Football Shoes Market Size

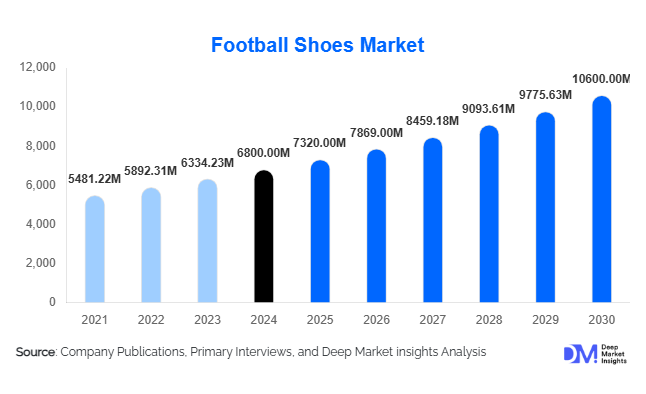

According to Deep Market Insights, the global football shoes market size was valued at USD 6,800 million in 2024 and is projected to grow from USD 7,320 million in 2025 to reach USD 10,600 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). The football shoes market growth is primarily driven by the rising global popularity of football, the increasing adoption of advanced performance footwear technologies, the expansion of synthetic turf fields, and growing youth engagement in the sport worldwide.

Key Market Insights

- Firm Ground (FG) shoes dominate globally, accounting for approximately 38% of the market in 2024 due to widespread use in professional and amateur leagues.

- Synthetic materials lead the market, holding around 45% share, thanks to affordability, lightweight properties, and rising youth adoption.

- Professional-level footwear drives premium sales, capturing 35% of the market, influenced by endorsements and high-performance requirements.

- Online and e-commerce channels are rapidly expanding, contributing roughly 25% of global sales due to increased digital penetration and direct-to-consumer marketing.

- APAC is the fastest-growing region, driven by India and China, with a CAGR of approximately 9% due to grassroots programs and urban synthetic turf adoption.

- Technological innovations, including lightweight knits, 3D uppers, and stud optimization, are reshaping product development and consumer preferences.

Latest Market Trends

Technologically Advanced Performance Footwear

Manufacturers are increasingly integrating performance-enhancing technologies into football shoes, including lightweight synthetic materials, 3D-knit uppers, and optimized stud configurations. Smart shoes with embedded sensors for tracking foot pressure, movement, and fatigue are emerging in professional and elite segments. These innovations cater to athletes’ performance needs, while also offering high-margin premium products that appeal to brand-conscious consumers.

Growing Youth and Grassroots Adoption

Football participation among youth and amateur players is accelerating, particularly in APAC and LATAM regions. Grassroots programs, football academies, and school leagues are driving demand for both entry-level and mid-tier shoes. Manufacturers are increasingly targeting these segments with affordable, durable, and synthetic shoes, creating strong volume growth opportunities.

Football Shoes Market Drivers

Rising Popularity of Football Worldwide

Football remains the most popular sport globally, with increasing viewership, professional leagues, and international tournaments driving consistent demand for footwear. The sport’s universal appeal spans professional, amateur, and recreational levels, ensuring a stable and growing market base. Growing investment in football infrastructure in emerging economies further supports market expansion.

Technological Innovations and Product Differentiation

Advances in footwear technology, such as lightweight materials, 3D knit uppers, enhanced cushioning, and ankle support systems, have increased performance and comfort. These innovations have spurred growth in premium and professional segments, enabling manufacturers to charge higher prices while meeting professional athletes’ requirements.

Expansion of E-commerce Channels

Digital platforms have transformed the football shoes market, providing access to global consumers and enabling direct-to-consumer sales. E-commerce accounts for approximately 25% of total sales, with growing adoption in APAC and LATAM. Online platforms allow consumers to compare products, read reviews, and access exclusive product launches, enhancing convenience and driving demand.

Market Restraints

High Production Costs

The use of premium materials and advanced technologies increases manufacturing costs, particularly for professional and performance-oriented shoes. This can limit affordability for mass-market consumers, especially in emerging economies, restricting wider adoption.

Competition from Multi-Sport Footwear

Footwear designed for multiple sports competes with football-specific shoes, particularly in casual and youth segments. This competition can slow the growth of specialized football shoes and affect the market share of certain product categories.

Football Shoes Market Opportunities

Smart and Performance-Tracking Footwear

The integration of sensors and wearable technology in football shoes presents an opportunity to differentiate products and add value. Professional and semi-professional players increasingly demand data-driven insights to optimize performance, creating a high-margin niche for technologically advanced footwear.

Expansion in Emerging Markets

Rising football participation in the APAC and LATAM regions offers significant growth potential. Targeting youth programs, school leagues, and sports clubs can drive volume growth for both premium and entry-level products. Increased government support for sports infrastructure further enhances these opportunities.

Sustainable and Eco-Friendly Materials

Manufacturers focusing on recycled, biodegradable, or ethically sourced materials can attract environmentally conscious consumers. The growing trend of sustainability in sports footwear aligns with global ESG initiatives, allowing companies to differentiate their brands while meeting consumer demand for eco-friendly products.

Product Type Insights

Firm Ground (FG) shoes dominate the market due to versatility and widespread use in professional and amateur leagues. Synthetic materials lead in terms of volume, while professional and elite shoes capture premium segments. Youth-focused and entry-level shoes drive volume growth in emerging markets, supporting manufacturers in capturing both value and market share. Online sales and direct-to-consumer distribution are increasingly important across all product types.

Application Insights

The primary applications of football shoes are professional leagues, amateur clubs, and individual consumers. Professional leagues drive premium sales with high-performance footwear. Amateur and youth clubs represent a large-volume segment for synthetic and entry-level shoes. Individual consumers contribute to fashion-oriented and casual usage, with growing adoption in urban areas and among recreational players. Export-driven demand is prominent in North America and Europe, with imported high-end footwear supporting professional and club segments.

Distribution Channel Insights

Online platforms dominate growth due to digital convenience and access to global products. Specialty retail stores cater to professional players and premium consumers. Multi-brand sports retail chains remain significant, particularly in mature markets like Europe and North America. Digital marketing, social media campaigns, and influencer endorsements are increasingly shaping consumer behavior and purchase decisions.

Player Level Insights

Professional and elite players drive premium segment growth, accounting for 35% of the market. Amateur and semi-professional players contribute to mid-tier sales, while youth and grassroots players represent a high-volume segment in emerging markets. Brand endorsements, sponsorship deals, and technological innovations predominantly influence professional players’ purchasing behavior.

Age Group Insights

Players aged 18–30 dominate volume-driven segments due to youth participation programs, casual adoption, and online purchasing trends. Players aged 31–50 represent a significant premium segment, balancing performance requirements with disposable income. Youth players under 18 drive entry-level synthetic shoe adoption, particularly in APAC and LATAM.

| By Type | By Material | By Player Level | By End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 19% of the global market (USD 1,300 million in 2024). Demand is driven by MLS growth, youth leagues, and urban recreational football. Online platforms and specialty stores dominate distribution, and high disposable income supports premium and professional footwear purchases.

Europe

Europe holds the largest share (35%, USD 2,400 million) of the market, with strong adoption of FG shoes and premium brands. Germany, the UK, Spain, and France lead demand. High professional league penetration, football culture, and developed retail channels support growth. Growth rate is moderate (6% CAGR) due to mature market saturation.

Asia-Pacific

APAC is the fastest-growing region (9% CAGR), led by India and China. Expansion is driven by youth football programs, urban synthetic fields, and rising middle-class incomes. Demand includes entry-level, mid-tier, and performance shoes, with e-commerce enabling broader access.

Latin America

Latin America accounts for USD 900 million, led by Brazil and Argentina. Traditional football culture ensures strong FG and SG shoe adoption. Emerging demand is focused on youth programs, amateur clubs, and exports from regional manufacturing hubs.

Middle East & Africa

The Middle East (USD 250 million) shows growing adoption among high-income populations, particularly in the UAE and Saudi Arabia. Africa (USD 450 million) is a growing production hub and supports local football leagues and youth development programs, further fueling demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Football Shoes Market

- Nike

- Adidas

- Puma

- Under Armour

- New Balance

- Mizuno

- Lotto

- Umbro

- Diadora

- Kappa

- Joma

- Kelme

- Concave

- Asics

- Hummel

Recent Developments

- In March 2025, Nike launched a smart football shoe integrating sensors for real-time performance tracking and professional athlete analytics.

- In February 2025, Adidas unveiled a new eco-friendly synthetic football shoe line, using recycled materials and biodegradable packaging to target environmentally conscious consumers.

- In January 2025, Puma expanded distribution in India and Brazil, introducing mid-tier and youth-focused products to capture high-volume emerging market segments.