Food Chopper Market Size

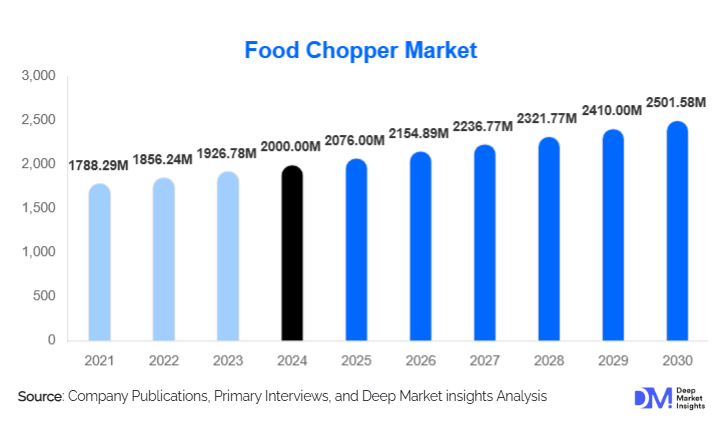

According to Deep Market Insights, the global food chopper market size was valued at USD 2,000 million in 2024 and is projected to grow from USD 2,076.00 million in 2025 to reach USD 2,501.58 million by 2030, expanding at a CAGR of 3.8% during the forecast period (2025–2030). The market growth is primarily driven by increasing demand for time-saving and efficient kitchen appliances, rising urbanization, and the growing popularity of home-cooking and meal-prep trends across both developed and emerging regions.

Key Market Insights

- Electric food choppers dominate the market, offering speed, convenience, and efficiency, particularly for households and commercial kitchens.

- Stainless steel components are preferred globally, owing to durability, hygiene, and premium quality appeal.

- North America leads the market, with high appliance penetration and strong consumer purchasing power driving demand.

- Asia-Pacific is the fastest-growing region, fueled by rising disposable incomes, urbanization, and expanding retail and e-commerce infrastructure.

- Residential and commercial applications are expanding, supported by cloud kitchens, restaurants, and meal-prep culture.

- Technological integration, including smart and IoT-enabled appliances, multi-speed control, and detachable safety features, is enhancing user experience and boosting adoption.

What are the latest trends in the food chopper market?

Smart and Connected Kitchen Integration

Manufacturers are increasingly developing smart food choppers that integrate with home automation systems and mobile applications. Features such as Bluetooth connectivity, app-based control, usage analytics, and voice-command operation are emerging as key differentiators. These innovations cater to tech-savvy consumers seeking convenience and efficiency in meal preparation. Connected choppers also allow for recipe-based automation, reducing human error and enhancing safety with auto-stop functions.

Sustainable and Eco-Friendly Designs

Rising consumer awareness of environmental issues is driving demand for food choppers made from BPA-free plastics, recycled materials, and durable stainless steel. Energy-efficient motors, rechargeable battery-powered models, and recyclable components are gaining prominence. Brands adopting sustainable practices are able to command premium pricing while appealing to environmentally conscious consumers, especially in Europe and North America.

Emergence of Multi-Functional and Compact Appliances

There is growing adoption of compact and multifunctional choppers that combine chopping, slicing, dicing, and blending in one appliance. Consumers are increasingly favoring small-capacity, easy-to-store models suitable for apartments and kitchens with limited counter space. Multi-functionality is particularly attractive in the residential segment, while commercial kitchens benefit from modular designs for high-volume preparation.

What are the key drivers in the food chopper market?

Rising Need for Convenience and Time Efficiency

Urban lifestyles and dual-income households have increased the need for quick and efficient food preparation solutions. Electric food choppers reduce meal preparation time, enabling consumers to chop vegetables, nuts, and herbs quickly and safely. The convenience factor is a major driver, especially in residential and small commercial kitchens.

Growth in Home Cooking and Meal Prepping

Meal prepping and home-cooked meals are increasingly popular, driven by health-conscious consumers and dietary awareness. Food choppers help streamline ingredient preparation, allowing consumers to efficiently process large quantities of food, enhancing productivity and reducing waste. This trend is particularly strong in North America, Europe, and urban areas of the Asia-Pacific.

Product Innovation and Safety Features

Innovations in blade technology, motor efficiency, and safety mechanisms have increased adoption. Detachable, dishwasher-safe parts, anti-slip bases, and multi-speed control features enhance the user experience. Manufacturers introducing advanced ergonomic designs and premium materials are driving demand among both mid-range and high-end consumer segments.

What are the restraints for the global market?

Competition from Multi-Functional Appliances

Food choppers face competition from blenders, food processors, and all-in-one kitchen appliances that perform chopping along with multiple other functions. Consumers seeking versatility may opt for these alternatives, limiting standalone chopper adoption, especially in price-sensitive segments.

Durability and Maintenance Concerns

Lower-cost choppers often face issues such as blade dulling, plastic wear, and motor overheating. Consumers’ concerns regarding product longevity, frequent replacement, and maintenance reduce adoption in budget-sensitive markets. Manufacturers must balance affordability with durable design to maintain competitiveness.

What are the key opportunities in the food chopper market?

Smart and Connected Appliances

Integration with IoT and smart home systems presents a high-growth opportunity. Consumers increasingly demand app-controlled, voice-enabled, and automated appliances that enhance convenience and efficiency. Brands can capitalize on premium pricing and loyalty by offering advanced, tech-enabled features.

Sustainable and Eco-Friendly Materials

There is growing market potential for choppers made with recycled plastics, BPA-free components, and stainless steel. Environmentally conscious consumers, particularly in Europe and North America, are willing to pay a premium for sustainable appliances. This trend also allows manufacturers to differentiate and improve brand image.

Emerging Markets and Commercial Expansion

Emerging economies such as India, China, and Southeast Asia are experiencing rising middle-class incomes and urbanization. These markets provide opportunities for affordable electric choppers and small-capacity commercial models. Additionally, growth in cloud kitchens, restaurants, and QSRs fuels B2B demand for high-durability and high-volume choppers.

Product Type Insights

Electric food choppers dominate globally, accounting for approximately 63% of the market in 2024, due to their speed, convenience, and applicability in both residential and commercial settings. Manual choppers, while still relevant in budget-conscious markets, account for less than a third of global sales. The rising popularity of cordless and multi-speed electric choppers is expected to further solidify this segment.

Application Insights

The residential segment remains the largest, driven by home cooking, meal prep, and convenience-driven demand, contributing over 60% of global consumption in 2024. Commercial applications, including restaurants, catering services, and cloud kitchens, are the fastest-growing segment, particularly in the Asia-Pacific region, due to expansion in the foodservice industry. Industrial applications in food processing are emerging but currently represent a smaller share.

Distribution Channel Insights

Offline retail channels, including supermarkets, hypermarkets, and specialty kitchen stores, account for approximately 65% of sales, driven by consumer preference to physically inspect appliances. Online sales are rapidly growing, especially in Asia-Pacific and North America, facilitated by e-commerce platforms, direct-to-consumer websites, and digital marketing.

| By Product Type | By Blade Material | By Capacity | By Distribution Channel | By End Use |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest market, contributing 32% of global demand in 2024. Strong appliance penetration, high disposable income, and preference for convenience-driven appliances drive growth. The U.S. leads, followed by Canada, with the adoption of smart and multi-functional choppers accelerating.

Europe

Europe accounts for approximately 27% of the market in 2024, with Germany, the U.K., and France as major contributors. Demand is fueled by sustainability concerns, high urban household penetration, and interest in premium kitchen appliances.

Asia-Pacific

Asia-Pacific holds 29% of the market and is the fastest-growing region. China and India are the primary growth drivers, supported by urbanization, rising disposable incomes, e-commerce expansion, and the adoption of compact, multi-functional appliances.

Latin America

Brazil and Mexico are leading markets, though the region accounts for a smaller share (6%). Demand is increasing due to rising urban middle-class households and the modernization of kitchens.

Middle East & Africa

Urban centers in the UAE, Saudi Arabia, and South Africa are witnessing rising adoption, driven by luxury and mid-range product preferences. MEA remains the smallest regional market but has growth potential in high-income urban areas.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Food Chopper Market

- Whirlpool Corporation (KitchenAid)

- De’Longhi Group (Braun)

- Breville Group Limited

- Conair LLC (Cuisinart)

- Groupe SEB (Moulinex)

- Hamilton Beach Brands, Inc.

- Koninklijke Philips N.V.

- Magimix

- OXO (Helen of Troy)

- Preethi Kitchen Appliances Pvt. Ltd.

- SharkNinja, Inc.

- Tupperware Brands Corporation

- Zyliss

- Other global kitchen appliance brands

- Additional leading manufacturers with global operations

Recent Developments

- In March 2025, KitchenAid launched a smart, multi-speed food chopper with app integration and IoT functionality for North American markets.

- In January 2025, Preethi introduced an energy-efficient electric chopper in India with BPA-free components, targeting the growing residential segment.

- In November 2024, Breville expanded its stainless-steel premium chopper line in Europe, focusing on durability, smart safety features, and multi-functionality.