Herbal Beauty Products Market Size

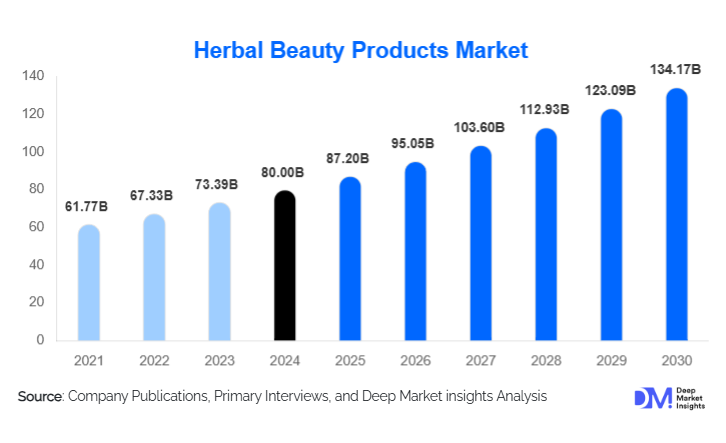

According to Deep Market Insights, the global Herbal Beauty Products market size was valued at USD 80.0 billion in 2024 and is projected to grow from USD 87.2 billion in 2025 to reach USD 134.17 billion by 2030, expanding at a CAGR of 9% during the forecast period (2025–2030). The market growth is primarily driven by increasing consumer preference for natural and chemical-free beauty solutions, rising awareness of skin and hair health, and the rapid expansion of e-commerce channels offering wide accessibility to herbal products worldwide.

Key Market Insights

- Consumer demand is shifting toward natural and sustainable beauty products, driven by concerns about allergies, skin sensitivities, and chemical exposure in conventional products.

- Skin care products dominate the market, with herbal creams, serums, and moisturizers holding significant preference among consumers due to anti-aging and skin-brightening properties.

- Asia-Pacific leads global demand, with India and China driving growth owing to traditional herbal usage, urbanization, and e-commerce adoption.

- E-commerce is the fastest-growing distribution channel, enabling both established and niche herbal brands to reach broader consumer bases.

- Product innovation and premiumization, including multi-functional herbal formulations like anti-aging sunscreens and personalized serums, are reshaping market dynamics.

- Regulatory support and certifications, such as organic labeling and cruelty-free verification, are increasing consumer confidence and global export opportunities.

Latest Market Trends in Herbal Beauty Products

Rising Preference for Natural and Organic Formulations

Consumers are increasingly adopting herbal-based products as part of their daily beauty routines. Ingredients like aloe vera, neem, turmeric, green tea, and ginseng are highly sought after for their natural benefits. Brands are emphasizing transparency by highlighting ingredient sourcing, sustainability practices, and eco-friendly packaging. The trend toward clean beauty is reinforced by social media campaigns, influencer endorsements, and rising awareness of chemical-related skin issues, encouraging new product launches in hair care, skin care, and cosmetics.

Integration of Technology in Product Development

Advanced extraction techniques, nano-encapsulation, and AI-driven personalization are shaping the herbal beauty products. Companies are leveraging bioactive plant compounds to enhance efficacy while maintaining natural integrity. Personalized beauty recommendations through online tools and AI-enabled skin diagnostics are gaining traction, allowing consumers to select products tailored to their skin type, hair type, and regional climate. This trend supports premiumization and consumer engagement.

Market drivers

Health and Wellness Consciousness

Global consumers are more informed about chemical sensitivities and the long-term health impacts of synthetic beauty products. Herbal formulations are perceived as safer and environmentally friendly, promoting strong growth in skin care, hair care, and oral care segments. Approximately 68% of global beauty consumers prioritize natural ingredients, driving higher adoption rates and repeat purchases.

E-Commerce and Direct-to-Consumer Channels

Online retailing has revolutionized market access, particularly in regions lacking traditional retail infrastructure. E-commerce accounted for nearly 27% of global sales in 2024. Direct-to-consumer channels allow small brands to reach niche markets and leverage digital marketing, influencer campaigns, and subscription models to increase penetration.

Product Innovation and Premiumization

Introduction of multi-functional, high-efficacy herbal products such as serums combining anti-aging and sunscreen benefits has attracted premium customers. Consumers are willing to pay higher prices for products offering scientifically validated natural benefits, enabling brands to enhance margins while expanding market share.

Market Restraints

High Raw Material Costs and Supply Volatility

Prices of key herbal ingredients like aloe vera, ginseng, and argan oil fluctuate due to seasonal availability, climate impact, and import/export regulations. Supply chain disruptions can affect product costs and profitability for both established brands and new entrants.

Lack of Standardization and Certification Challenges

Inconsistent quality standards across regions limit consumer trust. Absence of universally recognized certifications and labeling frameworks makes it challenging for brands to scale internationally, particularly for niche and smaller manufacturers.

Herbal Beauty Products Opportunities

Expansion into Emerging Economies

Markets in India, Brazil, Nigeria, and other emerging economies are experiencing growing disposable incomes, urbanization, and rising beauty awareness. Localized product launches catering to regional preferences such as turmeric-based skin care in India and shea butter hair care in Africa present lucrative opportunities for both new entrants and established brands.

Advanced Technology Integration in Formulations

Bioactive compound extraction, nano-encapsulation, and personalized skincare solutions enable high-efficacy, multi-functional products. Investment in R&D for such innovations helps brands differentiate themselves, enhance premium offerings, and expand into new consumer segments.

Regulatory Support and Government Initiatives

Initiatives like “Make in India” and organic certification frameworks in Europe enhance market credibility and facilitate international trade. Brands leveraging these regulations gain consumer trust, improve export potential, and strengthen compliance-based competitive advantage.

Product Type Insights

Skin care dominates the market, accounting for 38% of the global share (USD 6.3 billion in 2024), driven by herbal creams, serums, and moisturizers. Hair care follows, with increasing demand for herbal shampoos and oils. Oils and serums (31% of the market) are popular globally for their multi-functional benefits. Bath & body, cosmetics, and oral care products are growing steadily, driven by premium formulations and e-commerce availability.

Distribution Channel Insights

E-commerce accounts for 27% of global sales, offering convenience, product variety, and access to niche brands. Specialty stores and health & beauty shops (23%) continue to serve loyal customers. Supermarkets and hypermarkets offer mass-market penetration, while direct selling channels target loyal customer bases through multi-level marketing campaigns.

End-Use Insights

Personal care and cosmetics dominate (55% of market, USD 9.1 billion in 2024) due to rising disposable income and urban lifestyles. Professional salons, wellness clinics, and hospitality sectors are increasingly adopting herbal products for premium services. Export-driven demand is significant, with major importing countries including the USA, Germany, France, and Japan, providing growth opportunities for manufacturers.

| By Category | By Ingredient | By Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds 19% of the global market (USD 3.2 billion). The USA leads with high consumer awareness of natural products and growing e-commerce adoption. Canada shows steady demand for eco-friendly beauty products, supported by sustainability trends.

Europe

Europe accounts for 25% of the market (USD 4.1 billion). Germany and France dominate due to established herbal certification standards, high disposable income, and eco-conscious consumers. Nordic countries are the fastest-growing segment in the region (9% CAGR).

Asia-Pacific

Asia-Pacific leads with 35% market share (USD 5.8 billion), driven by India and China. Strong traditional herbal usage, urbanization, and e-commerce penetration contribute to growth. India exhibits the fastest CAGR (11%) globally.

Latin America

Brazil and Argentina lead regional demand (USD 1.5 billion), driven by rising natural beauty trends and consumer preference for herbal formulations. CAGR is 8.5%.

Middle East & Africa

UAE, Saudi Arabia, and South Africa show increasing demand (USD 1.0 billion). Luxury and wellness-oriented herbal products are gaining traction, supported by tourism, disposable income, and rising awareness of natural beauty solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Herbal Beauty Products Market

- Himalaya Drug Company

- Dabur

- Patanjali Ayurved

- Forest Essentials

- The Body Shop

- Khadi Natural

- Kiehl’s

- Lush

- Biotique

- Aveda

- Burt’s Bees

- Weleda

- Innisfree

- Nature’s Essence

- VLCC

Recent Developments

- In March 2025, Dabur expanded its herbal hair care range in India, launching multi-functional anti-hair-fall shampoos and conditioners.

- In January 2025, Himalaya launched a global campaign for organic skincare products in Europe, emphasizing eco-friendly packaging and natural ingredients.

- In February 2025, Forest Essentials introduced premium herbal serums with advanced bioactive extraction, targeting the luxury skincare segment in North America and Asia-Pacific.