Foil Shavers Market Size

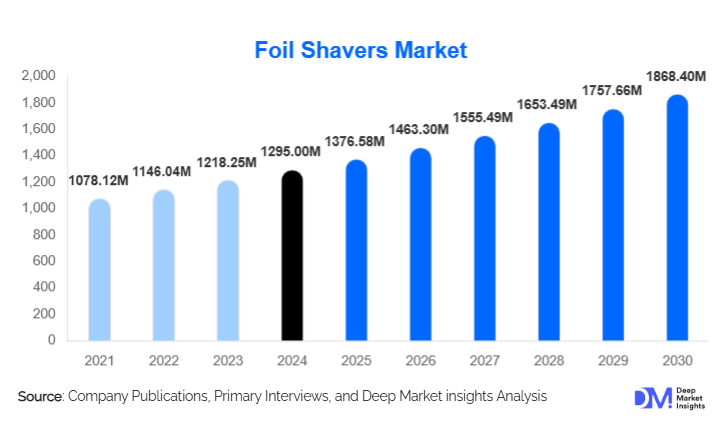

According to Deep Market Insights, the global foil shavers market size was valued at USD 1,295 million in 2024 and is projected to grow from USD 1,376.58 million in 2025 to reach USD 1,868.4 million by 2030, expanding at a CAGR of 6.3% during the forecast period (2025–2030). The market expansion is driven by rising consumer preference for precision grooming tools, advancements in electric shaving technology, and growing adoption of premium personal care devices across developed and emerging economies.

Key Market Insights

- Premium and multifunctional foil shavers are gaining rapid traction, supported by demand for high-performance grooming tools among urban consumers.

- North America leads the global market, driven by strong brand penetration and high grooming expenditure.

- Asia-Pacific is the fastest-growing region, primarily propelled by rising incomes, expanding e-commerce, and a surge in male grooming awareness.

- Technological innovations such as AI-based skin sensors, self-cleaning mechanisms, and long-lasting lithium-ion batteries are reshaping product preferences.

- Online retail channels are outpacing offline stores as consumers increasingly prefer direct-to-consumer (D2C) product discovery and comparison-based purchase patterns.

Latest Market Trends

Smart & AI-Integrated Shaving Technologies

Foil shavers are transitioning from traditional electric devices to advanced smart grooming systems. Manufacturers are integrating AI-powered skin response sensors, adaptive shaving algorithms, and digital performance monitoring into premium models. These innovations help shavers adjust blade speed and vibration levels based on hair density, improving comfort and reducing skin irritation. App-connected shavers, offering usage insights, blade replacement notifications, and personalized grooming modes, are gaining popularity among tech-forward consumers, particularly in North America, Europe, and East Asia.

Rising Demand for Sustainable & Skin-Friendly Grooming Tools

Consumers increasingly seek shavers with long-lasting build quality, recyclable materials, hypoallergenic foils, and low-energy consumption. Manufacturers are responding by offering stainless-steel foil heads, replaceable components, and energy-efficient motors. In Europe, sustainability-driven buyers are accelerating demand for shavers with extended product lifecycles and reduced plastic usage. Additionally, dermatologically tested foils and ultra-thin hypoallergenic coatings are becoming mainstream as skin sensitivity concerns rise globally.

Foil Shavers Market Drivers

Surge in Male Grooming & Personal Care Spending

Global spending on male grooming has significantly increased, with consumers seeking high-quality grooming devices for both personal style and hygiene. Urbanization, rising disposable incomes, and social media influence are key contributors. Foil shavers, known for precise, close shaving and skin protection, cater directly to this growing preference. The trend is especially prominent among millennials and Gen Z populations in the U.S., China, India, and the U.K.

Technological Innovation & Product Upgrades

The market is benefiting from rapid innovation, including multi-directional shaving heads, fast-charging batteries, travel-friendly compact models, and wet/dry functionality. These advancements enhance convenience and performance, encouraging consumers to upgrade frequently. Leading brands are rolling out advanced foil architectures that lift and cut varied hair lengths, improving grooming efficiency and expanding the market.

Growth of E-Commerce & D2C Grooming Brands

Online retail growth has dramatically accelerated foil shaver sales by offering price comparison, broad availability, and user-generated product reviews. D2C brands leverage social media and influencer partnerships, gaining strong traction in Asia-Pacific and Europe. Subscription-based blade replacement models and personalized grooming kits are further driving online engagement.

Market Restraints

High Prices of Premium Models

Premium foil shavers, often priced above USD 250, limit adoption in price-sensitive markets. While high-income consumers value premium features, mid- and low-income groups in Latin America, Southeast Asia, and Africa remain constrained by cost considerations. This restricts the penetration of advanced grooming devices in emerging economies.

Competition from Rotary Shavers & Disposable Razors

Foil shavers face stiff competition from rotary shavers known for contour handling and from low-cost disposable razors favored in developing regions. Many consumers remain loyal to traditional shaving methods, slowing the transition to electric grooming devices.

Foil Shavers Market Opportunities

Expansion of Smart Grooming Ecosystems

The integration of IoT and AI into grooming appliances offers vast growth potential. Smart foil shavers with app connectivity, diagnostic feedback, blade optimization alerts, and customized shaving modes can unlock new premium consumer segments. As home grooming becomes more personalized, brands offering connected ecosystems will gain a competitive edge, especially in technologically advanced markets like Japan, South Korea, the U.S., and Germany.

Growing Demand Across Emerging Asian Markets

Rising disposable incomes, rapid urbanization, and evolving grooming norms are driving massive demand in India, China, Indonesia, and Vietnam. Younger demographics are becoming increasingly grooming-conscious, fueling purchases of affordable and mid-range electric shavers. Local manufacturing incentives in India and China further support market expansion for global brands seeking cost-effective production hubs.

Opportunities in Women's Precision Grooming

While foil shavers primarily target men, the global shift toward female body grooming and facial-hair precision tools offers significant untapped potential. Women's foil shavers for sensitive areas, bikini trimming, and facial hair removal are emerging as high-growth subcategories. Integrating ergonomic designs, skin sensors, and compact travel-friendly features will drive adoption in North America, Europe, and Japan.

Product Type Insights

Premium foil shavers constitute the dominant segment, accounting for over 42% of global demand. This dominance is attributed to superior shaving performance, durability, advanced features such as fast charging, and innovative foil designs. Mid-range shavers continue gaining traction among price-conscious consumers seeking quality and performance without premium pricing. Entry-level models remain essential in developing markets, supported by affordability and basic grooming functionality.

Application Insights

Personal grooming applications account for the largest share of product usage, particularly among working professionals and younger male demographics seeking daily clean-shave convenience. Professional grooming applications, such as barbershops, salons, and beauty studios, are rapidly expanding, supported by demand for high-precision tools and long-lasting performance under frequent usage. Rising men’s salon culture in India, China, and Southeast Asia is increasing the commercial adoption of foil shavers.

Distribution Channel Insights

Online retail accounts for the majority of sales globally, representing over 54% of the 2024 market. Platforms such as Amazon, Flipkart, JD.com, and brand-owned D2C websites are key sales drivers due to high product visibility and competitive pricing. Offline stores, such as electronics retailers, hypermarkets, and specialty grooming outlets, remain important in regions with limited digital penetration, including parts of Latin America and Africa.

End-Use Insights

Household end-users represent the largest demand segment as consumers increasingly prefer home grooming solutions for convenience, hygiene, and cost efficiency. Professional grooming spaces, including salons and barbershops, are experiencing fast growth, driven by rising emphasis on premium shaving experiences, hygienic equipment, and high-performance electric tools. Emerging industries such as men’s wellness studios, personal styling centers, and premium grooming lounges further support demand for high-quality foil shavers.

| By Product Type | By End User | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the global market with approximately 32% share in 2024. Strong consumer spending on personal care, high adoption of electric grooming tools, and widespread availability of premium international brands drive market leadership. The U.S. remains the largest contributor with growing demand for smart and skin-sensitive shavers. Canada shows high adoption rates in the premium grooming category.

Europe

Europe holds around 28% market share, driven by Germany, the U.K., France, and Italy. The region’s focus on sustainability, high-quality engineering, and dermatology-tested grooming products continues to propel demand. Germany leads due to strong manufacturing, while the U.K. remains a major importer and high-consumption market.

Asia-Pacific

APAC is the fastest-growing region, expected to register a CAGR above 11% through 2030. China dominates with expanding male grooming awareness, strong e-commerce penetration, and domestic brand activity. India is experiencing rapid demand growth due to urbanization and rising grooming awareness. Japan and South Korea remain mature markets with high adoption of premium smart shavers.

Latin America

Brazil and Mexico represent the largest markets, driven by growing male grooming trends and increasing availability of mid-range products. Economic volatility and high import duties limit premium product penetration, but urban centers show strong growth potential.

Middle East & Africa

The region is gaining pace, with the UAE, Saudi Arabia, and South Africa leading demand. Rising disposable incomes, a growing expatriate population, and premium grooming preferences support regional growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Foil Shavers Market

- Philips

- Panasonic

- Braun (P&G)

- Wahl Clipper Corporation

- Remington

- Xiaomi

- Hatteker

- Andis Company

- Veet

- Flyco

- Syska

- Havells

- Surker

- BaByliss

- Rowenta

Recent Developments

- In March 2025, Philips introduced a new AI-enabled foil shaver with auto-adjusting blade speed and skin protection algorithms.

- In January 2025, Panasonic launched a lightweight travel-friendly foil shaver with an extended battery life of 40 days per charge.

- In November 2024, Braun expanded its Series 9 Pro lineup with sustainable packaging and upgraded titanium-coated foils.