Four-Side Flat Pouch Market Size

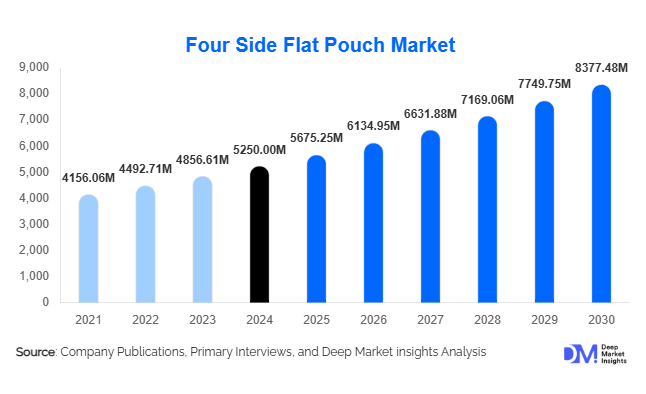

According to Deep Market Insights, the global four-sided flat pouch market size was valued at USD 5,250 million in 2024 and is projected to grow from USD 5,675.25 million in 2025 to reach USD 8,377.48 million by 2030, expanding at a CAGR of 8.1% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for convenient, resealable, and sustainable packaging solutions across food, beverage, pharmaceutical, and personal care industries, coupled with increasing e-commerce penetration and urbanization.

Key Market Insights

- Food and beverage applications dominate the market, particularly snacks, coffee, dairy, and frozen foods, accounting for a significant share of global demand.

- Pharmaceutical and personal care sectors are adopting high-barrier four-sided flat pouches for safety, tamper-evidence, and extended shelf-life requirements.

- North America and Europe hold the largest market shares, driven by mature retail infrastructure and advanced packaging technologies.

- Asia-Pacific is the fastest-growing region, led by rising middle-class income, urbanization, and retail modernization in India, China, and Southeast Asia.

- Sustainable and biodegradable pouches are gaining traction, fueled by increasing regulatory mandates and consumer preference for eco-friendly packaging.

- Technological innovations, including smart packaging with QR codes and RFID tags, are enhancing traceability and consumer engagement.

Latest Market Trends

Sustainability and Eco-Friendly Packaging

Manufacturers are increasingly adopting biodegradable, recyclable, and compostable materials to align with growing environmental regulations and consumer demand. Companies are innovating mono-material and eco-laminate pouches to overcome recycling challenges posed by multi-layer designs. Sustainable packaging not only reduces environmental impact but also serves as a strong differentiator in retail branding and marketing, particularly in the food and personal care segments.

Technological Integration in Packaging

Smart packaging solutions, including QR codes, RFID-enabled pouches, and tamper-evident features, are becoming mainstream. These technologies improve supply chain traceability, enhance product authenticity, and engage consumers through digital content. Pharmaceutical and high-value food products increasingly rely on these innovations to maintain quality assurance and brand trust. Digital printing technologies also allow for on-demand, personalized packaging, which is gaining popularity among premium brands.

Four Side Flat Pouch Market Drivers

Convenience and Portability

Four-sided flat pouches offer lightweight, resealable, and easy-to-store packaging, making them ideal for on-the-go consumers. This convenience is driving adoption in retail and e-commerce channels, especially in single-serve food products and liquid packaging.

Growth in FMCG and E-Commerce

Rapid expansion of FMCG products, combined with e-commerce penetration, is boosting demand for durable, attractive, and lightweight packaging. Retailers prefer pouches for their shelf appeal, cost-effective shipping, and reduced logistics challenges.

Superior Barrier Properties

Advanced laminated films and aluminum foils protect products from moisture, oxygen, and UV exposure, extending shelf life. This is critical for pharmaceuticals, coffee, dairy, and snack foods, ensuring product quality from manufacturer to consumer.

Market Restraints

Fluctuating Raw Material Prices

The cost of polymers, aluminum, and laminates is volatile, influenced by global crude oil and metal markets. These fluctuations can increase production costs and affect profit margins for manufacturers.

Recycling Challenges

Multi-layer pouches, while offering excellent barrier properties, are difficult to recycle. Regulatory pressure in Europe and North America requires companies to adopt recyclable or mono-material solutions, demanding technological investments and innovation.

Four Side Flat Pouch Market Opportunities

Expansion in Emerging Economies

Emerging regions such as India, Southeast Asia, and Latin America offer significant growth potential. Rising disposable income, urbanization, and modernization of retail channels drive higher adoption of four-sided flat pouches, particularly for food, beverages, and personal care products.

Smart Packaging Integration

Integration of QR codes, RFID tags, and tamper-evident technologies presents opportunities for manufacturers to enhance supply chain traceability, engage consumers digitally, and secure premium pricing. This is especially relevant for pharmaceuticals, nutraceuticals, and premium food products.

Government Initiatives and Trade Policies

Programs like “Make in India” and other regional incentives promote domestic manufacturing and exports. Companies can leverage these policies to scale production, reduce costs, and enter new markets more effectively.

Material Type Insights

Plastic-based pouches, particularly polyethylene and laminated films, dominate the market, accounting for approximately 55% of the global market in 2024. Plastic offers cost-effectiveness, durability, and superior barrier properties. Aluminum foil pouches are preferred for high-value applications like pharmaceuticals and coffee, holding around 20% market share, while paper-based and biodegradable options are growing due to sustainability trends.

Application Insights

Food & beverage applications dominate the market, contributing nearly 60% of total demand in 2024. Snacks, coffee, dairy, and frozen foods are leading sectors. Pharmaceutical and healthcare applications account for around 15%, while personal care, cosmetics, and industrial chemicals occupy the remaining share. Growth in e-commerce and convenience packaging is further driving adoption in food and beverage categories.

Distribution Channel Insights

Modern retail, including supermarkets and hypermarkets, contributes approximately 40% of the market. E-commerce and online platforms are rapidly growing due to convenience and packaging suitability for shipping. Traditional retail and B2B channels account for the remaining share. Digital marketing and direct-to-consumer packaging strategies are increasingly influencing distribution trends.

| By Material Type | By Closure Type | By Application / End Use Industry | By Packaging Size | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for around 28% of the global market in 2024, led by the U.S. and Canada. Strong retail infrastructure, technological adoption, and high consumer awareness drive market dominance. Demand is primarily from food, beverage, and pharmaceutical applications.

Europe

Europe represents 25% of the market in 2024, with Germany, France, and the U.K. as major contributors. Sustainability regulations, consumer preference for eco-friendly packaging, and mature e-commerce channels support growth. The region emphasizes recyclable and biodegradable solutions.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by India, China, and Japan. Rapid urbanization, rising disposable income, and expansion of modern retail channels are key factors. Market share is expected to increase significantly by 2030 due to rising demand for packaged food, personal care, and pharmaceutical products.

Latin America

Brazil, Mexico, and Argentina are the primary markets. Growth is driven by urbanization, retail modernization, and increasing disposable income, though overall market size remains smaller compared to North America and Europe.

Middle East & Africa

Demand is centered in South Africa, the UAE, and Saudi Arabia. The market benefits from industrial growth, foodservice expansion, and the adoption of premium packaged products. Intra-regional trade and investment in manufacturing infrastructure are expected to drive further growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

- Amcor

- Bemis Company

- Sealed Air

- Berry Global

- Huhtamaki

- TC Transcontinental

- Winpak

- Printpack

- Uflex Ltd.

- Schur Flexibles

- Constantia Flexibles

- ProAmpac

- Coveris

- Klöckner Pentaplast

- Sonoco Products Company

Recent Developments

- In March 2025, Amcor launched new biodegradable four-sided flat pouches in Europe, targeting food and beverage applications.

- In February 2025, Uflex Ltd. expanded its smart packaging solutions, including QR-coded and tamper-evident pouches for pharmaceutical products.

- In January 2025, Berry Global introduced high-barrier laminated pouches for frozen foods in North America, enhancing shelf-life and durability.