Gold Infused Skincare Market Size

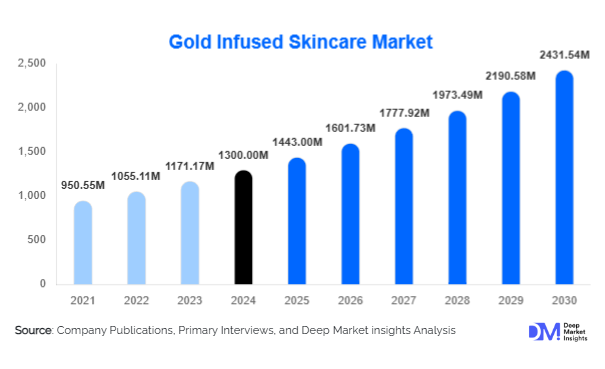

According to Deep Market Insights, the global gold-infused skincare market size was valued at USD 1,300 million in 2024 and is projected to grow from USD 1,443 million in 2025 to reach USD 2,431.54 million by 2030, expanding at a CAGR of 11% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer preference for premium and luxury skincare products, increasing adoption of nano-gold formulations, and growing e-commerce penetration that enhances accessibility for niche gold-based skincare offerings.

Key Market Insights

- Premiumization is reshaping the skincare landscape, with consumers increasingly opting for luxury products that combine visible anti-aging benefits with a sense of status.

- Technological innovations, such as nano-gold and micro-particle delivery systems, are enhancing product efficacy and boosting global adoption.

- Online retail channels are rapidly expanding, providing accessibility to gold skincare products in regions with limited offline luxury retail penetration.

- Anti-aging applications dominate the market, reflecting strong demand among aging populations in Europe and North America.

- Asia-Pacific is the fastest-growing region, driven by rising disposable incomes and increasing skincare awareness in China, India, and South Korea.

- Sustainability and ethical sourcing are emerging trends, with consumers favoring cruelty-free, eco-conscious, and responsibly sourced gold skincare products.

What are the latest trends in the gold-infused skincare market?

Premiumization and Luxury Skincare Adoption

Gold-infused skincare products are increasingly positioned as high-value luxury offerings. Anti-aging creams, serums, and moisturizers incorporating gold are marketed as premium, status-enhancing products, combining aesthetics with functional benefits. This trend is particularly strong in North America and Europe, where consumers are willing to pay a premium for products that deliver tangible skin benefits alongside luxury branding. Rising awareness of skin health and preventive anti-aging care further accelerates adoption in these regions.

Technological Innovations in Product Formulations

Innovations such as nano-gold particles, liposomal encapsulation, and bioactive ingredient integration are enhancing product efficacy and consumer appeal. Nano-gold formulations improve skin absorption, maximize anti-aging effects, and reduce irritation, giving these products a competitive edge. Personalized skincare offerings leveraging AI and skin diagnostics are emerging, enabling brands to recommend gold-based treatments tailored to individual skin types. This technology-driven customization is appealing to younger, tech-savvy consumers who demand high-performance, scientifically backed skincare.

What are the key drivers in the gold-infused skincare market?

Growing Affluent Consumer Base

Rising disposable incomes, especially in North America, Europe, and APAC, are increasing consumer willingness to invest in premium skincare. Affluent consumers are prioritizing products that provide visible anti-aging, radiance, and skin rejuvenation benefits. High-net-worth individuals often prefer gold-infused creams, serums, and masks due to perceived luxury and efficacy, driving the expansion of the premium product segment.

Rising Awareness of Skin Health and Anti-Aging

Global consumers are increasingly focused on proactive skincare, including wrinkle reduction, skin hydration, and radiance improvement. Gold-infused skincare products are perceived as effective anti-aging solutions, boosting demand among middle-aged and older demographics. Marketing campaigns emphasizing scientific efficacy and luxurious formulation enhance product desirability and market penetration.

Expansion of E-Commerce and Digital Marketing

Online retail platforms, including brand websites and marketplaces, have broadened access to gold skincare products globally. Digital marketing, influencer collaborations, and social media campaigns enhance brand visibility, particularly in emerging markets like India and China. The ease of online purchase and home delivery is making luxury skincare accessible to wider demographics.

What are the restraints for the global market?

High Product Costs

The premium pricing of gold-infused skincare limits accessibility for price-sensitive consumers, especially in emerging markets. Gold-based formulations involve expensive raw materials and sophisticated production processes, restricting mass adoption. This cost barrier may slow market expansion in regions with limited disposable income.

Regulatory and Compliance Challenges

Varying cosmetic regulations across regions regarding gold content, labeling, and safety can increase compliance costs and delay product launches. Companies must navigate stringent EU, FDA, and APAC standards, which may restrict speed-to-market and operational flexibility.

What are the key opportunities in the gold-infused skincare industry?

Emerging Market Expansion

Regions such as Asia-Pacific and Latin America present untapped growth potential. Rising urbanization, higher disposable incomes, and evolving beauty standards are driving demand for premium skincare products. Targeted regional marketing, influencer-led campaigns, and e-commerce penetration offer significant opportunities for both established and new market entrants.

Integration of Advanced Technology in Formulations

Innovations such as nano-gold encapsulation, AI-powered personalized skincare, and bioactive ingredient integration enhance product differentiation and efficacy. Companies leveraging technology can create high-value offerings that meet consumer expectations for visible anti-aging and radiance improvements, positioning themselves as market leaders.

Sustainability and Ethical Sourcing

Consumer preference for cruelty-free, eco-conscious, and ethically sourced products is rising globally. Brands that adopt sustainable packaging, renewable gold sourcing, and environmentally friendly production methods can capture premium segments while aligning with regulatory standards in Europe, North America, and APAC. This trend provides opportunities to enhance brand equity and loyalty among ethically conscious consumers.

Product Type Insights

Serums & oils dominate the market, representing 35% of the 2024 market. Their concentrated formulations offer targeted anti-aging and radiance benefits, making them highly preferred among premium consumers. Creams & lotions, masks, and cleansers follow closely, with trends emphasizing multi-functional products that combine hydration, firming, and brightening effects. Increasing preference for easy-to-apply, daily-use products is driving growth in this segment globally.

Application Insights

Anti-aging applications account for the largest share at 40% of the 2024 market, reflecting strong demand from middle-aged and older consumers. Brightening & radiance products are also growing due to increased focus on skin tone correction and aesthetic appeal. Hydration and acne care applications are rising in emerging markets, where skincare awareness and preventive routines are gaining momentum.

Distribution Channel Insights

Online retail accounts for 28% of the market and is the fastest-growing channel, driven by convenience, product variety, and digital marketing strategies. Offline retail remains significant through specialty stores, salons, and pharmacies, particularly in Europe and North America. Professional channels such as spas and dermatology clinics are also expanding, offering premium treatments with gold-infused formulations.

End-Use Insights

Personal care dominates the market with a 60% share, fueled by direct consumer adoption of anti-aging creams, serums, and moisturizers. Beauty & wellness centers are experiencing rapid growth, leveraging gold-based facial and spa treatments. New applications in luxury hotels and resorts are emerging, offering premium skincare treatments as part of hospitality wellness programs. Export-driven demand is rising in the Middle East and APAC, boosting international trade.

| By Product | By Price Tier | By Distribution |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds 30% of the 2024 market, led by the U.S. and Canada. High disposable income, preference for luxury skincare, and strong digital adoption drive growth. Anti-aging and radiance-focused products dominate, supported by a growing e-commerce infrastructure.

Europe

Europe accounts for 25% of the market, with Germany, France, and the U.K. leading demand. Consumers favor ethically sourced, cruelty-free, and premium products, supporting the adoption of gold-infused skincare. Sustainability-driven purchasing is a key trend in this region.

Asia-Pacific

Asia-Pacific is the fastest-growing region, with China, India, and South Korea contributing significantly. Rising middle-class wealth, urbanization, and social media influence are expanding the consumer base. CAGR in APAC is projected at 8.2% through 2030.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is witnessing growing adoption of luxury skincare, particularly gold-infused anti-aging products. Africa itself represents a smaller but emerging market for high-end skincare treatments in urban hubs.

Latin America

Brazil and Mexico are key markets, showing steady growth driven by increasing beauty consciousness and willingness to pay for premium skincare. Outbound demand for imported gold-based skincare is also increasing.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Gold-Infused Skincare Market

- L’Oréal

- Estée Lauder

- Shiseido

- Amorepacific

- Sisley

- La Prairie

- Oriflame

- Orogold Cosmetics

- Cosmax

- Kao Corporation

- Revlon

- The Body Shop

- Orveda

- Clarins

- Forest Essentials

Recent Developments

- In June 2025, Estée Lauder expanded its gold skincare portfolio with a nano-gold serum targeting anti-aging and radiance enhancement.

- In March 2025, Shiseido launched an AI-personalized gold-infused facial cream line in Japan and APAC markets.

- In January 2025, Orogold Cosmetics introduced a sustainable gold sourcing initiative, enhancing its luxury product appeal in North America and Europe.