Hand Dryer Market Size

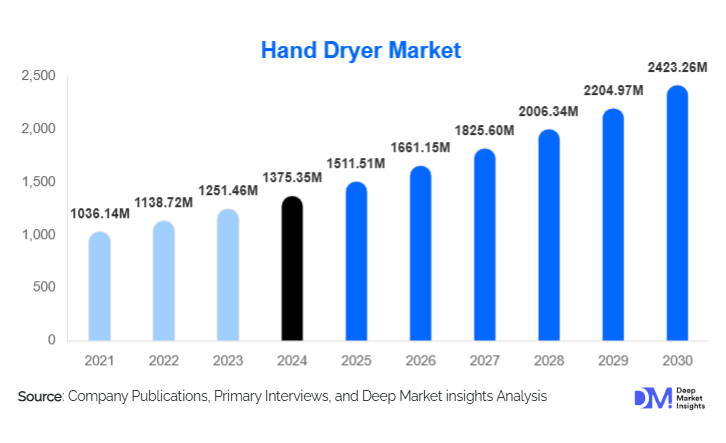

According to Deep Market Insights, the global hand dryer market size was valued at USD 1,375.35 million in 2024 and is projected to grow from USD 1,511.51 million in 2025 to reach USD 2,423.26 million by 2030, expanding at a CAGR of 9.9% during the forecast period (2025–2030). Market growth is fueled by the rapid transition toward touchless hygiene solutions, increased sustainability mandates in commercial buildings, and the widespread adoption of high-speed jet-air dryers across airports, malls, offices, and hospitality establishments.

Key Market Insights

- Jet-air dryers dominate adoption due to rapid drying time, low energy usage, and rising demand for hygiene-centric washroom infrastructure.

- Touchless, sensor-based dryers are becoming standard in high-traffic commercial facilities, supported by growing awareness of germ-free hand hygiene.

- Europe leads the global market with strong environmental regulations and rapid replacement of paper towels.

- Asia-Pacific is the fastest-growing region, driven by commercial construction, smart city development, and rising hygiene standards in India, China, and Southeast Asia.

- Sustainability initiatives, waste reduction targets, and green building certifications are boosting demand for energy-efficient dryers.

- Technological advancements, including HEPA filtration, IoT monitoring, and energy-optimized airflows, are reshaping product offerings and improving the total cost of ownership.

What are the latest trends in the hand dryer market?

Advanced Hygiene & Filtration Technologies

Hand dryer manufacturers are integrating HEPA filters, antimicrobial coatings, UV sterilization modules, and sealed airflow channels to address hygiene concerns. Public institutions and hospitals increasingly prefer dryers with 99%+ particulate filtration, especially in areas sensitive to cross-contamination. These hospital-grade filtration systems are also gaining traction in airports and hotels seeking premium hygiene standards. As air quality regulations strengthen globally, HEPA-enabled dryers are emerging as the benchmark for public sanitation facilities.

IoT-Enabled & Smart Restroom Ecosystems

IoT-connected hand dryers, capable of monitoring usage cycles, filter health, power consumption, and maintenance schedules, are becoming an integral part of smart buildings. Facility managers use integrated dashboards to optimize cleaning cycles, reduce downtime, and manage restroom occupancy. Smart dryers appeal strongly to airports, corporate offices, and malls with sophisticated facility-management needs. Connected diagnostics also improve operational efficiency, reduce service costs, and enhance performance tracking, making digital adoption a key trend across premium installations.

What are the key drivers in the hand dryer market?

Heightened Focus on Hygiene & Touchless Operation

Post-pandemic hygiene awareness has transformed public restroom standards. Touchless sensors, sealed HEPA airflow, and fast-drying mechanisms significantly reduce germ transfer, making them the preferred choice over manual models or paper towels. High-traffic locations, especially airports, hospitals, offices, and educational institutions, are aggressively adopting touchless dryers to minimize hand contact and enhance user safety. This shift continues to be one of the strongest drivers of market expansion.

Sustainability and Waste Reduction Priorities

Hand dryers drastically cut paper waste, landfill load, and supply-chain emissions, aligning with global sustainability goals. Companies, hotels, airports, and retail chains increasingly prefer energy-efficient jet dryers due to 70–90% lower operating costs compared to paper towels. Green building certifications such as LEED, BREEAM, and WELL also encourage the use of eco-friendly restroom technologies. The global regulatory push toward waste reduction and carbon-neutral facilities amplifies demand for high-efficiency hand dryers.

What are the restraints for the global market?

High Upfront Installation Cost

Despite low long-term operating costs, modern high-speed dryers require a higher initial investment than paper towel dispensers. Electrical retrofitting, wiring, and integration with ventilation systems add installation complexity. For small businesses, cafés, and budget facilities, upfront costs remain a deterrent, particularly in emerging markets where capex constraints are more pronounced.

Noise & User Perception Challenges

High-speed jet dryers generate noise levels of 70–90 dB, which may be disruptive in quiet environments such as clinics, libraries, or wellness facilities. Some consumers also remain concerned about aerosolization, despite improvements in airflow filtration, which impacts adoption in certain segments. These factors create perceptual and practical hurdles that manufacturers must overcome through quieter and cleaner airflow technologies.

What are the key opportunities in the hand dryer industry?

Retrofit & Replacement Wave Across Older Buildings

Millions of existing commercial and institutional restrooms worldwide still rely on outdated warm-air dryers or paper towel dispensers. This presents a large-scale retrofit opportunity for high-speed, energy-efficient models. Airports, malls, schools, and hospitals are undertaking washroom modernization to reduce operating costs and meet hygiene standards. Manufacturers offering modular, low-energy, touchless retrofit solutions are positioned to benefit strongly from this multi-year replacement cycle.

Smart City, Infrastructure & Emerging Market Growth

Asia-Pacific, the Middle East, and Latin America are witnessing significant infrastructure investments in airports, hotels, metro stations, business parks, and public sanitation. Governments are actively promoting modern, eco-friendly washrooms under initiatives like Smart Cities Mission (India), Vision 2030 (Saudi Arabia), and Belt & Road urban development. Demand for durable, energy-efficient, and touchless dryers is accelerating rapidly in these regions, creating long-term growth pathways for both global and local manufacturers.

Product Type Insights

Jet-air hand dryers dominate the global market, accounting for around 40% of revenue in 2024. Their quick drying time, energy savings, and strong adoption across airports, malls, and office buildings drive their leadership. Warm-air dryers continue to be used in budget installations, while blade/slot-style dryers are gaining traction in premium commercial spaces. IoT-enabled dryers with HEPA filters represent the emerging premium category, attracting hospitals and luxury hospitality brands that prioritize hygiene and performance.

Application Insights

The commercial sector, including airports, hotels, restaurants, offices, and malls, holds the largest share at about 55% in 2024. Healthcare facilities are increasingly adopting HEPA-equipped touchless dryers, making them one of the fastest-growing segments. Institutional settings such as schools and universities are also upgrading restrooms as part of broader facility-modernization initiatives. Industrial manufacturing plants prefer durable, vandal-resistant dryers, while premium residential projects are beginning to integrate compact touchless models.

Distribution Channel Insights

Offline channels led by distributors, facility installers, and OEM partnerships dominate high-volume commercial purchases. However, online B2B procurement and direct manufacturer websites are expanding rapidly due to transparent pricing, easier comparison, and faster fulfillment. Retrofit buyers, primarily small businesses and boutiques, prefer online platforms. Meanwhile, after-market channels for replacement units are strengthening as global installed bases expand.

End-User Insights

Commercial users remain the primary buyers, but healthcare and institutional facilities are witnessing the highest growth due to hygiene mandates and large restroom footprints. Rapid expansion of malls, airports, hotels, and coworking spaces in developing regions drives strong adoption. Residential demand is emerging in premium smart homes and eco-friendly housing projects, though currently small in scale.

| By Product Type | By Operation / Sensor Mode | By End-Use Industry / Application |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for approximately 25% of the global hand dryer market in 2024. The U.S. leads due to high hygiene standards, widespread adoption of touchless technology, and regular restroom upgrades in airports, corporate offices, and retail chains. Canada follows similar trends, driven by sustainability regulations and high commercial construction activity.

Europe

Europe is the largest regional market with around a 35% share. The U.K., Germany, France, and Scandinavia lead adoption due to strict environmental policies, early preference for paperless restrooms, and aggressive retrofit programs. High-speed and HEPA-enabled dryers are widely installed in airports, malls, universities, and government institutions.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by commercial construction in China, India, Japan, and Southeast Asia. Smart city initiatives and public sanitation reforms are accelerating adoption. China leads in manufacturing and export, while India shows fast-growing installation across malls, airports, hospitals, and metro stations. Japan and South Korea exhibit a strong preference for premium, technologically advanced dryers.

Latin America

Latin America is emerging steadily with growing installations in Brazil, Mexico, and Argentina. Expanding hospitality and retail sectors, along with the modernization of public facilities, support demand. Manufacturers increasingly target this region with mid-range, durable products suited for varying power infrastructures.

Middle East & Africa

The Middle East sees strong demand from the UAE, Saudi Arabia, and Qatar, with large-scale infrastructure, hospitality, and airport expansions. Africa, led by South Africa and Kenya, is upgrading public sanitation facilities and adopting hand dryers in malls, offices, and transportation hubs. Luxury hotels across MEA prefer premium, low-noise, touchless dryers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hand Dryer Market

- Dyson Ltd.

- Excel Dryer, Inc.

- Mitsubishi Electric Corporation

- TOTO Ltd.

- World Dryer Corporation

- Bobrick Washroom Equipment, Inc.

- Hokwang Industries Co., Ltd.

- Mediclinics S.A.

- Bradley Corporation

- Panasonic Corporation

- JVD SAS

- Stiebel Eltron GmbH

- Taishan Jieda Electrical Co., Ltd.

- Palmer Fixture

- Euronics Industries Pvt. Ltd.

Recent Developments

- In March 2025, Dyson unveiled a new-generation jet-air dryer featuring enhanced acoustic dampening and upgraded HEPA filtration for public institutions.

- In January 2025, Mitsubishi Electric launched its IoT-connected hand dryer line in Europe, offering predictive maintenance and real-time usage analytics.

- In October 2024, Excel Dryer expanded its North American manufacturing operations to meet rising demand for energy-efficient, touchless restroom fixtures.