Granite Kitchen Sink Market Size

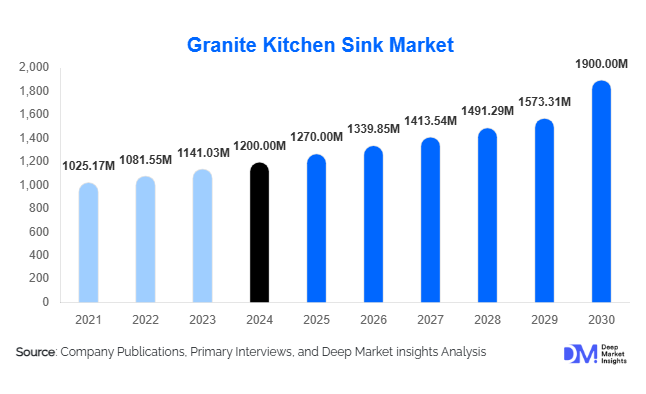

According to Deep Market Insights, the global granite kitchen sink market size was valued at USD 1,200 million in 2024 and is projected to grow from USD 1,270 million in 2025 to reach USD 1,900 million by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). The granite kitchen sink market growth is primarily driven by increasing consumer preference for durable and aesthetically pleasing kitchen fixtures, rising residential renovations, and technological advancements in manufacturing that enhance affordability and product quality.

Key Market Insights

- Durability and aesthetic appeal are major growth drivers, with granite sinks offering resistance to scratches, stains, and heat, making them a preferred choice for modern kitchens.

- Residential end-use dominates the market, driven by renovation trends and rising disposable income among homeowners in developed and emerging economies.

- Asia-Pacific is emerging as the fastest-growing regional market, particularly in India and China, due to rapid urbanization, housing development, and increasing awareness of premium kitchen fixtures.

- Offline retail channels remain dominant, although online sales and D2C channels are gaining traction as consumers increasingly research and compare products digitally before purchase.

- Sustainability trends are influencing buyer preferences, with granite sinks viewed as eco-friendly alternatives to metal or composite sinks, tapping into environmentally conscious consumer segments.

- Technological advancements in manufacturing, including improved molding techniques and surface treatments, are enhancing product durability and visual appeal while lowering production costs.

Latest Market Trends

Rising Demand from Home Renovations

The granite kitchen sink market is witnessing strong growth due to the booming home renovation industry, particularly in North America and Europe. Homeowners are increasingly replacing traditional stainless steel or composite sinks with granite alternatives for their superior durability, heat resistance, and stain-proof surfaces. Renovation trends favor integrated kitchen designs, where granite sinks complement countertops and cabinetry. Additionally, real estate developments and new housing projects in the Asia-Pacific and the Middle East are generating consistent demand for high-quality kitchen fixtures, further fueling market growth.

Technological Enhancements in Granite Sink Manufacturing

Advanced manufacturing techniques, such as precision molding, improved resin bonding, and surface polishing technologies, are making granite sinks more lightweight, aesthetically versatile, and cost-effective. These innovations enable manufacturers to produce sinks with a variety of colors, finishes, and shapes to cater to evolving consumer preferences. Technology also supports sustainability by reducing waste and improving raw material utilization. The adoption of automated manufacturing lines is enhancing production efficiency, helping manufacturers meet increasing global demand while maintaining quality standards.

Granite Kitchen Sink Market Drivers

Durability and Low Maintenance

Granite sinks are highly durable, resistant to scratches, chips, and heat, and require minimal maintenance compared to traditional stainless steel or ceramic sinks. This combination of longevity and ease of care appeals to homeowners seeking long-term kitchen investments, driving steady market growth. The perception of premium quality reinforces their adoption, particularly in high-end residential projects and luxury kitchen renovations.

Increasing Residential Renovations and New Constructions

The expansion of urban housing, luxury apartments, and renovation projects globally is increasing the demand for granite kitchen sinks. Middle- and high-income households are investing in modern kitchens with upgraded fixtures, while developers in emerging economies are incorporating granite sinks as part of premium apartment offerings. Government housing initiatives in countries like India and China are indirectly supporting market expansion by promoting residential construction growth.

Sustainability and Eco-Friendly Consumer Preferences

Consumers are increasingly choosing eco-friendly materials in their kitchens. Granite, being a natural material combined with resins, is positioned as a sustainable choice compared to entirely synthetic or metal alternatives. Brands emphasizing eco-friendly manufacturing processes and durable, long-lasting products are capturing environmentally conscious segments, further boosting market adoption.

Market Restraints

High Initial Cost

The premium pricing of granite kitchen sinks, relative to stainless steel or composite alternatives, may limit adoption among price-sensitive consumers. The higher upfront cost can deter households with constrained budgets, especially in emerging markets, restricting market penetration.

Installation Challenges and Weight Considerations

Granite sinks are heavier than most conventional sinks, requiring reinforced countertops and cabinetry during installation. This increases installation costs and complexity, which can discourage some potential buyers and limit adoption in older housing projects or budget-conscious renovations.

Granite Kitchen Sink Market Opportunities

Expansion in Emerging Markets

Rapid urbanization, growing middle-class incomes, and rising residential construction in Asia-Pacific, Latin America, and the Middle East present significant growth opportunities. Manufacturers can leverage these markets by offering affordable, high-quality granite sinks and localized distribution strategies to capture the increasing demand for premium kitchen fixtures.

Technological Innovation and Product Differentiation

Investments in manufacturing innovations, such as lightweight composite blends and customizable finishes, allow companies to differentiate products and attract new customer segments. Offering sinks with integrated accessories, modular designs, and unique aesthetics enhances market competitiveness and supports higher margins.

Sustainable and Eco-Friendly Product Lines

With growing global awareness of environmental sustainability, introducing eco-friendly granite sinks can attract environmentally conscious consumers. Companies can leverage certifications, recycled materials, and green manufacturing processes to strengthen brand positioning and capitalize on the increasing demand for sustainable kitchen solutions.

Product Type Insights

Granite composite sinks dominate the market, accounting for approximately 32% of the global granite kitchen sink market in 2024. Their popularity stems from the combination of aesthetic appeal, enhanced durability, and affordability. These sinks offer resistance to scratches, stains, and heat, making them highly suitable for modern residential kitchens. Composite granite sinks are particularly favored because they complement a variety of countertop materials while providing long-term usability with minimal maintenance. Additionally, the broader consumer adoption is driven by their balance of premium looks and practical performance, attracting both first-time homeowners and renovation-focused customers.

Single-bowl sinks are emerging as a leading product type due to their space-saving design, making them ideal for smaller kitchens. Their simplicity and ease of use appeal to urban households and apartments, where kitchen space optimization is a priority. Meanwhile, double-bowl sinks are increasingly preferred in larger kitchens due to their versatility for multitasking, such as separating washing and rinsing areas, which supports higher kitchen efficiency in family homes and commercial applications.

Application Insights

Residential kitchens continue to dominate the application segment, driven by home renovation trends, increasing disposable income, and rising consumer preference for premium kitchen fixtures. Homeowners are investing in high-quality sinks as part of integrated kitchen designs that prioritize both aesthetics and functionality. Commercial applications, including hotels, restaurants, and luxury resorts, also contribute to market growth, though on a smaller scale, as these establishments increasingly adopt granite sinks for their durability and low maintenance. Additionally, export-driven demand from countries importing high-quality kitchen fixtures is stimulating adoption in both residential and commercial sectors globally, further enhancing the market outlook.

Distribution Channel Insights

Offline retail remains the dominant distribution channel due to the consumer preference for in-person product evaluation, especially for premium granite sinks, where aesthetics and texture are important. Home improvement stores and specialty kitchen showrooms are key touchpoints. However, online retail channels, including e-commerce and direct-to-consumer (D2C) platforms, are gaining traction by providing convenience, transparent pricing, and access to a wider variety of product styles and finishes. Hybrid distribution models combining offline and online strategies are emerging as manufacturers and retailers aim to capture both traditional and digitally savvy consumers.

End-Use Insights

The residential sector drives the largest share of demand, with increased home renovations and premium new constructions boosting granite sink adoption. High-income households and luxury housing projects are particularly influential in North America and Europe. Commercial kitchens, including restaurants and hotels, are steadily increasing their usage of granite sinks, primarily for their durability, low maintenance, and premium aesthetics. Export-driven demand is also a notable contributor, particularly in developed regions that import high-quality kitchen fixtures, ensuring sustained growth across multiple geographies.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounted for over 25% of global demand in 2024. The market is primarily driven by a strong focus on home aesthetics, premium kitchen renovations, and functionality, with granite sinks being a preferred choice for modern kitchens. Rising disposable incomes, increasing homeownership, and a growing renovation trend are key growth enablers. The U.S. leads the regional market, with Canada following closely due to urban housing expansion and a preference for durable, low-maintenance fixtures. Additionally, the trend of smart kitchen integrations, where granite sinks are combined with modular cabinetry and countertop designs, is further supporting market adoption.

Europe

Germany and the U.K. together contributed approximately 22% of the global market in 2024. Market growth is driven by increasing demand for sustainable and durable kitchen solutions, with granite sinks aligning perfectly with these preferences. Renovation activities and high disposable income levels in mid- to high-income households support continued expansion. Consumers are increasingly focused on eco-friendly products, driving manufacturers to innovate with sustainable composite materials. Additionally, the trend of premium residential and luxury apartment developments, coupled with strong urbanization in major cities, is boosting the adoption of granite kitchen sinks across the region.

Asia-Pacific

China and India are leading the rapid market expansion in the Asia-Pacific. Drivers include rising urbanization, increased residential construction, and higher disposable incomes among the growing middle class, fueling demand for high-quality kitchen fixtures. Japan and Australia contribute to steady market demand, particularly for premium residential and commercial applications. Rapid modernization of urban kitchens and the preference for durable, aesthetically appealing materials further support the regional market. Additionally, government initiatives promoting urban housing development and modern infrastructure indirectly enhance granite sink adoption in emerging Asia-Pacific economies.

Latin America

Brazil, Mexico, and Argentina are gradually increasing adoption, driven by premium residential developments and new urban housing projects. Rising disposable income in middle- and upper-class households, coupled with growing awareness of durable kitchen solutions, is driving market growth. Urban renovation trends and investment in modern kitchen layouts further support the regional demand for granite sinks.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, and Africa, particularly South Africa, are key markets. Drivers include high-income households, luxury housing developments, and the demand for aesthetically appealing kitchen designs. Africa is also benefiting from urbanization projects and export-driven demand for high-quality kitchen fixtures. Additionally, government initiatives supporting housing infrastructure and private investments in luxury real estate developments are key growth enablers, contributing to the rising adoption of granite sinks in premium residential and commercial applications.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Granite Kitchen Sink Market

- Blanco GmbH

- Franke Group

- Kohler Co.

- Villeroy & Boch

- ELKAY Manufacturing

- Schock GmbH

- Ruvati

- Swanstone

- Wellborn Cabinet

- Reginox

- Teka Group

- Sapphire Steel

- Royal Kitchen Sinks

- Bridgeford

- Granite Transformations

Recent Developments

- In March 2025, Blanco GmbH launched a new line of lightweight granite composite sinks designed for easy installation in urban apartments.

- In February 2025, Franke Group introduced a sustainable manufacturing process using recycled granite materials for its premium sink portfolio.

- In January 2025, Kohler Co. expanded its distribution network in Asia-Pacific, targeting emerging residential markets in India and China.