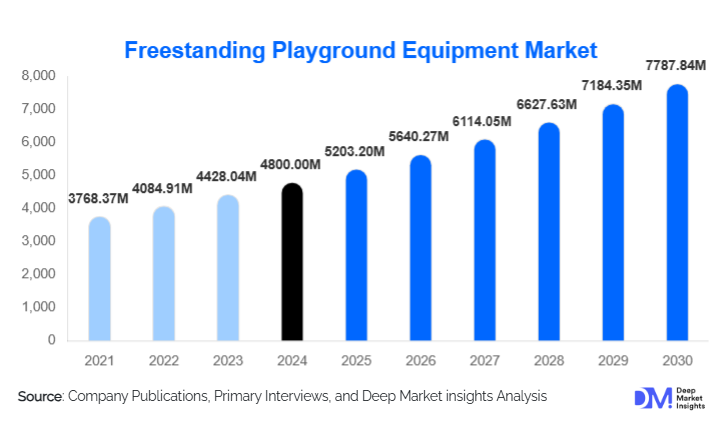

Freestanding Playground Equipment Market Size

According to Deep Market Insights, the global freestanding playground equipment market size was valued at USD 4,800 million in 2024 and is projected to grow from USD 5,203.20 million in 2025 to reach USD 7,787.84 million by 2030, expanding at a CAGR of 8.4% during the forecast period (2025–2030). The market growth is primarily driven by increasing government initiatives to promote children’s outdoor activities, rising awareness of physical and cognitive development benefits through play, and the growing adoption of innovative and modular playground equipment in schools, parks, and residential complexes globally.

Key Market Insights

- Urbanization and community development projects are fueling demand for playground infrastructure, particularly in emerging economies, creating opportunities for both public and private sector players.

- Technological integration, including interactive and sensory play panels, is transforming traditional playground equipment into educational and cognitive development tools for children.

- Safety standards and certifications are increasingly shaping purchasing decisions, ensuring that products meet stringent durability, material, and design regulations.

- Outdoor playground installations dominate the market, while indoor play areas in commercial complexes and schools are witnessing steady growth.

- Asia-Pacific is emerging as the fastest-growing region, driven by rising population, urban infrastructure expansion, and government funding for early childhood development programs.

- Eco-friendly and sustainable materials, including recycled plastics and treated wood, are becoming preferred choices for playground manufacturers, reflecting consumer and regulatory trends.

What are the latest trends in the freestanding playground equipment market?

Integration of Educational and Interactive Play

Modern freestanding playground equipment increasingly incorporates educational elements such as interactive panels, musical instruments, and sensory-focused designs. These innovations help children develop cognitive and motor skills while playing. Schools and daycare centers are prioritizing equipment that combines learning with physical activity, leading to greater adoption of educational playground structures. Integration of digital elements, such as AR-enabled learning games and QR-code-based storytelling, is also gaining traction, particularly in technologically advanced regions like North America and Europe.

Focus on Safety and Compliance

Safety regulations and certifications are becoming a critical factor in playground equipment design and adoption. Manufacturers are focusing on anti-slip surfaces, soft-fall impact zones, rounded edges, and non-toxic materials to comply with international standards such as ASTM, EN 1176, and ISO certifications. These safety-focused designs increase buyer confidence, particularly in schools, public parks, and commercial installations, thereby driving market growth.

What are the key drivers in the freestanding playground equipment market?

Government and Municipal Investments

Governments worldwide are investing heavily in public parks, recreational spaces, and school playgrounds to promote child health, physical fitness, and community engagement. Initiatives such as “Playgrounds for All” in the U.S., and municipal development programs in China and India, are supporting large-scale procurement of playground equipment, thereby driving market growth.

Rising Awareness of Child Development

Parents and educators are increasingly recognizing the role of playgrounds in holistic child development, including physical health, social skills, and problem-solving abilities. This awareness is boosting demand for age-specific playground structures and innovative equipment that promotes interactive learning and physical activity.

Technological Advancements and Modular Designs

Modular and customizable playground solutions are becoming popular, allowing installations to be tailored to varying space, age group, and budget requirements. Integration of technology-driven play panels, musical equipment, and motion-based interactive games is attracting both schools and recreational centers to adopt advanced freestanding playground solutions.

What are the restraints for the global market?

High Initial Capital Investment

Premium playground equipment, especially those with advanced interactive panels or modular structures, requires substantial upfront investment, limiting adoption among smaller schools or local communities with restricted budgets. Maintenance costs, including periodic safety checks and component replacements, add to the financial burden.

Space Constraints in Urban Areas

Urban densification and limited available open spaces pose challenges for large-scale playground installations. Compact or indoor playground solutions are increasingly preferred, but these often offer limited play variety, potentially reducing overall market growth.

What are the key opportunities in the freestanding playground equipment industry?

Expansion in Emerging Economies

Rapid urbanization in countries such as India, China, and Brazil is creating significant opportunities for playground equipment providers. Governments and private developers are investing in public parks, schools, and residential communities, offering growth potential for both domestic and international manufacturers. The rising population of children and increased focus on early childhood education are further amplifying demand.

Integration of Smart and Interactive Play Equipment

Smart playgrounds with AR/VR features, interactive educational panels, and sensor-based equipment are gaining popularity. These technologically advanced installations provide unique experiences that blend play with learning and fitness, offering a high-value proposition for premium buyers. Companies integrating IoT-enabled monitoring and adaptive play designs can differentiate their offerings and capture a larger share of the market.

Eco-Friendly and Sustainable Product Development

With growing environmental awareness, demand for playground equipment made from recycled plastics, sustainable timber, and non-toxic materials is rising. Governments and educational institutions are increasingly mandating eco-compliant designs, creating an opportunity for manufacturers to develop green-certified products that align with both regulatory requirements and consumer preferences.

Product Type Insights

Slides dominate the global freestanding playground equipment market, accounting for approximately 28% of the 2024 market. The popularity of slides is driven by their universal appeal to children of all ages, ease of installation, and compatibility with modular play structures. Swings follow closely at 20%, driven by their adaptability to both public parks and private residential areas. Climbing equipment is gaining momentum due to increasing focus on motor skill development, while interactive play panels are witnessing rapid adoption in educational institutions, emphasizing STEM learning through play.

Application Insights

Public parks and recreational areas represent the largest application segment, capturing around 35% of the market in 2024. Educational institutions, particularly schools and preschools, follow at 30%, driven by growing investment in child development infrastructure. Residential communities and commercial establishments, such as hotels and resorts, are emerging applications with high growth potential, especially in urban areas where playground installations enhance community value and tenant satisfaction.

Distribution Channel Insights

Direct sales to schools, municipal bodies, and residential developers dominate the distribution landscape, accounting for approximately 60% of total sales. Online platforms and manufacturer websites are gaining traction, particularly for mid-range and modular equipment. Specialized distributors and installers play a key role in supporting logistics, safety compliance, and after-sales service, particularly in regions with complex import and regulatory requirements.

Age Group Insights

The 6–12 years segment leads demand globally, representing 42% of market share in 2024, due to the popularity of physically engaging and socially interactive equipment such as slides, swings, and climbing structures. The 2–5 years (toddler) segment is steadily growing, supported by daycare and preschool expansions. Playgrounds for teens and universal-age designs are niche, but are witnessing rising adoption in mixed-use residential communities and commercial recreational spaces.

| By Product Type | By Material | By Age Group | By Installation Area | By Sales Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 32% of the 2024 global market, led by the U.S. and Canada. Government spending on public parks, school infrastructure upgrades, and stringent safety regulations drives adoption. Innovative and interactive playground equipment is particularly popular, with a focus on inclusivity and accessibility for children with disabilities.

Europe

Europe holds around 28% of the 2024 market, with Germany, the UK, and France leading demand. Sustainability, safety compliance, and educational play integration are key growth factors. European municipalities are increasingly replacing old equipment with modern, eco-friendly, and interactive installations. Germany is the largest European market due to high urban infrastructure spending and awareness of child development programs.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China, India, and Japan. Rapid urbanization, rising middle-class income, and government initiatives for school and community infrastructure expansion are accelerating adoption. Growth in indoor playground centers, particularly in urban commercial complexes, is complementing outdoor installations.

Latin America

Brazil and Mexico are leading markets in Latin America, focusing on public parks and school playgrounds. Adoption is gradually increasing with urban development projects and rising awareness of child health and recreation.

Middle East & Africa

South Africa, the UAE, and Saudi Arabia are key contributors, driven by residential community projects and urban recreational infrastructure development. The market here is still emerging but growing steadily, particularly in high-income urban areas.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Freestanding Playground Equipment Market

- Kompan A/S

- PlayCore

- Miracle Recreation

- Landscape Structures Inc.

- HAGS

- GameTime

- Proludic

- Little Tikes Commercial

- Park & Playground Solutions

- ABC Recreation

- Belson Outdoors

- UltraPlay

- Playworld

- SportsPlay Equipment

- Playdale Playgrounds

Recent Developments

- In March 2025, Kompan launched a new eco-friendly modular playground system in Europe using recycled HDPE and stainless steel, targeting schools and municipalities.

- In January 2025, PlayCore expanded its interactive digital play panel line in North America, integrating AR and sensory play elements for educational institutions.

- In July 2024, Miracle Recreation opened a new manufacturing facility in India to serve the growing APAC market with customized playground equipment for urban communities.