Hair Brushes & Combs Market Size

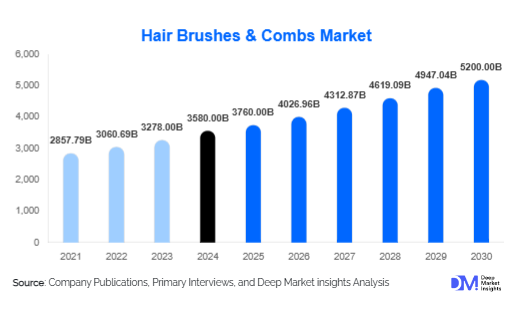

According to Deep Market Insights, the global hair brushes & combs market size was valued at USD 3,580 million in 2024 and is projected to grow from USD 3,760 million in 2025 to reach USD 5,200 million by 2030, expanding at a CAGR of 7.1% during the forecast period (2025-2030). The market growth is primarily driven by increasing global personal grooming awareness, rising demand for premium and sustainable hair care tools, and the growing adoption of innovative designs catering to diverse hair types and consumer preferences.

Key Market Insights

- Premium and multifunctional hair brushes are gaining traction, as consumers increasingly seek products that reduce hair damage, enhance styling efficiency, and cater to specific hair types.

- Eco-friendly and sustainable brushes and combs are witnessing high demand due to rising consumer awareness of environmental impact and growing regulations around plastic use in beauty products.

- Women’s grooming segment dominates the market globally, with products such as detangling brushes, round brushes, and styling combs leading sales.

- Asia-Pacific is the fastest-growing regional market, driven by rising disposable income, expanding e-commerce penetration, and growing beauty & personal care trends in countries such as China and India.

- Technological innovations in materials, including ceramic, ionic, and heat-resistant composites, are reshaping consumer preference and enhancing product differentiation.

What are the latest trends in the hair brushes & combs market?

Premium and Customized Brushes

Consumers are increasingly opting for high-quality brushes that address specific hair concerns, such as frizz control, detangling, scalp massage, and heat styling compatibility. Products with ergonomic designs, lightweight handles, and anti-static bristles are leading the market. Personalization, such as combs tailored for curly or textured hair, is also gaining traction, with brands offering specialized product lines targeting diverse hair types globally.

Eco-Friendly & Sustainable Materials

Sustainable hair brushes and combs made from bamboo, recycled plastics, and biodegradable polymers are becoming popular among environmentally conscious consumers. Major beauty brands are integrating eco-certifications and recyclable packaging, appealing to millennials and Gen Z buyers. Additionally, increasing regulations restricting single-use plastics in Europe and North America are encouraging manufacturers to adopt renewable or biodegradable materials.

What are the key drivers in the hair brushes & combs market?

Rising Personal Grooming Awareness

The growing focus on self-care, beauty routines, and professional styling is significantly increasing the demand for quality hair brushes and combs. Consumers are investing in tools that prevent hair damage and promote healthy hair, driving sales across premium and mid-range segments. Influencer-led tutorials and beauty-focused social media campaigns are further fueling awareness and product adoption worldwide.

Expansion of E-Commerce Platforms

E-commerce penetration has made premium brushes and combs more accessible to consumers globally. Online platforms provide detailed product information, reviews, and personalized recommendations, enabling higher purchase confidence. Cross-border e-commerce also allows consumers in emerging markets to access international brands, expanding market reach and driving growth.

Technological Innovation & Material Advancement

Advanced materials such as ceramic, ionic bristles, and heat-resistant composites improve styling efficiency and reduce hair damage. Ergonomic designs, multifunctional brushes, and combs integrating scalp massage or detangling features are increasingly popular. Such innovations differentiate brands, creating premium pricing opportunities and driving market expansion.

What are the restraints for the global market?

High Competition and Price Sensitivity

The market faces intense competition with numerous local and global brands, which creates pricing pressure. Price-sensitive consumers often prefer low-cost alternatives, particularly in developing regions, limiting profit margins for premium players. Brand differentiation through quality and innovation is necessary to maintain a competitive advantage.

Dependence on Raw Material Costs

Fluctuating prices of plastics, polymers, bamboo, and other raw materials impact production costs. Sudden increases in material costs can constrain manufacturers’ pricing strategies and affect overall profitability. Additionally, sourcing sustainable materials adds complexity and cost for eco-conscious product lines.

What are the key opportunities in the hair brushes & combs industry?

Expansion in Emerging Markets

Rising disposable income, urbanization, and beauty-conscious lifestyles in countries like India, China, and Brazil present significant growth opportunities. Increased retail penetration and the rise of online shopping are making premium and specialized brushes more accessible to a wider audience. Market entrants can tap into tier-2 and tier-3 cities where grooming habits are evolving rapidly.

Integration of Smart and Multifunctional Features

Innovative products such as brushes with heat-sensing technology, built-in ionic conditioning, and ergonomic designs that reduce styling time are opening new segments. These features appeal to tech-savvy consumers seeking efficiency and value-added functionality, driving premiumization in the market.

Regulatory & Eco-Friendly Incentives

Government regulations on single-use plastics, coupled with rising sustainability initiatives, create opportunities for manufacturers of biodegradable or recyclable brushes and combs. Brands adopting eco-friendly practices can differentiate themselves and capture environmentally conscious consumers, driving growth in both mature and emerging regions.

Product Type Insights

Detangling brushes dominate the market, holding approximately 27% of the global market in 2024. Their ergonomic design and effectiveness in reducing hair breakage have driven popularity among women and children. Round styling brushes and paddle brushes are also significant contributors, particularly in professional salon settings. Bamboo and eco-friendly combs are gaining market share due to environmental awareness, while specialty brushes targeting curly, thick, or textured hair are expanding rapidly in emerging regions.

Application Insights

The personal grooming segment accounts for the majority of market demand, while professional salon use drives high-value sales, particularly for premium brushes and combs. At-home styling and self-care routines are rapidly growing due to increased social media influence, virtual tutorials, and a shift toward DIY beauty practices. Export-driven demand from beauty retailers in North America and Europe further strengthens market growth.

Distribution Channel Insights

E-commerce platforms dominate global sales due to convenience, variety, and consumer reviews. Specialty beauty stores and salons retain importance for premium product exposure and professional recommendations. Mass retail and supermarkets provide cost-effective options for low- to mid-range products, particularly in emerging markets. Direct-to-consumer channels are expanding, with brands leveraging social media campaigns and subscription models to build loyalty.

End-Use Insights

Consumers, particularly women aged 18-45, represent the largest end-use segment, followed by professional salons and beauty parlors. Salon demand is expected to grow steadily due to rising emphasis on professional hair care. Emerging applications include gifting sets, travel-friendly combs, and specialty brushes for specific hair textures, providing incremental market opportunities.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds around 26% of the global hair brushes & combs market in 2024. The U.S. leads demand due to high disposable income, widespread beauty awareness, and a strong salon industry. Canada is growing steadily, particularly for eco-friendly and premium brushes. Online retail penetration and influencer-led marketing campaigns drive adoption in both countries.

Europe

Europe accounts for approximately 24% of the market, with Germany, France, and the U.K. as major contributors. Rising sustainability consciousness, eco-friendly product adoption, and strong professional salon networks underpin growth. Germany leads the market for premium brushes, while the U.K. shows strong demand for innovative and multifunctional products.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China and India. Rapid urbanization, expanding e-commerce, and rising beauty-conscious middle-class populations drive growth. Demand for specialized and affordable brushes is high, while premium products gain traction in urban centers. Japan and Australia also contribute to steady growth through professional salon adoption and premium consumer preference.

Latin America

Brazil and Mexico are key markets, contributing to growing demand for both personal grooming and professional salon products. Urban beauty trends and e-commerce growth drive the adoption of mid-range and specialty brushes.

Middle East & Africa

South Africa is the primary market in Africa, while the Middle East, led by the UAE and Saudi Arabia, shows rising demand for premium and luxury brushes. Strong income levels, beauty awareness, and a growing professional salon industry support growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Hair Brushes & Combs Market

- Conair Corporation

- Goody Products Inc.

- Revlon, Inc.

- Denman International

- Mason Pearson Ltd.

- Cricket Hair Tools

- Kent Brushes

- Olivia Garden

- FHI Heat

- Hair Tools USA

- Acca Kappa

- Wet Brush

- Michel Mercier

- Spornette

- Loew-Cornell

Recent Developments

- In March 2025, Conair Corporation launched a new line of sustainable, bamboo-handled brushes with recyclable packaging, targeting eco-conscious consumers.

- In January 2025, Wet Brush introduced a premium detangling series incorporating heat-resistant bristles and anti-static technology for salon professionals.

- In June 2025, Denman International expanded its global footprint by opening a new manufacturing unit in India focused on ergonomic and multifunctional brushes for emerging markets.