Hair Color Market Size

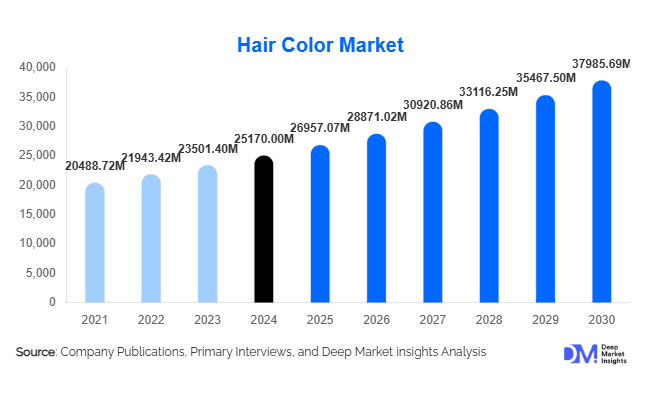

According to Deep Market Insights, the global hair color market size was valued at USD 25,170 million in 2024 and is projected to grow from USD 26,957.07 million in 2025 to reach USD 37,985.69 million by 2030, expanding at a CAGR of 7.1% during the forecast period (2025–2030). The hair color market growth is primarily driven by the increasing demand for personal grooming, the growing influence of social media and fashion trends, and the rapid expansion of salon and e-commerce channels offering innovative hair color products worldwide.

Key Market Insights

- Shift toward natural and ammonia-free formulations is shaping consumer preferences, reflecting growing awareness of scalp health and chemical safety.

- Rising male grooming trends are expanding the target demographic, particularly in urban and millennial markets.

- At-home hair coloring kits continue to gain popularity post-pandemic due to convenience and affordability.

- Asia-Pacific remains the fastest-growing region, driven by increasing disposable income, changing beauty standards, and expanding retail networks.

- Digital engagement and influencer-driven marketing are boosting brand visibility and accelerating product adoption among younger consumers.

- Innovation in color technology, including long-lasting, plant-based, and customized digital shade matching, is enhancing customer experience.

Latest Market Trends

Rising Demand for Natural and Organic Hair Colors

Consumers are increasingly shifting toward natural, organic, and vegan hair color solutions as awareness about harmful chemicals such as ammonia, parabens, and PPD grows. Manufacturers are responding by formulating dyes infused with botanical extracts, argan oil, and henna-based pigments. Brands like L’Oréal, Garnier, and Revlon are expanding their organic product lines to cater to this demand. Additionally, certification programs such as Ecocert and USDA Organic are influencing purchase decisions, further strengthening the clean beauty segment in the hair color industry.

Technology-Driven Customization and Shade Innovation

Advancements in AI and AR technology are revolutionizing the consumer experience by enabling virtual try-ons and personalized color recommendations. Leading companies are launching mobile apps and in-store kiosks that analyze hair tone and texture to recommend ideal shades. These digital tools not only enhance engagement but also reduce consumer hesitation associated with at-home coloring. Furthermore, micro-pigment technology and long-lasting formulations are enhancing product durability while minimizing hair damage, expanding adoption among both salon and DIY users.

Hair Color Market Drivers

Growing Fashion and Self-Expression Trends

The rising global emphasis on fashion, self-expression, and individuality is a key driver of the hair color market. Changing hair color is increasingly viewed as a form of personal identity enhancement, particularly among Gen Z and millennial consumers. Influencer culture and celebrity endorsements amplify this trend by normalizing frequent hair transformations. Seasonal color launches, social media filters, and fashion collaborations are also fueling demand for temporary and semi-permanent shades.

Expansion of E-commerce and Salon Networks

Online retail and professional salons remain pivotal to market expansion. E-commerce platforms like Amazon, Sephora, and Nykaa are making diverse hair color brands accessible to global audiences, while subscription-based beauty boxes and D2C websites foster recurring sales. Simultaneously, professional salons are seeing increased footfall due to rising disposable incomes and a focus on premium grooming experiences. Strategic partnerships between color brands and salon chains are boosting brand loyalty and driving premiumization in product offerings.

Market Restraints

Health and Safety Concerns

Growing concerns about allergic reactions, hair damage, and scalp sensitivity from chemical dyes remain key challenges for the market. Regulatory scrutiny is tightening in major markets such as the EU and North America, requiring brands to adhere to stricter formulation standards. These health-related apprehensions can deter first-time users and limit product adoption in certain demographics. Educating consumers on safe application and offering hypoallergenic alternatives are critical to addressing this restraint.

Fluctuating Raw Material Costs and Supply Chain Disruptions

Volatility in raw material prices, particularly for pigments, natural extracts, and packaging components, can impact product pricing and profitability. Supply chain disruptions stemming from geopolitical tensions, logistics delays, or environmental regulations further challenge production efficiency. Companies are increasingly investing in local manufacturing and sustainable sourcing strategies to mitigate these risks and ensure business continuity.

Hair Color Market Opportunities

Growth of Men’s Grooming Segment

Men’s hair color products represent a rapidly expanding opportunity within the broader grooming category. Increasing social acceptance of male beauty and aging management is driving the adoption of gray coverage solutions, beard colorants, and natural tinting products. Brands are launching targeted campaigns and formulations tailored to male consumers, emphasizing ease of use, quick application, and subtle results. This segment is expected to experience double-digit growth through 2030, particularly in emerging economies.

Personalization and Smart Color Technology

Customized and data-driven hair color solutions are gaining traction. AI-based color matching, DNA-based formulation kits, and subscription-based shade updates are transforming the consumer journey. Some brands are offering smart dispensers that mix colors based on real-time scalp and hair analysis. As consumers increasingly seek exclusivity and convenience, personalization technologies present a major growth frontier for both online and in-salon channels.

Product Type Insights

Permanent hair colors dominate the market, accounting for the largest revenue share due to their long-lasting results and salon-grade formulations. However, semi-permanent and temporary dyes are witnessing the fastest growth, appealing to younger consumers seeking low-commitment experimentation. Natural and organic dyes are expanding rapidly within both professional and retail channels, reflecting the global shift toward clean beauty. Meanwhile, root touch-up sprays and color-depositing conditioners are creating micro-segments that support continuous consumer engagement between full-color applications.

Application Insights

The salon segment continues to hold a dominant position in the global hair color market, supported by professional-grade treatments, brand partnerships, and high-value clientele. The at-home application category, however, is witnessing accelerated growth as consumers increasingly prefer DIY options for convenience and cost-effectiveness. Technological innovations such as pre-measured applicators and mess-free formulas are improving the at-home experience, bridging the gap between salon and retail-grade results.

Distribution Channel Insights

Online channels are gaining significant traction, supported by influencer marketing, digital shade-matching tools, and subscription-based services. Offline retail—including supermarkets, drugstores, and beauty specialty outlets—remains essential for first-time buyers and impulse purchases. Salon-exclusive distribution is a major revenue driver for premium and professional-grade products. Hybrid strategies combining online consultation and offline purchase are becoming prevalent, enhancing customer reach and conversion rates.

End-User Insights

Women continue to represent the largest consumer group, driven by fashion cycles, social media exposure, and frequent product use. However, the male segment is expanding quickly, particularly in urban and middle-income markets. Unisex products featuring gender-neutral branding and inclusive advertising are reshaping the competitive landscape, appealing to diverse audiences across generations.

| By Product Type | By Formulation | By Application | By End User | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains a leading market, driven by high consumer spending on beauty products and widespread acceptance of hair coloring as a lifestyle choice. The U.S. leads in innovation, with a strong presence of salon chains, influencer-driven brands, and digital-first startups. Consumers increasingly prefer ammonia-free, cruelty-free, and vegan-certified products, reflecting a maturing clean beauty culture.

Europe

Europe holds a substantial share of the global market, supported by the region’s fashion-forward population and stringent cosmetic regulations ensuring product safety. The U.K., Germany, France, and Italy are key contributors. European consumers demonstrate high brand loyalty toward eco-certified and organic formulations. Premium and salon-exclusive hair color brands dominate in this region, while sustainable packaging initiatives are becoming a standard competitive differentiator.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the hair color market. Rising disposable incomes, urbanization, and exposure to Western beauty trends are driving significant adoption in China, India, Japan, and South Korea. Younger demographics are experimenting with bold and vibrant shades, while natural henna-based and herbal colors remain popular among traditional consumers. Expanding retail infrastructure and online platforms are accelerating accessibility and awareness across Tier II and Tier III cities.

Latin America

Latin America presents steady growth potential, led by Brazil and Mexico. Increasing salon penetration, influencer marketing, and social media beauty trends are driving consumer engagement. Hair color brands focusing on diverse shade ranges and tropical climate-resilient formulas are gaining a competitive edge. Economic recovery and expanding middle-class consumption are expected to further strengthen the regional market outlook.

Middle East & Africa

The Middle East and Africa region is witnessing growing demand for both luxury and natural hair color products. High disposable income in Gulf countries such as the UAE and Saudi Arabia supports premium segment expansion, while African nations like South Africa and Nigeria are showing rising interest in vibrant and textured-hair-compatible dyes. Localized product development addressing humidity resistance and cultural preferences will be crucial to capturing long-term market share.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hair Color Market

- L’Oréal Group

- Kao Corporation

- Coty Inc.

- Henkel AG & Co. KGaA

- Revlon Inc.

- Godrej Consumer Products Ltd.

- Unilever PLC

- Hoyu Co., Ltd.

- Amorepacific Corporation

- Shiseido Company, Limited

Recent Developments

- In August 2025, L’Oréal announced the global expansion of its “Metal Detox” hair color protection range to enhance post-color care and prevent breakage.

- In June 2025, Kao Corporation launched an AI-powered shade recommendation tool under its “Blaune” brand in Japan, offering real-time virtual color try-ons for home users.

- In April 2025, Revlon introduced an ammonia-free “ColorSilk Naturals” line targeting eco-conscious consumers in North America and Europe.

- In March 2025, Henkel’s Schwarzkopf Professional unveiled a new plant-based hair dye collection in collaboration with salons across Europe, emphasizing sustainability and ethical sourcing.