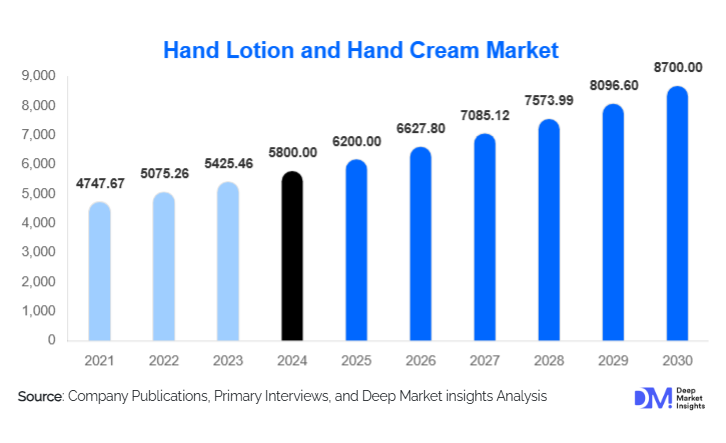

Hand Lotion and Hand Cream Market Size

According to Deep Market Insights, the global hand lotion and hand cream market size was valued at USD 5,800 million in 2024 and is projected to grow from USD 6,200 million in 2025 to reach USD 8,700 million by 2030, expanding at a CAGR of 6.9% during the forecast period (2025–2030). The market growth is driven by rising consumer awareness regarding skin health, the surge in demand for natural and organic formulations, and the growing influence of premium skincare routines worldwide. Increasing disposable income, a higher focus on self-care, and innovation in texture and packaging formats have also contributed to the steady expansion of this industry.

Key Market Insights

-

Shift toward clean beauty: Consumers are increasingly preferring hand care products formulated with natural, vegan, and cruelty-free ingredients.

-

Premiumization in skincare: Hand lotions and creams are no longer seen as basic hygiene products but as extensions of facial skincare routines, driving growth in the premium segment.

- Asia-Pacific leads production and consumption, supported by large populations, an expanding middle class, and dynamic cosmetics industries in China, Japan, and South Korea.

- North America and Europe dominate global demand, accounting for more than 55% of total revenues in 2024.

- E-commerce and D2C channels are becoming critical for brand visibility and consumer engagement, especially among younger demographics.

- Technological innovation in formulations, including fast-absorption and microbiome-balancing creams, is reshaping the competitive landscape.

Latest Market Trends

Growing Preference for Natural and Organic Ingredients

Consumers are rapidly shifting away from synthetic formulations toward products that emphasize plant-derived oils, essential extracts, and sustainable sourcing. Brands are launching hand creams infused with shea butter, aloe vera, avocado oil, and vitamin E, appealing to the “clean beauty” movement. This trend is reinforced by stringent regulations in Europe and rising consumer awareness in North America and Asia-Pacific. The inclusion of eco-certified ingredients and recyclable packaging has become a key differentiator for new product launches.

Personalization and Functional Skincare

Product innovation is moving beyond fragrance and hydration toward functional benefits such as anti-aging, SPF protection, and antibacterial properties. Brands are developing customized formulas that cater to diverse skin types and environmental exposures, integrating technology such as AI skin analysis for personalized recommendations. Multifunctional hand creams combining moisturizer, sanitizer, and skin repair properties are witnessing particularly high demand in post-pandemic markets.

Hand Lotion and Hand Cream Market Drivers

Rising Awareness of Hand Hygiene and Skin Care

The COVID-19 pandemic permanently altered global hygiene habits, leading to sustained use of moisturizing and reparative hand care products. The regular use of sanitizers and soaps has heightened the need for replenishing hand creams that restore the skin barrier. This behavioral change has driven demand across both developed and emerging economies, expanding the consumer base.

Growth of E-Commerce and Direct-to-Consumer Brands

Digital-first beauty and personal care brands have significantly disrupted the market. Online retail allows emerging companies to target niche consumer groups and rapidly scale across geographies. In 2024, online sales accounted for approximately 37% of total global hand cream revenues, and this figure is projected to surpass 45% by 2030. Social media marketing, influencer collaborations, and subscription models have further enhanced consumer reach and loyalty.

Increasing Demand for Premium and Luxury Products

Premium hand creams are gaining traction among urban consumers who associate skincare with self-care and status. Brands such as L’Oréal, Chanel, and Dior have introduced high-end hand lotions featuring sensory textures and luxurious packaging. This segment accounted for nearly 29% of global revenues in 2024, with steady expansion projected through 2030, particularly in North America, Europe, and East Asia.

Market Restraints

Price Sensitivity and Counterfeit Products

Intense price competition among mass-market players and counterfeit proliferation in online marketplaces pose challenges. Low-cost replicas affect brand reputation and erode profit margins. The availability of unregulated products in emerging economies also undermines consumer trust in premium segments.

Supply Chain Volatility and Raw Material Costs

Volatility in raw material prices, such as natural oils, waxes, and packaging components, affects manufacturing costs. Sustainability requirements and rising costs for eco-friendly packaging materials further pressure producers, particularly small and mid-sized brands, limiting scalability in certain regions.

Hand Lotion and Hand Cream Market Opportunities

Expansion in Emerging Markets

The untapped potential in Asia-Pacific, Latin America, and the Middle East presents strong opportunities for both global and regional players. Urbanization, rising disposable incomes, and Western beauty influences are fueling demand for skincare essentials. India, Indonesia, and Brazil are expected to register double-digit growth rates through 2030, supported by an expanding retail network and social media-driven awareness.

Technological Integration and Smart Packaging

Advances in formulation sciences as time-release hydration, nanotechnology-based absorption, and probiotic-infused creamsare opening new product categories. Additionally, the adoption of smart packaging with QR codes, usage tracking, and sustainability scoring enhances transparency and customer engagement, providing a competitive advantage for early adopters.

Sustainability and Ethical Branding

Brands emphasizing cruelty-free testing, carbon-neutral manufacturing, and recyclable packaging are witnessing strong growth. Consumers increasingly associate ethical standards with quality, creating a premium perception. Corporate social responsibility (CSR) campaigns focused on biodiversity preservation and sustainable sourcing further strengthen brand loyalty in mature markets.

Segmental Analysis

By Product Type

The market is segmented into hand lotion and hand cream. In 2024, hand creams accounted for 61% of global market revenues owing to their higher viscosity, intensive hydration, and preference among consumers in colder climates. The lotion segment is growing steadily, supported by lightweight formulations suitable for humid regions and younger demographics seeking fast-absorbing products.

By Category

Natural and organic products held approximately 33% of the market share in 2024 and are projected to reach nearly 45% by 2030. Increasing health consciousness and regulatory support for clean formulations are driving this trend, particularly across Europe and Japan.

By Distribution Channel

Offline retail channels, including supermarkets, pharmacies, and beauty stores, remained dominant with a 63% share in 2024. However, online channels are the fastest-growing, projected to exhibit a CAGR of 9.2% through 2030, as consumers shift toward convenience-based and subscription purchasing.

By End Use

The individual consumer segment accounted for 78% of revenues in 2024, followed by professional and hospitality sectors (22%), including spas, salons, and hotels. Institutional bulk buying is expected to rise as the hospitality and healthcare sectors emphasize hygiene-based hand care.

End-Use Analysis

Demand from the personal care and beauty industry continues to dominate, driven by consumers seeking multi-functional skincare. The hospitality industry represents a fast-growing end-use, as hotels and airlines increasingly adopt branded hand care amenities to enhance customer experience. The global hospitality amenities marketvalued at USD 17 billion in 2024is expected to grow at a 5.8% CAGR, indirectly fueling hand lotion demand. Export-driven demand is particularly strong in the Asia-Pacific, where regional manufacturers supply private-label hand creams to Europe and North America.

| By Product Type | By Category | By Distribution Channel | By End Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for 28% of the global market share in 2024. High consumer spending on premium skincare and growing male grooming adoption are key factors driving demand. The U.S. remains the largest market, supported by innovation from brands like Bath & Body Works and CeraVe. The region is also witnessing strong momentum in fragrance-infused and dermatologist-recommended hand creams.

Europe

Europe captured 27% of global revenues in 2024, led by Germany, France, and the U.K. The region’s stringent cosmetic regulations promote product quality and transparency, supporting strong adoption of organic and sustainable brands such as L’Oréal and The Body Shop. Northern European markets have shown a preference for intensive moisturizing creams due to colder climates.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing regional market, representing nearly 32% of total demand in 2024 and projected to grow at a CAGR of 8.3% through 2030. China, Japan, South Korea, and India lead regional expansion. Rising skincare consciousness, celebrity endorsements, and K-beauty trends are major growth enablers. Local brands such as Shiseido and Innisfree are gaining traction with affordable, high-performance products.

Latin America

Latin America accounts for around 7% of the global market, led by Brazil and Mexico. The growing penetration of retail beauty chains and social media marketing is expanding the consumer base. Increasing preference for fragranced, tropical formulations tailored to local climate conditions drives regional differentiation.

Middle East & Africa

The region held a 6% share of global revenues in 2024. The UAE and Saudi Arabia are emerging hotspots due to high disposable income and luxury brand adoption. In Africa, South Africa and Nigeria lead in mass-market hand cream consumption, aided by the rise of local manufacturing units and regional distribution networks.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top 15 Players in the Global Hand Lotion and Hand Cream Market

- L’Oréal S.A.

- Unilever PLC

- Beiersdorf AG (NIVEA)

- Procter & Gamble Co.

- Johnson & Johnson

- Shiseido Company, Limited

- Kao Corporation

- The Estée Lauder Companies Inc.

- L’Occitane International S.A.

- Avon Products Inc.

- The Body Shop International Limited

- Coty Inc.

- Burt’s Bees (Clorox Company)

- Amorepacific Corporation

- GlaxoSmithKline Consumer Healthcare