Foosball Table Market Size

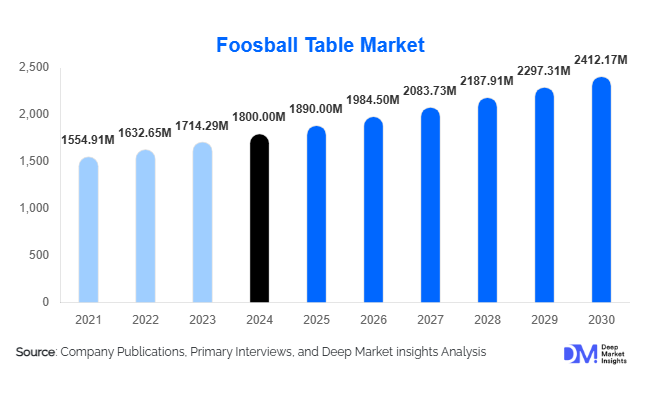

According to Deep Market Insights, the global foosball table market size was valued at USD 1,800 million in 2024 and is projected to grow from USD 1,890 million in 2025 to reach USD 2,412.17 million by 2030, expanding at a CAGR of 5% during the forecast period (2025–2030). The foosball table market growth is primarily driven by increasing adoption of indoor recreational activities, rising demand from commercial entertainment centers, and the growing popularity of premium and technologically integrated foosball tables for home and professional use.

Key Market Insights

- Residential adoption of foosball tables is increasing globally, fueled by rising disposable incomes, urbanization, and interest in home entertainment and recreational sports.

- Commercial venues such as bars, cafes, and arcades are driving coin-operated table demand, providing stable recurring revenue and contributing to market expansion.

- Technological integration, including digital scoring, IoT-enabled leaderboards, and modular designs, is enhancing user engagement and attracting younger demographics.

- North America and Europe dominate the market, with high-income consumers and well-established recreational infrastructures supporting premium and standard foosball tables.

- Asia-Pacific is the fastest-growing region, led by urban youth populations, rising middle-class incomes, and increased interest in leisure gaming.

- Online retail channels are increasingly preferred, allowing customers to compare products, access reviews, and purchase customized foosball tables conveniently.

What are the latest trends in the foosball table market?

Rise of Premium and Professional Tables

Foosball tables are no longer limited to casual home use. Premium professional tables, designed for tournament play and certified by competitive leagues, are gaining popularity. These tables feature high-quality wood, precision rods, ergonomic player designs, and customizable aesthetics. The trend is supported by growing competitive leagues and recreational tournaments, which not only enhance player engagement but also increase awareness and desirability of high-end foosball products globally.

Integration of Smart Technologies

Technological enhancements are redefining the foosball experience. Smart tables equipped with digital scoring, IoT-enabled leaderboards, interactive apps, and modular designs allow real-time tracking of scores and performance analytics. Some manufacturers are experimenting with augmented reality features and mobile app integrations to attract tech-savvy players. These innovations appeal particularly to younger consumers and commercial venues seeking to enhance user experience, positioning the market for higher-value product adoption.

What are the key drivers in the foosball table market?

Growing Popularity of Indoor Recreational Games

Increasing preference for indoor games in urban households is a major growth driver. With limited outdoor space in cities, consumers are investing in recreational activities that can be enjoyed at home. Foosball tables are seen as interactive, social, and entertaining, making them a preferred choice among families, youth, and recreational clubs.

Commercial and Institutional Adoption

Bars, arcades, hotels, and corporate offices are increasingly installing foosball tables to engage customers and employees. Coin-operated tables generate additional revenue streams for commercial establishments. Corporate wellness programs are also driving adoption in office spaces and coworking environments, reflecting an untapped growth opportunity for institutional segments.

Innovation and Customization

Manufacturers are introducing premium materials, digital scoring systems, modular layouts, and aesthetic customizations. Personalized tables that cater to both home and commercial users encourage repeat purchases and higher consumer spending, enhancing market growth and profitability.

What are the restraints for the global market?

High Cost of Premium Tables

Professional and premium foosball tables are often expensive, ranging from USD 1,500 to USD 2,500, which limits affordability for price-sensitive consumers. This restricts market penetration in emerging regions and smaller cities, slowing overall growth in certain markets.

Limited Awareness in Emerging Regions

Foosball is still relatively underpenetrated in rural and semi-urban regions, particularly in the Asia-Pacific and Latin America. Limited knowledge about recreational benefits, combined with fewer commercial gaming centers, hinders market expansion, requiring education and marketing efforts to overcome this restraint.

What are the key opportunities in the foosball table market?

Expansion in Emerging Markets

Urbanization, rising disposable income, and the adoption of Western recreational trends in countries like India, China, and Brazil provide a fertile ground for market expansion. Government investments in community recreational infrastructure also encourage the introduction of foosball tables in public spaces, offering a significant growth opportunity for new entrants and established manufacturers.

Corporate and Institutional Adoption

Employee wellness programs and recreational initiatives in offices, coworking spaces, and educational institutions are driving demand for foosball tables. Customized office-friendly designs and compact layouts provide an avenue for B2B sales growth, extending the market beyond traditional consumer segments.

Technology-Enabled Foosball Experiences

Smart foosball tables with IoT integration, digital scoring, and app-based analytics are attracting younger audiences and premium customers. This trend allows manufacturers to differentiate products, command higher prices, and create new revenue streams through digital engagement and subscription-based features.

Product Type Insights

Standard foosball tables dominate the market, holding nearly 55% of the global revenue in 2024, due to affordability and suitability for home use. Coin-operated tables account for 25% of the market, primarily driven by bars, arcades, and entertainment centers. Premium professional tables, which constitute 20% of the market, are favored in competitive and tournament settings. Rising interest in high-end, aesthetically appealing, and durable tables is fueling premiumization trends across global markets.

Material Insights

Wooden foosball tables lead the market with a 60% share in 2024 due to their durability, visual appeal, and suitability for residential and commercial spaces. Plastic and composite tables are gaining traction for cost-conscious buyers in home and institutional segments, while metal and aluminum tables are preferred for commercial settings due to longevity and low maintenance.

End-Use Insights

The residential segment accounts for 50% of demand, reflecting rising home recreation trends. Commercial adoption contributes 35%, fueled by bars, arcades, hotels, and coworking spaces. Institutional adoption accounts for 15%, primarily in schools and universities integrating foosball tables for recreational and wellness initiatives. Export-driven demand is strongest from North America and Europe, importing premium tables from APAC, providing new growth avenues for manufacturers.

Distribution Channel Insights

Online retail dominates with a 45% share, as consumers prefer convenient access, product variety, and direct comparison. Offline retail holds 35% of the market, particularly in specialty stores and hypermarkets. Direct B2B sales account for 20%, primarily for commercial and institutional installations. Increasing digital engagement and e-commerce adoption are key trends shaping distribution strategies globally.

| By Product Type | By Material | By End-Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America dominates with 35% of the global market share in 2024, led by the USA and Canada. High disposable income, growing home recreation trends, and well-established commercial entertainment venues support adoption. Premium and standard foosball tables are popular across residential and commercial segments, with recreational leagues further stimulating demand.

Europe

Europe holds a 30% market share, led by Germany, the UK, and France. Competitive foosball tournaments, recreational cafes, and a culture of indoor sports are driving strong adoption. Germany alone contributes 12% of global revenue. Eco-conscious consumer preferences and high-quality manufacturing standards maintain steady growth.

Asia-Pacific

Asia-Pacific is the fastest-growing region with a 9% CAGR, led by China and India. Urban youth populations, rising disposable income, and growing interest in leisure activities and gaming cafes fuel market expansion. Premiumization and online sales are key drivers in APAC.

Latin America

Brazil and Argentina lead market growth in Latin America, with rising urban recreation trends and increasing adoption in bars and entertainment centers. Export-driven imports of premium foosball tables from APAC further contribute to market expansion.

Middle East & Africa

MEA represents a smaller but growing segment, led by the UAE and Saudi Arabia. Increasing investment in hospitality and entertainment sectors, coupled with high-income populations, is driving adoption. Intra-regional tourism also supports recreational foosball table demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Foosball Table Market

- KICK

- Tornado

- Garlando

- Bonzini

- René Pierre

- Shelti

- Warrior Table Soccer

- Carrom

- Roberto Sport

- Fireball

- Leonhart

- Valley-Dynamo

- US-Table

- Sport Squad

- Stiga

Recent Developments

- In March 2025, Tornado launched a digitally enhanced foosball table with integrated scoring and IoT connectivity for competitive tournaments.

- In January 2025, Garlando introduced premium modular foosball tables targeting luxury residential and commercial segments in Europe and North America.

- In November 2024, KICK expanded production facilities in China to meet growing export demand from North America and Europe, improving lead times and customization options.