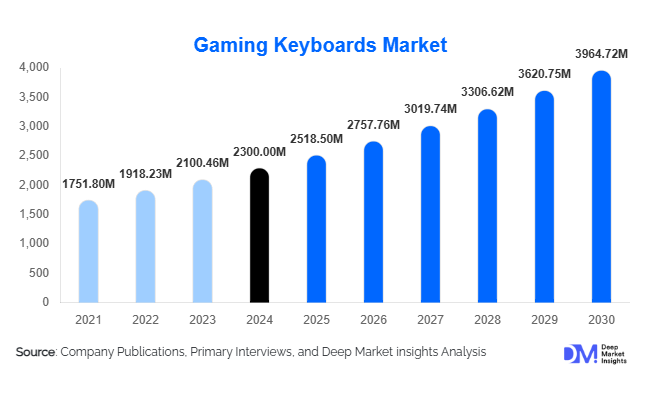

Gaming Keyboards Market Size

According to Deep Market Insights, the global gaming keyboards market was valued at USD 2,300 million in 2024 and is projected to grow from USD 2,518.50 million in 2025 to reach USD 3,964.72 million by 2030, expanding at a CAGR of 9.5% during the forecast period (2025–2030). Growth is being driven by the surging global gamer population, increasing penetration of eSports and streaming culture, and rapid technological innovation in mechanical, optical, and wireless keyboard designs that enhance performance and aesthetics.

Key Market Insights

- Mechanical keyboards dominate the market, accounting for about 65% of 2024 sales due to superior tactile feedback, durability, and gamer preference.

- Wireless adoption is accelerating as latency reduction technologies make cable-free setups more viable for competitive gaming.

- Asia-Pacific leads global demand, representing 35–40% of market share in 2024 and showing the highest forecast growth rates.

- The premium segment contributes over half of the market revenue, reflecting consumers' willingness to pay for customization, aesthetics, and quality.

- Online channels drive almost half of global sales, enabled by D2C websites, e-commerce platforms, and influencer-led marketing.

- Technological integration – RGB ecosystems, hot-swappable switches, and AI-driven customization – is shaping the next wave of gaming peripherals.

Latest Market Trends

Rise of Wireless and Low-Latency Connectivity

Wireless gaming keyboards have evolved from niche accessories to mainstream performance peripherals. Enhanced 2.4 GHz and Bluetooth 5.3 technologies, higher polling rates, and improved battery life have minimized latency gaps between wired and wireless models. Major brands are focusing on lag-free gaming, multi-device connectivity, and sleek form factors that cater to minimalist setups. As gamers prioritize desk aesthetics and flexibility, wireless mechanical keyboards are expected to represent over 30% of market revenue by 2030.

Customization and Modularity

The mechanical keyboard hobby has catalyzed demand for modular, hot-swappable, and customizable products. Enthusiasts now expect interchangeable switches, keycaps, and software-controlled RGB lighting. Manufacturers are responding with open-architecture designs that let users tailor the feel and acoustics to their liking. This trend is also fueling niche sub-segments such as 60 % compact keyboards and ergonomic split layouts. As a result, the category is transitioning from standardized peripherals to lifestyle devices that express identity and brand loyalty.

Gaming Keyboards Market Drivers

Growth of eSports and Streaming Ecosystems

The proliferation of eSports tournaments, professional gaming teams, and streaming platforms has turned gaming peripherals into aspirational gear. Professional endorsement, influencer marketing, and the visibility of RGB-lit setups on Twitch and YouTube are pushing mainstream adoption. Players now view keyboards as competitive tools that can improve response times and accuracy, driving repeat purchases and upgrades.

Technological Innovation and Product Differentiation

Innovation in optical and Hall-effect switches, ultra-polling wireless modules, and cloud-based software suites has refreshed the upgrade cycle. Hot-swappable boards, per-key actuation customization, and synchronized lighting ecosystems across devices are helping brands maintain price premiums. The introduction of AI-driven configuration software further enhances personalization, creating strong replacement demand among existing users.

Expanding Gamer Demographics

With over 3 billion gamers globally, PC gaming continues to attract new entrants from mobile and console segments. Increasing disposable incomes and hybrid work-play setups make high-performance keyboards desirable for both productivity and entertainment. Casual and female gamer segments are also driving demand for aesthetic, compact, and customizable keyboards, diversifying the buyer base.

Market Restraints

High Price Sensitivity and Commoditization

While premium products dominate revenue, cost-sensitive consumers in emerging markets often opt for standard or semi-mechanical keyboards. Rising competition from regional manufacturers has led to price erosion in mid-tier categories, squeezing margins. Lack of clear differentiation between brands may also slow replacement cycles.

Component Cost and Supply Chain Volatility

Fluctuating prices of switches, PCBs, and aluminum cases, along with logistics challenges and tariffs, impact profitability. Dependence on Asian OEMs for key components creates vulnerability to geopolitical disruptions and currency fluctuations, forcing brands to balance cost and quality.

Gaming Keyboards Market Opportunities

Wireless Innovation and Multi-Platform Expansion

The shift toward cable-free, cross-device ecosystems offers a major growth frontier. As latency barriers disappear, wireless mechanical keyboards are becoming the preferred choice for PC, console, and smart-TV gaming. Brands investing in multi-platform compatibility, wireless charging, and low-latency firmware will capture the premium segment.

Emerging Markets and Localized Production

Rapid digitalization and eSports growth in India, Brazil, and Southeast Asia are unlocking untapped demand. Establishing regional assembly and distribution hubs under programs like “Make in India” and “Made in China 2025” can reduce import duties and increase affordability. Localization of layouts, language options, and marketing will help brands scale efficiently in these regions.

Streaming and Creator Integration

Keyboards that double as control panels for content creators – integrating macro keys, touch strips, and stream-deck functionality – are gaining momentum. The creator economy’s expansion provides new cross-selling opportunities. Hardware-software ecosystems linking lighting, audio, and video workflows represent a high-margin niche.

Product Type Insights

Mechanical keyboards dominate the category, contributing about 65% of global revenue in 2024. Their tactile precision, durability, and customizability make them the top choice for competitive and enthusiast gamers. Membrane and hybrid optical keyboards serve the budget and transition segments, respectively, appealing to casual gamers seeking quiet operation or affordability. The trend toward optical and hot-swappable mechanical designs indicates a continued shift toward performance-driven segments.

Connectivity Insights

Wired keyboards currently account for approximately 75% of market share, reflecting the ongoing preference for zero-latency input in eSports. However, wireless keyboards are expected to grow at a double-digit CAGR through 2030 as advances in RF technology eliminate lag. The adoption of USB-C, rechargeable batteries, and multi-device switching is accelerating this transition.

Price Tier Insights

The premium/high-end tier represents over 50% of market value due to strong demand for RGB ecosystems, metal chassis, and software integration. Mid-range models balance performance and price, appealing to semi-professional gamers. Entry-level keyboards continue to serve as gateway products in developing markets but contribute less to overall revenue.

Distribution Channel Insights

Online sales dominate with roughly 45–50% share, driven by brand D2C stores and e-commerce platforms. The online channel’s transparency, global reach, and user reviews encourage premium purchases. Retail specialty stores remain important for hands-on testing, while mass retail supports budget categories. Subscription-based peripherals bundles and limited-edition drops are emerging as new engagement models.

End-User Insights

Enthusiast and professional gamers drive the bulk of revenue owing to frequent upgrades and brand loyalty. Casual gamers represent the largest volume share, benefitting from the increasing affordability of mechanical models. The streamer/content-creator segment is expanding rapidly, demanding specialized features for on-air control and aesthetic setups. Export-driven OEM demand from Asian manufacturers also contributes a significant portion of market volume.

| By Product Type | By Connectivity | By Switch Type | By Price Range | By Distribution Channel | By End-User |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

Accounting for around 30% of global revenue in 2024, North America is a mature yet profitable market supported by high disposable incomes, strong eSports culture, and brand awareness. The U.S. remains the single largest national market, emphasizing premium and wireless segments.

Europe

Europe contributes about 20% of the global share, led by the U.K., Germany, and France. European consumers value design, sustainability, and ergonomics, spurring demand for eco-friendly materials and recyclable packaging. Growth remains steady at 7–8% CAGR.

Asia-Pacific

Asia-Pacific dominates with a 35–40% share and is the fastest-growing region. China is the largest producer and consumer, while India and South Korea exhibit double-digit growth thanks to expanding eSports and streaming adoption. Local manufacturing and government incentives enhance competitiveness.

Latin America

Representing a 5–7% share, Latin America – led by Brazil and Mexico – shows rising interest in affordable mid-range peripherals. Improved internet infrastructure and localized eSports leagues are accelerating adoption.

Middle East & Africa

Though smaller (3–5% share), this region demonstrates strong potential with 10–12% projected CAGR. Gulf nations’ high income levels and youth demographics are fueling gaming hardware imports, while African markets are building local eSports ecosystems.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Gaming Keyboards Market

- Logitech International S.A.

- Razer Inc.

- Corsair Gaming Inc.

- SteelSeries A/S

- ASUS Tek Computer Inc.

- HP Inc.

- Lenovo Group Limited

- Cooler Master Technology Inc.

- Acer Inc.

- Redragon Technology Co., Ltd.

- DuckyChannel International Co., Ltd.

- Glorious PC Gaming Race

- Keychron Co. Ltd.

- Akko Technology Co., Ltd.

- Rapoo Technology Co., Ltd.

Recent Developments

- August 2025 – Razer launched its next-gen HyperSpeed Pro wireless keyboards featuring a 4 kHz polling rate and AI-based latency optimization for competitive gaming.

- June 2025 – Logitech announced the expansion of its MX series into gaming, integrating ergonomic and productivity features into mechanical boards produced under the “Pro Hybrid” label.

- April 2025 – Corsair inaugurated a new assembly plant in Taiwan to boost production of optical-mechanical switches and reduce lead times for global exports.

- March 2025 – ASUS introduced its ROG Falchion II, a compact 65 % wireless keyboard with an interactive touch bar and real-time battery telemetry.