Hidden TV Lifts Market Size

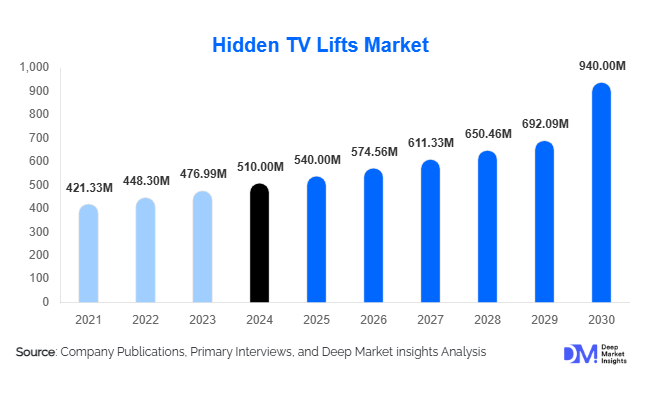

According to Deep Market Insights, the global hidden TV lifts market size was valued at USD 510 million in 2024 and is projected to grow from USD 540 million in 2025 to reach USD 940 million by 2030, expanding at a CAGR of 6.4% during the forecast period (2025–2030). The hidden TV lifts market growth is primarily driven by the rising adoption of smart home solutions, increasing demand for space-saving furniture, and the integration of advanced automation and design aesthetics in residential and commercial environments.

Key Market Insights

- Residential applications dominate the market, as homeowners increasingly seek modern, space-efficient entertainment solutions that enhance aesthetic appeal.

- Integration with smart home ecosystems is accelerating, enabling remote and voice-controlled operation of TV lifts, improving convenience and user experience.

- Commercial adoption is emerging, particularly in hotels, conference rooms, and retail spaces, where discrete installation of display systems is in high demand.

- North America holds the largest market share, led by the U.S. and Canada, due to high consumer spending on home automation and entertainment technologies.

- Asia-Pacific is the fastest-growing region, driven by urbanization, rising disposable incomes, and increasing interest in modern interior design solutions in countries such as China and Japan.

- Technological innovation, including motorized lifts with smart device integration and enhanced safety mechanisms, is driving differentiation and adoption across all regions.

What are the latest trends in the hidden TV lifts market?

Smart Home Integration

Hidden TV lifts are increasingly being designed for seamless integration with smart home systems, including voice assistants, remote control apps, and home automation hubs. This allows homeowners to control lifts along with lighting, climate, and entertainment systems from a single interface, enhancing convenience and improving the overall user experience. Manufacturers are also developing lifts with programmable settings and automated schedules, catering to growing demand for connected living spaces.

Customization and Premium Aesthetics

Consumer preferences are shifting toward customizable solutions that match furniture design, material finish, and room aesthetics. Leading manufacturers now offer fully tailored TV lift mechanisms that can fit bespoke cabinetry or modular furniture. Luxury and premium segments, in particular, are focusing on high-quality materials, quiet operation, and visually appealing mechanisms, making hidden TV lifts both functional and an interior design statement.

What are the key drivers in the hidden TV lifts market?

Growing Smart Home Adoption

The rising adoption of smart home technologies globally is a primary driver for the hidden TV lifts market. Consumers are increasingly seeking integrated solutions that enhance convenience, such as lifts that operate through apps, voice assistants, or programmable automation. This trend is particularly prominent in North America and Europe, where high digital penetration and technology awareness drive early adoption.

Urbanization and Space Optimization

With urban living spaces becoming smaller, consumers are prioritizing space-efficient furniture solutions. Hidden TV lifts allow for televisions to be concealed when not in use, freeing up valuable space for other activities. This functionality is particularly attractive in apartments, condos, and multi-purpose living areas, supporting market growth.

Technological Advancements in Automation

Advancements in motorized and electric lift mechanisms, including quiet and smooth operation, weight handling capabilities, and smart integration features, have enhanced product appeal. Innovations such as voice control, automated scheduling, and app-based monitoring are making hidden TV lifts more accessible to a wider consumer base.

What are the restraints for the global market?

High Initial Investment

The cost of hidden TV lift systems, especially premium motorized models with smart integration, remains high relative to traditional wall mounts or static furniture. This upfront investment can be a barrier for price-sensitive consumers, limiting adoption in certain regions.

Complex Installation Requirements

Professional installation is often required to ensure proper integration with furniture and smart home systems, adding time and cost to the overall setup. Precision in installation is critical, particularly for ceiling-mounted or custom-fit lifts, which may limit DIY adoption and slow market penetration.

What are the key opportunities in the hidden TV lifts market?

Smart Home Ecosystem Expansion

As connected home devices become ubiquitous, there is a growing opportunity for hidden TV lift manufacturers to integrate their products with broader home automation platforms. Collaborations with smart device providers can expand product functionality and appeal to tech-savvy consumers seeking seamless, centralized control.

Customization for High-End Interiors

Demand for personalized and aesthetically appealing furniture is creating opportunities for manufacturers to provide tailor-made solutions. Premium segments benefit from bespoke designs, luxury materials, and silent, smooth operations, catering to affluent customers and interior designers who prioritize both function and visual appeal.

Commercial Applications

Hotels, conference rooms, and retail stores are increasingly adopting hidden TV lifts to maintain a clean and professional environment. In commercial spaces, hidden lifts enhance functionality without compromising aesthetics, representing a fast-growing market segment for new entrants and existing players seeking diversification.

Product Type Insights

Motorized hidden TV lifts dominate the market due to their convenience and compatibility with smart home systems. Hydraulic lifts, while less prevalent, are preferred for larger screens requiring higher weight capacity. Ceiling-mounted lifts are increasingly popular in modern homes and apartments where wall space is limited, whereas furniture-integrated lifts maintain high adoption in residential and luxury applications.

Application Insights

Residential applications account for the largest share of the market, driven by consumer desire for space optimization and modern home entertainment setups. Commercial applications, including hotels, conference rooms, and corporate offices, are witnessing the fastest growth, reflecting a rising trend in luxury and technology-integrated environments. Hospitality-focused deployments are particularly significant in high-end hotels and resorts seeking discreet multimedia solutions.

Distribution Channel Insights

Online retail channels, including direct-to-consumer websites and e-commerce platforms, are increasingly becoming the preferred purchasing route due to convenience, wider selection, and easy comparison of features. Specialty home automation dealers and interior design partners also contribute to distribution, particularly for premium installations requiring professional guidance. B2B sales to commercial clients, including hotels and corporate offices, are growing steadily as large-scale integration projects expand.

End-Use Insights

The residential sector represents the largest end-use segment, driven by smart home adoption and rising consumer interest in multifunctional furniture. Commercial applications, particularly in the hospitality and corporate sectors, are emerging rapidly as businesses prioritize aesthetics and technological integration. Export-driven demand is notable from North America and Europe, supplying premium lifts to regions such as Asia-Pacific and the Middle East.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America is the largest market, with the U.S. and Canada accounting for nearly 38% of global demand in 2024. High disposable income, early adoption of smart home technologies, and strong interest in luxury home upgrades drive demand. Customizable and automated lifts are particularly popular in urban centers and affluent suburban households.

Europe

Europe holds a 28% market share, led by Germany, the U.K., and France. The region’s demand is influenced by home design trends, space constraints in urban apartments, and increasing smart home adoption. Residential applications dominate, with commercial installations in hotels and offices gaining traction. Germany and France are leading the market due to high purchasing power and technology awareness.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with China, Japan, and Australia witnessing significant adoption. Rapid urbanization, rising middle-class income, and growing interest in modern interiors drive growth. Luxury and smart-enabled products are gaining popularity, particularly in metropolitan cities where space optimization is critical.

Middle East & Africa

The Middle East, particularly the UAE and Saudi Arabia, is emerging as a key market for premium hidden TV lifts due to high-income populations and a preference for luxury homes. Africa remains a smaller segment but shows potential in upscale residential projects.

Latin America

Latin America, led by Brazil and Mexico, represents an emerging market. Demand is gradually increasing in urban households and premium hotels, with consumers seeking both residential and commercial applications of hidden TV lift systems.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hidden TV Lifts Market

- Nexus 21

- Auton Motorized Systems

- Future Automation

- Touchstone Home Products

- Cabinet Tronix

- Venset

- AV Cabinet Solutions

- TV Lift Cabinets

- Motorized TV Lifts Inc.

- AV Cabinetry

- Lift TV Systems

- Elite TV Lifts

- Cabinet Innovations

- HomeLift Solutions

- SmartLift Technologies

Recent Developments

- In March 2025, Nexus 21 launched a new line of ultra-quiet, motorized TV lifts compatible with voice assistants, targeting luxury residential applications.

- In February 2025, Future Automation expanded its commercial solutions portfolio, supplying motorized TV lifts to international hotel chains in Europe and the Middle East.

- In January 2025, Auton Motorized Systems introduced modular ceiling-mounted lifts, enabling easier customization for space-constrained apartments and smart home installations.