Grass Trimmer Market Size

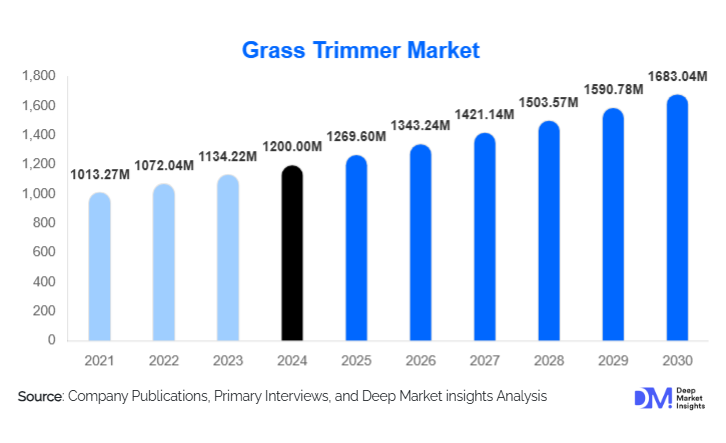

According to Deep Market Insights, the global grass trimmer market size was valued at USD 1,200 million in 2024 and is projected to rise to USD 1,269.60 million in 2025, eventually reaching USD 1,683.04 million by 2030. The market is expected to expand at a steady CAGR of 5.8% during the forecast period (2025–2030). Growth is primarily driven by rising adoption of battery-powered trimming tools, increasing investment in residential landscaping, and expanding green-space infrastructure across emerging and developed markets.

Key Market Insights

- Cordless electric grass trimmers dominate global demand, capturing over half of the total market due to improved battery life, zero emissions, and enhanced portability.

- Residential landscaping remains the largest application segment, accounting for more than 60% of global consumption amid rising homeowner interest in garden maintenance.

- Asia-Pacific leads overall demand, contributing approximately 40% of the global market, supported by urbanization and booming home-improvement activity.

- North America and Europe show the highest adoption of eco-friendly equipment, driven by strict emissions and noise regulations.

- Robotic and smart trimmers are emerging rapidly, fueled by the integration of IoT, AI, and autonomous navigation systems.

- Online distribution channels continue to gain share as consumers increasingly purchase outdoor tools through e-commerce platforms.

What are the latest trends in the grass trimmer market?

Shift Toward Battery-Powered and Eco-Friendly Trimmers

The most transformative trend reshaping the grass trimmer industry is the widespread shift from gasoline-powered equipment to battery-powered solutions. Driven by environmental regulations, noise restrictions, and cost efficiencies, lithium-ion trimmers now represent the preferred choice for homeowners and professional landscapers alike. Manufacturers are investing heavily in high-capacity batteries, quick-charge technology, and brushless motors to maximize performance while reducing noise and emissions. As sustainability becomes a global priority, cordless trimmers are increasingly positioned as the long-term replacement for petrol models, particularly in North America and Europe, where low-carbon gardening is strongly promoted.

Rise of Smart, Robotic & Autonomous Trimmers

Following the success of robotic lawn mowers, robotic grass trimmers, and AI-enhanced cutting tools are emerging as a high-value niche. These devices integrate sensors, GPS mapping, object detection, and app-based control to automate edging and trimming tasks. Early adopters include tech-savvy homeowners, premium landscaping service providers, and institutional facility managers seeking labor efficiency. Manufacturers are piloting trimmers with predictive maintenance alerts, smart routing, and energy optimization. As the cost of sensors and connectivity decreases, robotic trimmers are expected to transition from niche to mainstream over the next decade.

What are the key drivers in the grass trimmer market?

Growing Global Landscaping and Home-Gardening Activity

Across developed and emerging markets, rising focus on beautifying residential outdoor spaces is a major demand catalyst. Suburban expansion, increasing homeownership, and the popularity of DIY gardening have substantially boosted sales of consumer-grade grass trimmers. This trend accelerated post-pandemic and continues as homeowners invest in outdoor living spaces, entertainment gardens, and low-maintenance lawns. Consumers increasingly prefer lightweight, easy-to-use trimmers that deliver fast and clean results.

Advancements in Battery and Motor Technologies

Technological improvements in brushless motors, lithium-ion batteries, multi-tool power platforms, and ergonomic designs are reshaping product performance. Longer runtimes, rapid charging, reduced maintenance needs, and improved energy efficiency are prompting both residential and commercial users to adopt cordless models. Manufacturers offering universal battery systems, compatible across multiple garden tools, are gaining a competitive advantage.

Environmental Regulations & Noise Restrictions

Stringent emissions rules and noise control policies in the U.S., EU, and parts of APAC are rapidly displacing petrol-powered trimmers. Municipalities, universities, airports, and commercial landscapers increasingly prefer electric trimmers to comply with sustainability targets. This regulatory push is a key factor accelerating the transition to cleaner and quieter trimming solutions.

What are the restraints for the global market?

High Upfront Cost of Battery-Powered Trimmers

Although operating costs are lower, cordless trimmers typically carry a higher purchase price compared to corded or petrol alternatives. Cost-sensitive buyers in developing regions may prefer traditional models despite long-term disadvantages. Battery packs represent a significant percentage of product cost, and commercial landscaping companies face steep initial investment when replacing legacy petrol fleets.

Battery Life Limitations and Replacement Concerns

Battery degradation, replacement expenses, and runtime limitations remain consumer pain points, especially for professional users requiring long operation cycles. High-performance batteries require frequent charging or spare battery packs, adding recurring costs. These limitations may slow conversion from petrol models in heavy-duty applications.

What are the key opportunities in the grass trimmer industry?

Expansion of Green Public Infrastructure

Global investments in public parks, recreational areas, urban green belts, and smart-city landscaping offer strong growth potential. Governments in Asia-Pacific, Europe, and the Middle East are allocating larger budgets for sustainable lawn and garden maintenance equipment. Suppliers offering durable, low-noise, and low-emission trimmers are positioned to secure long-term municipal contracts.

High-Growth Demand in Emerging Economies

Rapid urbanization in India, China, Indonesia, and Latin America is creating new demand for residential lawn equipment. Rising disposable incomes and expanding suburban housing communities offer major opportunities for manufacturers introducing cost-effective electric trimmers. Local assembly and distribution partnerships can further accelerate market penetration.

Smart, Connected & Autonomous Trimmers

The integration of AI, robotics, and IoT is opening a premium product category with high margins. Smart trimmers capable of remote monitoring, route optimization, and sensor-assisted trimming provide value for commercial landscapers and tech-oriented homeowners. Companies that invest in automation, software updates, and cloud-enabled maintenance solutions can unlock recurring revenue streams.

Product Type Insights

Cordless electric trimmers dominate the global market, accounting for nearly 55% of total market share in 2024. Their lightweight design, ease of handling, zero emissions, and compatibility with multi-tool battery platforms make them the preferred choice for both homeowners and professionals. Petrol trimmers maintain relevance in high-torque, heavy-duty applications but face declining demand due to emissions restrictions. Corded electric trimmers retain a niche among cost-sensitive users, while robotic trimmers represent the fastest-growing premium segment due to advancements in sensors and AI navigation.

Application Insights

Residential usage leads global demand with over 60% share, driven by rising interest in home gardening, backyard improvements, and DIY landscaping. Commercial landscaping is experiencing strong growth as professional service providers transition to battery-powered fleets that reduce noise and operational costs. Institutional applications, such as campuses, parks, and municipal green spaces, are expanding due to government sustainability mandates. Emerging applications include automated facility maintenance and integrated robotic lawn-care ecosystems.

Distribution Channel Insights

Online retail channels are rapidly expanding as consumers increasingly purchase outdoor tools via e-commerce platforms, benefiting from product comparisons, reviews, and home delivery. Offline retail remains important, particularly in developing countries where consumers prefer hands-on product evaluation. B2B sales channels cater to landscapers, municipalities, and facility managers requiring bulk procurement and service contracts. Manufacturers are also strengthening direct-to-consumer (D2C) channels through official websites and subscription-based battery replacement programs.

End-User Type Insights

Professional landscapers represent a high-value segment with strong demand for rugged, high-performance cordless trimmers capable of long runtimes and frequent use. Homeowners form the largest end-user base, prioritizing convenience, ergonomic design, and affordability. Institutions and municipalities increasingly adopt electric fleets to meet noise and environmental regulations. Sports complexes, hotels, and commercial facilities are emerging as new institutional buyers investing in sustainable maintenance tools.

| By Product Type | By Shaft Type | By End-User | By Power Source | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains a major market driven by high lawn ownership, strong DIY culture, and early adoption of battery-powered tools. The U.S. leads demand, supported by stringent emission regulations, suburban expansion, and a mature landscaping service industry. Canada shows robust growth in battery solutions due to environmental policies and the modernization of municipal green-space management.

Europe

Europe is a key region shaped by strong environmental regulations and high consumer preference for low-noise, eco-friendly garden tools. Germany, the U.K., and France are leading markets, with strong adoption of cordless and robotic trimming solutions. Municipal sustainability goals further encourage the procurement of electric tools for public parks and urban landscaping.

Asia-Pacific

Asia-Pacific is the largest and fastest-growing region, holding around 40% of the global market share. China and India are driving rapid adoption due to rising disposable incomes, expansion of residential housing, and growing interest in home gardening. Japan and Australia show strong demand for premium cordless and robotic models. Urban infrastructure development across Southeast Asia also supports commercial adoption.

Latin America

Latin America is experiencing steady demand growth led by Brazil, Mexico, and Argentina. Rising urbanization, expanding home-improvement retail networks, and growing interest in outdoor lifestyle trends support adoption. Affordability remains crucial, making corded and entry-level cordless trimmers popular choices.

Middle East & Africa

MEA markets are small but growing, particularly in Gulf nations, investing heavily in green landscaping for tourism, smart cities, and real estate developments. Africa’s adoption is centered on South Africa, where residential and commercial landscaping industries are expanding. Petrol trimmers still hold share, but the shift to electric is accelerating in affluent urban zones.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Grass Trimmer Market

- Husqvarna AB

- STIHL Group

- Makita Corporation

- The Toro Company

- Stanley Black & Decker

- Robert Bosch GmbH

- MTD Products

- Honda Motor Co.

- Yamabiko (Echo)

- Emak S.p.A.

- Kubota

- Briggs & Stratton

- Zomax

- Blount International

- Gardena (Husqvarna Group)

Recent Developments

- In 2025, several major manufacturers expanded their cordless platforms, introducing high-capacity lithium-ion batteries compatible across multiple garden tools.

- In early 2025, leading brands launched AI-enabled robotic grass trimmers with improved navigation sensors, targeting premium residential users.

- In 2024–2025, multiple companies invested in new APAC manufacturing facilities to meet growing regional demand and reduce supply chain disruptions.