Green Electronics Manufacturing Market Size

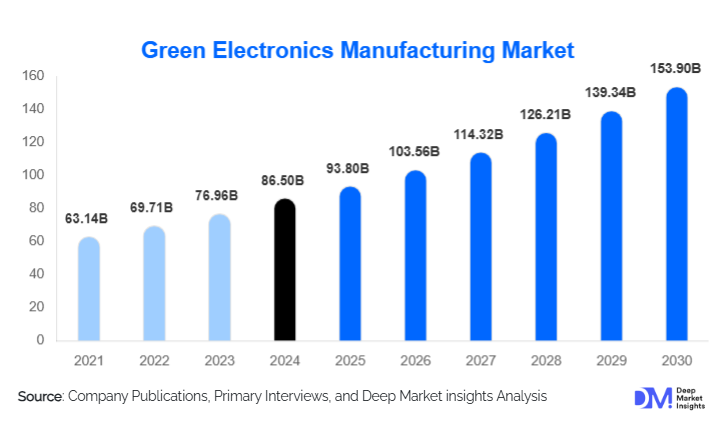

According to Deep Market Insights, the global green electronics manufacturing market size was valued at USD 86.5 billion in 2024 and is projected to grow from USD 93.8 billion in 2025 to reach USD 153.9 billion by 2030, expanding at a CAGR of 10.4% during the forecast period (2025–2030). The market growth is primarily driven by the increasing demand for energy-efficient, recyclable, and environmentally sustainable electronic products, combined with stricter global environmental regulations and growing consumer awareness of electronic waste management.

Key Market Insights

- Rising adoption of eco-friendly materials and processes across semiconductor, display, and component manufacturing is fueling industry transformation.

- Growing emphasis on circular economy practices, including product take-back and recycling programs, is influencing OEM strategies.

- Asia-Pacific dominates the global market, supported by strong electronics production bases in China, Japan, and South Korea.

- Europe remains the most regulation-driven region, with initiatives such as RoHS, WEEE, and REACH shaping sustainable manufacturing practices.

- North America is witnessing increased investment in green manufacturing technologies and e-waste recycling infrastructure.

- Emergence of biodegradable and low-carbon components is redefining material innovation in the electronics industry.

Latest Market Trends

Shift Toward Carbon-Neutral Electronics Production

Manufacturers are increasingly committing to carbon-neutral production lines through the integration of renewable energy sources, green supply chains, and energy-efficient automation systems. Companies are adopting net-zero roadmaps that include waste heat recovery, optimized energy management, and carbon offset programs. Leading players are collaborating with sustainability certification bodies to validate their eco-friendly production processes, aiming to reduce lifecycle emissions and enhance brand credibility among environmentally conscious consumers.

Advancements in Recyclable and Biodegradable Components

Technological innovation is driving the development of recyclable printed circuit boards (PCBs), bioplastics-based casings, and water-soluble substrates. These materials not only minimize toxic waste but also simplify product disassembly and recycling. Companies are investing heavily in material science research to replace hazardous substances like lead, mercury, and cadmium with non-toxic alternatives. This trend aligns with the global push for sustainable design and extended producer responsibility (EPR) policies that mandate product recyclability.

Market Drivers

Stringent Environmental Regulations

Governments worldwide are enforcing stricter environmental compliance measures, including the Restriction of Hazardous Substances (RoHS), Waste Electrical and Electronic Equipment (WEEE), and Energy Star programs. These regulations compel manufacturers to adopt cleaner production technologies and improve energy efficiency, significantly accelerating the adoption of green manufacturing practices. Compliance has become a key competitive differentiator among global OEMs.

Rising Consumer Demand for Sustainable Electronics

Increasing environmental awareness and demand for ethically produced electronics are reshaping purchasing behavior. Consumers prefer devices made from recycled or biodegradable materials and those with longer lifespans. Brands promoting eco-labels and transparent sustainability reporting are gaining market advantage. This shift is particularly evident in smartphones, laptops, and home appliances, where sustainability is now a key factor in brand perception and customer loyalty.

Market Restraints

High Initial Investment and Technological Costs

Transitioning to green manufacturing requires substantial capital investment in advanced machinery, clean energy systems, and waste management infrastructure. Small and medium-sized enterprises (SMEs) often face challenges in adopting these technologies due to limited financial resources. The cost burden of certification, testing, and compliance further adds to operational expenses, slowing adoption in developing economies.

Lack of Standardization in Green Certification

Inconsistent global standards for defining and certifying “green electronics” create confusion among manufacturers and consumers. The absence of a unified framework complicates compliance and hinders cross-border trade of eco-certified products. As a result, companies face difficulties in harmonizing sustainability goals with international trade and supply chain requirements.

Market Opportunities

Integration of Renewable Energy in Manufacturing

Expanding the use of solar, wind, and bioenergy sources in production facilities presents a significant opportunity for the green electronics market. Manufacturers investing in renewable-powered plants can reduce carbon footprints and operational costs while appealing to ESG-conscious investors. Governments offering incentives for clean energy adoption are further accelerating this shift.

Circular Economy and Product Lifecycle Management

The growing emphasis on product life extension, refurbishment, and recycling programs creates new opportunities for value recovery. Companies are investing in closed-loop supply chains that allow for component recovery and reuse. This approach not only mitigates e-waste but also reduces dependency on rare raw materials such as cobalt and lithium. Partnerships between OEMs and recycling firms are expected to become a key growth catalyst.

Product Type Insights

Green consumer electronics, including smartphones, laptops, and wearables dominate the market due to strong consumer demand for energy-efficient and recyclable devices. Green industrial electronics such as sensors, controllers, and power devices are also gaining traction, driven by Industry 4.0 and smart factory initiatives. Meanwhile, green semiconductors and components represent the fastest-growing category as manufacturers invest in low-power chips and recyclable PCBs to enhance energy performance and sustainability.

Application Insights

Consumer electronics hold the largest share, supported by sustainability initiatives from major OEMs such as Apple, Samsung, and Dell. Automotive electronics are rapidly expanding due to the rise of electric vehicles (EVs) and the demand for sustainable components in battery and infotainment systems. Industrial automation and energy systems are also witnessing growth as manufacturers transition to low-emission, energy-efficient electronic solutions.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global green electronics manufacturing market, accounting for over 45% of revenue share in 2024. China, Japan, and South Korea lead production through strong policy frameworks and advanced R&D capabilities. The region’s large-scale electronics exports and growing investments in renewable-powered factories further reinforce its leadership position.

Europe

Europe represents the most regulation-driven market, with initiatives such as the European Green Deal and Extended Producer Responsibility (EPR) programs driving sustainable production. Germany and the Nordic countries are pioneers in implementing closed-loop manufacturing and eco-design principles. The region is also home to several major recyclers and green certification bodies.

North America

North America is experiencing rapid adoption of green electronics manufacturing, led by strong corporate sustainability commitments and government incentives for clean energy adoption. The U.S. and Canada are investing heavily in battery recycling, carbon-neutral chip fabrication, and renewable-powered data centers, contributing to steady market expansion.

Latin America

Latin America is emerging as a growing market, with Brazil and Mexico leading investments in electronics recycling and eco-friendly consumer goods. Government policies encouraging sustainable production and e-waste management are gradually improving regional competitiveness.

Middle East & Africa

The Middle East and Africa are gradually adopting green electronics manufacturing through renewable energy integration and circular economy initiatives. The UAE and Saudi Arabia are leading sustainability efforts through smart city and clean energy projects, while South Africa is focusing on e-waste recycling infrastructure development.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Green Electronics Manufacturing Market

- Apple Inc.

- Samsung Electronics

- HP Inc.

- Sony Corporation

- Panasonic Corporation

- LG Electronics

- Dell Technologies

- Intel Corporation

- Lenovo Group

- Hitachi Ltd.

Recent Developments

- In August 2025, Samsung announced a new initiative to use 100% recycled aluminum and bioplastics in its premium smartphone lineup by 2027.

- In July 2025, Apple unveiled its first carbon-neutral MacBook, manufactured using renewable energy and fully recyclable materials.

- In May 2025, Sony partnered with Honda to develop sustainable automotive electronics using low-emission semiconductors and bio-based materials.

- In February 2025, Dell Technologies expanded its global recycling program, achieving a milestone of 2 billion pounds of electronics collected and repurposed.