Functional Textiles Market Size

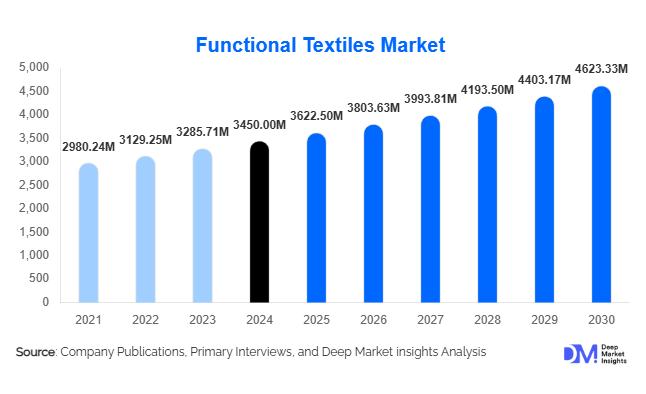

According to Deep Market Insights, the global functional textiles market size was valued at USD 3450.00 million in 2024 and is projected to grow from USD 3622.50 million in 2025 to reach USD 4623.33 million by 2030, expanding at a CAGR of 5.0% during the forecast period (2025–2030). The functional textiles market growth is primarily driven by the rising demand for high-performance fabrics across apparel, healthcare, and industrial sectors, increasing adoption of smart and sustainable textile technologies, and regulatory pressures for hygiene, safety, and eco-friendly materials.

Key Market Insights

- Asia-Pacific dominates the global functional textiles market, accounting for nearly 45% of global revenue in 2024, driven by large-scale manufacturing and export capacities in China, India, and Southeast Asia.

- Antimicrobial and antibacterial textiles lead by function type, representing approximately 25% of the total market value in 2024 due to surging demand in healthcare, hygiene, and protective wear applications.

- Woven functional textiles remain the largest product form segment, with 40% market share in 2024, owing to their versatility in apparel, upholstery, and industrial applications.

- Apparel and footwear applications dominate end-use, capturing 30% of the market, as consumers increasingly prefer activewear, athleisure, and performance-oriented garments.

- Sustainable and eco-functional innovations are reshaping industry dynamics, with leading manufacturers introducing bio-based, fluorine-free, and recyclable performance fabrics.

- Smart and connected textiles represent a growing sub-sector, supported by rising adoption in wearable devices, health monitoring, and defense applications.

What are the latest trends in the functional textiles market?

Integration of Smart and Connected Textiles

Smart functional textiles, incorporating sensors, conductive fibers, and data interfaces, are rapidly gaining traction across healthcare, defense, and sportswear. These fabrics enable real-time monitoring of body temperature, heart rate, and motion, positioning them at the forefront of the wearable technology revolution. Manufacturers are collaborating with tech companies to integrate IoT and AI into fabric structures, transforming passive textiles into responsive systems. This trend is particularly strong in medical textiles, where intelligent fabrics assist in patient monitoring and rehabilitation support, and in defense sectors for real-time soldier performance tracking.

Sustainability and Eco-Functional Innovations

Global emphasis on sustainability is reshaping the functional textiles landscape. Companies are investing in bio-based polymers, natural antimicrobial agents, and fluorine-free water repellents to align with environmental regulations and consumer expectations. Closed-loop recycling systems, renewable energy in textile processing, and waterless finishing technologies are also being adopted to reduce carbon footprints. The market’s transition toward sustainable performance textiles enhances both brand value and compliance with emerging green procurement standards in the EU and North America.

What are the key drivers in the functional textiles market?

Increasing Demand for High-Performance Fabrics

Functional textiles are witnessing exponential demand in sportswear, activewear, healthcare, and protective applications. Consumers prioritize moisture management, odor resistance, UV protection, and thermal comfort, particularly within athleisure and outdoor apparel. Similarly, medical textiles require antimicrobial and barrier properties to maintain hygiene standards, while industrial users demand flame-retardant and anti-static materials. This rising performance expectation across industries fuels steady market expansion.

Technological Advancements in Fabric Engineering

Nanotechnology, microencapsulation, and plasma treatment techniques have enabled the production of multifunctional textiles with enhanced durability. Conductive yarns and advanced coatings provide fabrics with intelligent responsiveness. Companies leveraging these technologies achieve competitive differentiation and margin expansion, particularly in premium performance categories.

Government and Regulatory Support

National programs such as India’s “National Technical Textiles Mission” and China’s “Made in China 2025” are bolstering functional textile production through funding, R&D incentives, and infrastructure investment. Similarly, Western markets’ hygiene and safety regulations encourage the adoption of high-specification medical and industrial fabrics, stimulating consistent demand globally.

What are the restraints for the global market?

High Production and Technology Costs

Functional textiles require advanced machinery, specialty coatings, and extensive R&D expenditure, resulting in elevated manufacturing costs. The price differential between standard and functional fabrics limits widespread adoption in cost-sensitive sectors. Additionally, energy-intensive finishing processes increase overall operational expenses, challenging small manufacturers’ competitiveness.

Durability and Performance Degradation

Functional coatings and finishes often deteriorate after multiple wash cycles, reducing effectiveness over time. This performance loss poses product quality challenges, impacting consumer trust and replacement cycles. Continuous innovation in long-lasting coatings remains crucial to maintaining market momentum and customer satisfaction.

What are the key opportunities in the functional textiles industry?

Smart Textile and E-Textile Expansion

The convergence of electronics and textiles is opening lucrative growth avenues. E-textiles embedded with micro-sensors and conductive threads are being developed for health diagnostics, sports analytics, and defense communications. The growing IoT ecosystem will expand textile applications beyond garments into automotive interiors and industrial monitoring fabrics, significantly enhancing market value.

Emerging Markets and Export-Driven Growth

Rising industrialization and healthcare expansion in Asia-Pacific, the Middle East, and Africa are stimulating local demand for geotextiles, protective clothing, and medical fabrics. Export-oriented manufacturing hubs such as India, Vietnam, and Indonesia are benefiting from Western demand for cost-effective functional textiles, supporting both regional and global revenue growth.

Green Performance Textiles

With environmental mandates tightening globally, developing recyclable, biodegradable, and non-toxic functional fabrics presents a strong opportunity. Brands adopting eco-functional innovations enjoy premium pricing, government incentives, and enhanced consumer loyalty, reinforcing sustainable competitiveness across global markets.

Product Type Insights

The functional textiles market is segmented by product functionality into antimicrobial, UV-protective, water- and oil-repellent, flame-retardant, temperature-regulating, conductive/smart, and comfort/stretch textiles. Among these, antimicrobial and antibacterial textiles lead the global market with a 25% share in 2024. This dominance stems from heightened hygiene awareness in both healthcare and consumer apparel post-pandemic, alongside stricter infection-control norms in the medical and hospitality sectors. Antimicrobial finishes are increasingly used in hospital bedding, uniforms, sportswear, and travel apparel.

UV-protective and temperature-regulating textiles are witnessing accelerated adoption in sportswear and outdoor apparel as consumers pursue climate-adaptive, health-conscious clothing solutions. Water- and oil-repellent variants remain critical in workwear, defense uniforms, and upholstery applications due to growing demand for durability and stain resistance in industrial and home settings. Flame-retardant fabrics continue to dominate protective clothing and defense sectors, driven by global safety regulations and stringent standards in construction and automotive industries.

Conductive and smart textiles represent a fast-emerging category, projected to expand at a double-digit CAGR through 2030, driven by the rapid integration of IoT, wearables, and remote health monitoring technologies. Comfort and stretch textiles also form a strong growth segment, supported by the global athleisure movement and consumer preference for lightweight, breathable apparel. In terms of treatment technology, nano and micro treatments are increasingly preferred for their performance enhancements and self-cleaning attributes, while laminates and breathable membranes are expanding in high-performance outdoor apparel.

Application Insights

By end use, apparel and footwear dominate the global functional textiles market with a 30% revenue share in 2024, reflecting the strong influence of athleisure, sportswear, and premium outdoor apparel brands adopting multifunctional materials. Demand for UV-resistant, moisture-wicking, and temperature-regulating fabrics continues to surge as global consumers prioritize comfort and performance.

Healthcare and medical textiles represent the fastest-growing application segment, fueled by rising hospital infrastructure investments, infection-control standards, and increasing adoption of smart patient-monitoring fabrics. The segment benefits from antimicrobial, antiviral, and breathable materials designed for PPE, surgical drapes, and wound care products. Protective and industrial textiles also hold a significant share, with strong penetration in PPE, uniforms, filtration, and insulation materials across construction, manufacturing, and logistics sectors.

Beyond these, geotextiles, automotive interiors, and home furnishings are gaining momentum as infrastructure projects and consumer demand for durable, easy-to-clean materials increase globally. The integration of functional textiles in transport seating, flooring, and smart home interiors demonstrates growing cross-industry adoption.

| By Product Type | By Technology / Treatment | By End-Use Industry | By Material / Fiber Type | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific (APAC) dominates the global functional textiles market with a 45% share in 2024, led by China, India, Japan, and South Korea. The region’s leadership is attributed to its massive manufacturing scale, export competitiveness, and expanding domestic consumption of sportswear and technical textiles. Shifting supply chains, from China to Vietnam, Bangladesh, and Turkey, continue to reshape cost dynamics and production hubs. India, supported by government initiatives such as the National Technical Textiles Mission, is emerging as the fastest-growing country in the region.

Key drivers for regional growth include cost-efficient production, robust raw material availability, and rising regional demand for athleisure and performance wear. Moreover, the integration of smart textiles into consumer electronics and defense applications is accelerating adoption. APAC’s expanding infrastructure projects are also bolstering the demand for industrial and geotextiles, positioning it as the global growth engine for functional textiles.

North America

North America accounts for approximately 20% of the global market in 2024, underpinned by high R&D intensity, technological innovation, and government procurement in defense and healthcare sectors. The United States remains a leading importer of high-performance and smart textiles, particularly those used in medical PPE, protective clothing, and wearable devices.

Regional growth is primarily driven by strong investment in smart and conductive textiles for healthcare monitoring and defense applications, alongside widespread adoption by major performance apparel brands. Advanced materials featuring embedded sensors, temperature control, and energy harvesting capabilities are seeing accelerated commercialization due to R&D funding and collaborations between textile manufacturers, defense agencies, and technology firms. The growing presence of sustainable and recyclable textile technologies also aligns with evolving consumer preferences for eco-conscious performance wear.

Europe

Europe commands around 18% of the global functional textiles market, anchored by strict environmental regulations and a strong sustainability mandate. The region’s textile innovation ecosystem, led by Germany, the U.K., Italy, and France, focuses on biodegradable fibers, fluorine-free water-repellent treatments, and recyclable high-performance materials. European standards continue to push global performance benchmarks for protective wear and eco-label compliance.

Market growth in Europe is driven by regulatory pressure and consumer preference for sustainable, certified textiles. Initiatives promoting circular textile economies and local reindustrialization under EU sustainability frameworks are fostering the production of functional, eco-engineered fabrics. The growing adoption of technical textiles in construction, defense, and automotive sectors, combined with strong R&D investments, supports Europe’s continued leadership in high-value, innovation-driven textile applications.

Latin America

Latin America holds roughly 8% of the global market, with Brazil, Mexico, and Argentina at the forefront of regional growth. The region’s functional textiles adoption is accelerating due to urbanization, rising sportswear demand, and expanding industrial and healthcare sectors. Brazil’s textile industry is modernizing rapidly, emphasizing imports of high-performance fabrics and the local production of treated cotton blends suited for tropical climates.

Regional growth drivers include increasing industrialization, automotive sector development, and demand for affordable performance fabrics. Infrastructure growth across Latin America is boosting the consumption of technical textiles for filtration, construction, and protective applications. Although the market remains smaller than APAC or North America, rising middle-class spending on branded apparel and functional sportswear presents strong upside potential.

Middle East & Africa (MEA)

The Middle East & Africa (MEA) region accounts for approximately 9% of global functional textile revenues, with the UAE, Saudi Arabia, and South Africa as key markets. MEA exhibits some of the fastest regional growth rates, supported by massive infrastructure development, extreme climatic conditions, and growing healthcare and defense investments.

Drivers include demand for UV-protective and flame-retardant textiles suited for hot, arid environments, alongside increasing use of geotextiles in construction and civil engineering projects. Government diversification programs, such as Saudi Arabia’s Vision 2030 and the UAE’s manufacturing initiatives, are attracting foreign investments in local textile production. Rising awareness of occupational safety and climate-adaptive materials in oil & gas, construction, and military sectors is also propelling MEA’s functional textiles demand trajectory.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Functional Textiles Market

- BASF SE

- The Dow Chemical Company

- Huntsman Corporation

- Evonik Industries AG

- Covestro AG

- Sumitomo Chemical Co., Ltd.

- Wacker Chemie AG

- Schoeller Technologies AG

- CHT Group

- Tanatex Chemicals B.V.

- Zschimmer & Schwarz GmbH

- Schoeller Textil AG

- Kapp-Chemie GmbH

- Tepar Tekstil Sanayi ve Ticaret A.S.

- Evonik Performance Materials division

Recent Developments

- In June 2025, BASF SE announced an expansion of its sustainable textile finishing chemicals line, introducing bio-based repellents for high-performance fabrics.

- In April 2025, Huntsman Corporation launched an advanced antimicrobial treatment designed for hospital and PPE applications, offering extended wash durability.

- In March 2025, Schoeller Technologies AG unveiled a new generation of temperature-adaptive smart fabrics that respond dynamically to user body heat, aimed at sportswear and outdoor apparel manufacturers.