Grocery Lockers Market Size

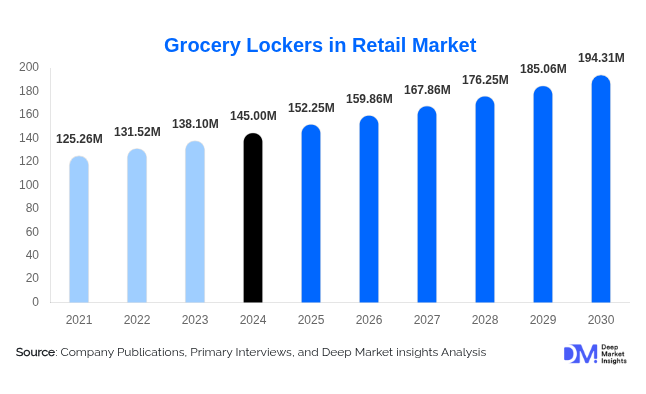

According to Deep Market Insights, the global grocery lockers in the retail market size was valued at USD 145.0 million in 2024 and is projected to grow from USD 152.25 million in 2025 to reach USD 194.31 million by 2030, expanding at a CAGR of 5.0% during the forecast period (2025–2030). Growth is primarily driven by accelerating e-grocery adoption, rising demand for contactless and temperature-controlled pickup solutions, and investments in last-mile efficiency and smart-locker technology by major grocery retailers and logistics integrators.

Key Market Insights

- Ambient lockers currently dominate deployments because they are lower cost, easier to install, and applicable to the largest share of grocery order volumes.

- Temperature-controlled lockers (chilled and frozen) are the fastest-growing technical segment, enabling perishable fulfillment and unlocking more grocery use-cases for locker systems.

- Supermarkets and hypermarkets lead adoption as they can justify space and investment for locker banks to support click-and-collect and curbside fulfillment.

- North America holds the largest share of market revenue in 2024, owing to mature e-grocery penetration and scale deployments by large grocery chains.

- Asia-Pacific is the fastest-growing region in percentage terms, driven by rapid urbanization, rising smartphone usage, and expanding e-grocery.

- IoT and software integration are decisive differentiators; vendors offering hardware + cloud services + analytics capture higher lifetime value.

Latest Market Trends

Omnichannel Grocery & Click-and-Collect Expansion

Retailers are increasingly embedding locker systems into omnichannel strategies as click-and-collect becomes a standard fulfillment option. Locker banks, both in-store and curbside, reduce failed delivery attempts, offer 24/7 pickup windows, and lower last-mile labor costs. Supermarket chains are piloting locker rollouts across high-traffic stores to encourage in-store cross-sell while providing customers with the speed of online shopping. This trend is expanding locker use beyond simple pickup to integrated fulfillment nodes supporting in-store micro-fulfillment and returns.

Temperature-Controlled Locker Adoption

Chilled and frozen lockers are moving from niche pilots to commercially viable products. Advances in modular refrigeration, better insulation, and remote monitoring allow grocery operators to deliver perishables via lockers with reduced spoilage risk. As consumer demand for fresh and frozen e-grocery grows, retailers are investing in refrigerated locker modules that can be integrated alongside ambient units, enabling a single locker bank to handle mixed-temperature orders.

Smart Lockers & Service Models

IoT connectivity, predictive maintenance, and mobile app integrations are converting one-time hardware sales into recurring service revenues. Locker providers bundle analytics, remote diagnostics, and software integrations (POS, OMS, e-commerce platforms) to improve uptime and utilization. Many vendors also offer leasing/subscription models to lower retailer entry costs and accelerate network rollouts, shifting cost burden from CAPEX to OPEX.

Grocery Lockers Market Drivers

Rapid Growth of Online Grocery Shopping

The surge in online grocery ordering is the primary growth engine for locker deployment. Consumers increasingly prefer ordering ahead and collecting at convenient times; lockers provide a contactless, reliable pickup experience and reduce the need for costly home delivery time windows. As e-grocery penetration deepens, retailers look to lockers to deliver predictable pickup flows and lower last-mile cost per order.

Last-Mile Efficiency & Cost Reduction

Lockers reduce failed deliveries and consolidate customer pickups to a single point, improving delivery density and lowering per-order fulfillment costs. Urban delivery constraints and labor scarcity make locker solutions attractive for grocers and third-party logistics providers seeking scalable, lower-cost pickup alternatives.

Technology Maturation & Integration

Falling IoT and sensor costs, robust cloud platforms, and improved refrigerated module designs make modern locker systems more reliable and easier to integrate with retailer systems. This enables new capabilities slot reservation, timed pickups, and real-time temperature logs that increase retailer confidence and user adoption.

Market Restraints

High Upfront Cost and Site Constraints

Installing locker banks, particularly chilled and frozen modules, requires capital investment, electrical infrastructure, and dedicated floor or curbside space. Small retailers and stores in dense urban areas may lack suitable installation sites, and ROI can be uncertain for low-volume locations.

Customer Awareness and Behavioral Barriers

Despite growing familiarity, a portion of consumers still prefer home delivery or in-store shopping. Convincing broad customer segments to adopt locker pickup requires clear UX, signage, education, and incentive programs. In markets with limited adoption, behavioral inertia slows locker rollouts.

Grocery Lockers Market Opportunities

Modular Cold-Chain Locker Solutions for Perishables

Offering modular chilled and frozen lockers that can be appended to ambient banks is a significant opportunity. Vendors that provide energy-efficient refrigeration, remote temperature logging, and certifications for food safety can command premium pricing and enter long-term service contracts with major grocery chains. This opportunity ties directly to decreasing food waste and improving last-mile handling for fresh produce and frozen goods.

Shared & Multi-Tenant Locker Networks in Urban Nodes

Shared locker networks deployed at transport hubs, apartment complexes, and shopping centers create scale for locker providers and broaden retailer reach. Operators that partner with real-estate owners, municipalities, and multiple retail brands can amortize installation costs and improve utilization through multi-tenant demand aggregation. This model is especially attractive in dense urban markets where storefront space is limited.

Sustainability & Energy-Efficiency Innovation

There is a rising demand from retailers and regulators for low-energy refrigeration and greener operations. Locker providers who develop energy-efficient refrigerated modules, integrate renewable power sources, or provide carbon-saving analytics will align with retailer sustainability goals and may access government incentives or green financing. This creates a product differentiation and new funding pathways for large deployments.

Product Type Insights

The market segments into Ambient, Chill, and Frozen locker types. Ambient lockers lead in installed base due to lower cost and broad applicability for non-perishable goods. Chilled lockers are rapidly gaining share as grocery e-commerce order composition shifts toward fresh items and dairy; frozen lockers follow closely where frozen-goods penetration is high. Smart/IoT-enabled lockers (across all temperature classes) command higher service fees and recurring revenues because of remote monitoring, analytics, and maintenance contracts. Retailers often deploy ambient units first to validate demand, then add chilled/frozen modules in high-volume stores.

Application Insights

Supermarkets and hypermarkets are the largest applications for grocery lockers, using them for click-and-collect and curbside fulfillment. Convenience stores and click-and-collect hubs (micro-fulfillment centers) are adopting compact lockers to serve urban shoppers. E-grocery pure-plays leverage locker networks to de-risk home delivery and improve fulfillment density. Emerging applications include community lockers in residential complexes, lockers at transit hubs for commuter pickups, and returns/reverse-logistics use for packaged grocery items.

Distribution Channel Insights

Direct sales and enterprise contracts with major grocery chains remain the primary distribution route for locker hardware. Increasingly, leasing and subscription models are offered through third-party integrators and logistics partners to lower retailer CAPEX. Software and service revenues (SaaS, maintenance, analytics) are distributed via direct vendor platforms or integrators who bundle locker hardware with fulfillment and installation services. Channel partnerships with store-fit contractors and refrigeration specialists are common for chilled/frozen deployments.

User Type Insights

Primary users of grocery lockers include: omnichannel grocery shoppers who value speed and contactless pickup, busy urban professionals who collect orders on the commute, families using scheduled pickup windows, and time-sensitive shoppers needing after-hours access. B2B customers include supermarket chains, e-grocery operators, and property owners using shared lockers as amenity services. The propensity to use lockers increases with smartphone penetration and clear communication of the pickup process.

Age Group Insights

Working adults aged 25–44 represent the largest user group for grocery lockers due to high online grocery adoption and the need for convenient pickup options. The 45–64 segment uses lockers for planned weekly shopping and scheduled pickups, while younger adults (18–24) are adopting lockers as part of app-driven convenience behaviors. Older demographics (65+) use lockers less frequently but can be served through assisted pickup options and simplified UX designs.

| By Type | By Technology | By Deployment Model | By End User | By Ownership Model |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest regional market (55–60% of global revenue in 2024). The U.S. leads due to mature e-grocery adoption, the presence of national supermarket chains, and early large-scale locker pilots and rollouts. Retailers here deploy lockers as part of omnichannel fulfillment strategies and are more likely to fund refrigerated locker modules.

Europe

Europe accounts for roughly 25–30% of global revenue in 2024. The UK, Germany, and France are the key countries driving demand, with urban density and strong convenience retail networks encouraging locker deployment. Regulation around food safety and energy efficiency influences the adoption of chilled and frozen locker modules.

Asia-Pacific

Asia-Pacific represents about 20–25% of the market in 2024 and is the fastest-growing region. China, India, Japan, and Southeast Asian countries show strong growth potential as e-grocery penetration and retail modernization accelerate. India and China are notable for rapid percentage expansion from relatively smaller bases.

Latin America

Latin America holds a smaller share (5–8% in 2024), with Brazil and Mexico being the primary markets. Growth is present but constrained by infrastructure and price sensitivity; however, urban hubs show increasing pilot activity for lockers.

Middle East & Africa

This region accounts for 3–5% of the market. UAE, Saudi Arabia, and South Africa lead deployments in the region, driven by modern retail expansion and interest in smart city solutions. Expansion is expected as retail modernization and e-grocery adoption progress.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Grocery Lockers Market

- Cleveron

- Bell & Howell

- Luxer One

- Avery Berkel

- LockTec

- StrongPoint

- Parcel Pending

- American Locker

- KEBA Group

- Ricoh Group

- TZ Limited

- Hollman, Inc.

- Shenzhen Zhilai Sci & Tech

- Package Concierge (Gibraltar Industries)

- Meridian Kiosks

Recent Developments

- Major grocery chains expanded pilot programs to integrate chilled locker modules in high-footfall stores to support fresh and frozen order pickup.

- Locker vendors launched subscription/lease services enabling retailers to adopt lockers with reduced upfront CAPEX and bundled maintenance agreements.

- Partnerships between locker providers and property owners have increased, deploying shared locker banks in apartment complexes, transit hubs, and mall car parks to boost utilization.