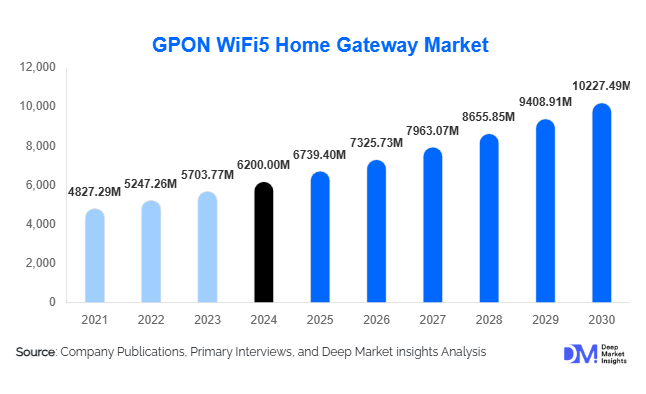

GPON WiFi5 Home Gateway Market Size

According to Deep Market Insights, the global GPON WiFi5 Home Gateway market size was valued at USD 6,200 million in 2024 and is projected to grow from USD 6,739 million in 2025 to reach USD 10,227 million by 2030, expanding at a CAGR of 8.7% during the forecast period (2025–2030). Growth in this market is primarily driven by rapid fiber-to-the-home (FTTH) deployments, demand for reliable multi-device WiFi connectivity, and the integration of smart home and IoT ecosystems across both developed and emerging markets.

Key Market Insights

- Residential FTTH deployments dominate the market, accounting for more than 65% of total GPON WiFi5 Home Gateway sales in 2024.

- Dual-band WiFi5 gateways lead technology adoption, capturing nearly 45% of market share, owing to balanced performance and affordability.

- The Asia-Pacific region remains the largest market, accounting for 38% of global demand, driven by large-scale fiber rollouts in China and India.

- North America and Europe are early adopters of hybrid GPON + LTE/5G gateways, addressing redundancy needs for businesses and high-value households.

- ISP-provided gateways dominate distribution, with telecom operators bundling devices with broadband subscriptions to ensure customer retention.

- Growing demand in the education and healthcare verticals is fueling new applications for GPON WiFi5 gateways in e-learning and telemedicine.

Latest Market Trends

Integration of Hybrid GPON + Wireless Connectivity

One of the most significant trends is the emergence of hybrid gateways that combine GPON with LTE or 5G backup connectivity. These devices are increasingly favored by enterprises, SMBs, and smart home users who require uninterrupted internet connectivity. This trend is particularly strong in North America and Western Europe, where high-value consumers are willing to pay a premium for redundancy solutions.

Rising Role of Smart Home and IoT Ecosystems

GPON WiFi5 gateways are becoming the foundation for smart home networks, enabling seamless integration of connected devices such as smart TVs, security cameras, and IoT appliances. Growing adoption of connected homes in APAC and North America is accelerating demand for gateways with advanced MU-MIMO capabilities and tri-band support.

Shift Toward Operator-Customized Gateways

Telecom operators are increasingly seeking customized gateways with advanced remote management capabilities, allowing ISPs to push firmware updates, monitor performance, and provide differentiated services. This trend is expected to continue as operators prioritize user experience and customer retention in highly competitive broadband markets.

GPON WiFi5 Home Gateway Market Drivers

Expansion of Fiber-to-the-Home (FTTH) Networks

Governments and telecom operators are investing heavily in FTTH rollouts, particularly in Asia-Pacific, Europe, and the Middle East. The surge in gigabit-speed broadband is directly fueling demand for GPON WiFi5 gateways as the standard customer-premise equipment.

Growing Bandwidth Demand from Multi-Device Households

The rise of streaming services, remote work, and online gaming has amplified the need for high-performance home networking solutions. Wi-Fi 5 gateways with dual and tri-band capabilities are becoming essential in households with multiple connected devices.

Government Digitalization Initiatives

Initiatives such as “Digital India” and Europe’s broadband acceleration programs are creating substantial opportunities for the deployment of GPON infrastructure. Subsidies and public-private partnerships support these initiatives, significantly boosting market growth.

Market Restraints

Technology Transition Toward WiFi6

The market faces pressure from the adoption of Wi-Fi 6 gateways, which offer superior performance. While Wi-Fi 5 gateways remain cost-effective, the gradual transition may reduce long-term growth potential in premium customer segments.

Price Sensitivity in Emerging Markets

In developing economies, affordability remains a barrier. The higher cost of GPON WiFi5 gateways compared to basic routers slows adoption in low-income households, especially where government subsidies are limited.

GPON WiFi5 Home Gateway Market Opportunities

Smart City and E-Governance Projects

Smart city projects in Asia, the Middle East, and Europe are creating opportunities for GPON WiFi5 gateways as part of public WiFi and connected infrastructure rollouts. These initiatives are expected to drive significant demand through 2030.

Education and E-Learning Growth

The education sector’s reliance on high-speed internet is increasing post-pandemic. GPON WiFi5 gateways are being deployed widely in schools, universities, and student housing to support digital classrooms and e-learning platforms.

Healthcare and Telemedicine Expansion

Hospitals and clinics are adopting GPON WiFi5 gateways to enable secure, high-speed connectivity for telemedicine consultations, medical imaging, and connected health devices. This vertical represents one of the fastest-growing demand areas.

Product Type Insights

Dual-band WiFi 5 gateways dominate the GPON WiFi 5 Home Gateway market, holding a 45% market share in 2024. Their popularity stems from the ability to balance speed, affordability, and multi-device performance, making them the preferred choice for both residential households and small-to-medium enterprises (SMEs). The growth in multi-device households with users simultaneously streaming, gaming, and running smart home devices has fueled adoption in this segment.

Tri-band gateways, though a smaller base, represent the fastest-growing product category with an estimated CAGR of ~10% (2025–2030). This surge is largely attributed to heavy data users, particularly gamers, 4K/8K video streamers, and urban families with multiple connected devices. As broadband speeds climb and FTTH networks expand, demand for high-capacity, low-latency gateways will continue accelerating.

Application Insights

Residential broadband access remains the largest application segment, accounting for 65% of global demand in 2024. The dominance of this segment is underpinned by rising smart device usage per home, strong FTTH rollouts, and increasing demand for seamless WiFi coverage. In markets such as China, India, and Latin America, large-scale rural-to-urban connectivity programs are further propelling adoption.

The enterprise segment is steadily gaining traction, particularly in SMEs seeking affordable broadband solutions for hybrid and remote work setups. Large enterprises and co-working spaces are also upgrading to GPON-powered gateways for private office networks with stable WiFi5 connectivity, while hospitality and education institutions are emerging as secondary but promising growth areas.

Distribution Channel Insights

Telecom operators accounted for nearly 70% of GPON WiFi5 gateway distribution in 2024. This channel remains dominant because ISPs bundle gateways with broadband subscriptions, ensuring service reliability, customer loyalty, and lower churn rates. The ISP bundling strategy has been particularly effective in North America and Asia-Pacific, where consumers prefer operator-provided gateways for guaranteed compatibility.

The retail and e-commerce channel (20% share) caters to tech-savvy users who prefer to customize or upgrade their WiFi performance independently. This segment is expanding in Europe and North America, where consumers are increasingly familiar with DIY installations and aftermarket device upgrades. The remaining 10% of the market is held by system integrators and OEM partnerships, serving enterprise-grade deployments and government projects.

| By Product Type | By Application | By Distribution Channel | By End-User Vertical |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

The Asia-Pacific region is the largest market, accounting for 38% of the global share in 2024. China alone represents over 25% of global demand, followed by India and Southeast Asian economies. The primary growth driver is massive FTTH adoption supported by government-led rural broadband schemes and rapid digital transformation agendas.

FTTH penetration in China and India, coupled with government-backed rural broadband initiatives, is creating long-term demand. In addition, the rise of smart cities in Southeast Asia and surging demand for low-cost, high-capacity broadband solutions are reinforcing APAC’s dominance.

North America

North America captured 25% market share in 2024, led by the United States. The region benefits from high broadband penetration, widespread OTT streaming, and early adoption of smart home ecosystems. The U.S. also shows strong demand for hybrid GPON + 5G gateways, enabling households to maintain high-speed connectivity with fallback redundancy.

Regional Driver: High broadband penetration and growing multi-device streaming demand in smart homes are accelerating gateway adoption. Moreover, ISP-led bundling and the need for enterprise-grade remote work solutions are sustaining market momentum.

Europe

Europe accounted for 22% of the global market in 2024, led by Germany, the U.K., and France. The EU’s digital infrastructure expansion and fiber acceleration policies are major growth enablers. Additionally, consumer demand for affordable dual-band gateways is sustaining volume growth, while enterprises are shifting toward tri-band solutions in urban hubs.

Middle East & Africa (MEA)

MEA represented 8% share in 2024, with adoption concentrated in GCC countries such as Saudi Arabia and the UAE. Large-scale smart city projects and national digitalization programs are fueling demand. However, penetration in Sub-Saharan Africa remains comparatively lower due to limited infrastructure.

Latin America

Latin America accounted for 7% of the global market share in 2024, with Brazil and Mexico as the leading contributors. ISP-driven bundling strategies combined with ongoing fiber expansion projects are fueling adoption. Growing consumer demand for multi-device connectivity and affordable dual-band gateways is further accelerating the market.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the GPON WiFi5 Home Gateway Market

- Huawei Technologies Co., Ltd.

- ZTE Corporation

- Nokia Corporation

- FiberHome Networks

- TP-Link Technologies

- D-Link Corporation

- Netgear, Inc.

- ADTRAN, Inc.

- Calix, Inc.

- Technicolor Connected Home (Vantiva)

- Arris International

- MitraStar Technology Corp.

- Edgecore Networks

- Ubiquiti Inc.

Recent Developments

- In June 2025, Huawei launched a new GPON WiFi5 hybrid gateway with integrated LTE fallback for enterprise applications.

- In April 2025, Nokia expanded its operator partnerships in Europe to supply Wi-Fi 6 gateways under customized ISP branding.

- In February 2025, ZTE introduced tri-band WiFi5 gateways with MU-MIMO designed for high-density smart homes in the Asia-Pacific.