Glass Door Merchandiser Market Size

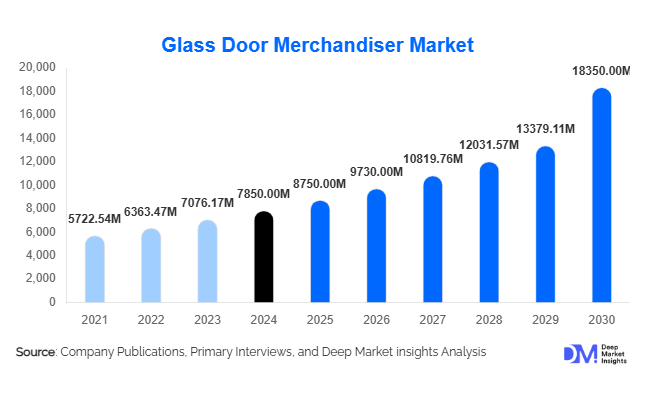

According to Deep Market Insights, the global glass door merchandiser market size was valued at USD 7,850 million in 2024 and is projected to grow from USD 8,750 million in 2025 to reach USD 18,350 million by 2030, expanding at a CAGR of 11.2% during the forecast period (2025–2030). The market growth is primarily driven by increasing demand for energy-efficient refrigeration, the expansion of the retail and foodservice sectors, and technological advancements such as IoT-enabled monitoring systems and sustainable refrigeration solutions.

Key Market Insights

- Energy-efficient and environmentally sustainable glass door merchandisers are increasingly favored by retailers and foodservice providers aiming to reduce operational costs and carbon footprint.

- Self-contained and hinged door designs dominate the market, offering ease of installation and wide applicability across retail and institutional settings.

- Retail outlets remain the largest end-use segment, driven by growing demand for visually appealing product displays that boost sales and customer engagement.

- Asia-Pacific is the fastest-growing region, led by China and India, fueled by urbanization, rising disposable incomes, and the expansion of modern retail infrastructure.

- North America and Europe hold significant shares of the global market, driven by advanced technology adoption, regulatory compliance, and mature retail sectors.

- Technological integration, including IoT, smart temperature monitoring, and energy-efficient natural refrigerants, is reshaping market dynamics and operational efficiencies.

Latest Market Trends

Energy-Efficient and Sustainable Solutions

Manufacturers are increasingly focusing on energy-efficient glass door merchandisers to meet regulatory requirements and consumer demand for eco-friendly solutions. Integration of inverter compressors, natural refrigerants, LED lighting, and smart temperature monitoring systems has become mainstream. These technologies reduce energy consumption and improve operational efficiency, aligning with sustainability trends and supporting long-term cost savings for retailers and foodservice operators. Companies are also offering modular designs that allow retailers to customize units based on space and product requirements.

Smart and Connected Merchandisers

The adoption of IoT and smart monitoring features enables remote control, predictive maintenance, and real-time temperature tracking. Retailers can optimize product storage conditions, reduce spoilage, and monitor energy usage, while gaining valuable data for operational improvements. These features appeal to larger retail chains and chain restaurants, which prioritize efficiency and compliance with food safety standards. Additionally, cloud-based monitoring and data analytics platforms are becoming essential for managing multiple units across geographically dispersed locations.

Glass Door Merchandiser Market Drivers

Rising Retail and Foodservice Demand

The expansion of retail chains, supermarkets, convenience stores, and foodservice establishments is a primary driver for glass door merchandisers. Retailers increasingly prioritize product visibility to attract customers and boost sales of perishable goods such as beverages, dairy, and frozen items. Growth in urban populations and rising disposable incomes in emerging economies are further fueling this trend. This segment alone accounted for nearly 45% of global market demand in 2024.

Technological Advancements in Refrigeration

Innovations such as energy-efficient compressors, natural refrigerants, and IoT-enabled temperature monitoring have significantly improved unit performance. These technological advancements not only reduce energy consumption but also support sustainability initiatives, making glass door merchandisers more attractive to large-scale retailers and environmentally conscious operators.

Government Regulations and Sustainability Initiatives

Stricter energy efficiency regulations, especially in North America and Europe, are compelling manufacturers and retailers to adopt advanced merchandisers. Programs promoting low-GWP refrigerants and energy-saving technologies create market opportunities for companies offering compliant solutions, thereby driving demand and incentivizing innovation.

Market Restraints

High Initial Investment Costs

Advanced glass door merchandisers with smart features and energy-efficient technologies require significant upfront investment. This can be a barrier for small and medium enterprises, limiting adoption among cost-sensitive operators.

Maintenance and Operational Challenges

Complex refrigeration systems require skilled personnel for maintenance and monitoring. Higher operational and servicing costs may pose challenges for retailers and foodservice operators, especially in regions with limited technical expertise.

Glass Door Merchandiser Market Opportunities

Expansion in Emerging Markets

Rapid urbanization and the expansion of modern retail and foodservice sectors in Asia-Pacific and Latin America present growth opportunities. Rising disposable incomes and changing consumer lifestyles in countries such as China, India, and Brazil are driving the adoption of visually appealing and energy-efficient merchandisers.

Integration of Smart Technologies

IoT-enabled monitoring systems, cloud-based analytics, and automated refrigeration controls are emerging as opportunities to improve operational efficiency, reduce spoilage, and enhance user experience. Manufacturers investing in smart solutions can differentiate their products and capture premium market segments.

Sustainable and Eco-Friendly Product Innovations

With increasing environmental awareness, there is a rising demand for merchandisers using natural refrigerants, LED lighting, and energy-saving features. Companies focusing on sustainability are well-positioned to capture market share and comply with global regulatory frameworks.

Product Type Insights

Hinged door merchandisers dominate the global market due to their versatility, ease of use, and wide applicability in retail and foodservice settings. Sliding door models are preferred in space-constrained environments. Self-contained refrigeration systems are particularly popular among smaller retail outlets, while remote-condensing units are gaining traction in large-scale supermarkets and hypermarkets.

Application Insights

Retail outlets remain the largest application segment, with supermarkets and convenience stores driving substantial demand. Foodservice establishments, such as restaurants, cafes, and quick-service chains, are increasingly adopting merchandisers for beverages and ready-to-eat products. Emerging applications in airports, institutional cafeterias, and vending solutions are creating new revenue streams for manufacturers.

Distribution Channel Insights

Direct sales to retailers, foodservice operators, and institutional buyers remain the dominant channel. Online B2B platforms and manufacturer portals are gaining traction for bulk orders, while distributors serve secondary markets. OEM partnerships with large retail chains and franchise operators are becoming increasingly significant for long-term contracts and recurring sales.

End-Use Insights

Retail outlets hold the largest share, followed by foodservice and institutional applications. The fastest-growing end-use segments are convenience stores and quick-service restaurants, driven by urbanization, consumer preference for ready-to-eat meals, and beverage sales. Export-driven demand is also rising, particularly from Europe and North America to emerging markets in the Asia-Pacific and Latin America.

| By Product Type | By End-Use / Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America, led by the U.S. and Canada, accounted for nearly 35% of the global market in 2024. Growth is driven by high adoption of energy-efficient units, retail expansion, and regulatory compliance. Supermarket chains and convenience store networks are the primary consumers.

Europe

Europe contributed around 30% of the 2024 market, with Germany, the U.K., and France leading demand. Energy regulations and environmental standards drive the adoption of sustainable and smart merchandisers.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, and Japan. Rapid urbanization, rising middle-class income, and expansion of modern retail infrastructure are driving demand. The market here is projected to expand at a CAGR exceeding 12% from 2025 to 2030.

Latin America

Brazil and Mexico are the leading markets, driven by retail modernization and urban population growth. Demand is primarily focused on energy-efficient and medium-capacity units.

Middle East & Africa

The UAE, Saudi Arabia, and South Africa are emerging as growth hubs due to modern retail expansion and infrastructure investments. Luxury retail and commercial foodservice growth are key demand drivers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Glass Door Merchandiser Market

- True Manufacturing Co., Inc.

- ARNEG S.p.A.

- Liebherr-International Deutschland GmbH

- Beverage-Air

- Hoshizaki Corporation

- Foster Refrigerator

- Gram Commercial

- Heatcraft Worldwide Refrigeration

- Delfield

- Imperial Commercial Refrigeration

- Fagor Industrial

- Traulsen

- KoolMore Refrigeration

- Metalfrio Solutions

- Electrolux Professional

Recent Developments

- In May 2025, True Manufacturing launched a new energy-efficient glass door merchandiser with IoT-enabled monitoring for large retail chains.

- In April 2025, Beverage-Air expanded its product portfolio with sliding door merchandisers optimized for convenience stores and small retail outlets.

- In February 2025, Liebherr introduced a sustainable refrigeration unit using natural refrigerants and LED lighting, targeting European supermarkets.