Heart Health Supplements Market Summary

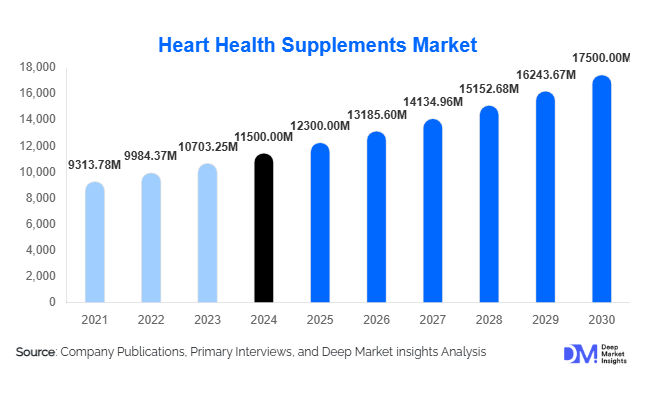

According to Deep Market Insights, the global heart health supplements market size was valued at USD 11,500 million in 2024 and is projected to grow from USD 12,300 million in 2025 to reach USD 17,500 million by 2030, expanding at a CAGR of 7.2% during the forecast period (2025–2030). The heart health supplements market growth is primarily driven by the rising prevalence of cardiovascular diseases, increasing consumer awareness regarding preventive healthcare, and the adoption of nutraceuticals as adjuncts to traditional medicine.

Key Market Insights

- Omega-3 fatty acids and CoQ10 dominate the product landscape, accounting for the largest market share due to strong clinical evidence supporting cardiovascular benefits.

- North America leads the global market, driven by high disposable income, health-conscious consumers, and strong retail distribution networks.

- Asia-Pacific is the fastest-growing region, supported by rising middle-class income, urbanization, and increasing awareness of heart health supplements in India, China, and Japan.

- E-commerce platforms are reshaping distribution, providing wider consumer access and enabling targeted marketing campaigns.

- Regulatory support and government preventive health initiatives, such as awareness programs in Europe and North America, are enhancing adoption.

- Technological innovations, including advanced bioavailability formulations and personalized supplement recommendations, are driving product differentiation.

What are the latest trends in the heart health supplements market?

Personalized and Technology-Enhanced Supplements

Manufacturers are increasingly adopting personalized nutrition approaches, integrating AI-driven health assessments and wearable-based monitoring to recommend tailored heart health supplements. Nanoencapsulation, liposomal delivery, and plant-based bioactive enhancements are being introduced to improve bioavailability and efficacy. These technologies appeal to consumers seeking scientifically validated and effective cardiovascular support, creating differentiation among competitors.

Shift Toward Plant-Based and Clean Label Products

Consumers are showing a preference for plant-based omega-3s, natural CoQ10, and other plant-derived cardioprotective supplements. Clean label formulations, minimal additives, and sustainable sourcing are becoming major purchase influencers. This trend aligns with the broader global demand for natural, environmentally conscious, and health-optimized products.

What are the key drivers in the heart health supplements market?

Rising Prevalence of Cardiovascular Diseases

The global increase in cardiovascular diseases, including high cholesterol, hypertension, and heart disease, is a primary driver. Preventive supplement consumption is rising among adults aged 30–60, with geriatric populations increasingly seeking CoQ10, omega-3 fatty acids, and plant sterols to support cardiac health.

Increasing Health Awareness and Lifestyle Changes

Growing awareness of preventive healthcare, adoption of balanced diets, and engagement in fitness activities are boosting demand for heart health supplements. Consumers proactively manage cholesterol, blood pressure, and heart wellness through nutraceuticals, complementing prescribed medications.

Expansion of E-Commerce and Online Accessibility

The growth of online retail enables direct-to-consumer reach, personalized subscription models, and targeted digital marketing. Remote consumers now have greater access to supplements, increasing market penetration globally.

What are the restraints for the global market?

Regulatory and Compliance Barriers

Strict labeling, health claims, and safety regulations in major markets can delay product launches and increase operational costs. Companies must navigate complex approval processes to introduce new formulations.

Competition from Prescription Medications

While supplements are preventive, prescription drugs for cholesterol and heart disease remain dominant among diagnosed patients. This limits supplement adoption in certain demographics, especially in regions with high prescription drug penetration.

What are the key opportunities in the heart health supplements market?

Technological Innovation in Formulations

Advanced formulations such as nanoencapsulation, liposomal delivery, and plant-based bioactive enhancements provide higher bioavailability and efficacy, offering manufacturers opportunities for premium products and differentiation.

Expansion into Emerging Markets

Emerging economies, particularly India, China, and Brazil, present untapped potential due to rising disposable income, urbanization, and awareness of cardiovascular disease prevention. Tailored marketing strategies and localized manufacturing can accelerate adoption in these regions.

Regulatory Support and Health Initiatives

Government-led programs promoting preventive healthcare, such as cardiovascular wellness campaigns, support market growth. Policies encouraging nutraceutical approvals and incentivizing local production provide opportunities for manufacturers to expand reach and reduce dependence on imports.

Product Type Insights

Omega-3 fatty acids dominate the market with a 35% share in 2024 due to extensive clinical evidence supporting heart health benefits. CoQ10 and plant sterols follow as important segments, with growing awareness among geriatric populations. Supplements for preventive healthcare and general wellness are increasingly preferred over treatment-oriented products, reflecting broader consumer health trends.

Formulation Insights

Capsules and tablets are the leading formulation segment (55% of global sales), attributed to ease of consumption, longer shelf-life, and cost efficiency. Liquid and softgel formulations are growing but remain niche markets.

Distribution Channel Insights

Pharmacies and drug stores account for 40% of 2024 sales due to consumer trust and established supply chains. Online retail channels are the fastest-growing distribution segment, leveraging subscription models, direct-to-consumer marketing, and wide accessibility.

End-Use Insights

Adults aged 30–60 account for 60% of demand, largely for preventive cardiovascular care. Geriatric populations are the fastest-growing segment due to higher cardiovascular risk. Fitness enthusiasts are also adopting supplements to enhance cardiovascular performance, opening niche growth opportunities. Export-driven demand from North America to Europe, Japan, and the Middle East is significant.

| By Product Type | By Formulation | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds 45% of the global market, led by the U.S. and Canada. High disposable income, awareness of preventive healthcare, and mature retail and e-commerce networks drive market growth. Personalized supplementation and preventive wellness programs further strengthen demand.

Europe

Europe accounts for 25% of the market, with Germany, the U.K., and France as key contributors. The region emphasizes natural and clinically backed supplements, with rising interest in preventive health campaigns supporting growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region (CAGR 9–10%), driven by India, China, and Japan. Rising middle-class income, urbanization, and lifestyle diseases are fueling demand. Increasing e-commerce adoption further accelerates market expansion.

Latin America

Brazil and Argentina are major contributors, with rising health awareness and preventive healthcare adoption. Outbound and imported supplements are increasingly consumed among affluent consumers.

Middle East & Africa

GCC countries, led by the UAE, and South Africa, are primary markets. High-income populations and growing awareness of preventive healthcare drive supplement consumption. Intra-regional demand in Africa is also growing steadily.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Heart Health Supplements Market

- Amway

- GNC

- Pfizer

- Nestlé Health Science

- DSM

- Herbalife

- NOW Foods

- Solgar

- Bayer

- Abbott

- Nature’s Bounty

- Blackmores

- Swisse

- Herbaland

- NutraLife

Recent Developments

- In March 2025, GNC launched a new line of plant-based omega-3 supplements with enhanced bioavailability, targeting vegan consumers in North America and Europe.

- In February 2025, Nestlé Health Science introduced CoQ10 gummies for geriatric populations in the Asia-Pacific region, focusing on preventive cardiovascular health.

- In January 2025, DSM expanded its manufacturing facility in China, aimed at producing advanced heart health supplement formulations for APAC markets.