Golf Launch Monitor Market Size

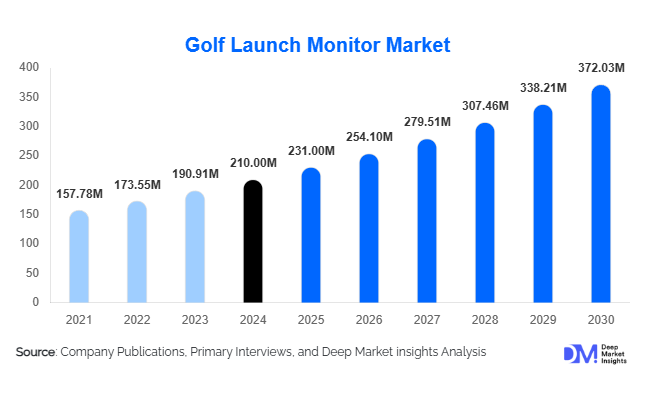

According to Deep Market Insights, the global golf launch monitor market size was valued at USD 210.00 million in 2024 and is projected to grow from USD 231.00 million in 2025 to reach USD 372.03 million by 2030, expanding at a CAGR of 10.0% during the forecast period (2025–2030). Market growth is driven by the rising popularity of indoor golf simulators, technological advancements in data analytics, and the increasing adoption of launch monitors among both professional golfers and recreational users seeking game improvement.

Key Market Insights

- Growing demand for indoor and at-home golf experiences is fueling the adoption of portable and affordable launch monitors among casual golfers.

- Professional golfers and coaches are increasingly integrating advanced launch monitors into training programs for precision analytics and performance improvement.

- North America dominates the global market, driven by strong golf culture, high consumer spending, and widespread simulator adoption.

- Asia-Pacific is the fastest-growing region, supported by a surge in golf participation in China, Japan, South Korea, and India.

- Integration of AI, IoT, and cloud-based platforms is enhancing data accuracy, usability, and remote coaching applications.

- Commercial indoor golf centers and entertainment venues are expanding demand for multi-user launch monitors with simulation capabilities.

What are the latest trends in the golf launch monitor market?

Portable and Affordable Monitors Gaining Momentum

The market is witnessing rapid growth in compact, affordable devices designed for amateur golfers. These models offer essential data points such as ball speed, launch angle, and carry distance, making them highly appealing for home use. Subscription-based apps bundled with devices are becoming popular, offering video analysis, performance tracking, and gamification features that engage younger demographics and entry-level players.

AI and Cloud-Powered Analytics

AI-powered shot analysis and cloud-based data storage are reshaping user engagement. Players can access performance data anytime and share it with remote coaches for feedback. Predictive analytics is emerging, where algorithms suggest swing corrections and customized training drills. This trend supports both elite golfers aiming for marginal gains and recreational players seeking structured improvement.

What are the key drivers in the golf launch monitor market?

Rising Popularity of Indoor Golf

The expansion of golf simulators in entertainment venues, hotels, and training facilities is driving demand for launch monitors. Urban golfers, particularly in Asia-Pacific, are opting for indoor facilities due to limited course access, fueling sales of commercial-grade devices. Partnerships between simulator manufacturers and launch monitor providers are reinforcing this trend.

Growing Focus on Game Improvement

Golfers at all skill levels are increasingly adopting launch monitors to refine swing mechanics and track progress. Professional tours and academies endorse these devices, boosting consumer awareness. Amateur golfers are also motivated by the desire for data-driven improvement, further driving adoption of mid-range and entry-level monitors.

What are the restraints for the global market?

High Cost of Premium Devices

Advanced launch monitors with 3D radar tracking and simulation features remain expensive, restricting adoption among casual golfers. Prices often exceed several thousand dollars, limiting penetration into developing regions and budget-sensitive consumer segments.

Technical Complexity and Learning Curve

Many golfers face challenges in interpreting complex datasets such as spin rates, smash factor, and attack angle. Without professional guidance, users may underutilize advanced features, reducing overall satisfaction and retention rates.

What are the key opportunities in the golf launch monitor industry?

Integration with Golf Simulators

The growing popularity of entertainment-focused golf simulators presents a major opportunity. Manufacturers can expand revenues by offering integrated packages that combine accurate shot tracking with immersive virtual courses, appealing to both commercial venues and home users.

Adoption in Emerging Golf Markets

Rising golf participation in Asia-Pacific, the Middle East, and Latin America presents significant opportunities. Affordable, portable launch monitors designed for first-time users and junior golfers are expected to drive penetration in these regions, supported by government initiatives and expanding golf infrastructure.

Product Type Insights

Radar-based launch monitors dominate the market due to superior accuracy in measuring ball speed, spin, and trajectory, making them popular among professionals. Camera-based systems are gaining traction in indoor setups where space is limited. Portable entry-level models appeal to casual players, while high-end systems with simulation integration target commercial venues and elite users.

Application Insights

Commercial applications, including golf academies, simulator centers, and entertainment venues, represent the largest revenue share. Residential applications are rapidly growing as golfers invest in home practice setups, fueled by post-pandemic shifts toward at-home sports technologies. Professional sports training continues to expand demand for high-accuracy monitors.

Distribution Channel Insights

Online platforms dominate sales, with e-commerce enabling wide access to portable and mid-range devices. Specialty sports retailers remain critical for premium systems, offering personalized demonstrations and installation. Direct-to-consumer models are expanding, supported by brand-owned digital platforms and subscription-based add-ons.

| Technology | Use Case | Connectivity |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the global market, supported by a large golf-playing population, high disposable income, and established simulator infrastructure. The U.S. accounts for a majority share, with strong adoption across both professional and recreational segments.

Europe

Europe represents a mature market, with strong demand in the U.K., Germany, and Nordic countries. Indoor golf growth in colder climates supports adoption, while professional academies drive usage of high-end monitors for player development.

Asia-Pacific

Asia-Pacific is the fastest-growing market, with rapid adoption in China, Japan, South Korea, and India. Rising middle-class affluence, urban simulator facilities, and expanding golf culture are driving growth. Partnerships with local distributors and sports academies are accelerating penetration.

Latin America

Golf participation is growing in Brazil, Mexico, and Argentina, presenting emerging opportunities. While market penetration remains low, rising interest among younger demographics and growing tourism-driven golf activities are expected to fuel adoption.

Middle East & Africa

High-income populations in the UAE, Saudi Arabia, and Qatar are driving luxury purchases of premium monitors. Africa’s adoption remains limited but is expected to grow with expanding golf tourism and infrastructure development in countries like South Africa and Kenya.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Golf Launch Monitor Market

- TrackMan

- Foresight Sports

- FlightScope

- SkyTrak

- Rapsodo

- Garmin

- Ernest Sports

- Uneekor

- Full Swing Golf

- Flightscope Mevo+

Recent Developments

- In March 2024, TrackMan launched a next-gen portable monitor with enhanced AI analytics and cloud integration for remote coaching.

- In January 2024, Foresight Sports partnered with a major golf simulator chain to integrate its GCQuad monitors into entertainment venues across North America.

- In November 2023, Garmin introduced an affordable launch monitor bundled with a mobile app targeting recreational golfers and home users.