Golf Putter Market Size

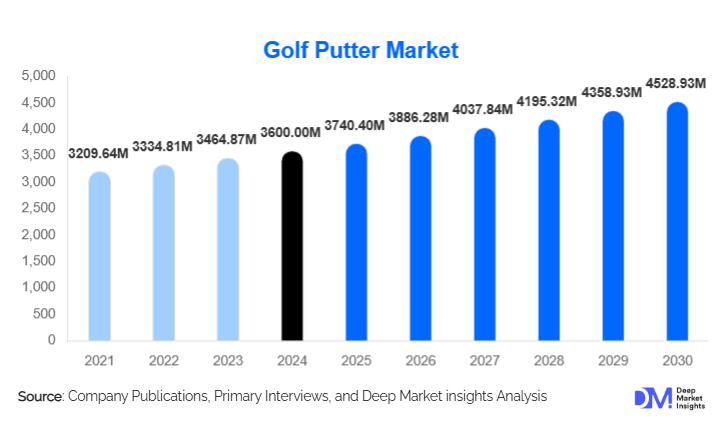

According to Deep Market Insights, the global golf putter market size was valued at USD 3,600 million in 2024 and is projected to grow from USD 3,740.4 million in 2025 to reach USD 4,528.93 million by 2030, expanding at a CAGR of 3.9% during the forecast period (2025–2030). The golf putter market growth is primarily driven by increasing global participation in golf, rising adoption of technologically advanced putters, and the growing preference for customized and performance-enhancing golf equipment across both recreational and professional segments.

Key Market Insights

- Smart and sensor-integrated putters are gaining traction, catering to tech-savvy golfers seeking real-time feedback on stroke, alignment, and impact metrics.

- Customization and fitting services are becoming mainstream, offering golfers adjustable weighting, grip options, shaft lengths, and alignment features to optimize performance.

- North America dominates the global market, driven by high golf participation rates, established infrastructure, and strong per-capita spending on premium putters.

- Asia-Pacific is the fastest-growing region, led by China, India, and Southeast Asia, due to rising disposable income, golf infrastructure development, and growing recreational participation.

- Europe holds a stable market, supported by traditional golfing culture and high demand for premium and precision putters.

- Technological innovation, including multi-material inserts, zero-torque designs, and IoT-enabled putters, is reshaping consumer preferences and driving adoption of premium segments.

What are the latest trends in the golf putter market?

Smart and Performance-Optimized Putters

Golfers are increasingly opting for putters embedded with sensors and connected apps that track stroke performance, face angle, and impact location. These smart putters provide actionable insights to improve accuracy, consistency, and overall game performance. Integration with mobile apps allows golfers to record metrics, analyze trends, and receive personalized recommendations, making technology-enhanced putters a rapidly expanding market segment. Smart putters are particularly appealing to intermediate and advanced golfers who prioritize precision and performance analytics.

Customization and Fitting Services

The demand for personalized putters is surging, as golfers seek equipment tailored to their swing style, posture, and personal preferences. Adjustable weightings, grip styles, face inserts, and alignment aids are now standard offerings in custom-fit putters. Fitting services provided at pro shops, golf courses, and specialized centers are strengthening the link between product performance and user satisfaction. This trend not only drives revenue for premium putters but also encourages repeat purchases, as golfers upgrade equipment to match evolving performance needs.

What are the key drivers in the golf putter market?

Rising Participation in Golf

Global golf participation is on the rise, particularly in recreational and amateur segments. Investments in golf infrastructure, including new courses, driving ranges, and academies, have broadened access and encouraged more players to take up the sport. Higher participation naturally translates to greater demand for putters, both for new golfers purchasing their first clubs and for existing golfers replacing or upgrading equipment. Emerging markets in the Asia-Pacific region are experiencing particularly strong growth due to expanding golf communities and increased disposable income.

Technological Innovation and Product Differentiation

Innovations such as face-balanced and zero-torque designs, multi-material construction, and smart sensor integration are improving performance and driving consumer demand. These features appeal to serious golfers who value precision and consistency. Manufacturers who focus on R&D, ergonomic design, and performance optimization are capitalizing on this demand, particularly in the premium segment.

Customization and Fit Services

Custom-fitted putters that adjust for shaft length, weight, grip, and alignment are increasingly popular. Golfers are willing to pay a premium for equipment that suits their individual stroke style. Fitting centers and simulator-based trials have become crucial in driving sales, as golfers experience the benefits of personalized putters firsthand. Brands offering seamless customization are gaining market share and customer loyalty.

What are the restraints for the global market?

High Price Points for Premium and Smart Putters

Advanced putters, particularly those incorporating smart technology or premium materials, carry higher price tags. This limits adoption among casual or budget-conscious golfers. The high cost of R&D, sensor integration, and specialized customization can pose financial challenges for manufacturers and may restrict broader market penetration.

Market Saturation in Mature Regions

In established markets such as North America and Europe, the putter segment faces saturation due to high replacement cycles and a well-established customer base. Growth in these markets largely depends on the replacement rather than the acquisition of new users. Additionally, intense competition among brands limits pricing flexibility and can constrain profit margins.

What are the key opportunities in the golf putter industry?

Smart Technology Integration

The integration of sensors, connectivity, and data analytics into putters presents a high-growth opportunity. Smart putters that provide stroke feedback, impact data, and swing analytics appeal to intermediate and professional golfers, as well as tech-savvy enthusiasts. Manufacturers developing connected products with software support can enhance customer loyalty and secure premium pricing.

Customization and Fit Services

Demand for adjustable, personalized putters continues to rise. Advanced fitting services in pro shops and golf academies are creating opportunities for manufacturers to offer bespoke equipment, driving premium sales and repeat purchases. This is especially relevant for markets with high recreational participation and a focus on performance optimization.

Expansion in Emerging Golf Markets

Emerging regions such as China, India, and Southeast Asia are witnessing rapid golf infrastructure development and growing middle-class interest. New entrants and established brands can capitalize on these markets by offering affordable, customizable, or smart putters. Partnerships with local golf courses and training centers can accelerate adoption and establish brand presence.

Product Type Insights

Face-balanced putters dominate the global market, representing approximately 58% of the 2024 market. Their popularity stems from ease of alignment, stroke stability, and widespread appeal across beginner, intermediate, and professional golfers. Blade putters follow closely in design preference due to their traditional style and performance consistency. Mid-range putters maintain strong sales by balancing affordability and performance, while premium and smart putters are increasingly capturing the attention of tech-focused consumers.

Application Insights

Individual recreational golfers represent the largest end-use segment, accounting for about 70% of demand. Golf courses and pro shops are key distribution points, providing fitting services and trial opportunities. Training centers and indoor golf simulators are emerging applications, particularly in regions such as Asia-Pacific, where infrastructure growth supports the adoption of performance-optimized and smart putters. Professional and tournament use, though smaller in volume, drives demand for high-end and customized models.

Distribution Channel Insights

Specialty golf retail stores and pro shops dominate the distribution landscape, accounting for approximately 45–50% of sales, due to the availability of expert guidance and fitting services. Online channels, including brand websites and marketplaces, are growing rapidly, particularly among younger, tech-savvy golfers. Direct-to-consumer sales allow manufacturers to offer customization, smart technology integration, and post-purchase engagement, enhancing brand loyalty.

| By Product Type | By Application / End User | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America is the largest market for golf putters, holding roughly 40% of the global share in 2024. High participation rates, disposable income, and established golf infrastructure drive demand. The U.S. leads in premium and custom putter adoption, with recreational and professional golfers fueling replacement cycles.

Europe

Europe accounts for approximately 27% of the global market, with the U.K., Germany, and France leading demand. Traditional golf culture, strong pro-shop networks, and high interest in premium and precision putters maintain stable growth. Eco-conscious and performance-focused equipment adoption is particularly prominent in Western Europe.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China, India, Japan, and Southeast Asia. Rising disposable income, expanding golf infrastructure, and increasing participation among younger demographics are fueling demand for mid-range, customizable, and smart putters. Investments in golf tourism and training facilities further support growth.

Latin America

Latin America, led by Brazil and Mexico, is an emerging market. While overall market share is lower, growing outbound travel and interest in recreational golf provide potential for premium and mid-range putter adoption. Operators are targeting adventure and group-oriented packages to capture new golfers.

Middle East & Africa

Africa is home to high-end golf destinations, while the Middle East, led by the UAE and Saudi Arabia, represents a high-income niche market. Luxury golfers, regional tournaments, and golf tourism contribute to demand. Intra-African travel is also expanding, providing regional market support.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Golf Putter Market

- Acushnet Holdings (Titleist / Scotty Cameron / Odyssey)

- TaylorMade Golf Company

- Callaway Golf Company

- Ping (Karsten Manufacturing)

- Mizuno Corporation

- Cleveland Golf

- Bridgestone Sports

- Cobra Golf

- Honma Golf

- Bettinardi Golf

- PXG (Parsons Xtreme Golf)

- Fourteen Golf

- L.A.B. Golf

- Srixon / Sumitomo Rubber

- Wilson Sporting Goods

Recent Developments

- In March 2025, TaylorMade launched a new line of smart putters featuring embedded sensors and AI-driven swing analysis, targeting intermediate and advanced golfers.

- In April 2025, Odyssey (Acushnet) expanded its custom-fit service globally, offering adjustable weights and alignment customisation at pro shops in North America and Europe.

- In June 2025, L.A.B. Golf introduced a zero-torque putter line aimed at professional golfers, emphasising stability and consistency for competitive play.