on middlemen. In many regions, a hybrid approach (click-and-collect, online ordering with showroom pickup) is emerging as an effective channel model.

End-User Insights

Residential / Household users form the core market, driving the vast majority of unit sales. This segment is propelled by convenience, small kitchen usage, and first adoption in emerging markets. Commercial / Foodservice users (restaurants, hotels, institutional kitchens) form a smaller but high-value segment; although their unit numbers are limited, their purchase volumes (higher capacity, durable units) and willingness to pay a premium for reliability make them strategically important. The residential side is expected to remain the volume engine, while commercial demand is a steady incremental growth contributor.

| By Product Type | By Capacity | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific is the largest regional market, accounting for roughly 60–65 % of global high-pressure rice cooker revenue in 2024. China likely contributes around 30–40 % of global demand, driven by both domestic consumption and exports. Japan and South Korea demand high-end premium models, whereas India and Southeast Asia represent high-volume, cost-sensitive opportunities. Growing urbanization, rising incomes, and strong rice consumption patterns underpin ongoing growth in this region.

North America

North America holds about 15–20 % of the global share. Demand is concentrated in the U.S., Canada and is driven by multicultural demographics, premium / smart models, and increasing interest in time-saving appliances. Though growth is modest in base models, the smart and premium segments show higher CAGR as consumers adopt connected appliances.

Europe

Europe’s share is about 10–15 %. Countries like Germany, the U.K., France, and the Nordic region favor energy efficiency, safety, and premium build standards. Rice is not a staple in all European diets, so adoption is slower, but smart & premium models find niche demand among health-conscious and tech-savvy consumers.

Latin America

Latin America accounts for 5–7 % of the global market, with Brazil and Mexico leading. Demand is largely cost-sensitive; basic models dominate, while premium/smart units remain niche. Growth is steady, tied to rising middle classes and urban adoption.

Middle East & Africa

MEA comprises a 4–6 % share. The Gulf Cooperation Council (UAE, Saudi Arabia) is a key market, fueled by expatriate populations seeking rice appliances, high disposable incomes, and premium adoption. In Africa, adoption is more limited, constrained by electricity access and affordability, but urban centers show increasing demand. Among these, the Middle East subregion is the fastest growing from a small base.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the High-Pressure Rice Cooker Market

- Midea

- Joyoung

- Supor (Groupe SEB)

- Philips

- Zojirushi

- Cuckoo

- Tiger

- Cuchen

- Panasonic

- Mitsubishi Electric (Japan)

- Galanz (Guangdong Galanz)

- Povos

- Peskoe (Guangdong Peskoe)

- Aroma (Aroma Housewares)

- Other regional manufacturers

Recent Developments

- In 2025, several major brands rolled out new smart high-pressure rice cookers featuring voice assistant compatibility, remote app control, and AI-based recipe suggestions to capture premium demand.

- During 2024–25, the expansion of manufacturing footprints into Southeast Asia and India by Chinese makers helped reduce costs and bypass import tariffs, facilitating growth in those markets.

- Recently, grants and incentives under “Make in India” and similar national manufacturing schemes have encouraged local appliance production of pressure cookers, reducing reliance on imports and boosting local employment.

- Also, partnerships between appliance makers and smart-home platform companies (IoT firms) have strengthened, for example, co-development of apps or integration over common ecosystems.