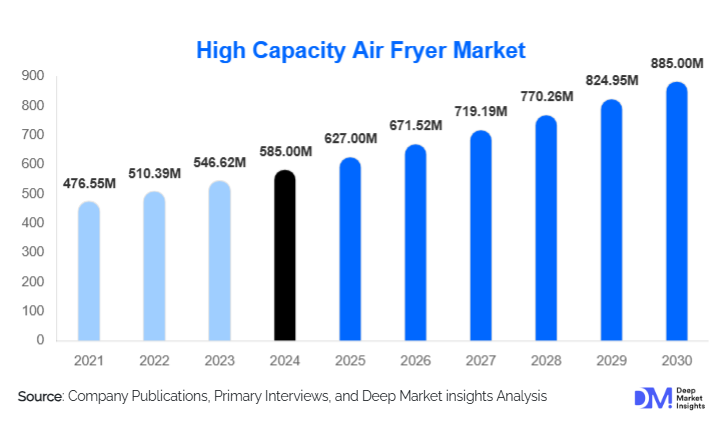

High Capacity Air Fryer Market Size

According to Deep Market Insights, the global high capacity air fryer market size was valued at USD 585.0 million in 2024 and is projected to grow from USD 627.0 million in 2025 to reach USD 885.0 million by 2030, expanding at a CAGR of 7.1% during the forecast period (2025–2030). Market expansion is driven by rising household demand for batch-cooking solutions, growing adoption in small commercial kitchens (cloud kitchens, catering), and increasing consumer preference for healthier cooking methods that reduce oil usage while delivering fried textures.

Key Market Insights

- High high-capacity segment is shifting from niche to mainstream as families, meal-preppers, and small foodservice operators prefer 4–8 L and above units that enable batch cooking and multifunctional use.

- Smart and multi-function models command premium pricing, with digital controls, app connectivity, and multi-cook presets being decisive purchase factors for value-seeking buyers.

- Asia-Pacific dominates global demand, representing nearly half of the high-capacity market in 2024 due to population density, larger household sizes, and growing middle-class appliance purchases.

- Commercial adoption is accelerating among cloud kitchens and smaller restaurants seeking oil reduction, cleaner operations, and faster throughput.

- Offline retail remains important for large appliances buyers prefer to inspect size and build yet online channels are rapidly closing the gap for information, reviews, and cross-border purchases.

- Energy efficiency and safety regulations are becoming differentiators as buyers expect lower running costs and compliance with regional electrical standards.

Latest Market Trends

Premiumization through Smart & Multi-Function Features

Manufacturers are increasingly packaging large capacity units with features beyond simple air-frying. Rotisserie attachments, multi-rack baskets, dehydration modes, convection baking, and sensor-based cooking are now common. Smart featuresmobile apps, cloud presets, integration with voice assistants, and automatic load-sensing algorithms, justify a premium and improve user experience for multi-meal households. These enhancements also reduce the perceived trade-off between a high-capacity single-purpose appliance and a conventional oven.

Commercial & Cloud Kitchen Adoption

High-capacity air fryers are no longer solely household appliances. Cloud kitchens, small restaurants, and catering businesses increasingly deploy robust high-capacity units to accelerate service, reduce oil use and cleanup, and widen menu flexibility. The result is stronger revenue per sale for manufacturers supplying commercial-grade models, and a growing aftermarket for service, spare parts, and B2B leasing programs.

Localized Manufacturing & Supply-Chain Optimization

To reduce shipping costs and tariff sensitivity for large, heavy appliances, producers are partnering with regional manufacturers or moving assembly closer to end markets. This localization reduces time-to-shelf, allows price competitiveness in price-sensitive regions, and helps manufacturers conform to local standards/certifications more quickly.

High Capacity Air Fryer Market Drivers

Health & Wellness Cooking Preferences

Consumers continue to avoid excessive oil and fat for health reasons. Air fryers deliver fried textures with significantly less oil, attracting families and health-conscious cooks. The ability to produce large batch healthier meals appeals strongly to households that cook for multiple family members or entertain frequently.

Need for Convenience & Batch Cooking

High-capacity air fryers fulfill a practical need: they reduce overall meal preparation time and enable batch cooking (multi-dish or larger single items), appealing to busy dual-income households, meal-preppers, and consumers who cook in larger quantities. The time savings compared to traditional ovens for certain recipes is a tangible driver.

Rising Food Service & Cloud Kitchen Sector

Expanding food delivery models (cloud kitchens) and smaller quick-service operators favor equipment that reduces oil usage, simplifies cleaning, and shortens cook times. High-capacity air fryers provide these benefits while enabling menu diversification (e.g., “fried” proteins, vegetable platters, and reheating), boosting demand from this end-use segment.

Market Restraints

Higher Upfront Cost & Running Cost Concerns

Large capacity units are materially costlier than compact models due to more powerful heating elements, larger housings, and additional features. For price-sensitive households, higher acquisition costs and concerns about energy consumption (higher wattage) act as adoption barriers.

Space & Infrastructure Limitations

High-capacity air fryers require more counter or cabinet space and often higher electrical capacity. Densely packed urban kitchens and regions with constrained electrical infrastructure can find deploying large units impractical. Additionally, shipping and after-sales service for bulky appliances add operational complexity in some markets.

High Capacity Air Fryer Market Opportunities

Smart & Subscription-Enabled Value Chains

Embedding connectivity and offering subscription services (recipe packs, maintenance plans, consumable replacement filters or coatings) can create recurring revenue. Manufacturers can sell premium cookbooks, community recipe platforms, or firmware-based feature packs that differentiate their models and build customer loyalty.

Commercial Product Lines & Service Contracts

Designing commercial-grade high-capacity, robust construction, longer warranties, parts availability, and service contracts opens a profitable B2B channel. Leasing, rent-to-own, and equipment finance options make large units accessible to smaller food operators who cannot afford capex up-front.

Regional Production & Market Entry in Emerging Economies

Setting up localized manufacturing or assembly (or partnering with local OEMs) in Asia, Latin America, and Eastern Europe can reduce landed costs and enable competitive pricing. Coupled with targeted financing and promotion, local production helps overcome tariffs and distribution constraints, accelerating penetration among mid-income households.

Product Type Insights

High-capacity models split largely into basket/drawer types and oven-style countertop chambers. Basket/drawer models lead residential adoption due to familiarity and compact footprint, while oven-style units appeal to premium buyers seeking multi-rack baking and larger roast capacity. Built-in or freestanding heavy-duty models are niche but are gaining traction among commercial users. Across price tiers, digital and smart control variants are growing fastest, capturing the premium segment.

Application Insights

Primary applications remain residential batch cooking and commercial small-scale frying/roasting. Popular residential uses include family dinners, meal prep, and entertainment (party platters). Commercial applications include quick-service sides, reheating, and smaller protein frying for delivery menus. New applications as institutional cooking for schools or healthcare facilities seeking healthier food optionsare emerging as operators seek lower oil use and simpler cleaning protocols.

Distribution Channel Insights

Large appliances retain a hybrid distribution pattern. Offline retail (appliance stores, big-box retailers, specialty kitchen shops) still captures a majority of immediate purchases because buyers want to inspect size and build. However, online channels (brand websites + marketplaces) increasingly dominate discovery and research; many buyers confirm online and purchase offline or vice-versa. Omnichannel strategies that combine try-and-see with extensive online content perform best for high-capacity models.

Buyer Type Insights

Buyers for high-capacity units fall into: (1) family households (the largest share), (2) meal-preppers and health enthusiasts (high willingness to pay), and (3) commercial kitchens/cloud kitchens (fastest growing by percentage). Families seeking batch cooking and multi-functionality represent the core volume segment; commercial buyers drive higher revenue per unit and steer product ruggedness and service requirements.

Household & Demographic Insights

Households of 4+ members dominate purchases of high-capacity air fryers. Age cohorts 30–50 years represent the largest buying group due to stable incomes, family size, and interest in convenience cooking. Younger buyers (25–35) lean toward smart features and social-media-driven recipe discovery. Affluent older buyers favor premium, easier-to-use models with safety features.

| By Product Type | By Application | By Distribution Channel | By Capacity Range |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia Pacific

Asia-Pacific leads the global high-capacity air fryer market with an estimated 48% market share in 2024 ( USD 280.8 million of the 2024 market). China, India, and Southeast Asia drive volume. China with strong domestic manufacturing, and India with accelerating household appliance adoption. Fastest growth is expected in India and Southeast Asia due to low base and rising urban appliance penetration.

North America

North America accounts for about 22% of the 2024 market ( USD 128.7 million). The U.S. prefers premium, feature-rich high-capacity units for family kitchens and meal prep; adoption is steady with moderate CAGR as penetration is already high relative to emerging markets.

Europe

Europe holds roughly 16% of the market, with demand concentrated in Western Europe (Germany, the UK, and France). Buyers focus on energy efficiency, build quality, and brand reputation. Growth is steady, favoring premium models.

Latin America

Latin America (Brazil, Mexico) is emerging, with constrained adoption due to price sensitivity and distribution challenges; opportunities lie in localized pricing and financing solutions.

Middle East & Africa

MEA is a smaller but growing market, Gulf countries show high per-capita uptake for premium units, while African markets grow slowly due to infrastructure constraints. Intra-region tourism and hospitality can boost commercial demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the High Capacity Air Fryer Market

- Philips

- SharkNinja

- Breville Group

- Instant Brands

- Midea Group

- Whirlpool Corporation

- Samsung Electronics

- LG Electronics

- Panasonic Corporation

- Groupe SEB (Tefal)

- Conair Corporation (Cuisinart)

- Haier Group

- Stanley Black & Decker

- GoWISE USA

- Cosori