Golf Trolley Market Size

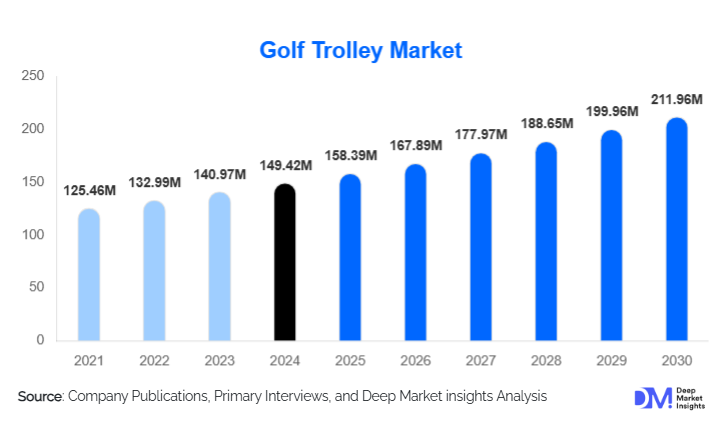

According to Deep Market Insights, the global golf trolley market size was valued at USD 149.42 million in 2024 and is projected to grow from USD 158.39 million in 2025 to reach USD 211.96 million by 2030, expanding at a CAGR of 6.00% during the forecast period (2025–2030). The growth of the golf trolley market is primarily driven by increasing global participation in golf, a rising preference for electric and smart trolleys, and the expansion of golf infrastructure across emerging regions. Technological advancements and the premiumisation of golf equipment are further fueling demand among both individual golfers and commercial operators such as golf clubs and resorts.

Key Market Insights

- Electric and smart golf trolleys dominate the market, offering convenience, battery-powered mobility, and automated features that reduce physical strain for golfers.

- Non-commercial individual golfer use accounts for the largest demand, reflecting growing participation in golf as a leisure and lifestyle sport.

- North America leads the global market, driven by a mature golf ecosystem, high disposable incomes, and strong adoption of premium equipment.

- Asia-Pacific is the fastest-growing region, fueled by rising disposable income, golf tourism development, and growing interest in recreational golf.

- Technological integration, including GPS-enabled trolleys, remote-control systems, and smartphone connectivity, is increasingly shaping consumer purchasing decisions.

- Commercial fleet adoption by golf resorts and hospitality operators is creating recurring demand for electric and smart trolleys, complementing individual sales.

What are the latest trends in the golf trolley market?

Shift Toward Electric and Smart Trolleys

Golfers are increasingly adopting electric and smart trolleys over traditional manual models. Features such as lithium-ion batteries, automatic follow functionality, GPS navigation, and smartphone integration provide convenience and reduce physical effort, especially for older golfers. Smart trolleys allow golfers to control speed, direction, and other settings remotely, improving the on-course experience. The trend toward technological upgrades is encouraging manufacturers to invest in R&D and premium product launches.

Growth of Commercial Fleet and Rental Models

Golf resorts, clubs, and hospitality providers are increasingly investing in trolley fleets for guest use, driving demand for high-quality, durable, and easy-to-maintain models. Some operators are introducing subscription and rental models, generating recurring revenue opportunities for manufacturers. Maintenance and battery replacement services bundled with trolleys are emerging as additional revenue streams, strengthening customer loyalty and market penetration.

What are the key drivers in the golf trolley market?

Rising Participation in Golf

Golf’s popularity is growing worldwide among both younger and older demographics. Recreational and amateur golfers are expanding the individual ownership base for golf trolleys. Golf tourism development in emerging economies also supports fleet purchases by resorts and clubs, driving market growth globally.

Technological Innovation and Convenience

Electric and smart trolleys reduce physical exertion and provide an enhanced on-course experience, appealing particularly to older players and premium buyers. Innovative designs such as foldable frames, lightweight materials, and app-enabled features have boosted adoption rates and allowed higher average selling prices.

Expansion of Golf Infrastructure

The development of new golf courses, resorts, and recreational facilities, especially in Asia-Pacific and the Middle East, is driving demand for both individual and commercial trolley purchases. Growth in golf tourism and hospitality-led adoption also supports higher fleet sales and recurring demand for maintenance services.

What are the restraints for the global market?

High Cost of Electric and Smart Trolleys

Premium electric and smart trolleys are costlier than manual models, limiting affordability in emerging markets. Price sensitivity among casual golfers can slow penetration and restrict market growth in certain regions.

Battery Infrastructure and Maintenance Concerns

Electric trolleys require charging infrastructure and ongoing maintenance, which can be limited in less-developed regions. Concerns about battery life, replacement costs, and technical service availability may hinder adoption, particularly in emerging markets.

What are the key opportunities in the golf trolley industry?

Technology Integration and Premiumisation

Manufacturers can differentiate their offerings by incorporating smart features such as GPS navigation, Bluetooth connectivity, remote-control capabilities, and advanced battery systems. Premium models attract higher-margin customers and allow differentiation in mature markets.

Emerging Regional Markets

Asia-Pacific, the Middle East, and Latin America are key growth regions due to rising golf participation and the development of new resorts and courses. Manufacturers entering these markets can capitalize on infrastructure growth and expanding middle-class leisure spending.

Commercial Fleet and Service-Oriented Models

Golf clubs, resorts, and rental operators provide opportunities for bulk sales, leasing models, and subscription-based services. Offering after-sales service packages, maintenance, and battery replacement can create recurring revenue and strengthen customer relationships.

Product Type Insights

Electric trolleys dominate the market, accounting for approximately 70% of the global market value in 2024. They are preferred for convenience, ease of use, and advanced features. Manual push trolleys continue to hold niche appeal among cost-conscious golfers and in markets with limited access to charging infrastructure. Remote-controlled and smart trolleys are emerging as premium segments, attracting tech-savvy players and commercial buyers seeking fleet automation and convenience.

Application Insights

Non-commercial individual golfer use remains the largest application, contributing around 65% of the market in 2024. Commercial and resort-based usage is growing rapidly, particularly in emerging markets, as golf tourism and hospitality industries expand. The commercial segment presents high growth potential, driven by fleet modernization and smart trolley adoption.

Distribution Channel Insights

Offline retail remains the leading channel with approximately 78% share of 2024 sales, as buyers prefer to physically inspect and test premium trolleys. Online retail is rapidly growing due to e-commerce platforms, offering convenience, product comparisons, and delivery services. Manufacturers increasingly use direct-to-consumer sales and online subscriptions for premium models.

End-Use Insights

Individual golfers dominate current demand, but commercial end-use (golf clubs, resorts, rental fleets) is the fastest-growing segment due to fleet purchases and recurring service needs. Emerging applications include subscription models and hospitality-focused amenities, supporting export-driven demand from North America and Europe to Asia-Pacific and the Middle East.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America is the largest market, accounting for 53% of global value in 2024. High disposable income, extensive golf infrastructure, and strong adoption of premium electric trolleys drive growth. The U.S. is the leading country, while Canada contributes steadily to demand for both individual and commercial segments.

Europe

Europe holds, 23% share of the global market value in 2024, led by the U.K., Germany, and France. Demand is driven by golf participation, premium equipment adoption, and eco-friendly initiatives in resorts and clubs. Growth is moderate but steady.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, Japan, South Korea, and Australia. Rising disposable incomes, growing golf tourism, and increasing leisure activity among the middle class are driving adoption. CAGR is expected to exceed 7% over 2025–2030.

Latin America

Latin America accounts for, 5–8% share, with Brazil and Mexico leading adoption. Golf tourism and resort developments are slowly expanding, contributing to market growth.

Middle East & Africa

MEA has a small current market (3–5% share), with growth driven by luxury resorts in the UAE and Saudi Arabia. Adoption of electric trolleys in premium resorts supports market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Golf Trolley Market

- Motocaddy

- BATCADDY

- Bag Boy Company

- Sun Mountain Sports

- PowaKaddy

- Big Max

- Cart Tek

- Axglo International

- The Proactive Sports Group

- Golf Tech Golfartikelvertriebs GmbH

- Spitzer Products Corp

- Stewart Golf

- Clicgear

- JuCad

- MGI Golf

Recent Developments

- In 2025, Motocaddy introduced a new lithium-ion electric trolley series featuring GPS-enabled tracking and a foldable design, enhancing convenience for both individual and commercial users.

- In 2024, BATCADDY expanded its operations in the Asia-Pacific region, supplying premium electric trolleys to golf resorts in China and India.

- In 2024, Sun Mountain Sports introduced a smart follow trolley that automatically tracks the golfer, targeting tech-savvy consumers and commercial fleet buyers.