Folding Bikes Market Size

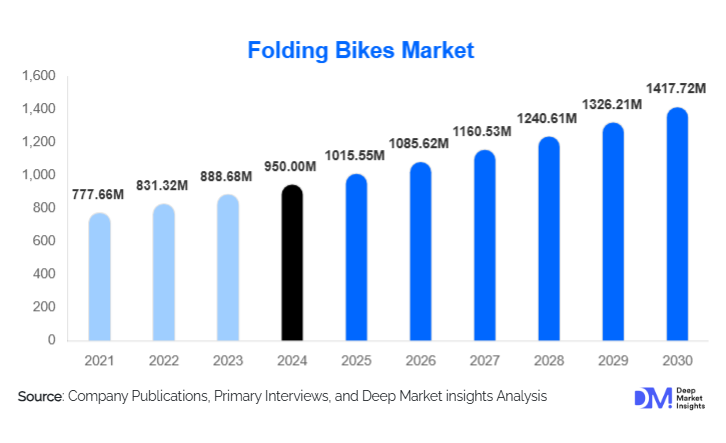

According to Deep Market Insights, the global folding bikes market size was valued at USD 950 million in 2024 and is projected to grow from USD 1,015.55 million in 2025 to reach USD 1,417.72 million by 2030, expanding at a CAGR of 6.9% during the forecast period (2025–2030). Growth is primarily driven by rising urbanization, increasing congestion in major cities, the growing appeal of multi-modal commuting, and the rapid adoption of electric folding bikes designed for last-mile mobility.

Key Market Insights

- Conventional folding bikes currently dominate the market, but electric folding bikes (e-folders) are the fastest-growing segment as commuters seek convenient, power-assisted mobility options.

- Vertical-fold mechanisms lead the market due to their compactness, structural stability, and widespread adoption by top manufacturers.

- North America holds the largest regional share, driven by high spending power and demand for portable, sustainable commuting alternatives.

- Asia-Pacific is the fastest-growing regional market, supported by massive urbanization, rising disposable incomes, and a strong manufacturing ecosystem.

- Lightweight materials, especially aluminum and carbon fiber, are defining product innovation, enabling more compact and portable designs.

- Corporate fleet deployment and campus mobility programs are emerging as new demand pockets, especially for e-folding bikes.

- Online distribution channels are rapidly expanding, supported by D2C (direct-to-consumer) models and rising consumer preference for digital buying.

What are the latest trends in the folding bikes market?

Smart and Connected Folding Bikes

Integration of smart technologies is reshaping the folding bikes landscape. Manufacturers are embedding GPS tracking, app-based locking systems, IoT-enabled diagnostics, and ride-data analytics into both conventional and electric folding models. These features appeal particularly to tech-savvy commuters in major metropolitan areas who value security, connectivity, and operational transparency. Advanced mobile apps now offer theft alerts, battery health monitoring for e-folders, geo-fencing, and service reminders. Emerging smart fleet systems also enable corporate campuses and universities to manage shared folding-bike programs through centralized dashboards, improving maintenance efficiency and lowering operational downtime.

Lightweight Materials and Next-Generation Foldability

Innovation in frame materials, including high-grade aluminum alloys, carbon fiber, and titanium, is driving a trend toward ultra-light folding bikes. Weight reduction significantly enhances portability, especially for commuters who need to carry bikes into offices, apartments, or public transit. At the same time, companies are refining hinge systems, magnet-based locks, and single-motion folding architectures to improve speed, structural rigidity, and long-term durability. These engineering advancements are redefining the user experience and allowing premium brands to command higher price points while maintaining strong demand.

What are the key drivers in the folding bikes market?

Urbanization and Congestion Reduction Efforts

With major cities struggling with congestion, limited parking, and rising pollution levels, governments and commuters alike are shifting toward micromobility solutions. Folding bikes offer unmatched flexibility by combining cycling with public transit and solving last-mile connectivity issues. They occupy minimal space, making them ideal for apartment dwellers and office commuters, which strengthens demand across both developed and developing markets.

Growing Popularity of Sustainable, Active Transport

A global shift toward environmentally friendly and health-oriented transportation is fueling adoption. Folding bikes, both manual and electric, allow users to reduce their carbon footprint while staying physically active. Cities investing in cycling infrastructure, such as dedicated cycle lanes and integrated transit hubs, further support long-term market expansion.

Rapid Adoption of Electric Folding Bikes

E-folders are gaining traction due to longer commuting distances, hilly terrain in many urban areas, and growing consumer demand for low-effort mobility. Battery technology improvements, compact motors, and enhanced safety systems make electric folding bikes more accessible and reliable. This segment is projected to outpace all others and significantly shape overall market growth.

What are the restraints for the global market?

High Purchase Costs and Price Sensitivity

Premium folding and electric folding bikes come with elevated price points due to advanced hinges, drivetrain systems, and specialty materials. This limits adoption among price-sensitive consumers in regions where traditional bicycles remain more affordable. Additionally, e-folder battery replacement and maintenance costs create ongoing financial considerations for buyers.

Concerns Over Durability and Ride Performance

Some consumers perceive folding bikes as less robust compared with full-size bicycles, especially concerning hinge longevity, frame stability, and shock absorption. These concerns can restrict adoption among performance-focused cyclists and discourage long-distance riders. Educating users and improving product engineering remain critical to overcoming this restraint.

What are the key opportunities in the folding bikes industry?

Corporate and Campus Mobility Programs

Organizations, universities, and business parks are adopting folding-bike fleets to improve internal transportation and reduce reliance on shuttle vehicles. E-folders, in particular, offer convenient on-campus commuting options, and subscription-based fleet management models present ongoing revenue streams for manufacturers. This opportunity aligns with sustainability goals and offers significant scale potential.

Transit-Integrated Last-Mile Solutions

As public transport networks expand, commuters increasingly require seamless connections from bus/train stations to final destinations. Folding bikes excel in this domain, and partnerships with transit authorities can unlock substantial demand. Cities offering subsidies or tax incentives for micromobility purchases further boost this opportunity. Smart docking stations and shared folding-bike systems at transit hubs are emerging as value-added solutions.

Product Type Insights

Conventional folding bikes currently dominate the product landscape, accounting for nearly 70–75% of global revenue in 2024. Their lower price, lighter weight, and mechanical simplicity make them the preferred choice for most commuters. However, electric folding bikes are the fastest-growing category due to enhanced range, motor assistance, and user-friendly smart features. Premium models featuring carbon frames and compact electric drivetrains are particularly gaining traction among urban professionals seeking high performance and portability.

Application Insights

Urban commuting represents the largest application segment, fueled by demand for flexible, multi-modal mobility solutions. Recreational cycling and fitness use cases follow closely, especially in regions with a growing cycling culture. Corporate fleet mobility and tourism applications, such as travel-friendly foldable bikes, are rapidly emerging niches, driven by increasing adoption of sustainable travel and employee mobility programs. Delivery and last-mile logistics sectors are also experimenting with e-folding bikes due to their maneuverability and low operational costs.

Distribution Channel Insights

Offline retail, including specialty bicycle shops, continues to dominate the folding bikes market, as consumers prioritize test rides and physical inspection. However, online channels are expanding rapidly, supported by the surge of D2C brands offering customizable configurations, transparent pricing, and doorstep servicing. E-commerce platforms are also boosting demand among younger demographics who prefer reviewing models, specs, and comparisons online before making purchase decisions.

End-User Insights

Urban commuters represent the core end-user base, followed by fitness enthusiasts and recreational riders. Corporate users, university campuses, and institutional buyers are emerging rapidly, especially for electric folding-bike fleets. Travelers and mobility-on-demand customers are contributing to niche demand, especially in Europe and APAC. Delivery services using compact e-folders are also a rising application segment due to cost savings and ease of navigation in congested areas.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest market share at approximately 35–40% in 2024. Strong demand for micromobility options, widespread urban commuting, and high purchasing power contribute to market dominance. U.S. cities with dense transit systems show the highest adoption of e-folders, while Canada exhibits strong recreational folding-bike demand.

Europe

Europe remains a key market driven by a strong cycling culture and emphasis on sustainable transportation. Germany, the U.K., the Netherlands, and France lead adoption across both commuting and leisure applications. Widespread cycling infrastructure, supportive green policies, and a preference for premium lightweight designs strengthen regional growth.

Asia-Pacific

APAC is the fastest-growing region, led by China, Japan, India, and Southeast Asia. High population density, rising disposable incomes, and manufacturer presence accelerate market expansion. China benefits from a large-scale e-mobility ecosystem, while India’s demand is driven by affordability and multi-modal commuting needs.

Latin America

Demand is growing gradually across Brazil, Mexico, and Argentina, driven by increasing urban congestion and interest in low-cost mobility. Adoption remains moderate but promising, with rising attention toward e-folders as bike infrastructure improves.

Middle East & Africa

MEA shows emerging demand, especially in the UAE, Saudi Arabia, and South Africa. High disposable income and growing sustainability awareness drive premium model sales. Africa’s internal tourism and campus mobility applications are generating additional interest in foldable bikes.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Folding Bikes Market

- Brompton Bicycle

- Dahon

- Tern (Pacific Cycles)

- Gocycle (Karbon Kinetics)

- Bike Friday

- Montague Corporation

- Giant Bicycles

- Forever Bicycle

- Birdy (Riese & Müller)

- Helix

- Strida

- B’Twin / Decathlon

- A-bike

- GoGear

- MiQro

Recent Developments

- In March 2025, Brompton unveiled a new carbon-fiber folding bike series, reducing weight by 25% compared to previous models.

- In January 2025, Tern launched a fleet-focused e-folder designed specifically for corporate and university campus mobility programs.

- In April 2025, Gocycle introduced an upgraded smart connectivity suite, featuring IoT-enabled battery monitoring and anti-theft geo-fencing.