Garden Hand Tools Market Size

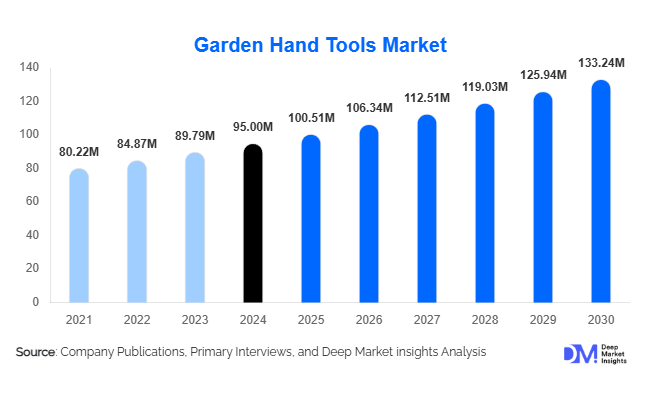

According to Deep Market Insights, the global garden hand tools market size was valued at USD 95 billion in 2024 and is projected to grow from USD 100.51 billion in 2025 to reach USD 133.24 billion by 2030, expanding at a CAGR of 5.8% during the forecast period (2025–2030). The garden hand tools market growth is primarily driven by the rising popularity of home gardening and landscaping, increasing urbanization, coupled with higher disposable incomes, and growing demand for sustainable and ergonomic tools among both residential and professional users.

Key Market Insights

- Rising urban gardening and DIY landscaping trends are significantly boosting the demand for compact, ergonomic, and multi-purpose hand tools.

- North America dominates the market, supported by a mature gardening culture, widespread DIY adoption, and advanced retail infrastructure.

- Asia-Pacific remains the fastest-growing region, driven by expanding middle-class populations and rapid urban greening initiatives.

- Online retail channels are witnessing the fastest growth due to convenience, broader product selection, and digital marketing outreach.

- Eco-friendly materials and sustainable manufacturing are becoming central to new product development strategies among leading manufacturers.

- Technological innovation in ergonomic design and smart tool features (e.g., usage sensors, modular attachments) is reshaping the market landscape.

Latest Market Trends

Urban and Micro-Gardening Tools in High Demand

The rapid urbanization of major cities has created a surge in small-space gardening, including balcony, rooftop, and vertical gardens. This shift is driving demand for compact and lightweight hand tools such as trowels, pruners, and mini-rakes designed for limited areas. Manufacturers are introducing foldable and multifunctional tools that save space while maintaining functionality. Rising interest in indoor and hydroponic gardening further expands demand for precision hand instruments suitable for container and indoor plants. The micro-gardening trend is particularly strong in Asia-Pacific and Europe, where urban dwellers seek self-sufficiency and sustainable living practices.

Shift Toward Sustainable and Ergonomic Designs

Consumers increasingly prefer garden tools made from recycled materials and responsibly sourced components. Manufacturers are responding with innovations such as biodegradable handles, FSC-certified wooden grips, and recyclable metal alloys. Ergonomic improvements like anti-slip grips and lightweight composite materials enhance usability for hobbyists and professionals alike. This trend also aligns with global sustainability goals and corporate social responsibility initiatives, making eco-friendly hand tools a core differentiator in the market.

Garden Hand Tools Market Drivers

Rising DIY Gardening Culture

Home gardening has become both a leisure activity and a lifestyle choice, particularly since the pandemic. Consumers in North America and Europe are increasingly turning their backyards, terraces, and balconies into personal green spaces. This behavioral shift has driven robust demand for essential hand tools such as pruning shears, trowels, and hand forks. The trend also extends to younger demographics who view gardening as a form of wellness and self-care, ensuring sustained long-term demand.

Commercial Landscaping and Green Infrastructure Projects

Commercial and institutional landscaping projects, such as urban parks, resorts, golf courses, and educational campuses, are fueling large-volume demand for durable, professional-grade hand tools. Government investments in public green spaces and city beautification programs further enhance the market outlook. As municipalities and corporations adopt sustainability mandates, the need for manual, non-powered garden tools for maintenance tasks continues to rise.

Emerging Demand from Developing Regions

In Asia-Pacific and Latin America, rising disposable incomes, coupled with expanding e-commerce availability, have accelerated market penetration. Urban housing developments increasingly include green spaces and rooftop gardens, boosting the uptake of hand tools. India and China, in particular, are becoming manufacturing hubs as well as growing consumer markets, offering significant growth opportunities for global players.

Market Restraints

Competition from Powered Gardening Equipment

The proliferation of electric and battery-operated gardening tools presents a substitution challenge. As technology prices decline, consumers often prefer powered tools for convenience and efficiency. This limits potential volume growth for traditional hand tools in certain applications, especially in developed markets.

Volatile Raw Material Costs

Fluctuations in steel, aluminum, and wood prices directly affect the profitability of manufacturers. Rising logistics and labor costs also add to production expenses. Smaller regional manufacturers, in particular, struggle to absorb these costs, leading to pricing pressure and narrower margins across the value chain.

Garden Hand Tools Market Opportunities

Eco-Friendly Product Innovation

The global shift toward sustainability creates lucrative opportunities for manufacturers to develop environmentally responsible hand tools. By using recycled metals, biodegradable plastics, and minimal packaging, companies can appeal to eco-conscious consumers. Partnerships with green initiatives and certifications like FSC or ISO 14001 further strengthen brand positioning.

Integration of Smart Technologies

While garden hand tools remain primarily manual, there is growing potential for digital enhancements such as usage tracking sensors, smart irrigation attachments, or modular handles compatible with multiple tool heads. These innovations improve functionality, offer data-driven gardening insights, and align with the broader smart-home ecosystem trend.

Expanding Online Retail Ecosystem

E-commerce platforms and direct-to-consumer websites are transforming the garden tools market. Online retail allows brands to reach new customer segments, especially in emerging economies. Integration of augmented reality previews, tutorial content, and subscription-based replenishment models can boost engagement and loyalty.

Product Type Insights

Pruning tools represent the largest product category, accounting for approximately 35% of the global garden hand tools market in 2024 (USD 7.0 billion). Their dominance is fueled by a recurring replacement cycle, blades dull and springs wear over time, along with adoption by professional landscapers and ornamental gardeners who rely on high-quality pruners for frequent maintenance. The surge in home orchards, ornamental gardening, and small-scale horticulture continues to bolster this segment. Trowels and hand forks are also significant, driven by starter gardeners and small-scale vegetable cultivation, while shears and hoes/cultivators see growth from landscaping and organic/weed-control trends. Seasonal tools like rakes experience cyclical demand during leaf-fall and lawn care periods, whereas hand saws, loppers, and multi-tools are increasingly used by professionals and urban gardeners seeking convenience in compact spaces.

Distribution Channel Insights

Offline channels, particularly home-improvement and specialty garden stores, dominate with around 33% market share (USD 6.6 billion in 2024). These outlets offer hands-on product evaluation and expert advice, supporting bundled purchases of complementary tools and accessories. Online retail is the fastest-growing channel, with a projected CAGR of over 7% during 2025–2030, driven by wider product selection, convenience, and the rise of digital marketing and influencer-led gardening content. Mass merchandisers cater to price-sensitive buyers and high-volume economy-line sales, while B2B direct channels are preferred for bulk procurement by landscapers, municipalities, and institutional buyers.

End-Use Insights

Residential users account for approximately 60% of the global market (USD 12.0 billion in 2024), propelled by lifestyle and hobby trends, social media-driven gardening content, and urban/micro-gardening popularity. Commercial landscaping and horticulture/nurseries form the remaining market, where tool selection is driven by durability, bulk pricing, supplier relationships, and the need for high-precision instruments. Institutional buyers such as municipal parks and educational campuses rely on long-term contracts, compliance standards, and repeat purchase cycles. Emerging applications include community gardens, rooftop terraces, and horticultural therapy programs, which expand non-traditional demand for hand tools.

| By Product Type | By Application | By Distribution Channel | By Material Type | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global garden hand tools market with a 35% share (USD 7.0 billion in 2024), driven by a strong DIY culture and the adoption of gardening as a wellness activity. Aging homeowners prioritize ergonomic and premium-quality tools, supporting demand for lightweight, professional-grade, and corrosion-resistant products. The professional landscaping sector also drives sustained growth, requiring durable pruners, shears, and multi-tools for large-scale projects. High online penetration enables convenient access to niche and premium tools, while established retail networks and high disposable incomes maintain a steady growth rate of approximately 3–4% CAGR.

Europe

Europe holds around 25% of the market (USD 5.0 billion), with the U.K., Germany, and France leading demand. Long-standing gardening traditions, combined with rising interest in sustainability, drive the purchase of repairable, eco-friendly tools. Strict regulations on chemicals and pesticides favor mechanical gardening methods, further supporting demand for pruning tools, shears, and hoes. The strong garden-center retail network enhances in-store discovery and bundled purchases, while professional landscaping and urban green-space projects reinforce the market. Eco-conscious consumer preferences contribute to a steady CAGR of 3–4%.

Asia-Pacific

Asia-Pacific accounts for approximately 20% of the market (USD 4.0 billion) and is the fastest-growing region with a 5–7% CAGR projected through 2030. Rapid urbanization and a growing middle class are driving small-space gardening, such as balcony, rooftop, and community gardens. Expanding commercial landscaping in fast-growing cities of China, India, and Southeast Asia increases demand for durable pruners, shears, and multi-tools. Online retail growth, affordability of mid-tier tools, and e-commerce penetration further boost adoption among residential and professional users.

Latin America

Latin America contributes 8–10% of the global market, with Brazil, Argentina, and Mexico showing increasing demand. Favorable climates enable year-round gardening, while urban agriculture and community garden initiatives expand small-scale residential and commercial gardening activities. However, price sensitivity and fragmented retail channels present challenges. Seasonal spikes in pruning tools and hand forks are observed during major planting and harvest periods. Growth is supported by rising middle-class homeownership and DIY trends, with a CAGR of 4–5% expected through 2030.

Middle East & Africa

MEA contributes roughly 5% of global revenue, driven primarily by landscaping booms in Gulf countries, including luxury and commercial projects. Harsh climates necessitate water-efficient and corrosion-resistant gardening tools. The professional landscaping sector demands durable shears, pruners, and multi-tools to manage large-scale green spaces. Urban green-space initiatives in Africa are gradually increasing adoption, particularly in major cities. Demand growth is moderate, with a CAGR of 3–4%, supported by infrastructure investment and the introduction of ergonomically designed tools tailored to local conditions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Garden Hand Tools Market

- Fiskars Corporation

- Stanley Black & Decker Inc.

- Husqvarna Group

- Griffon Corporation

- The AMES Companies Inc.

- FELCO SA

- Spear & Jackson

- Corona Tools

- Wolf-Garten

- Burgon & Ball Ltd.

- A.M. Leonard Inc.

- True Temper Tools

- Radius Garden

- Bulldog Tools

- ARS Corporation (Japan)

Recent Developments

- In March 2025, Fiskars Corporation introduced a new line of eco-ergonomic hand pruners made from 70% recycled materials, targeting urban gardeners worldwide.

- In January 2025, Stanley Black & Decker expanded its European production facility to improve sustainability and reduce carbon emissions by 30% by 2030.

- In May 2025, Husqvarna Group launched a professional landscaping hand-tool range emphasizing lightweight alloys and modular attachments for multi-functionality.