Gym Software Market Size

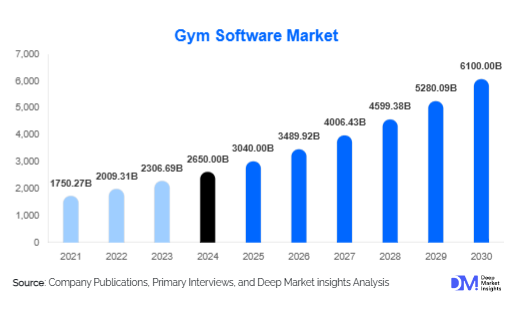

According to Deep Market Insights, the global gym software market size was valued at USD 2,650 million in 2024 and is projected to grow from USD 3,040 million in 2025 to reach USD 6,100 million by 2030, expanding at a CAGR of 14.8% during the forecast period (2025-2030). The gym software market growth is primarily driven by rising digital transformation in the fitness industry, increasing demand for integrated membership management solutions, and the expansion of hybrid fitness models that combine physical and virtual offerings.

Key Market Insights

- Cloud-based platforms dominate gym software adoption, accounting for more than 65% of deployments in 2024 due to scalability, affordability, and remote access capabilities.

- Integrated all-in-one solutions are rapidly gaining traction, as gyms and boutique studios seek single platforms that manage memberships, payments, scheduling, and performance tracking.

- North America leads the global gym software market, contributing nearly 38% of 2024 revenues, supported by the strong penetration of health clubs and fitness chains.

- Asia-Pacific is the fastest-growing region, expected to expand at over 17% CAGR during 2025-2030, fueled by rising disposable incomes and growing fitness awareness in India, China, and Southeast Asia.

- Wearable and IoT integration is reshaping user engagement, allowing gyms to personalize training plans and track member performance in real time.

- AI-driven analytics for customer retention and predictive health insights are emerging as a key differentiator for leading software providers.

What are the latest trends in the gym software market?

Integration with Wearables and IoT

Gym software platforms are increasingly integrating with smartwatches, fitness trackers, and connected equipment. Real-time biometric tracking enables gyms to offer personalized workout plans, while data integration supports member engagement and retention. IoT-connected machines are becoming common in large gyms, where gym software can record usage patterns, optimize schedules, and reduce equipment downtime. This shift toward data-driven fitness is a major trend shaping the industry.

Hybrid Fitness Models Expanding

Post-pandemic, fitness consumers are demanding flexibility in how they access training. Gym software now powers hybrid ecosystems that allow members to combine in-person training sessions with virtual classes. Platforms with live-streaming, on-demand libraries, and virtual scheduling tools are witnessing strong adoption. This trend has opened up new revenue channels for gyms and studios while broadening their customer base beyond geographic limitations.

AI-Powered Customer Retention

Artificial intelligence is increasingly embedded in gym software to predict churn and enhance customer loyalty. Platforms analyze member behavior such as attendance frequency, class preferences, and payment history to identify dropout risks. Personalized notifications, targeted promotions, and automated reminders are then triggered to retain members. This adoption of AI-driven engagement tools is helping gyms increase retention rates and optimize marketing spend.

What are the key drivers in the gym software market?

Rising Fitness and Wellness Awareness

Global health awareness is driving more people to join gyms and fitness studios, creating strong demand for gym software solutions. Memberships in both commercial gyms and boutique studios have increased substantially, with digital platforms playing a central role in managing customer engagement and ensuring seamless service delivery. The growth of wellness-focused corporate programs is further fueling adoption.

Shift Toward Cloud-Based Solutions

Cloud deployment has become the industry standard due to its cost-effectiveness and accessibility. Cloud-based gym software reduces the need for costly IT infrastructure while enabling real-time updates, mobile access, and cross-location synchronization. Independent gyms and large chains alike are migrating to cloud-based platforms, boosting adoption rates significantly.

Growing Popularity of Hybrid Membership Models

Consumers are demanding flexibility in how they consume fitness services. Gym software that supports hybrid models combining in-person memberships with virtual access is gaining popularity. These solutions allow members to train from home, join live online sessions, and access digital fitness libraries, making them indispensable for modern gyms.

What are the restraints for the global market?

High Initial Setup Costs for Small Gyms

While cloud-based solutions have reduced costs, smaller gyms and studios still face challenges in adopting premium gym software. Integration with IoT devices, advanced analytics, and customized modules often requires significant upfront investment. This cost barrier limits adoption in price-sensitive markets, particularly in developing regions.

Data Privacy and Cybersecurity Risks

As gym software platforms collect sensitive customer data such as health metrics, payment details, and personal identifiers, cybersecurity risks are a growing concern. Any data breach can erode customer trust and damage brand reputation. Vendors need to invest heavily in security protocols and compliance frameworks, increasing operational costs and creating entry barriers for new players.

What are the key opportunities in the gym software industry?

Expansion into Emerging Markets

Rapid urbanization and rising disposable incomes in countries such as India, Brazil, and Indonesia present significant opportunities. Growing health consciousness and the expansion of boutique fitness studios in these regions create strong demand for localized, affordable software solutions. Providers that tailor features to regional payment systems, cultural fitness trends, and multi-language interfaces can capture high-growth markets.

AI and Data-Driven Personalization

The adoption of AI in gym software presents a major growth opportunity. AI-powered platforms can provide real-time performance insights, design adaptive workout plans, and forecast equipment maintenance needs. Data-driven personalization not only improves member satisfaction but also increases retention, making it a critical revenue driver for gyms and studios.

Corporate Wellness Integration

Corporations are investing heavily in employee wellness programs, and gym software providers can tap into this trend by offering enterprise-level solutions. Platforms that allow businesses to manage employee memberships, track participation, and incentivize healthy behavior are becoming highly attractive. This opportunity expands the traditional gym software market into the corporate wellness segment, a sector poised for rapid growth.

Product Type Insights

Cloud-based gym software dominates the market, accounting for 65% of revenues in 2024. Its scalability, affordability, and mobile accessibility make it the preferred choice for both large gym chains and independent fitness studios. On-premise solutions still hold relevance among enterprises prioritizing data control and customization, but represent a shrinking share of the global market.

Application Insights

Membership management software is the leading application, contributing nearly 30% of the global market in 2024. Automating sign-ups, renewals, attendance, and customer engagement saves time and improves operational efficiency for gyms. Other high-growth applications include scheduling software for group classes and integrated billing modules that simplify recurring payments and compliance management.

End-User Insights

Commercial gyms and health clubs represent the largest end-user segment, accounting for over 45% of revenues in 2024. The expansion of large gym chains, coupled with the need for standardized software across multiple branches, drives adoption. Boutique studios are the fastest-growing segment, supported by the rising popularity of specialized fitness formats such as yoga, CrossFit, and martial arts.

| By Deployment Model | By Functionality | End-User Type | By Enterprise Size | By Revenue Model |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America dominates the gym software market with a 38% revenue share in 2024. Strong penetration of health clubs, a high number of boutique studios, and rapid adoption of AI-powered solutions drive growth. The U.S. is the largest contributor, with Canada showing steady expansion through wellness-focused digital gyms.

Europe

Europe holds 28% of the market in 2024, led by the U.K., Germany, and France. The region’s demand is shaped by strong health awareness and widespread adoption of cloud-based software. Fitness chains in Europe are integrating virtual classes and wearable device connectivity, further expanding demand.

Asia-Pacific

Asia-Pacific is the fastest-growing region, forecasted to expand at a 17% CAGR during 2025-2030. Rising middle-class incomes, urbanization, and strong cultural shifts toward fitness are driving growth in India, China, and Southeast Asia. Localized, cost-effective gym software solutions are particularly in demand.

Latin America

Latin America is emerging as a promising region with steady adoption in Brazil, Mexico, and Argentina. Boutique studios are driving digital transformation, and demand for affordable cloud-based platforms is on the rise. Market share in 2024 is estimated at around 7%.

Middle East & Africa

The Middle East & Africa account for approximately 5% of the 2024 market. The UAE and Saudi Arabia are leading adopters, with rapid growth supported by government wellness initiatives and investments in premium fitness clubs. Africa is still nascent but showing potential as health awareness increases across urban hubs.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Gym Software Market

- Mindbody

- Virtuagym

- Glofox

- Zen Planner

- TeamUp

- Wodify

- PushPress

- Pike13

- GymMaster

- RhinoFit

- EZFacility

- WellnessLiving

- GymDesk

- Trainerize

- FitSW

Recent Developments

- In June 2025, Mindbody announced an AI-powered personalization feature for boutique studios, enabling automated workout recommendations and retention alerts.

- In April 2025, Glofox expanded its footprint in Asia-Pacific, launching localized platforms in India and Southeast Asia to target emerging fitness markets.

- In March 2025, Virtuagym introduced a corporate wellness integration module, allowing enterprises to manage employee fitness programs across multiple regions.