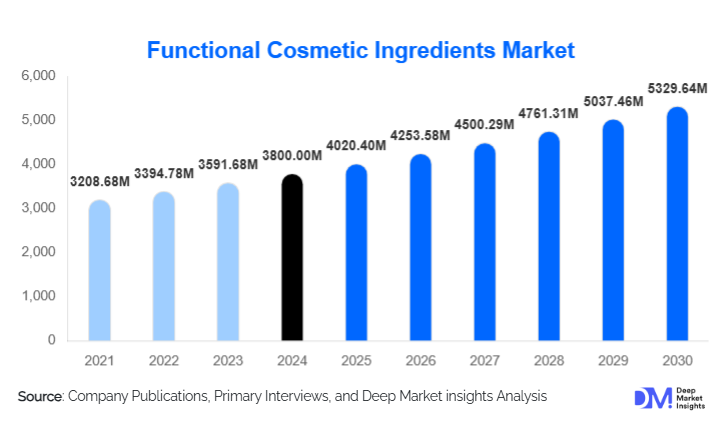

Functional Cosmetic Ingredients Market Size

According to Deep Market Insights, the global functional cosmetic ingredients market size was valued at USD 3,800 million in 2024 and is projected to grow from USD 4,020.40 million in 2025 to reach USD 5,329.64 million by 2030, expanding at a CAGR of 5.8% during the forecast period (2025–2030). The market growth is primarily driven by increasing consumer demand for multifunctional skincare, rising interest in clean and sustainable beauty products, and technological innovations in bioactive ingredients and delivery systems.

Key Market Insights

- Functional cosmetic ingredients are increasingly focused on bio-based and biotechnology-derived actives, offering enhanced efficacy, sustainability, and clean-label appeal to consumers.

- Skin care products dominate the application segment, with serums, creams, and moisturizers accounting for the largest share of ingredient usage worldwide.

- Asia-Pacific is emerging as the fastest-growing region, led by rising disposable incomes, digital-native beauty brands, and local formulation innovations in China, South Korea, and India.

- North America maintains a significant market share, driven by strong R&D infrastructure, premium cosmetic brands, and high consumer awareness of active ingredients.

- Technological integration, such as encapsulation, peptide delivery systems, and fermentation-derived actives, is shaping innovation and adoption in the market.

- Consumer education and clinical validation are becoming key differentiators, with brands seeking proven efficacy to justify premium pricing and build trust.

What are the latest trends in the functional cosmetic ingredients market?

Bio-Based and Biotechnology-Derived Actives

Functional cosmetic ingredients are increasingly sourced from bio-based and biotechnology-derived processes. Fermentation, microbial synthesis, and enzymatic production are enabling high-purity peptides, antioxidants, and barrier-repair lipids that meet consumer demand for sustainability and performance. These innovations also reduce reliance on petrochemical or resource-intensive raw materials, offering cleaner, eco-friendly solutions while enhancing product efficacy. Ingredient suppliers are investing in biotech R&D and scaling up production, allowing cosmetic formulators to incorporate high-potency actives with minimal environmental impact.

Clean Beauty and Sustainability Integration

Consumer preference for clean, natural, and environmentally sustainable products is driving formulation changes. Brands are focusing on certified natural extracts, plant-based actives, and biodegradable carriers. Sustainability extends beyond ingredient sourcing to packaging, production methods, and carbon footprint reduction. This trend encourages functional ingredient manufacturers to innovate with renewable feedstocks, eco-friendly encapsulation, and green chemistry technologies while differentiating their offerings in competitive markets.

What are the key drivers in the functional cosmetic ingredients market?

Rising Demand for Multifunctional Products

Consumers increasingly seek products that deliver multiple skin benefits, including hydration, anti-aging, brightening, and UV protection. This drives cosmetic brands to incorporate high-performance functional ingredients such as peptides, ceramides, and antioxidants into formulations. Multifunctional actives allow brands to differentiate products and justify premium pricing, supporting growth for ingredient manufacturers supplying these actives.

Technological Innovation in Ingredient Delivery

Advances in encapsulation, nano-carriers, and smart delivery systems are enhancing the stability, penetration, and efficacy of cosmetic actives. These technologies improve consumer outcomes while enabling formulators to create sophisticated products. The integration of such innovations is accelerating the adoption of functional ingredients, particularly in anti-aging and skin-repair products.

Consumer Awareness and Education

With increased access to information, consumers are demanding clinically validated, science-backed cosmetic ingredients. Ingredient companies are investing in trials, safety documentation, and consumer education to support their claims. Brands using validated ingredients gain trust, loyalty, and the ability to charge premium prices, further fueling the functional ingredients market.

What are the restraints for the global market?

Regulatory Challenges

Stringent and varying regulatory requirements across regions, especially for novel actives, pose challenges. Safety testing, claim substantiation, and compliance with cosmetic regulations (e.g., EU Cosmetics Regulation, FDA guidelines) can delay market entry and increase costs. Smaller companies may struggle with these requirements, limiting innovation adoption.

High R&D and Manufacturing Costs

Developing functional ingredients requires extensive research, testing, and process scale-up, resulting in higher costs. Premium actives such as peptides, biofermented compounds, or advanced encapsulation systems have higher production costs, which can restrict accessibility for smaller cosmetic brands and emerging markets.

What are the key opportunities in the functional cosmetic ingredients industry?

Expansion in Emerging Markets

Asia-Pacific, led by China, South Korea, and India, presents strong growth opportunities due to rising disposable income, urbanization, and digital-native beauty brands. Local ingredient production, partnerships with cosmetic brands, and formulations tailored to regional skin concerns allow manufacturers to capture expanding demand.

Innovation in Bio-Based Ingredients

There is a growing opportunity for companies to develop bio-based, fermented, and sustainable actives. These ingredients meet rising consumer demand for clean and eco-friendly products while providing differentiation in a competitive market. Biotech innovations such as microbial peptides and enzyme-derived actives are particularly promising.

Clinical Validation and Consumer Education

Providing clinically validated data for ingredient efficacy strengthens consumer trust and allows premium positioning. Ingredient manufacturers can support brand partners with testing, white papers, and education campaigns, enabling the adoption of high-performance actives and encouraging premium pricing strategies.

Product Type Insights

Emollients and moisturizers dominate ingredient types, accounting for approximately 28–30% of the market. Antioxidants, peptides, and UV filters are also key contributors. Multifunctional ingredients are increasingly preferred, offering hydration, anti-aging, and barrier-repair benefits in a single formulation. Bio-based and fermentation-derived actives are rapidly gaining traction due to sustainability and high efficacy.

Application Insights

Skin care remains the primary application, with serums, creams, and moisturizers consuming the majority of functional ingredients. Hair care, sun care, color cosmetics, and oral care are secondary applications seeing growth. Photoprotective, anti-aging, and brightening actives are highly demanded across formulations. Professional channels, including dermatology clinics and spas, are adopting high-potency actives for clinical-grade treatments.

Distribution Channel Insights

Retail cosmetic brands dominate ingredient consumption, representing 60–70% of the market. DTC and digital-native brands are growing fastest due to increased consumer access, transparency, and customization options. Contract manufacturers and professional channels also drive ingredient demand. Export-led trade from North America and Europe to emerging APAC markets is an important growth driver.

End-Use Insights

Premium and mass-market skincare brands are the largest consumers of functional cosmetic ingredients. Fastest growth is observed among digital-native brands offering targeted, clinically validated formulations. Emerging applications include hair care for scalp health, oral care, and men’s grooming products, expanding the addressable market.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for roughly 30–38% of the market, led by the U.S. High consumer awareness, R&D infrastructure, and premium brand adoption drive demand. Consumers prioritize anti-aging, hydration, and multifunctional products, with a strong preference for validated and sustainable ingredients.

Europe

Europe holds approximately 25–30% of the market, with Germany, France, and the U.K. leading adoption. Regulatory frameworks encourage safe and high-quality ingredients. Luxury and clean-beauty brands drive demand for bioactive ingredients and multifunctional formulations.

Asia-Pacific

Asia-Pacific is the fastest-growing region with a 35–40% share. China and India lead consumption, driven by rising incomes, local bioactive innovations, and digital brand growth. South Korea emphasizes peptide and fermented actives in K-beauty, while Japan focuses on clinical efficacy and innovative delivery systems.

Latin America

Latin America represents 5–8% of the market. Brazil, Argentina, and Mexico are key consumers, favoring adventure- and wellness-focused skincare trends, with premium imports from North America and Europe contributing to growth.

Middle East & Africa

MEA holds 3–6% of the market. GCC countries such as the UAE and Saudi Arabia show high demand for luxury skincare products incorporating advanced functional ingredients. Africa is both a production hub for botanical extracts and an emerging consumer base for premium cosmetics.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Functional Cosmetic Ingredients Market

- BASF SE

- Givaudan SA

- Lonza Group Ltd.

- Croda International Plc

- Evonik Industries AG

- Merck KGaA

- Clariant International Ltd.

- Symrise AG

- Inolex

- DSM Nutritional Products

- Seppic

- Lubrizol Corporation

- Ashland Inc.

- Solvay SA

- Elementis

Recent Developments

- In 2025, BASF announced the expansion of its bioactive peptide production facilities in Europe, targeting high-demand anti-aging formulations.

- In 2025, Givaudan launched a new line of fermented botanical actives aimed at APAC cosmetic brands, emphasizing sustainability and clean-beauty positioning.

- In 2024, Lonza completed the acquisition of a biotech startup specializing in skin barrier repair actives, enhancing its clinical-grade ingredient portfolio.