Functional Apparel Market Size

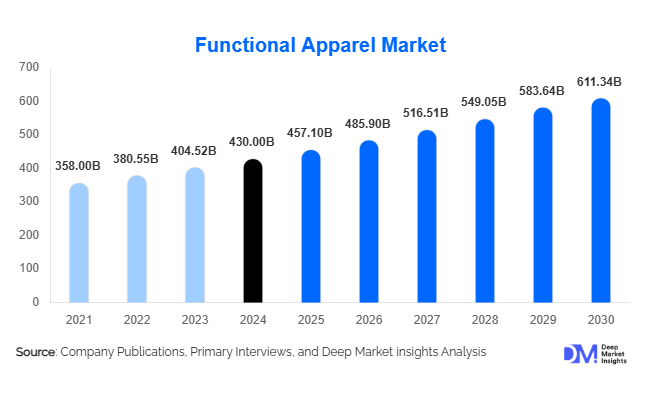

According to Deep Market Insights, the global functional apparel market size was valued at USD 430 billion in 2024 and is projected to grow from USD 457.1 billion in 2025 to reach USD 611.34 billion by 2030, expanding at a CAGR of 6.3% during the forecast period (2025–2030). Growth is being driven by rising fitness participation, technological innovation in textiles, increasing adoption of athleisure, and the emergence of smart and sustainable apparel solutions across both consumer and industrial segments.

Key Market Insights

- Functional apparel is transforming from niche performance wear into mainstream fashion, integrating technology, comfort, and sustainability.

- Sportswear and athleisure jointly dominate the product mix, accounting for around 40% of total global revenues in 2024.

- Asia Pacific is the fastest-growing region, driven by expanding middle-class populations, urbanization, and rising sports participation in China and India.

- North America leads in total market share, representing about 30–35% of global revenues due to high brand penetration and innovation leadership.

- Smart textiles and connected wearables are redefining product design, integrating biometric sensors and adaptive materials for next-generation apparel.

- Protective and medical functional apparel segments are emerging strongly, supported by stricter workplace safety regulations and healthcare demand.

Latest Market Trends

Smart and Connected Textiles: Redefining Functionality

Smart textiles integrating biometric sensors, phase-change materials, and nanotechnology are shifting functional apparel beyond traditional performance fabrics. These garments monitor physiological metrics such as heart rate, temperature, and muscle strain, creating new synergies between fashion and health technology. Leading sportswear brands are partnering with tech companies to develop AI-powered clothing ecosystems, enabling data-driven insights and personalized fitness experiences. This convergence is positioning functional apparel as a critical component of the broader wearable technology market.

Sustainability and Circular Manufacturing

Environmental consciousness is influencing product design and sourcing. Companies are investing in recycled fibers, biodegradable coatings, and traceable supply chains to align with sustainability expectations. Repreve polyester, organic cotton, and eco-dyed fabrics are increasingly being adopted, while brands emphasize carbon-neutral production and closed-loop recycling programs. These initiatives not only reduce environmental impact but also enhance brand equity among eco-aware consumers. Sustainability has thus evolved from a differentiator into a prerequisite for market competitiveness.

Functional Apparel Market Drivers

Rising Health and Fitness Awareness

Global participation in fitness and recreational sports has surged, fueled by health awareness and social media’s influence on active lifestyles. Consumers are seeking performance-oriented apparel that provides comfort, moisture management, and durability during physical activity. The fusion of fashion and fitness has led to the explosive growth of athleisure, blurring boundaries between gym and casual wear, and broadening the functional apparel consumer base.

Technological Innovation in Fabrics and Finishes

Advances in textile engineering have introduced next-generation materials offering temperature regulation, antimicrobial protection, and enhanced stretchability. Phase-change fabrics, nano-finishes, and graphene-based coatings are improving product durability and comfort. These innovations justify premium pricing and attract both performance athletes and mainstream consumers seeking technologically advanced apparel.

Expansion of E-Commerce and Direct-to-Consumer Channels

Online retail and D2C models are accelerating functional apparel accessibility. Digital platforms allow brands to offer customization, virtual try-ons, and AI-based recommendations, thereby increasing conversion rates. The pandemic-driven shift to online shopping has permanently expanded the consumer reach of functional apparel, allowing even niche performance brands to achieve global scale efficiently.

Market Restraints

High Product Costs and Raw Material Volatility

Advanced fabrics and smart textiles entail higher production costs, which constrain affordability in price-sensitive markets. Raw material volatility, especially in synthetic fibers like polyester and spandex, further compresses manufacturer margins. Balancing high-performance innovation with cost-effective scalability remains a major challenge for producers.

Limited Consumer Awareness in Emerging Economies

In developing regions, consumers often lack understanding of the tangible benefits of functional apparel. Without education on its long-term comfort and durability advantages, adoption can be limited to premium or urban segments. Targeted marketing, influencer collaborations, and experiential retail are needed to enhance consumer engagement and awareness.

Functional Apparel Market Opportunities

Smart Wearable Integration

The convergence of apparel and electronics presents a lucrative frontier. Embedding sensors, Bluetooth modules, and conductive fibers into garments enables continuous health monitoring and athletic performance tracking. Partnerships between sportswear giants and technology startups are expected to drive a new category of data-centric functional apparel with subscription-based service models.

Emerging Market Expansion

Asia-Pacific, Latin America, and parts of Africa offer high-growth potential due to rising disposable incomes, youthful demographics, and increasing adoption of fitness culture. Localization strategies, adapting designs to climate, lifestyle, and cultural preferences, will allow global brands to capture untapped consumer bases. Government initiatives promoting domestic textile manufacturing further amplify opportunities for regional production hubs.

Industrial and Healthcare Applications

Functional apparel for occupational and medical use is becoming a high-value B2B segment. Regulatory emphasis on worker safety and infection control has accelerated the adoption of flame-resistant, antimicrobial, and compression garments in industries and hospitals. Manufacturers that achieve compliance with stringent standards (such as EN ISO 20471 or ASTM F1506) can secure long-term institutional contracts and diversify revenue streams beyond consumer retail.

Product Type Insights

Sportswear dominates the global functional apparel market, representing roughly 40% of 2024 revenues. Its leadership is driven by widespread athletic participation, everyday fitness routines, and the popularity of sports events. Synthetic fabrics such as polyester-spandex blends offer breathability, stretch, and quick-dry properties, making them ideal for high-performance sportswear. Innovation in compression garments, temperature-control fabrics, and moisture-management finishes continues to sustain this segment’s global prominence, addressing consumer demand for comfort during intensive workouts.

Activewear/Athleisure is rapidly growing due to lifestyle adoption trends that blend performance and fashion. Consumers increasingly wear athleisure outside of gyms, creating crossover demand for versatile apparel that combines style, functionality, and everyday comfort.

Protective/Workwear maintains steady demand, primarily driven by regulatory and workplace safety compliance in industrial, oil & gas, and construction sectors. Flame-resistant, chemical-protective, and high-visibility garments are essential for occupational safety, and their adoption is further accelerated by regional workplace safety standards, particularly in Europe and North America.

Outdoor & Adventure Apparel benefits from rising adventure tourism, hiking, and outdoor participation. Emphasis on durability, lightweight fabrics, and thermal insulation ensures protection across different climates, supporting demand in both developed and emerging markets.

Smart / e-Textiles are gaining traction as sensor miniaturization and health-monitoring applications become mainstream. Smart apparel integrates wearable technology for fitness tracking, medical monitoring, and performance analysis, aligning with North America and Asia-Pacific’s tech-forward consumer base.

Fabric and Function Insights

Specialty synthetic fabrics (nylon, polyester, elastane) lead the market due to cost-effective scalability, consistent performance, and versatility. Moisture-management finishes account for around 35% of functional apparel revenues, addressing consumer preferences for comfort during intensive training. Thermal insulation, UV-protection, and antimicrobial/odor-control features further enhance garment functionality. Flame and chemical-resistant fabrics are key in protective/workwear segments, particularly in industrial and defense markets. Smart textiles with embedded electronics are increasingly adopted for health-monitoring and IoT-connected use cases, driving premium product growth.

End-Use Insights

Sports and fitness applications represent roughly 40% of overall demand, supported by gym culture, running, cycling, and outdoor recreation. Healthcare and industrial protective apparel are the fastest-growing segments, projected to register double-digit growth through 2030. Aging populations, clinical use cases for compression garments, and stricter occupational safety regulations are driving demand. Export-driven manufacturing in the Asia-Pacific continues to supply North American and European markets, highlighting the strategic role of cross-border trade in functional apparel expansion.

| By Product Type | By Fabric & Technology | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 30–35% of the 2024 global functional apparel market. Growth is primarily fueled by a strong athleisure and fitness culture, early adoption of smart apparel (wearable integration), and mature direct-to-consumer (DTC) channels. The U.S. leads due to entrenched brand presence, high disposable income, and technological innovation. Segments such as smart/e-textiles and activewear are particularly strong, supported by consumer interest in data-driven health monitoring and lifestyle-driven apparel. Online DTC platforms accelerate rapid adoption and allow brands to showcase advanced product features directly to consumers.

Europe

Europe accounts for 20–25% of global revenues, with the U.K., Germany, and France leading demand. Regulatory and workplace safety standards drive protective apparel adoption in industrial and occupational segments. Sustainability consciousness is another critical driver, pressuring manufacturers to use eco-friendly and ethically sourced materials. Segments such as protective/workwear and recycled-material sportswear are performing strongly. European consumers prioritize quality, environmental impact, and compliance with certifications, boosting growth for premium and mid-range sustainable functional apparel.

Asia-Pacific

Asia-Pacific is the fastest-growing region, representing around 30–35% of global market value in 2024. Rising disposable incomes, urbanization, and an expanding middle class drive demand for mid-market scalable products. China and India are central to both production and consumption, leveraging strong textile manufacturing bases to serve domestic and export markets. Segments such as sportswear, mid-range athleisure, and protective apparel benefit from increasing fitness participation, adventure tourism, and industrial compliance requirements. Government initiatives, export incentives, and large-scale textile infrastructure further strengthen regional competitiveness.

Latin America

Latin America contributes approximately 5–8% of the global market, with Brazil and Mexico as emerging hubs. Growth is driven by increasing fitness participation, growing online retail penetration, and rising awareness of functional apparel benefits. Price sensitivity remains a key factor, making value-performance products highly appealing. Segments such as mid-range sportswear and athleisure are leading due to affordability and lifestyle adoption. Online channels are critical in reaching younger, urban consumers.

Middle East & Africa

MEA holds roughly 5–6% of the global market in 2024. Rising disposable incomes in GCC countries, combined with climate-driven demand for UV/heat-protective and breathable technical clothing, drive growth. The nascent fitness market is also expanding, particularly in urban centers such as the UAE and Saudi Arabia. Outdoor apparel and smart/e-textile segments are benefiting from both climate considerations and emerging wellness trends. Investments in local textile manufacturing and strategic brand expansions further contribute to market development.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Functional Apparel Market

- Nike Inc.

- Adidas AG

- Under Armor Inc.

- Puma SE

- ASICS Corporation

- Lululemon Athletica Inc.

- Columbia Sportswear Company

- VF Corporation

- Gap Inc.

- Hanesbrands Inc.

- Amer Sports

- X-Bionic AG

- Jockey International Inc.

- Salomon Group

- Decathlon S.A.

Recent Developments

- March 2025 - Nike introduced its first fully recyclable performance shoe-apparel hybrid line, integrating smart temperature-control fibers.

- February 2025 - Adidas expanded its “Made to Be Remade” program to include recycled functional activewear across Asia-Pacific markets.

- January 2025 - Lululemon launched a biometric yoga apparel collection that tracks muscle activity and posture using embedded sensors.