Garage Organization & Storage Market Size

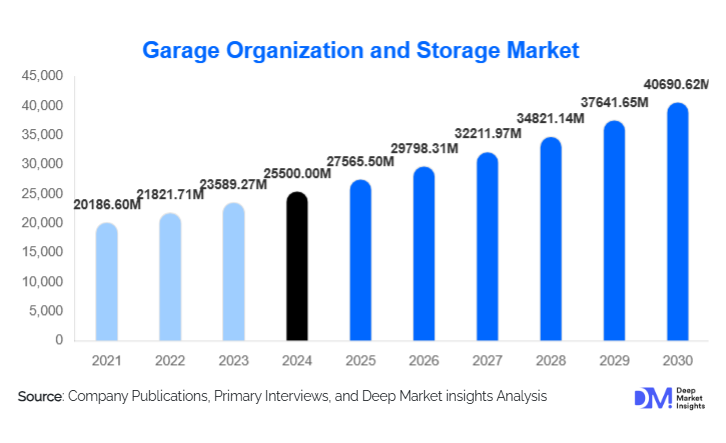

According to Deep Market Insights, the global Garage Organization and Storage Market size was valued at USD 25,500 million in 2024 and is projected to grow from USD 27,565.5 million in 2025 to reach USD 40,690.62 million by 2030, expanding at a CAGR of 8.10% during the forecast period (2025–2030). This growth is driven by the increasing shift toward multifunctional home spaces, rising home renovation and DIY trends, and the growing adoption of modular and smart storage solutions across residential and commercial garages worldwide.

Key Market Insights

- Cabinets remain the largest product segment, accounting for over 40% of the market in 2024, driven by demand for premium, enclosed, and customizable storage systems.

- Residential garages dominate global demand, representing approximately 75% of the total market, reflecting the rise of multifunctional, organized home spaces.

- North America leads the market, with a 40% share in 2024, supported by high garage ownership, DIY culture, and strong home-improvement spending.

- Asia-Pacific is the fastest-growing region, expanding at nearly 9% CAGR, fueled by rapid urbanization, growing middle-class income, and rising vehicle ownership.

- Smart and sustainable materials are transforming the product landscape, with IoT-enabled cabinets and eco-friendly, modular systems gaining traction.

- Online retail channels are expanding rapidly, accounting for nearly one-third of global sales in 2024, boosted by the surge in e-commerce for home improvement products.

What are the latest trends in the Garage Organization & Storage Market?

Smart and Connected Storage Systems

Smart garage storage is emerging as a major trend, integrating IoT sensors, lighting systems, and app-controlled modules that allow homeowners to monitor and organize tools and equipment efficiently. Smart wall panels, connected tool chests, and automated racks with motion-sensor lighting are increasingly being launched by major brands. Integration with voice assistants such as Alexa and Google Home is adding convenience, while connected systems also appeal to tech-savvy, younger homeowners seeking intelligent, modular solutions.

Eco-Friendly and Modular Design Adoption

Manufacturers are prioritizing sustainability through the use of recycled steel, bamboo, and eco-composite materials for cabinets and shelves. Modular and reconfigurable designs are in high demand, allowing consumers to adjust layouts as needs evolve. Eco-conscious buyers, particularly in Europe and North America, are opting for systems with minimal carbon footprint and high durability. This trend aligns with global sustainability movements and home-improvement incentives promoting green materials.

What are the key drivers in the Garage Organization & Storage Market?

Rising Vehicle Ownership and Multi-Purpose Garages

With an increase in global vehicle ownership, garages are transforming from simple parking spaces into multipurpose areas for storage, repair, recreation, and even home gyms. Homeowners seek to maximize garage space efficiency, fueling demand for wall-mounted organizers, cabinets, and overhead racks. The trend toward electric vehicles (EVs) also encourages consumers to redesign garages for charging setups and dedicated storage solutions.

Expanding Home-Improvement and DIY Culture

The growing popularity of home renovation, particularly in North America and Europe, is a significant driver. DIY culture, boosted by social media platforms and home-improvement shows, is encouraging consumers to invest in functional, aesthetic garage makeovers. Modular garage organization kits and online customization tools are empowering homeowners to plan and install their own systems, driving retail and e-commerce sales.

Growth of E-commerce and Customization

E-commerce platforms have revolutionized how consumers purchase storage solutions. Online configuration tools, 3D previews, and direct-to-consumer (D2C) models enable customized designs at lower costs. The availability of installation tutorials, free delivery, and bundled modular kits has accelerated online adoption, particularly in emerging markets where offline distribution is limited.

What are the restraints for the global market?

High Upfront Costs and Installation Complexity

Premium garage organization systems, such as modular cabinetry and ceiling racks, require a higher initial investment and often professional installation. This cost barrier can deter adoption in cost-sensitive regions. Additionally, the customization process can be time-intensive, making mass-market adoption slower in developing economies.

Limited Awareness in Emerging Economies

In many developing countries, garages are used primarily for vehicle parking, and the concept of dedicated garage organization is still nascent. Smaller garage sizes, lack of awareness, and lower discretionary spending reduce penetration of advanced storage systems. Educating consumers and promoting modular, space-efficient solutions is key to unlocking growth in these regions.

What are the key opportunities in the Garage Organization & Storage Industry?

Integration of Smart and IoT Technologies

The rapid evolution of smart home ecosystems offers opportunities to integrate garage storage with connected devices. Companies developing IoT-enabled racks, digital locks, lighting systems, and app-based inventory tracking are positioned to capture premium market segments. Such innovations enhance functionality, safety, and convenience, appealing to tech-forward consumers globally.

Expansion into Emerging Markets

Asia-Pacific and Latin America present substantial growth potential due to rising vehicle ownership and rapid suburban development. Manufacturers entering these markets with cost-efficient, modular storage units stand to benefit from untapped demand. Localization of design — smaller units and flexible configurations — will be crucial to address varied housing formats and price points.

Sustainable and Customizable Offerings

Eco-friendly materials and personalization are key differentiators. Consumers increasingly favor products made with recycled metals or sustainable wood, and brands that allow design flexibility, color options, and custom layouts are gaining an edge. Offering modular systems that can be expanded or upgraded aligns with long-term sustainability and user adaptability trends.

Product Type Insights

Cabinets dominate the garage organization and storage market, accounting for approximately 40% of global revenue in 2024. Their popularity is attributed to the demand for enclosed, lockable storage that combines functionality with aesthetics. Shelves and racks represent the second-largest category, offering affordable solutions for homeowners and small workshops. Wall-mounted systems, including pegboards and slat walls, are increasingly adopted in compact garages to maximize vertical space. Overhead and ceiling-mounted systems are also gaining traction for storing seasonal or bulky items, addressing the growing need for efficient space utilization.

Material Insights

Metal-based storage systems hold the largest material share, comprising nearly 45–50% of total sales in 2024, due to their durability and load-bearing capacity. Plastic and polymer-based products remain popular for lightweight, affordable applications, while wood and engineered-wood cabinets cater to high-end consumers seeking premium aesthetics. Composite and hybrid materials are gaining favor for balancing cost, durability, and eco-friendliness.

Application Insights

Residential applications lead the market, contributing nearly 75% of total demand in 2024. The surge in residential garage makeovers and the transformation of garages into multi-use spaces such as workshops, gyms, and home offices drive this dominance. Commercial applications, including auto service centers and light industrial units, represent a growing niche, fueled by the need for organized tool and parts storage. Institutional adoption is also expanding, with educational and government facilities investing in organized maintenance and storage areas.

Distribution Channel Insights

Offline retail stores, including home improvement chains and specialty showrooms, currently dominate sales. However, online retail is the fastest-growing channel, accounting for around 30–35% of global revenue in 2024. The rise of e-commerce has simplified access to customizable modular systems and direct installation services. Online configurators and bundled offers are boosting conversions among homeowners seeking convenient and affordable garage upgrades.

| By Product Type | By Material Type | By Application | By Distribution Channel | By End User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the global market, holding approximately 40% share in 2024, valued at nearly USD 9.6 billion. The United States dominates due to high home-ownership rates, strong DIY culture, and widespread use of garages as multi-functional spaces. Robust e-commerce penetration and high disposable income further support premium product demand.

Europe

Europe accounts for around 25–30% of the global market, led by the U.K., Germany, and France. The region’s focus on sustainable living and smart home integration is fueling the adoption of eco-friendly and modular garage systems. Renovation of older housing stock is also boosting replacement demand, particularly in Western Europe.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, expanding at nearly 9% CAGR from 2025–2030. Increasing vehicle ownership, rapid suburbanization, and rising disposable incomes in China, India, and Southeast Asia are driving growth. Domestic production and export of affordable modular systems are further enhancing market accessibility across this region.

Latin America

Latin America holds around 6–7% of the global share, with Brazil and Mexico leading demand. Expanding middle-class housing and rising DIY adoption are key growth factors. Local distributors and partnerships with global brands are helping introduce modular, affordable systems across the region.

Middle East & Africa

MEA represents about 5–6% of the global market, with growth centered in the Gulf states. The UAE and Saudi Arabia are investing in luxury housing projects featuring integrated garages, while Africa’s gradual urban development supports long-term potential. Demand for smart and sustainable materials is gaining traction among premium buyers.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Garage Organization & Storage Market

- Stanley Black & Decker

- Lowe’s Companies

- Newell Brands (Rubbermaid)

- Whirlpool Corporation (Gladiator)

- Sterilite Corporation

- Griffon Corporation (ClosetMaid)

- GarageTek Inc.

- Alpha Guardian

- NewAge Products Inc.

- Seville Classics

- The Container Store Group

- Flow Wall Systems

- Husky (Home Depot)

- Cannon Security Products

- Suncast Corporation

Recent Developments

- In August 2025, NewAge Products introduced a new line of smart-integrated garage cabinets with built-in LED lighting and mobile app connectivity for inventory tracking.

- In May 2025, Lowe’s expanded its in-house modular storage line featuring eco-friendly recycled metal and composite materials, targeting sustainable home improvement buyers.

- In February 2025, Stanley Black & Decker launched a premium DIY kit series combining tool storage, wall organizers, and installation guidance via augmented reality applications.