High Intensity Discharge (HID) Lighting Market Size

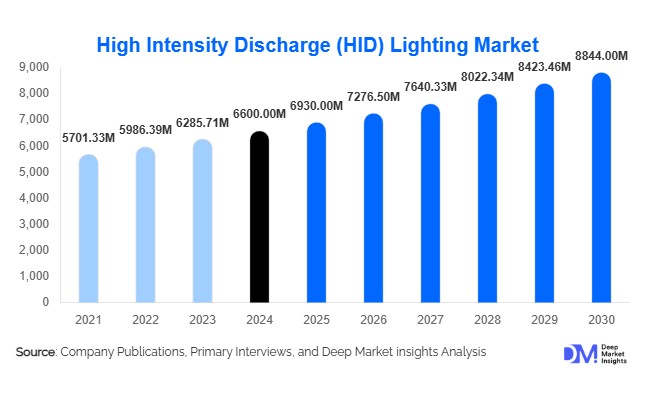

According to Deep Market Insights, the global High Intensity Discharge (HID) Lighting Market size was valued at USD 6,600 million in 2024 and is projected to grow from USD 6,930 million in 2025 to reach USD 8,844.63 million by 2030, expanding at a CAGR of 5.0% during the forecast period (2025–2030). Growth in this market is supported by rising infrastructure investments across developing economies, increasing demand for high-output lighting in industrial and public spaces, and ongoing retrofitting programs that integrate smart lighting technologies with traditional HID systems.

Key Market Insights

- High-pressure sodium (HPS) lamps remain the dominant HID product type, accounting for approximately 35% of the global market share in 2024, primarily due to widespread use in street and highway lighting.

- Asia-Pacific leads the global HID lighting market with an estimated 40% revenue share, driven by rapid urbanization, infrastructure development, and large-scale industrial projects in China and India.

- Street and highway lighting applications account for nearly 28% of total market revenues, supported by extensive government-led infrastructure projects worldwide.

- Technological upgrades in HID ballast systems and integration with smart lighting controls are extending the operational life and efficiency of traditional HID systems.

- Government infrastructure spending and “smart city” initiatives in emerging markets are creating consistent demand for high-output, cost-effective HID solutions.

- Competitive intensity remains moderate, with the top five manufacturers collectively accounting for 30–35% of the global HID lighting market.

What are the latest trends in the HID lighting market?

Smart and Connected HID Systems

As global municipalities modernize public lighting infrastructure, HID systems are being equipped with smart controls, motion sensors, and remote monitoring features. These smart HID solutions allow adaptive lighting management, energy efficiency optimization, and integration with IoT-based platforms. Retrofit kits enabling conventional HID systems to become “smart-ready” are gaining traction, especially in large street-lighting networks across Asia-Pacific and the Middle East. The integration of connected ballast systems and data-driven lighting management is helping governments achieve sustainability goals without fully replacing existing HID installations with LEDs.

Industrial and Warehouse Lighting Expansion

The rapid expansion of e-commerce and large-scale logistics hubs has spurred demand for high-output lighting systems suitable for tall ceilings and extensive floor areas. HID lamps, particularly those above 500 W, remain preferred for these applications due to their reliability, light intensity, and cost-effectiveness in high-mounting scenarios. Industrial retrofitting programs that integrate HID with automated control systems are emerging, optimizing illumination in manufacturing plants, warehouses, and distribution centers. This trend underscores HID’s continuing relevance in the industrial lighting segment despite the rise of LED alternatives.

Infrastructure-Led Urban Growth

Developing economies are experiencing major public infrastructure investments, including highways, airports, tunnels, and sports facilities—applications where HID lighting remains the technology of choice. Government-backed urban development and smart-city projects are fueling demand for both new HID installations and retrofit programs. Nations like India, Saudi Arabia, and Indonesia are accelerating highway expansion and public illumination schemes, reinforcing the sustained role of HID lighting in global infrastructure development.

What are the key drivers in the HID lighting market?

Infrastructure and Urbanization in Emerging Regions

Rapid infrastructure expansion in Asia-Pacific, the Middle East, and Africa continues to be the leading growth driver. Government investments in transportation, urban renewal, and industrial corridors demand powerful, reliable lighting systems. HID lamps, particularly high-pressure sodium and metal halide types, remain cost-effective options for these large-scale installations, offering broad coverage and longevity that justify their selection over newer technologies in certain conditions.

Industrial and Logistics Lighting Demand

With global supply chains expanding and warehouse construction on the rise, industrial users increasingly rely on HID lighting for its superior lumen output and ability to perform in demanding conditions. The trend toward 24-hour logistics operations further sustains this demand, making HID fixtures a mainstay in heavy-duty and high-bay environments.

Technological Advancements and Hybrid Systems

Continuous improvements in ballast efficiency, light quality, and control integration are extending the lifespan and competitiveness of HID systems. Hybrid HID-LED solutions are emerging, combining HID’s intensity with LED’s efficiency. This synergy allows existing installations to upgrade cost-effectively while maintaining high brightness levels, thus encouraging incremental market growth.

What are the restraints for the global market?

Competition from LED and Solid-State Lighting Technologies

The most significant restraint for the HID lighting market is the rapid adoption of LEDs, which offer lower energy consumption, longer lifespans, and reduced maintenance costs. As LED prices continue to decline, the total cost of ownership increasingly favors LED solutions for both new installations and retrofits, limiting HID market expansion.

Regulatory and Environmental Constraints

Stringent energy-efficiency standards and the global movement to phase out mercury-based lighting products are impacting HID lamp production and adoption. Environmental compliance costs and regulatory bans on certain lamp types—especially mercury vapor—pose challenges for manufacturers and end-users, compelling them to consider alternative technologies.

What are the key opportunities in the HID lighting industry?

Infrastructure Modernization and Smart City Programs

Emerging economies investing in large-scale infrastructure upgrades present significant opportunities for HID manufacturers. Smart-city initiatives seeking efficient, controllable lighting systems often prefer hybrid HID solutions as interim upgrades before full LED transitions. Governments prioritizing affordable, high-lumen technologies for roads and stadiums can drive substantial HID demand through 2030.

Industrial Retrofit and Hybrid Applications

Upgrading existing HID installations with smart ballasts or integrated sensors provides a lucrative opportunity. Companies offering hybrid HID-LED systems or retrofittable components can target end-users reluctant to replace entire lighting infrastructures. These upgrades enhance energy performance while preserving HID’s output characteristics, providing strong return-on-investment appeal.

High-Performance Niche Applications

HID lamps continue to dominate high-output niches such as stadiums, airports, and tunnels where intense, wide-area illumination is required. With global investments in sports infrastructure and aviation facilities, this segment provides steady long-term demand. Furthermore, HID’s proven reliability in extreme conditions ensures its continued use in mission-critical applications.

Product Type Insights

Among product categories, high-pressure sodium (HPS) lamps lead the market with approximately 35% revenue share in 2024, favored for their efficiency and longevity in outdoor and municipal lighting. Metal halide lamps follow closely, particularly used in industrial and sports facilities requiring high color rendering. Xenon arc lamps serve specialized niches such as cinema projection and automotive applications. While LEDs continue to encroach on HID market share, ongoing retrofits sustain moderate demand for traditional HID lamps worldwide.

Application Insights

Street and highway lighting remains the single largest application, accounting for roughly 28% of total HID revenues in 2024. Governments in India, China, and the Middle East continue deploying HID systems in urban and intercity road networks due to their high illumination power and cost efficiency. Other major applications include industrial facilities, stadiums and arenas, and transportation infrastructure such as tunnels and airports. Horticultural lighting and specialized commercial uses represent emerging subsegments, supported by improved HID spectral control.

Technology Insights

Conventional HID lighting systems still dominate, holding around 70% market share in 2024. However, smart and retrofit HID systems are the fastest-growing technology subsegment, fueled by rising adoption of intelligent controls, occupancy sensors, and automated lighting networks. These advancements are expected to capture increasing market share during 2025–2030 as municipalities pursue energy savings without full infrastructure replacement.

| By Product Type | By Wattage | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for approximately 25% of the global HID lighting market in 2024. The U.S. remains the largest consumer, primarily driven by highway maintenance programs and industrial lighting retrofits. However, market growth is moderate due to rapid LED adoption. Demand is mainly replacement-oriented, with upgrades focusing on energy efficiency and automation.

Europe

Europe represents about 20% of the 2024 market share, with Germany, the U.K., and France leading adoption. Strict energy standards and sustainability mandates are accelerating the shift toward LED, but HID remains significant in older public-lighting networks and specialized installations such as tunnels and airports.

Asia-Pacific

Asia-Pacific dominates with a 40% share of global revenues in 2024 and is projected to exhibit the fastest CAGR through 2030. China and India are key contributors, supported by strong infrastructure spending, rapid industrialization, and widespread public-lighting programs. Southeast Asian nations—Indonesia, Vietnam, and Thailand—are emerging growth hotspots.

Latin America

Latin America contributes roughly 5% of the global market. Brazil, Mexico, and Argentina are leading countries, investing in public lighting modernization and sports infrastructure. While growth potential exists, market expansion is moderate due to limited manufacturing capacity and import dependence.

Middle East & Africa

This region accounts for nearly 10% of global market revenues in 2024. The Middle East’s investment in mega infrastructure projects, stadiums, and smart cities (e.g., Saudi Arabia’s Vision 2030) continues to support HID demand. Africa’s market, led by South Africa, Nigeria, and Kenya, benefits from expanding urban infrastructure and donor-funded electrification projects.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the HID Lighting Market

- Signify (Philips Lighting)

- Osram GmbH

- GE Lighting

- Acuity Brands Inc.

- Hella KGaA Hueck & Co.

- Zumtobel Group AG

- Cree Inc.

- Cooper Lighting Solutions

- Nichia Corporation

- Eaton Corporation PLC

- Crompton Greaves Ltd.

- Bulbrite Industries Inc.

- Lithonia Lighting

- Avery Dennison Lighting

- Opple Lighting

Recent Developments

- In April 2025, Signify introduced an upgraded line of smart HID ballasts with IoT integration for municipal street lighting, targeting Asian and Middle Eastern markets.

- In February 2025, Osram launched its “HID X-Series” with improved luminous efficacy and longer life cycles for industrial and sports facility applications.

- In January 2025, Acuity Brands announced an investment in connected-lighting research focusing on hybrid HID-LED retrofit solutions for commercial and warehouse settings.