Foot Creams and Lotions Market Size

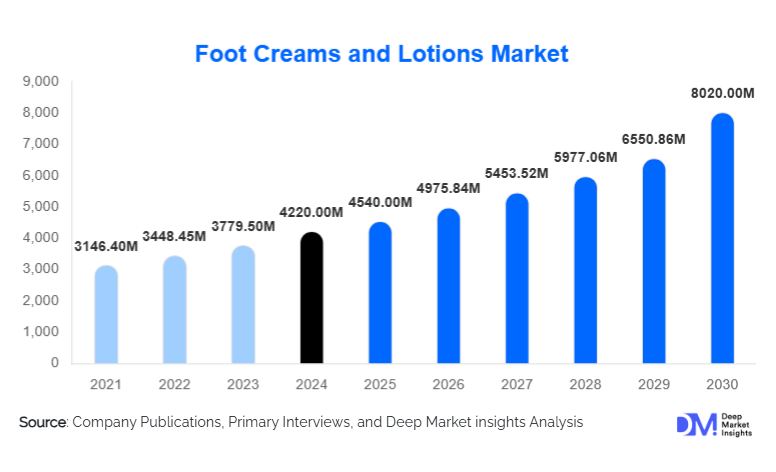

According to Deep Market Insights, the global foot creams and lotions market size was valued at USD 4,220 million in 2024 and is projected to grow from USD 4,540 million in 2025 to reach USD 8,020 million by 2030, expanding at a CAGR of 9.6% during the forecast period (2025–2030). The market growth is primarily driven by increasing consumer awareness of foot health, rising prevalence of foot-related ailments such as dry skin and fungal infections, and the growing focus on personal grooming and self-care across both developed and emerging regions.

Key Market Insights

- Moisturizing creams dominate the market, accounting for nearly 45% of the global market in 2025 due to their effectiveness in hydrating and repairing dry or cracked feet.

- Women represent the largest consumer segment, holding more than 55% of the market share, driven by growing interest in beauty and skincare routines.

- Pharmacies and drug stores are the leading distribution channels, favored for their credibility and availability of medically recommended products.

- North America dominates the market, with a share of over 45% in 2025, supported by high disposable income and strong consumer awareness.

- Asia-Pacific is the fastest-growing region, propelled by rising middle-class populations, urbanization, and increasing awareness of personal care.

- Technological adoption and e-commerce expansion, including online sales and digital marketing platforms, are enhancing consumer access and engagement.

What are the latest trends in the foot creams and lotions market?

Rising Demand for Specialized and Medical Foot Care

Consumers are increasingly seeking foot creams and lotions targeting specific medical conditions, such as diabetic foot care, eczema, or athlete's foot. This trend has encouraged manufacturers to develop specialized formulations containing ingredients like urea, tea tree oil, and aloe vera. These products not only serve therapeutic purposes but also provide preventive benefits, positioning brands as essential solutions for foot health. Health professionals and podiatrists are actively recommending these products, further strengthening consumer trust and adoption.

Integration of Natural and Sustainable Ingredients

The market is witnessing a strong preference for products with natural, organic, and sustainably sourced ingredients. Consumers are increasingly conscious of environmental impact and product safety, pushing manufacturers to innovate with plant-based extracts and eco-friendly packaging. Sustainable sourcing practices and transparency in product labeling are key differentiators, fostering brand loyalty among environmentally conscious users. Additionally, products with multifunctional benefits, such as moisturizing, exfoliating, and antifungal properties, are gaining traction for providing holistic foot care.

What are the key drivers in the foot creams and lotions market?

Increasing Prevalence of Foot Ailments

Foot conditions such as dry skin, cracked heels, fungal infections, and plantar fasciitis are becoming more common due to sedentary lifestyles, aging populations, and climatic variations. This rise in foot health concerns has significantly driven demand for foot creams and lotions that address both preventive and therapeutic needs. Specialized formulations targeting sensitive or problem-prone skin are increasingly preferred, fueling market growth globally.

Growing Awareness of Personal Grooming

Consumers today are more informed about the benefits of regular foot care, leading to higher adoption of foot creams and lotions in daily grooming routines. Social media campaigns, wellness blogs, and influencer marketing have played a key role in promoting foot care awareness. This behavioral shift has not only increased product demand but also encouraged the development of premium and specialized variants catering to various skin types and conditions.

Innovations in Product Formulations

Advancements in formulations, including the integration of shea butter, hyaluronic acid, and antifungal agents, have enhanced product efficacy. Innovations such as quick-absorbing creams, cooling gels, and therapeutic lotions cater to consumer preferences for convenience and effectiveness. The rise of multifunctional products that combine moisturizing, soothing, and antifungal properties is driving broader adoption and increasing market value.

What are the restraints for the global market?

High Competition and Brand Loyalty

The foot creams and lotions market is highly competitive, with several established brands dominating global and regional markets. Strong brand loyalty among consumers limits market entry opportunities for new players. Extensive marketing budgets and product differentiation strategies are required to gain visibility and attract a loyal customer base, posing a challenge for smaller or new entrants.

Price Sensitivity in Emerging Markets

While demand is growing in emerging markets, price sensitivity remains a key restraint. Consumers in regions such as Southeast Asia and Latin America often prioritize affordability over premium formulations. This limits the adoption of high-margin products, forcing manufacturers to balance pricing strategies with product quality and innovation.

What are the key opportunities in the foot creams and lotions industry?

Expansion via E-Commerce Channels

The rise of online shopping provides a major growth avenue. E-commerce platforms allow brands to reach a wider audience, offer exclusive product lines, and leverage digital marketing for consumer engagement. Online channels also facilitate data-driven personalization, enabling brands to recommend products based on foot care concerns and purchasing behavior, thereby boosting sales and brand loyalty.

Development of Niche Therapeutic Products

Targeting specific medical or dermatological conditions presents an untapped market segment. Products addressing diabetic foot care, fungal infections, and severe skin dryness offer high-value opportunities. Collaboration with dermatologists and podiatrists can further validate product efficacy, encouraging adoption and creating a strong market differentiator for specialized foot creams and lotions.

Sustainable and Natural Product Innovations

Consumer demand for eco-friendly, organic, and naturally sourced products is rising. Companies focusing on sustainable sourcing, biodegradable packaging, and plant-based ingredients can appeal to environmentally conscious consumers. This trend also allows differentiation from mass-market brands, potentially driving higher margins and fostering brand loyalty in a competitive landscape.

Product Type Insights

Moisturizing creams dominate the market, comprising approximately 45% of the total market share in 2025. Their leading position is attributed to their ability to provide hydration, repair cracked heels, and offer daily foot care solutions. Specialized therapeutic creams targeting diabetic foot care and antifungal lotions are gaining traction, reflecting an ongoing trend toward multifunctional products that combine health and cosmetic benefits.

Application Insights

The most common applications for foot creams and lotions include daily personal care, medical/therapeutic treatment, and cosmetic use. Healthcare applications are expanding as more medical professionals recommend foot creams for preventive and therapeutic care. Cosmetic use, particularly among women, remains strong due to increased grooming awareness. Emerging applications include spa and wellness treatments, highlighting opportunities for premium and luxury foot care offerings in personal care and hospitality sectors.

Distribution Channel Insights

Pharmacies and drug stores dominate distribution, offering credibility and medically recommended products. Online platforms are rapidly growing, providing consumers with convenience, a wide selection, and direct access to brand offerings. Retail chains and supermarkets continue to provide mass-market reach, while specialty stores cater to premium and niche products. E-commerce is particularly important in emerging markets, where digital adoption is rising quickly.

End-User Insights

Women are the leading end-users, accounting for over 55% of the global market in 2025. The growing male grooming segment is also contributing to increased consumption. Healthcare institutions and wellness centers are emerging as key buyers for therapeutic and premium products. The expansion of beauty, spa, and wellness industries globally supports market growth, highlighting the importance of export-driven demand from both developed and emerging regions.

Age Group Insights

Adults aged 31–50 years represent the largest consumer segment, combining disposable income with awareness of foot health. Younger consumers (18–30 years) drive demand for cosmetic and multifunctional products, particularly through e-commerce platforms. Older consumers (51–65 years) are increasingly purchasing therapeutic and specialized foot creams, contributing to growth in the medical-focused segment.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America is the largest market, accounting for over 45% of global demand in 2025. High disposable incomes, urban lifestyles, and strong awareness of personal care drive the adoption of foot creams and lotions. The U.S. leads regional demand, followed by Canada, with consumers favoring premium and therapeutic products.

Europe

Europe holds a significant market share, with Germany, the U.K., and France driving growth. Consumers are increasingly favoring natural and organic formulations. The market is experiencing steady growth, supported by high standards for quality and safety, as well as the popularity of cosmetic and therapeutic foot care.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, and Japan. Urbanization, rising disposable incomes, and increasing awareness of personal care are driving demand. Growth is particularly strong in e-commerce distribution and premium products.

Latin America

Brazil, Mexico, and Argentina are emerging markets with rising demand due to urbanization and changing lifestyle preferences. The market is price-sensitive, with an emphasis on affordable products.

Middle East & Africa

The Middle East, led by the UAE and Saudi Arabia, is showing increasing demand for premium and luxury foot care products. Africa remains an emerging market with growing awareness of personal hygiene and therapeutic products.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Foot Creams and Lotions Market

- Johnson & Johnson

- Unilever

- Procter & Gamble

- Revlon

- L'Occitane

- Beiersdorf

- Colgate-Palmolive

- Avon Products

- Mary Kay

- Shiseido

- Amway

- Oriflame

- Farfalla

- Kao Corporation

- Burt’s Bees

Recent Developments

- In March 2025, L'Oréal launched a new organic foot cream line in North America and Europe, emphasizing sustainable ingredients and eco-friendly packaging.

- In February 2025, Johnson & Johnson introduced a therapeutic diabetic foot cream in the Asia-Pacific markets, targeting rising diabetes-related foot health concerns.

- In January 2025, Beiersdorf expanded its e-commerce presence, offering personalized foot care kits via digital platforms in Europe and North America.