Hair Colorants Market Size

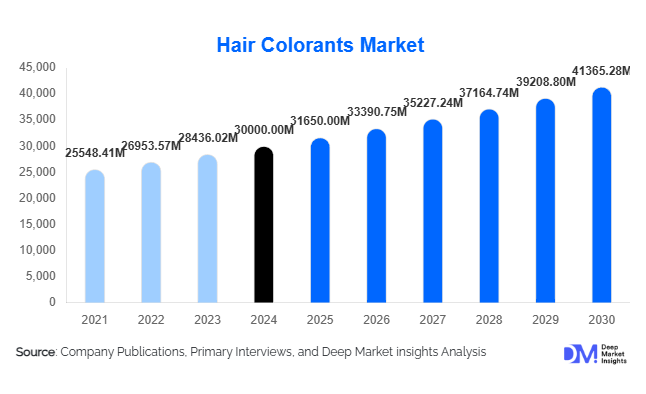

According to Deep Market Insights, the global hair colorants market size was valued at USD 30,000 million in 2024 and is projected to grow from USD 31,650.00 million in 2025 to reach USD 41,365.28 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). Growth in the hair colorants market is primarily driven by evolving beauty trends, increasing male participation in grooming, and the rising demand for clean, ammonia-free, and plant-based colorant formulations that blend fashion with scalp and hair health.

Key Market Insights

- Permanent hair colorants dominate the market, accounting for around 70% of the global share in 2024 due to their long-lasting grey coverage.

- Asia-Pacific leads globally, capturing nearly 35% of the market value, supported by rising disposable incomes and fashion awareness.

- At-home hair color kits account for 60% of total sales as DIY coloring becomes mainstream among working professionals and younger demographics.

- Natural and plant-based colorants are the fastest-growing category, boosted by consumer preference for safe and sustainable ingredients.

- Top 5 global players command roughly 35% market share, led by L’Oréal, Unilever, P&G, Coty, and Henkel, who continue to invest in clean-beauty R&D.

- Online distribution channels are expanding rapidly, with e-commerce sales forecast to exceed 30% of the market by 2030.

Latest Market Trends

Shift Toward Natural and Ammonia-Free Formulations

Manufacturers are reformulating products with botanical extracts, herbal pigments, and organic oils to minimize scalp irritation and chemical exposure. The trend aligns with global clean-beauty movements and stricter regulatory scrutiny in Europe and North America. Brands offering vegan, cruelty-free, and sulfate-free variants are witnessing higher repeat purchases. Ammonia-free permanent dyes are replacing conventional peroxide systems, appealing to both salon and at-home consumers who prioritize scalp safety and sustainable packaging.

Digital Transformation and At-Home Personalization

Technology integration is reshaping the hair colorants industry. Augmented-reality (AR) color-try-on apps, AI-based shade selectors, and subscription-based home-color delivery kits are enhancing consumer convenience. E-commerce platforms are enabling direct-to-consumer (D2C) brand models, while salons are leveraging digital tools to offer customized consultations. This personalization revolution reduces product waste, boosts loyalty, and strengthens data-driven marketing strategies across the value chain.

Hair Colorants Market Drivers

Growing Demand for Self-Expression and Fashion Styling

Coloring hair has evolved beyond grey coverage to a lifestyle statement. Millennials and Gen Z consumers experiment with vivid shades and frequent color changes inspired by influencers and pop culture. This behavioral shift drives repeat purchases and sustains high product turnover across semi-permanent and temporary dye categories.

Technological Advancements and Product Innovation

R&D investments are producing high-performance formulations with shorter processing times, enhanced shine, and longer retention. Breakthroughs in micro-pigmentation and hybrid color systems (blend of natural and synthetic pigments) allow brands to deliver superior results with reduced damage. Smart packaging and pre-measured applications simplify at-home use, further accelerating adoption.

Rising At-Home Grooming and E-Commerce Penetration

The pandemic-era DIY culture normalized home hair coloring, a trend that persists due to convenience and affordability. Enhanced product availability on digital platforms and influencer-led tutorials have democratized color styling. Subscription kits and same-day delivery further strengthen the home-use ecosystem, supporting steady global demand.

Market Restraints

Regulatory Compliance and Ingredient Restrictions

Stringent cosmetic-ingredient regulations, particularly in the EU and U.S., challenge product reformulation and market entry timelines. Compliance with allergen labeling, safety testing, and banned-substance lists adds costs and limits the use of certain synthetic pigments, restricting product flexibility for manufacturers.

Maturity and Slow Growth in Developed Regions

High penetration in North America and Western Europe constrains incremental growth, with mature consumer bases shifting toward premium rather than volume expansion. Competition from salon treatments such as glossing and balayage services also diverts spending away from boxed dyes, limiting volume gains in established markets.

Hair Colorants Market Opportunities

Expansion in Emerging Economies

Rising disposable incomes and beauty consciousness in India, China, and Southeast Asia present major growth avenues. Manufacturers are localizing product lines, introducing shades suited to regional hair tones, smaller SKUs, and affordable price points to penetrate new demographics. Urbanization and retail modernization in these regions will likely boost market value significantly through 2030.

Male Grooming and Aging Population Segments

The intersection of men’s grooming and aging demographics creates fresh demand for grey-coverage and quick-touch-up products. Brands introducing targeted men’s color ranges, natural-look shades, and easy-apply formats are capturing this previously underserved segment. Simultaneously, aging populations in Japan, the U.S., and Europe sustain a consistent base demand for permanent colorants.

Premium and Professional Product Innovation

Luxury salon and professional ranges featuring bond-protecting technology, scalp-soothing ingredients, and bespoke color blends are gaining popularity. Companies investing in hybrid models that connect salon and home experiences, such as a take-home maintenance kit, stand to expand their premium customer base and profit margins.

Product Type Insights

Permanent hair colorants lead the market with a 70% share in 2024, driven by consumer preference for longevity and grey-coverage efficiency. Semi-permanent and temporary colors are gaining younger users seeking experimentation without commitment, growing at over 7% CAGR. The shift toward cream formulations (45% share) stems from superior application control and moisture retention. Meanwhile, natural and ammonia-free categories, though smaller at 20% share, are projected to double by 2030 due to sustainability trends.

Application Insights

At-home color kits dominate with 60% share, benefiting from affordability and the ease of modern formulations. Professional salon use represents 40%, concentrated in urban centers and premium segments. Hybrid formats such as professional brands retailing DIY extensions are blurring the boundaries, creating multi-channel opportunities for players seeking omnipresence.

Distribution Channel Insights

Offline retail (supermarkets, salons, specialty beauty stores) remains the largest channel with a 70% share in 2024, but is ceding ground to online retail, expected to surpass 30% share by 2030. Digital sales growth is powered by influencer marketing, AR try-on tools, and D2C subscriptions. E-commerce also enables niche, clean-beauty brands to reach international consumers efficiently, reducing dependence on traditional retail networks.

End-Use Insights

Consumer use for personal styling represents the majority of end-use demand, followed by professional salons, which serve the premium demographic. Rapidly growing segments include male grooming and youth experimentation with vivid or pastel tones. Export-driven demand for ready-to-use kits from Asia and Europe supports manufacturing economies of scale. End-use industries such as fashion, entertainment, and influencer marketing continue to indirectly boost color-innovation cycles, sustaining the sector’s vibrancy.

| By Product Type | By Formulation | By Usage Type | By Gender | By Distribution Channel | By Ingredient Type |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

Accounting for approximately 25% of global revenue in 2024, North America is a mature but profitable market. The U.S. drives innovation through premium salon culture and clean-beauty brands. Growth remains steady at around 4–5% CAGR, supported by increased male grooming and digital retailing.

Europe

Europe holds a 30% share of the market, led by Germany, the U.K., France, and Italy. The region’s strict regulatory environment pushes product innovation toward safer, eco-friendly formulations. Demand is sustained by salon professionalism, but future growth hinges on eco-certified and vegan offerings gaining mainstream traction.

Asia-Pacific

The largest and fastest-growing region ( 35% share in 2024) is propelled by rising incomes, urban lifestyles, and beauty consciousness. China and India lead consumption, while Japan and South Korea anchor premium innovation. The region’s forecast CAGR exceeds 7%, fueled by new local entrants and increasing exports of herbal and natural colorants.

Latin America

Latin America, with around 8% share, exhibits strong potential in Brazil and Mexico, where Western beauty trends merge with local cultural expressions. Market growth above 6% CAGR is expected through 2030, supported by expanding retail networks and influencer-led promotions.

Middle East & Africa

This region contributes roughly 7% of global sales. Gulf Cooperation Council countries favor premium and salon-grade products, while African markets such as South Africa and Nigeria show rising demand for affordable at-home kits. The regional CAGR of 8% reflects a mix of nascent adoption and youthful populations embracing grooming trends.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hair Colorants Market

- L’Oréal S.A.

- Unilever PLC

- Procter & Gamble Co.

- Coty Inc.

- Henkel AG & Co. KGaA

- Revlon Inc.

- Estée Lauder Companies Inc.

- Kao Corporation

- Shiseido Company Limited

- Avon Products Inc.

- Wella Company

- Godrej Consumer Products Ltd.

- BBlunt (Honasa Consumer)

- NatureLab Tokyo

- Amorepacific Corporation

Recent Developments

- June 2025 – L’Oréal unveiled its next-generation Botanēa plant-based dye line, expanding its sustainable product portfolio in Europe and APAC.

- April 2025 – Henkel introduced a new digital shade-matching system for salons under the Schwarzkopf brand, integrating AI color analysis for precision results.

- March 2025 – Godrej Consumer Products announced capacity expansion of its hair-color manufacturing plant in India under the “Make in India” initiative.

- February 2025 – Coty partnered with Amazon Beauty to enhance D2C reach for Clairol and Wella Color Charm lines in North America.