Hair Spray Market Size

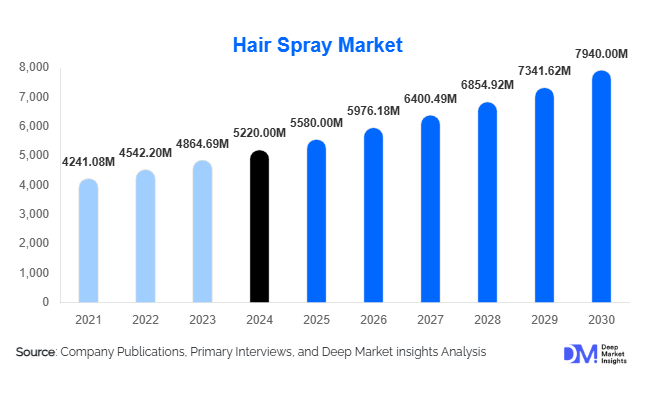

According to Deep Market Insights, the global hair spray market size was valued at USD 5,220 million in 2024 and is projected to grow from USD 5,580 million in 2025 to reach USD 7,940 million by 2030, expanding at a CAGR of 7.1% during the forecast period (2025–2030). The growth of the hair spray market is primarily driven by rising consumer awareness about personal grooming and hairstyling, increased adoption of premium and eco-friendly formulations, and the expanding penetration of e-commerce platforms facilitating direct-to-consumer sales.

Key Market Insights

- Professional and home-use segments are both witnessing growth, with urban populations increasingly styling hair at home, supported by online tutorials and DIY beauty trends.

- Eco-friendly and alcohol-free hair sprays are gaining popularity, driven by consumer demand for gentle and sustainable products that reduce hair damage and environmental impact.

- North America dominates the global hair spray market, led by the U.S., where premium products and professional salon usage are high.

- Asia-Pacific is the fastest-growing region, supported by rising disposable income, urbanization, and a growing young population in China, India, and South Korea.

- Technological integration and multi-functional formulations, including heat protection, anti-frizz, and volumizing sprays, are transforming product offerings and enhancing consumer engagement.

- E-commerce channels are expanding rapidly, allowing both established brands and new entrants to reach niche consumers globally with tailored and premium hair spray products.

Latest Market Trends

Premiumization and Multifunctional Formulations

Hair spray brands are increasingly offering premium products with multifunctional benefits, such as heat protection, shine enhancement, and humidity resistance. This trend caters to both professional salon usage and home consumers seeking long-lasting styling solutions. Alcohol-free and organic formulations are also gaining traction, as consumers prioritize scalp health and eco-conscious beauty practices. Brands are leveraging innovative delivery mechanisms, including lightweight aerosols, pump sprays, and mousse formats, providing improved user experience and product differentiation.

Growth of E-Commerce and Digital Influence

Online platforms have emerged as critical growth drivers for hair sprays, enabling consumers to access international brands and niche formulations. E-commerce facilitates personalized recommendations, subscription-based deliveries, and interactive product demos, driving higher engagement. Influencer marketing and social media trends are shaping consumer preferences, particularly among younger demographics who seek the latest styling innovations and value sustainability. Direct-to-consumer sales models are also reducing dependency on traditional retail and increasing profit margins for manufacturers.

Hair Spray Market Drivers

Urbanization and Fashion-Conscious Consumers

Urban populations in North America, Europe, and APAC increasingly demand professional-looking hairstyles for personal and professional purposes. Hair sprays provide quick and long-lasting styling solutions, supporting frequent styling routines. The rising influence of beauty and fashion trends, amplified through social media and celebrity endorsements, further encourages hair spray adoption among consumers of all age groups.

Premiumization and Product Innovation

Consumers are willing to invest in high-quality hair sprays offering multifunctional benefits. Innovations such as alcohol-free sprays, heat-resistant formulations, and eco-friendly packaging differentiate brands and support higher pricing strategies. Professional salons are increasingly adopting these premium products to enhance customer satisfaction and loyalty, further driving growth in this segment.

E-Commerce and Global Reach

Online sales channels enable brands to reach both mature and emerging markets with greater efficiency. Consumers benefit from product variety, competitive pricing, and convenient delivery, while brands can target niche segments, offer personalized formulations, and leverage subscription models. This trend significantly contributes to the overall market expansion, particularly in regions with rising digital penetration.

Market Restraints

Environmental Concerns and Regulatory Pressures

Traditional aerosol hair sprays contribute to greenhouse gas emissions, prompting regulatory scrutiny in key markets such as Europe and North America. Compliance with environmental standards increases production costs and can limit product availability. Additionally, consumer preference is shifting toward sustainable alternatives, pressuring manufacturers to innovate while maintaining profitability.

Volatility in Raw Material Prices

Fluctuations in the cost of propellants, polymers, essential oils, and other ingredients can impact production costs and pricing. Manufacturers must manage supply chain risks strategically to maintain margins without compromising product quality. This volatility can restrain market growth if not effectively addressed.

Hair Spray Market Opportunities

Expansion in Emerging Markets

Emerging economies such as India, Brazil, and Southeast Asia present significant opportunities. Rapid urbanization, a growing middle class, and rising awareness about hair care and personal grooming are driving demand. Brands can capitalize on these markets through culturally tailored marketing, partnerships with local retailers, and targeted e-commerce campaigns.

Eco-Friendly and Organic Hair Sprays

Consumer demand for environmentally responsible products is creating opportunities for organic, alcohol-free, and refillable formulations. Companies investing in R&D to produce sustainable products can capture premium market segments while adhering to global environmental regulations. Eco-conscious consumers increasingly prioritize products that align with personal health and sustainability goals.

Technological Integration and Multi-Functional Products

Integrating hair care benefits with styling, such as heat protection, anti-frizz, and volumizing properties, allows brands to differentiate their offerings. AI-driven personalized hair care services, smart dispensers, and digital styling recommendations provide a competitive edge. These innovations are appealing to tech-savvy consumers and creating new high-margin product categories.

Product Type Insights

Aerosol hair sprays dominate globally, accounting for 57% of the 2024 market, due to their convenience, long-lasting hold, and professional salon adoption. Non-aerosol and alcohol-free sprays are gaining traction, especially among consumers seeking sustainable and gentle alternatives. Hair mousse and foams are expanding in niche styling segments, offering volume and texture for personalized hairstyling needs.

Formulation Insights

Alcohol-free formulations are leading with 35% of the market in 2024. These products are preferred for their gentle effects on hair and scalp, aligning with rising consumer awareness of hair health. Organic and natural formulations are expanding in premium channels, supported by demand for eco-conscious products.

Distribution Channel Insights

E-commerce represents 29% of the market, driven by online penetration in APAC and North America. Supermarkets, specialty stores, and pharmacies continue to contribute significantly, providing mass-market access and convenience for diverse consumer segments.

End-Use Insights

Home-use consumers dominate with a 65% market share, driven by DIY styling trends, digital tutorials, and the availability of professional-grade products for personal use. Professional salon usage remains significant, contributing to product innovation and premium segment adoption. Export-driven demand is rising, particularly from manufacturers in APAC supplying North America and Europe.

| By Product Type | By Formulation | By Distribution Channel | By End-Use |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for 31% of global market share, led by the U.S., due to high disposable income, mature salon infrastructure, and premium product adoption. Canada contributes modestly, with growth supported by e-commerce channels and professional salon expansion.

Europe

Europe contributes 22% of global market share, led by Germany and the U.K., driven by eco-friendly product adoption, premiumization, and increasing interest in sustainable hair care solutions. The region is growing steadily, with increasing digital penetration and professional salon demand.

Asia-Pacific

APAC is the fastest-growing region, driven by China, India, and South Korea, with growth fueled by rising disposable income, urbanization, and a young, style-conscious demographic. The market is expanding rapidly in e-commerce and premium product channels.

Latin America

Brazil and Mexico are the key markets, with growth driven by urban populations and increasing awareness of personal grooming. Outbound exports from APAC support product availability and adoption.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, shows strong demand for premium hair sprays, while Africa’s market is primarily professional and urban-focused. High-income populations and luxury salon adoption drive regional growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hair Spray Market

- L’Oréal

- Procter & Gamble

- Unilever

- Henkel

- Kao Corporation

- Revlon

- Coty Inc.

- Shiseido

- Amorepacific

- Godrej Consumer Products

- Beiersdorf

- Estée Lauder

- Mary Kay

- Wella Professionals

- Schwarzkopf

Recent Developments

- In June 2025, L’Oréal launched a new line of alcohol-free hair sprays in North America, emphasizing heat protection and eco-friendly packaging.

- In April 2025, Henkel expanded its APAC operations with a new production facility in India, focusing on premium and organic hair sprays for domestic and export markets.

- In February 2025, Shiseido introduced a multifunctional hair spray in Europe, combining styling, anti-frizz, and UV protection, targeting premium salon clients.