Granite & Marble Countertops Market Size

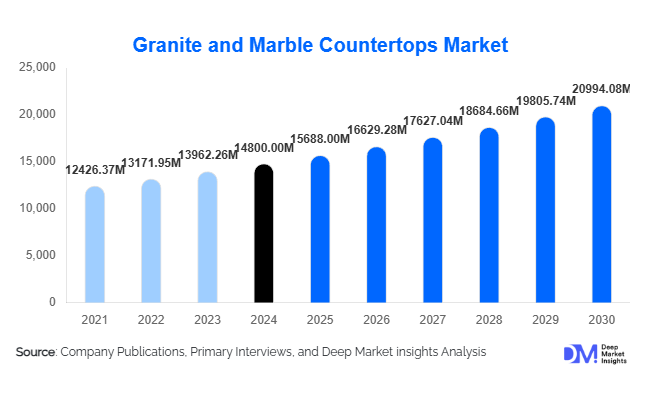

According to Deep Market Insights, the global granite and marble countertops market size was valued at USD 14800.00 million in 2024 and is projected to grow from USD 15688.00 million in 2025 to reach USD 20994.08 million by 2030, expanding at a CAGR of 6.0% during the forecast period (2025–2030). Market growth is primarily driven by rising home renovation trends, premium residential construction, and increasing demand for durable, aesthetic, and value-enhancing kitchen and bathroom surfaces worldwide.

Key Market Insights

- Granite countertops dominate the market, accounting for approximately 55% of global revenue in 2024, due to their durability, natural beauty, and cost versatility.

- Residential applications lead the market with around 60% share in 2024, propelled by growing kitchen and bathroom renovation projects in North America and Europe.

- North America remains the largest regional market, contributing nearly 35–40% of global demand in 2024, led by strong home improvement spending and high adoption of premium materials.

- Asia-Pacific is the fastest-growing region, expected to expand at a 7–8% CAGR due to rapid urbanization, rising disposable incomes, and expanding housing construction in China and India.

- Sustainable and recycled stone solutions are emerging as a key trend, aligning with global green building initiatives and low-carbon construction materials.

- Technological advances such as CNC cutting, digital templating, and robotic polishing are transforming fabrication efficiency and design precision.

What are the latest trends in the granite & marble countertops market?

Growing Demand for Sustainable and Recycled Stone

The industry is witnessing a significant shift toward eco-friendly production and recycled stone utilization. Manufacturers are adopting sustainable quarrying practices, water recycling systems, and carbon-neutral fabrication processes to meet green building certification requirements. Recycled granite and marble offcuts are being repurposed into countertops, tiles, and decorative products, minimizing waste and attracting eco-conscious consumers. Sustainability certifications are increasingly becoming a differentiator for suppliers and fabricators catering to LEED- and BREEAM-compliant construction projects.

Smart and Customizable Countertops

Customization and technology integration are reshaping the market. Consumers prefer countertops with integrated sinks, under-counter lighting, wireless charging, and antimicrobial coatings. Smart kitchen trends have boosted interest in multifunctional surfaces with embedded sensors and easy-clean finishes. Advanced fabrication technologies such as robotic finishing and digital 3D templating have enabled mass customization, reducing lead times and improving precision for made-to-order installations.

What are the key drivers in the granite & marble countertops market?

Home Renovation and Remodeling Boom

Global home improvement expenditure continues to grow, especially in the U.S., Canada, Western Europe, and parts of Asia. The aesthetic appeal and durability of granite and marble countertops make them preferred choices in modern kitchen and bathroom designs. Homeowners perceive these surfaces as long-term investments that enhance property value and interior appeal, driving consistent replacement and remodeling cycles.

Premiumization and Rising Disposable Income

As consumer incomes rise globally, particularly in emerging economies, demand for high-end natural stone finishes is accelerating. Consumers are willing to invest in luxury materials that convey status and exclusivity. Premium kitchen and bath projects increasingly specify marble and granite, reflecting global design trends and lifestyle upgrades associated with premium housing.

Growth in Commercial and Hospitality Projects

Commercial real estate development, retail spaces, hotels, and high-end restaurants increasingly feature granite and marble for reception desks, bar counters, and communal areas. The Middle East, Africa, and Asia-Pacific regions are witnessing strong demand from hospitality and tourism infrastructure, boosting countertop installations across hotels, resorts, and mixed-use projects.

What are the restraints for the global market?

Competition from Engineered Stone Alternatives

Engineered quartz, sintered stone, and composite surfaces are posing competitive challenges. These materials offer greater consistency in color, low porosity, and minimal maintenance requirements. The increasing adoption of quartz countertops in North America and Europe has slightly slowed natural stone’s growth rate, especially in mid-range price segments.

Raw Material and Supply Chain Challenges

Natural stone quarrying and transportation involve high logistics and environmental costs. Variations in quarry output, rising fuel costs, and regulatory limitations in extraction regions impact supply stability. Additionally, marble’s higher porosity and maintenance needs deter some commercial buyers, requiring improved surface treatment solutions and sealing technologies.

What are the key opportunities in the granite & marble countertops industry?

Expansion in Emerging Economies

Rapid urbanization in India, China, Indonesia, and Brazil presents lucrative growth opportunities. Government-backed housing projects, increasing disposable incomes, and expanding middle-class aspirations for luxury interiors are fueling demand. Establishing local fabrication and distribution hubs can help global players capture this high-growth segment effectively.

Advanced Fabrication and Smart Integration

Technological advancements such as automated cutting, robotic polishing, and waterjet finishing are enhancing efficiency and enabling intricate custom designs. Smart countertops with integrated lighting, heating, or wireless connectivity are becoming the next wave of product innovation, especially in premium residential and commercial markets.

Sustainable Quarrying and Green Certification

Adoption of sustainable quarrying, low-emission fabrication, and recycled material use provides differentiation in an increasingly eco-conscious market. Manufacturers investing in traceable sourcing and carbon-neutral production are expected to gain long-term competitive advantages.

Material Type Insights

Granite countertops continue to dominate the global market, accounting for around 55% share in 2024. Granite’s extensive availability, high strength, and resistance to heat and scratches make it the material of choice across both residential and commercial installations. Its wide color variety and compatibility with modern interior aesthetics further reinforce its dominance, particularly in mid- to high-end kitchen remodeling projects. The popularity of granite is also supported by ongoing innovations in surface finishing and sealant technologies that enhance durability and reduce maintenance costs.

Marble countertops maintain a strong foothold in the luxury segment, driven by their timeless appeal and distinctive veining that conveys exclusivity. They are widely preferred in premium residential interiors, boutique hotels, and upscale commercial projects. The hospitality sector’s growing emphasis on natural, aesthetic design themes has notably accelerated marble demand, particularly in regions such as Europe and the Middle East. Meanwhile, cultured and engineered marble are gaining traction as cost-effective alternatives, offering consistent appearance, lower porosity, and improved resistance to stains and cracking. This shift is attracting budget-conscious consumers and commercial developers seeking a balance between aesthetics and performance.

Product Type Insights

Standard prefabricated countertops held the largest share at approximately 60% in 2024, owing to their affordability, mass availability, and ease of installation. These countertops are widely used in multi-unit housing developments, apartment refurbishments, and mid-scale commercial projects, where cost efficiency and fast project turnaround are key priorities. The rising popularity of ready-to-install kitchen and bath solutions through retail and online channels also contributes to the growth of prefabricated slabs.

Custom-made countertops, while a smaller segment, are expanding steadily among luxury homeowners, architects, and interior designers. Increasing consumer preference for bespoke kitchen and bath designs, characterized by unique edge profiles, integrated sinks, and personalized finishes, is driving demand. Advanced fabrication techniques such as digital templating, CNC machining, and robotic polishing have enabled manufacturers to deliver precision-fit countertops with faster turnaround times. Modular prefabricated countertops are also emerging in large-scale housing and infrastructure projects, offering scalability, uniformity, and simplified logistics.

End-Use Insights

The residential sector remains the largest end-use segment, accounting for roughly 60% of global demand in 2024. Strong growth in home renovation, kitchen remodeling, and bathroom refurbishment activities across developed economies continues to underpin this dominance. Rising urban middle-class populations in developing countries are also fueling demand for natural stone countertops as aspirational home upgrades. Furthermore, the trend toward open-plan kitchens and integrated dining spaces is increasing the functional and aesthetic importance of countertops, boosting adoption rates globally.

The commercial and hospitality sectors are expected to register the fastest growth through 2030, driven by robust investments in global tourism infrastructure, luxury hotels, and retail developments. Granite and marble countertops are increasingly being used in restaurants, resorts, and corporate spaces due to their durability, visual appeal, and ease of maintenance. Additionally, the rapid expansion of high-end shopping centers and mixed-use developments in the Asia-Pacific and the Middle East is contributing to rising installations in commercial interiors. Export-driven supply from major producing countries such as India, Brazil, and Italy further supports growth by catering to global project requirements.

| By Material Type | By Product Type | By End-Use |

|---|---|---|

|

|

|

Regional Insights

North America

North America remains the largest market, accounting for approximately 35–40% of global revenue in 2024. The United States continues to lead due to high household spending on kitchen and bathroom remodeling, supported by a well-established home improvement culture and mature real estate sector. Strong retail distribution networks, including home improvement giants and specialized countertop fabricators, facilitate broad consumer access to premium stone surfaces. Canada’s growing luxury housing construction and preference for sustainable building materials further support regional expansion. Regional growth drivers include rising home renovation expenditure, a surge in luxury homebuilding, and growing consumer awareness regarding long-lasting and aesthetic interior solutions. Technological innovation in digital fabrication and eco-friendly sealants is also enhancing adoption, while the “do-it-yourself” (DIY) remodeling trend continues to boost demand for prefabricated granite and marble countertops.

Europe

Europe accounts for an estimated 25–30% of the global market, anchored by strong demand in Germany, the UK, Italy, and Spain. The region’s rich architectural heritage, preference for premium natural materials, and emphasis on craftsmanship drive steady consumption of both granite and marble. European consumers are highly responsive to design trends emphasizing minimalism and sustainability, which has encouraged the adoption of natural and recycled stone products. Regional growth drivers include the integration of green building certifications such as LEED and BREEAM, increasing demand for eco-friendly construction materials, and rising renovation projects in heritage buildings. Italy and Spain remain pivotal as both producers and exporters of high-quality marble and granite, while Northern European markets are seeing an uptick in imports for high-end residential renovations.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, projected to record a CAGR of 7–8% through 2030. China, India, Japan, and Southeast Asian countries dominate regional consumption, driven by rapid urbanization, expanding middle-class populations, and government-led infrastructure development. India is emerging as a global hub for both production and consumption, with extensive granite quarries and rising domestic installations contributing to robust double-digit growth. China’s large-scale housing developments and urban renewal programs also stimulate significant countertop demand. Regional growth drivers include large-scale residential construction, government housing initiatives, and a surge in demand for premium interiors among the growing urban middle class. The region’s expanding export capabilities and adoption of advanced processing technologies are further supporting competitiveness and global supply chain integration.

Middle East & Africa

The Middle East & Africa region accounts for roughly 5–10% of global market revenue and is witnessing accelerated growth. The region’s robust hospitality and tourism industries, particularly in the UAE, Saudi Arabia, and Qatar, are driving large-scale investments in luxury hotels, resorts, and commercial complexes, all of which favor natural stone applications. African nations, including South Africa, Nigeria, and Kenya, are also experiencing growing demand in institutional and commercial construction projects that incorporate marble and granite finishes. Regional growth drivers include strong government investment in tourism infrastructure, expansion of urban real estate development, and growing adoption of luxury interior materials in commercial projects. Additionally, the increasing presence of regional distributors and quarrying operations is enhancing local supply capacity and reducing dependency on imports.

Latin America

Latin America represents about 10% of the global market, led by Brazil, Argentina, and Mexico. Brazil, one of the world’s largest granite producers and exporters, benefits from a thriving domestic construction sector and growing international demand. The country’s abundant raw material resources and advanced processing capabilities strengthen its position in the global supply chain. Argentina and Mexico are seeing steady increases in countertop adoption driven by residential remodeling and mid-tier housing projects. Regional growth drivers include rising disposable incomes, expanding middle-class housing demand, and increasing export opportunities for natural stone products. The region’s strengthening ties with North American and European markets, coupled with ongoing investments in fabrication and finishing facilities, are expected to bolster market growth through 2030.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Granite & Marble Countertops Market

- Cosentino S.A.

- Levantina y Asociados de Minerales S.A.

- Polycor Inc.

- Dal-Tile Corporation

- ColdSpring Granite Company

- Madhav Marbles & Granite Ltd.

- Marcolini Marmi S.p.A.

- RK Marbles Pvt. Ltd.

- Modern Stone International LLC

- Best Marble & Granite Co.

- George Group Co. Ltd.

- Marble & Granite Inc.

- USA Marble & Granite Inc.

- Nabel China Co. Ltd.

- Decolores Mármores e Granitos Ltda.

Recent Developments

- In September 2025, Polycor Inc. announced the expansion of its sustainable quarry network in North America, emphasizing low-carbon extraction and recycled water use in processing.

- In June 2025, Cosentino launched a new digital showroom platform integrating AR visualization for countertop customization and smart installation scheduling.

- In March 2025, Levantina S.A. introduced an eco-certified marble collection with enhanced durability and stain resistance for commercial applications.

- In January 2025, Madhav Marbles & Granite Ltd. announced increased export capacity to the U.S. and Middle East markets through a new fabrication facility in Rajasthan, India.