Glueless Wigs Market Size

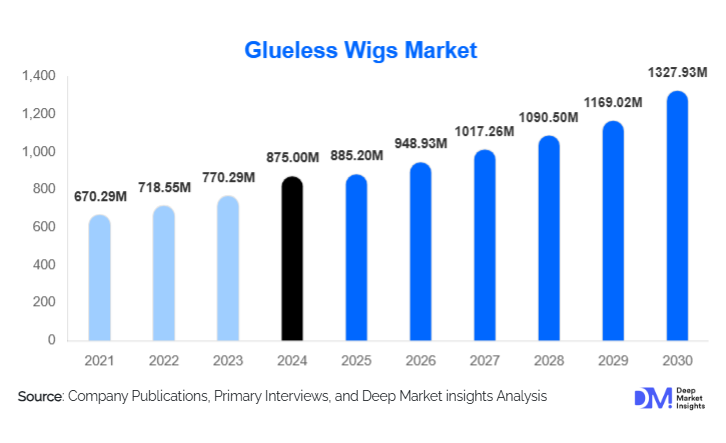

According to Deep Market Insights, the global glueless wigs market size was valued at USD 875.00 million in 2024 and is projected to grow from USD 938 million in 2025 to reach USD 1,327.93 million by 2030, expanding at a CAGR of 7.2% during the forecast period (2025–2030). The glueless wigs market growth is primarily driven by the rising adoption of convenient, non-damaging hair replacement options, increasing social media influence on beauty standards, and the expansion of e-commerce channels offering customizable and high-quality synthetic and human-hair wigs.

Key Market Insights

- Rising preference for damage-free hairstyling solutions is accelerating the adoption of glueless wigs, especially among consumers seeking versatile looks without chemical treatments.

- E-commerce and social media marketing have become the dominant sales channels, with influencers and digital try-on tools enhancing brand visibility.

- North America leads the global market, supported by strong consumer awareness and widespread adoption among fashion-conscious demographics.

- Asia-Pacific represents the fastest-growing region, fueled by increasing disposable incomes, beauty consciousness, and the influence of K-beauty and J-fashion trends.

- Technological advancements, including heat-resistant fibers, 3D lace bases, and breathable wig caps, are improving comfort and natural appearance.

- Celebrity endorsements and online tutorials are reshaping consumer perceptions, normalizing wig use for daily styling rather than just medical needs.

Latest Market Trends

Customization and Personalization on the Rise

Consumers are increasingly demanding personalized wig solutions that match specific head sizes, textures, and skin tones. Manufacturers are introducing AI-driven virtual fitting tools that recommend styles based on facial features and preferences. Custom lace front and full-lace wigs with adjustable straps and pre-plucked hairlines are gaining traction among premium buyers. Brands are also offering mix-and-match options for cap constructions and hair types, enhancing the personalization experience.

Sustainability and Ethical Sourcing

The glueless wig industry is witnessing a major shift toward ethically sourced human hair and eco-friendly packaging. Many brands are adopting transparency initiatives, highlighting the traceability of hair donations and ensuring fair-trade sourcing. Synthetic wig makers are also developing biodegradable fibers that mimic real hair. This sustainability-driven approach appeals strongly to younger consumers and aligns with broader clean beauty trends.

Glueless Wigs Market Drivers

Rising Popularity of Convenient and Protective Styling

Glueless wigs offer the advantage of easy application and removal without adhesives or salon visits. Their protective benefits, preventing hair loss and scalp damage, make them popular among women who frequently style or color their hair. The trend of natural hair care and protective hairstyles among African and African-American women has significantly contributed to market expansion.

Social Media Influence and Celebrity Endorsements

Platforms such as TikTok, YouTube, and Instagram have popularized wig transformations, styling tutorials, and influencer partnerships. Celebrities including Beyoncé, Rihanna, and Kim Kardashian have helped normalize wig use as a fashion accessory. This cultural acceptance is encouraging more mainstream consumers to invest in multiple wigs for daily styling versatility.

Market Restraints

High Cost of Premium Human-Hair Wigs

High-quality human-hair glueless wigs can be expensive due to labor-intensive production and limited raw material availability. This limits accessibility for price-sensitive consumers. Additionally, fluctuating hair supply from donor countries such as India and China can lead to inconsistent pricing and supply chain challenges.

Counterfeit and Low-Quality Products

The rapid growth of online marketplaces has led to an influx of counterfeit or low-grade wigs falsely marketed as “100% human hair.” Such products often disappoint consumers and harm brand reputations. Weak regulatory oversight and poor product labeling standards further complicate market credibility.

Glueless Wigs Market Opportunities

Expansion into Male and Medical Segments

Rising demand among men experiencing hair loss and medical patients undergoing chemotherapy represents a growing opportunity. Manufacturers are developing breathable, lightweight, and natural-looking glueless wigs specifically designed for these demographics. Clinics and wellness centers are partnering with wig brands to offer integrated hair restoration solutions.

Technological Innovation and Smart Wigs

Integration of smart features, such as scalp sensors, adjustable temperature control for styling, and 3D-printed lace bases, is emerging as a futuristic opportunity. These innovations enhance comfort and functionality, appealing to tech-savvy consumers and luxury buyers seeking premium experiences.

Product Type Insights

The human-hair glueless wigs segment dominates the global market, driven by premiumization, superior realism, and long-term durability. Consumers are increasingly willing to pay premium prices for wigs that provide a natural look, soft texture, and longevity, especially in the luxury and professional segments. These wigs appeal strongly to high-income groups and entertainment professionals who prioritize styling versatility and authenticity.

Meanwhile, synthetic glueless wigs are gaining traction due to affordability and constant improvements in fiber quality. The development of heat-resistant synthetic fibers that mimic the texture and shine of human hair has made these products popular among younger consumers seeking cost-effective and fashion-forward options. The ability to experiment with colors, styles, and seasonal trends without long-term commitment further strengthens synthetic wig adoption.

Across cap designs, lace front and full-lace wigs continue to lead the market, driven by their highly realistic hairlines and styling flexibility that allows consumers to achieve natural-looking results without adhesives. Monofilament and hand-tied caps are popular in the medical segment for their superior comfort and breathability, while machine-made caps dominate mass-market distribution, supported by affordability and easy scalability.

Application Insights

The personal fashion and beauty segment remains the leading application area, supported by strong social media influence, celebrity styling trends, and the growing culture of self-expression. Consumers increasingly view wigs as everyday fashion accessories rather than occasional cosmetic aids, fueling sustained demand. Influencers and content creators continue to shape purchasing decisions through tutorials and transformation videos, amplifying global awareness of glueless wig styling.

The medical application segment is projected to expand steadily due to rising awareness and support programs for individuals undergoing chemotherapy or managing alopecia. Healthcare partnerships and insurance reimbursement in regions like North America are further improving accessibility and acceptance. Additionally, the professional and entertainment segment contributes meaningfully, with stylists, performers, and actors favoring glueless wigs for their secure fit, realism, and ease of daily use.

Distribution Channel Insights

Online and e-commerce platforms dominate glueless wig sales worldwide, driven by convenience, wide product variety, consumer reviews, and virtual try-on technologies. Leading brands are leveraging AI-powered visualization tools to improve online purchasing confidence, while influencer-driven marketing via TikTok, Instagram, and YouTube accelerates discovery and engagement.

Specialty stores and salons remain key for premium and medical-grade wig purchases, offering personalized fittings, customization, and maintenance services. Boutique D2C (direct-to-consumer) brands in Europe and North America are strengthening this hybrid model by combining online ordering with local styling support. General retail channels are expanding among budget-conscious consumers through beauty supply chains and department stores, driving penetration into emerging markets.

End-User Insights

Women represent the dominant consumer group, accounting for over 80% of total market demand. Among them, millennials and Gen Z consumers lead adoption due to strong exposure to fashion trends, influencer marketing, and openness to self-expression through hairstyle changes. The male consumer segment is also expanding rapidly, driven by rising awareness of hair loss solutions and increasing social acceptance of wigs as a grooming accessory. Older demographics are adopting glueless wigs for convenience and comfort, particularly in cases of thinning hair or medical treatment, signaling broader market inclusion.

| By Product Type | By Cap Construction / Design | By Application / End-Use | By Distribution Channel | By Price Tier |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest share of the global glueless wigs market, underpinned by high fashion influence, celebrity culture, and widespread use in the entertainment industries. The region also benefits from strong e-commerce penetration and well-established awareness of medical wigs, including reimbursement programs that enhance accessibility for patients. The U.S. remains the largest individual market, led by African-American consumers embracing protective hairstyles and mainstream demand for premium human-hair products. Canada follows closely with increasing online retail activity and emerging boutique wig brands catering to natural hair aesthetics.

Europe

Europe demonstrates consistent growth, supported by strong consumer preference for premium, ethically sourced human-hair products and advanced salon services. The regional market is characterized by a growing emphasis on craftsmanship, sustainability, and transparent sourcing practices. Countries such as the U.K., France, and Germany lead demand through boutique D2C brands and professional salon channels. Increasing awareness of natural-looking, lightweight wigs has broadened appeal across both medical and fashion applications, while the rise of eco-conscious beauty trends positions Europe as a hub for ethical luxury wig products.

Asia-Pacific

The Asia-Pacific region is the fastest-growing glueless wigs market globally, benefiting from a massive population base, rising disposable incomes, and a robust manufacturing ecosystem. Countries such as China, India, Japan, and South Korea dominate both production and consumption. China serves as a global export hub for human and synthetic hair products, providing competitive pricing and product diversity. Meanwhile, domestic demand is expanding rapidly due to beauty consciousness, K-beauty and J-fashion influence, and social media exposure. The region’s rapid digitalization and strong e-commerce infrastructure further enable direct global sales from local manufacturers, reinforcing its dual role as a production and consumption powerhouse.

Latin America

Latin America is emerging as a promising growth region, with markets such as Brazil, Mexico, and Argentina leading adoption. Rising disposable incomes and a cultural emphasis on beauty and self-care are propelling market development. Social media trends, influencer endorsements, and the growth of regional e-commerce platforms are enhancing the visibility and accessibility of glueless wigs. Improved online retail logistics and distribution partnerships are supporting mid-tier segment expansion, while local salons are increasingly offering styling and fitting services to boost consumer trust in premium brands.

Middle East & Africa

Middle East & Africa (MEA) demonstrates substantial growth potential due to cultural acceptance of wigs for both fashion and convenience, particularly in Nigeria, South Africa, and the UAE. The market benefits from an expanding range of African-hair-specific products designed for natural textures and protective styles. Local brands are increasingly emerging to cater to diverse hair types, boosting consumer loyalty and accessibility. The presence of vibrant beauty cultures, high fashion engagement, and rising middle-class spending continues to reinforce regional demand for both synthetic and human-hair glueless wigs. The segment is further supported by growing local manufacturing initiatives and partnerships with global e-commerce platforms, facilitating cross-border trade.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Glueless Wigs Market

- UNice Hair

- RPGSHOW

- Divas Wigs

- Luvme Hair

- AliPearl Hair

- Hermosa Hair

- WowAfrican

Recent Developments

- In August 2025, Luvme Hair launched its “Zero-Glue HD Lace Series” designed for sensitive scalps, featuring breathable mesh caps and recyclable packaging.

- In June 2025, UNice Hair introduced an AI-based virtual wig try-on feature integrated into its mobile app, enhancing online shopping convenience.

- In February 2025, RPGSHOW expanded its European distribution network through partnerships with premium salon chains in France and the U.K.