Geotourism Market Size

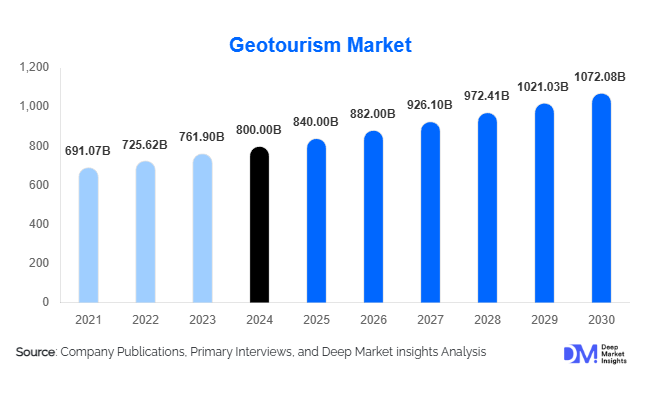

According to Deep Market Insights, the global geotourism market size was valued at USD 800 billion in 2024 and is projected to grow from USD 840 billion in 2025 to reach USD 1,072.08 billion by 2030, expanding at a CAGR of 5.0% during the forecast period (2025–2030). The geotourism market growth is primarily driven by the global shift toward sustainable and experience-based travel, rising interest in geological heritage destinations, and the expansion of eco-friendly infrastructure supporting community-based tourism models.

Key Market Insights

- Geotourism integrates sustainability, culture, and geology, offering authentic travel experiences centered on landscapes, local heritage, and environmental conservation.

- Digital transformation is reshaping traveler engagement, with AR/VR interpretation tools, mobile geo-guides, and AI-based itinerary planning enhancing visitor experiences.

- Asia-Pacific and Latin America are emerging as the fastest-growing regions, driven by untapped geoheritage potential and supportive government initiatives.

- Natural geo-destinations, volcanoes, caves, geoparks, and fossil sites dominate global demand, accounting for nearly 34% of total market share in 2024.

- Community-based tourism and local partnerships are strengthening, enabling destination authenticity and equitable economic distribution.

- Millennial and Gen Z travelers are fueling the rise of individual and solo geotourism experiences, leveraging digital booking platforms for personalized journeys.

What are the latest trends in the Geotourism Market?

Technology-Driven Destination Experiences

Technology adoption is rapidly transforming the geotourism sector. Augmented reality (AR) and virtual reality (VR) applications now allow travelers to visualize ancient geological processes, explore rock formations interactively, and understand environmental evolution through immersive simulations. Mobile apps integrated with geolocation and real-time navigation assist tourists in self-guided tours, while AI-powered recommendation engines provide personalized routes based on traveler interests. Furthermore, destination management organizations are deploying digital interpretation centers in geoparks and heritage zones, enhancing educational and cultural value. These innovations are particularly appealing to younger demographics seeking meaningful, tech-enhanced travel experiences.

Rise of Sustainable and Community-Linked Geotourism

The growing emphasis on sustainability has positioned community-based geotourism as a dominant trend. Destinations are collaborating with residents to co-manage geoparks, create eco-lodges, and develop educational programs around geology and conservation. This model enhances authenticity and ensures that tourism revenues directly benefit local communities. Countries such as Indonesia, Peru, and India are promoting “geoheritage villages,” where travelers can experience indigenous knowledge, traditional crafts, and geological wonders in harmony. Such initiatives align with global sustainability goals, strengthening geotourism’s long-term viability and appeal among eco-conscious travelers.

Expansion of Government-Supported Geoparks

Governments worldwide are recognizing geotourism as a driver of regional economic development. UNESCO Global Geoparks have become catalysts for heritage preservation and rural revitalization. National tourism boards are investing in access infrastructure, visitor interpretation centers, and digital promotion campaigns. For example, China and European Union countries have significantly increased funding for geopark expansion, while Africa and South America are identifying new geological corridors for international recognition. This trend is creating diversified opportunities for tour operators and investors, reinforcing the institutionalization of geotourism within mainstream travel sectors.

What are the key drivers in the Geotourism Market?

Rising Global Demand for Sustainable, Authentic Travel

Travelers are increasingly prioritizing experiences that contribute positively to nature and local communities. Geotourism perfectly aligns with this shift by combining cultural immersion, education, and conservation. As global awareness of climate change and biodiversity loss grows, demand for responsible travel to pristine natural landscapes is surging. This shift is further accelerated by eco-certification programs, green hotel networks, and media promotion of sustainable travel narratives.

Improved Accessibility and Infrastructure Development

Many countries are investing in roads, air links, and eco-friendly facilities connecting remote geosites. The proliferation of low-cost airlines, high-speed rail, and integrated booking platforms has made previously inaccessible geoparks and natural reserves reachable to mainstream travelers. These developments are lowering entry barriers, expanding the potential traveler base, and enabling local operators to scale up services in newly accessible regions.

Digital Platforms and Experience Customization

Online travel agencies, D2C websites, and social media have significantly enhanced visibility for niche destinations. Platforms now allow geo-focused travelers to curate itineraries, book eco-lodges, and connect with certified local guides seamlessly. Advanced analytics and user-generated content promote community-driven discovery of unique geological sites, fueling a self-sustaining ecosystem of digital engagement and repeat travel.

What are the restraints for the global market?

Limited Infrastructure and Accessibility in Remote Areas

While geotourism thrives in remote and natural landscapes, underdeveloped infrastructure, such as limited transport, lodging, and emergency services, remains a key constraint. Many geosites lack sustainable visitor facilities, making them difficult to access for general tourists. This limits scalability, increases operational costs for operators, and restricts participation to high-income travelers willing to pay premium prices for remote experiences.

Environmental and Regulatory Challenges

Unregulated tourism can lead to the degradation of sensitive geological and ecological sites. Many nations impose stringent environmental regulations, limiting expansion or development near protected areas. Although these measures ensure conservation, they can slow down investment and project approvals. Operators must balance profitability with compliance, integrating eco-friendly practices and adhering to local cultural norms to maintain long-term sustainability.

What are the key opportunities in the Geotourism Industry?

Community-Based and Heritage-Linked Partnerships

Collaborations between tour operators, governments, and local communities represent a major opportunity. Such partnerships can create inclusive tourism models that preserve cultural integrity while providing income diversification. Regions with strong geological heritage but low tourism exposure, such as sub-Saharan Africa and the Andean belt, are ripe for development through structured public–private partnerships. Local capacity building, community training, and microenterprise support can further strengthen value chains and create employment opportunities.

Technology Integration for Immersive Travel Experiences

Geotourism operators integrating technologies like AR/VR, IoT-based sustainability tracking, and AI-driven guides can significantly enhance traveler engagement. For example, AR applications in caves or volcanic sites can simulate historical eruptions or geological evolution, offering educational depth and entertainment value. Such tech-enabled differentiation allows operators to attract premium customers and position their services at the intersection of education, entertainment, and conservation.

Expansion in Emerging Regional Markets

Rapid economic growth and urban middle-class expansion in Asia-Pacific and Latin America are opening new demand channels for experiential travel. Governments in India, Indonesia, Chile, and South Africa are investing in geopark infrastructure and promotional campaigns, aiming to position their natural assets as world-class destinations. The increasing participation of domestic travelers in these regions also provides a buffer against global travel fluctuations, ensuring stable long-term growth.

Tour Type Insights

Individual travel dominates the global geotourism market, accounting for approximately 38% of market share in 2024. This trend is largely driven by millennials and Gen Z travelers seeking personalized, flexible, and self-guided exploration of geological landscapes. The rise of digital booking platforms and social media communities centered on sustainable adventure travel has further accelerated the popularity of solo and custom geotourism. Group and professional tours, focused on research, education, or corporate eco-retreats, represent a smaller but steadily expanding portion of the market.

Tourism Type Insights

Natural geotourism leads the market with around 34% share in 2024, encompassing visits to geoparks, caves, volcanoes, and fossil sites. These experiences combine scientific learning with outdoor adventure, attracting both eco-conscious leisure travelers and academic institutions. Rural and eco-geotourism are also witnessing robust growth as destinations promote sustainable, low-impact lodging and integrate agricultural, cultural, and geological experiences to diversify tourist offerings.

Distribution Channel Insights

Online booking channels dominate, holding nearly 45% of the market in 2024. The digitalization of travel services allows seamless itinerary customization, instant booking confirmations, and transparent sustainability ratings. Platforms such as specialized geotourism portals and mainstream OTAs have increased visibility for lesser-known destinations. Direct online sales by eco-lodges and tour operators are rising, reflecting broader industry digitization trends.

Age Group Insights

The 30–40 years demographic accounts for roughly 27% of the global geotourism market, representing the largest consumer base. These travelers typically combine financial capability with a strong inclination toward sustainability and experiential travel. Younger travelers (under 30) drive the budget and adventure-focused segments, while older age groups (above 50) favor guided and educational tours emphasizing comfort, culture, and accessibility.

| By Tour Type | By Traveler Type | By Booking Channel | By End-Use | By Geological Feature Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America represents approximately 22% of global geotourism revenue in 2024. The U.S. and Canada are characterized by well-established geoheritage sites such as Yellowstone, Grand Canyon, and Banff. High-income levels and environmental awareness underpin stable growth, while tech-enabled tour operators are enhancing domestic travel experiences. The region’s mature infrastructure ensures a consistent inflow of both domestic and international visitors.

Europe

Europe holds the largest regional share at about 28% in 2024. Countries including Italy, Spain, Germany, and the U.K. are leading through the integration of heritage and geological experiences. European travelers demonstrate a strong preference for sustainable, low-impact tourism models. The region benefits from robust transportation networks, high environmental consciousness, and proximity to multiple UNESCO geoparks.

Asia-Pacific

Asia-Pacific accounts for approximately 26% of global market value and is the fastest-growing regional segment. China leads in market size due to massive investment in national geoparks and tourism infrastructure, while India ranks among the fastest-growing nations, driven by expanding middle-class income and diverse geological heritage. Indonesia, Japan, and Australia are also significant contributors, supported by eco-tourism incentives and government-led sustainability programs.

Middle East & Africa

With an estimated 12% market share, this region is steadily emerging as a vital growth hub. Africa’s vast geological diversity, including volcanic landscapes, deserts, and fossil beds, positions it as a natural geotourism powerhouse. Meanwhile, Middle Eastern countries such as the UAE and Saudi Arabia are developing heritage-focused and eco-conscious tourism corridors to diversify their economies beyond oil dependency.

Latin America

Latin America holds about 12% of the global market share. Countries like Chile, Peru, and Brazil are developing new geoparks and adventure-geotourism circuits leveraging their volcanic and mountainous terrain. Governments are emphasizing conservation-linked tourism and eco-lodge investments to attract international travelers. Despite logistical challenges, regional demand is projected to grow rapidly over the next decade.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Geotourism Market

- TUI AG

- G Adventures Inc.

- Intrepid Travel Pty Ltd.

- Abercrombie & Kent Group

- Backroads Inc.

- Mountain Travel Sobek

- Natural Habitat Adventures

- World Expeditions

- Omega World Travel Inc.

- Butterfield & Robinson

- AAA Travel

- Exodus Travels

- JTB Americas Group

- GeoEx Ltd.

- Adventure Life

Recent Developments

- In August 2025, Intrepid Travel launched a new “Earth Footprints” series of guided tours focused on UNESCO Geoparks across Europe and Asia, incorporating carbon-neutral transportation and local homestays.

- In July 2025, TUI AG announced an investment program to digitize its eco-tour offerings with AR-based interpretation tools and sustainability tracking for all geotourism packages.

- In May 2025, G Adventures introduced community-led geotourism itineraries in South America, collaborating with indigenous communities for heritage preservation and income generation.