Heat-Not-Burn (HNB) Tobacco Market Size

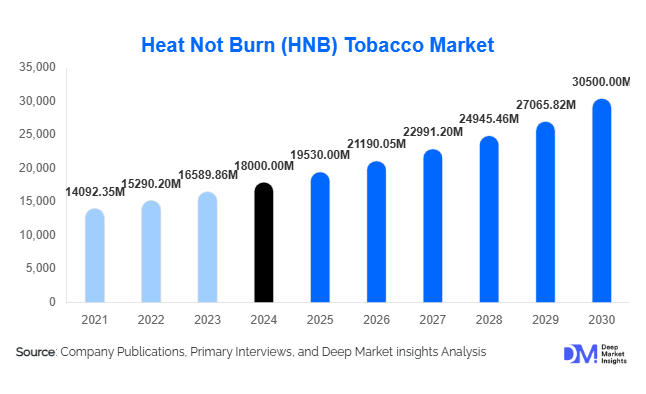

According to Deep Market Insights, the global Heat-Not-Burn (HNB) tobacco market size was valued at USD 18,000 million in 2024 and is projected to grow from USD 19,530 million in 2025 to reach USD 30,500 million by 2030, expanding at a CAGR of 8.5% during the forecast period (2025–2030). The HNB tobacco market growth is primarily driven by increasing health-consciousness among adult smokers, rising adoption of reduced-risk tobacco alternatives, and the expansion of premium HNB devices and flavored tobacco sticks in global markets.

Key Market Insights

- HNB tobacco is increasingly replacing traditional cigarettes among adult smokers, driven by the perception of reduced harm and growing regulatory support for reduced-risk products.

- Technological innovation in heating devices, including induction and hybrid heating, enhances flavor consistency and user experience, boosting adoption.

- Asia-Pacific dominates the market, with Japan and South Korea leading consumption due to early regulatory approvals and high consumer awareness.

- North America and Europe are rapidly expanding markets, driven by premium product adoption and favorable policy frameworks for reduced-risk tobacco.

- Online distribution channels are growing, enabling convenient access to devices and tobacco sticks, especially in regions with restricted physical retail networks.

- Flavored and menthol sticks are shaping consumer preference, increasing repeat purchases, and driving brand differentiation globally.

Latest Market Trends

Premiumization and Device Innovation

Manufacturers are focusing on high-end HNB devices with sleek, portable designs and advanced heating technology. Rechargeable and induction-based devices are becoming mainstream, providing improved battery life, flavor retention, and ease of use. Premium flavors and multi-packs are expanding consumer choices, catering to urban and affluent populations. Companies are also integrating smart features, such as usage tracking and app connectivity, to enhance user experience and strengthen brand loyalty.

Expansion of Online and Retail Channels

Direct-to-consumer sales through e-commerce portals and specialty online platforms are rapidly increasing. Retail expansion in convenience stores, supermarkets, and tobacco specialty shops is also driving awareness and adoption. Subscription-based models for flavored sticks and loyalty programs are being piloted to encourage repeat purchases. This dual-channel growth strategy ensures broad market penetration while maintaining premium product appeal.

HNB Tobacco Market Drivers

Health-Conscious Consumer Shift

Rising awareness of smoking-related health risks is driving adult smokers toward reduced-risk alternatives like HNB tobacco. Products that heat rather than burn tobacco significantly reduce harmful chemical exposure, which appeals to health-conscious consumers. Regulatory backing for reduced-risk products further legitimizes HNB adoption, providing a favorable growth environment.

Technological Advancements in Devices

Induction and hybrid heating technologies provide consistent flavor, improved efficiency, and better consumer satisfaction. Innovations such as rechargeable batteries, smart device integration, and ergonomic designs enhance user experience. These advancements are creating differentiation in a competitive market and driving premium segment growth.

Regulatory Support and Market Legitimization

Governments in Japan, South Korea, the U.S., and Europe are encouraging reduced-risk tobacco products. Favorable regulations, such as smoke-free public space policies and reduced taxation on safer alternatives, have increased consumer confidence and accelerated adoption globally.

Market Restraints

High Device and Stick Costs

HNB devices are generally more expensive than conventional cigarettes, which may restrict adoption in price-sensitive regions. Premium pricing of devices and flavored tobacco sticks limits penetration among middle- and low-income consumers.

Regulatory Complexity

While some countries support HNB products, others impose strict regulations or partial bans. Diverse technical, labeling, and safety standards increase operational challenges and compliance costs for global manufacturers.

HNB Tobacco Market Opportunities

Emerging Market Expansion

Asia-Pacific and Latin American regions present significant growth opportunities due to rising urbanization, disposable incomes, and evolving regulatory acceptance. Tailoring products for local preferences and affordability can unlock substantial market share in these regions.

Product Innovation and Technology Integration

Investments in flavor innovation, hybrid heating, and smart device features provide differentiation and cater to tech-savvy and premium consumers. App-enabled devices, flavor customization, and usage tracking improve user engagement and retention.

Policy and Regulatory Support

Governments are promoting reduced-risk tobacco as part of public health initiatives. Incentives for compliance and alignment with emerging regulations provide opportunities for market leaders to strengthen brand credibility and expand global presence.

Product Type Insights

Portable HNB devices dominate the global market with a 45% share in 2024 due to their ease of use, portability, and rechargeable functionality. Technological advancements and improved user experience have further enhanced the appeal of HNB devices, driving consumer adoption. Flavored tobacco sticks, capsules, and cartridges lead consumption within the tobacco segment, offering convenience, repeat purchase potential, and premium margins. The wide variety of flavors and ease of use are significant drivers for this segment. Overall, premium HNB segments contribute approximately 55% of total revenue, reflecting strong consumer willingness to pay for quality and technology-driven products, highlighting the importance of innovation and enhanced usability in the global HNB market.

Application Insights

Adult smokers represent the largest end-user segment with a 60% market share in 2024. This segment is primarily driven by individual health considerations and the desire for a less harmful smoking experience, motivating many consumers to switch from conventional cigarettes to HNB products. Former cigarette users are increasingly adopting HNB products for harm reduction purposes. Corporate gifting, promotional campaigns, and lifestyle-oriented applications are emerging as niche opportunities, creating additional revenue streams while enhancing brand visibility. Export-driven demand, particularly from Japan, South Korea, and select European countries, is strengthening international distribution channels, supporting global market expansion.

Distribution Channel Insights

Retail stores, including supermarkets, convenience stores, and specialty tobacco shops, hold 50% of global sales. The adoption of online channels, direct-to-consumer platforms, and subscription-based e-commerce models is rapidly expanding, offering convenience, wider reach, and improved brand engagement. Marketing campaigns, loyalty programs, and digital promotions are increasingly important in driving repeat purchases and enhancing customer retention. The growing trend of premium device offerings through both online and offline channels is significantly shaping consumer preference and market dynamics.

End-User Insights

Adult smokers continue to dominate demand, supported by heightened awareness of health risks associated with conventional cigarettes. Former cigarette users contribute significantly to market growth through harm-reduction adoption. Corporate and promotional usage is emerging as a specialized segment, driven by lifestyle and gifting applications. Notably, the adult smoker segment in Asia-Pacific is projected to grow at a 9% CAGR between 2025–2030, reflecting strong urban adoption, export-driven demand, and rising consumer willingness to adopt premium devices.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

Market size in 2024: USD 3,500 million. The U.S. accounts for 85% of regional demand, driven by strong regulatory support, rising awareness about smoking-related health risks, and premium product adoption. The availability of innovative HNB devices, along with supportive reduced-risk policies, encourages adult smokers to transition from conventional cigarettes, sustaining market growth. Key segment drivers include consumer health considerations and technological improvements in device usability.

Europe

Market size in 2024: USD 5,000 million. Germany and the U.K. dominate regional consumption, accounting for approximately 60% of the total. The market growth is fueled by increasing adoption of reduced-risk products, regulatory incentives, and the expanding premium segment. Smokers in these countries are actively seeking alternatives to traditional tobacco, making HNB devices highly attractive. Segment-specific drivers, such as the convenience and variety of flavored sticks, further reinforce growth in adult smoker and former cigarette user applications.

Asia-Pacific

Largest regional market in 2024: USD 6,300 million, growing at 10% CAGR. Japan and South Korea are leading adopters, driven by high smoking prevalence, robust regulatory support, and proactive government initiatives promoting reduced-risk products. Urbanization, rising disposable income, and consumer health awareness are additional growth enablers. The adoption of portable HNB devices is particularly strong, with technological innovations enhancing user experience. Export-driven demand from neighboring countries is also contributing to the rapid expansion of this market.

Latin America

Market size in 2024: USD 1,400 million, led by Brazil and Argentina. Emerging urban adoption, increased health awareness, and the growth of premium HNB devices are key drivers in this region. Retailers and distributors are expanding offerings to include a wider range of HNB products, responding to growing consumer demand for alternative smoking options.

Middle East & Africa

Market size in 2024: USD 800 million, with the UAE and South Africa leading regional demand. Rising disposable incomes, increased health awareness, and the adoption of premium devices are driving growth. Retail expansion, urban population growth, and lifestyle-focused marketing campaigns are supporting both individual and commercial adoption, creating strong potential for long-term market development.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the HNB Tobacco Market

- Philip Morris International

- British American Tobacco

- Japan Tobacco International

- Imperial Brands

- KT&G

- Altria Group

- China National Tobacco Corporation

- ITC Limited

- Logic Technology

- Glo Tech

- Swedish Match

- PMI Innovations

- BAT Korea

- Japan Tobacco Corp.

- Altria Innovations

Recent Developments

- In March 2025, Philip Morris International launched a new induction-based HNB device in Europe with improved flavor and battery life.

- In January 2025, British American Tobacco expanded its flavored tobacco stick portfolio in Japan and South Korea.

- In June 2024, KT&G introduced app-enabled smart HNB devices in the APAC region to enhance user tracking and engagement.