Fly Trap Market Size

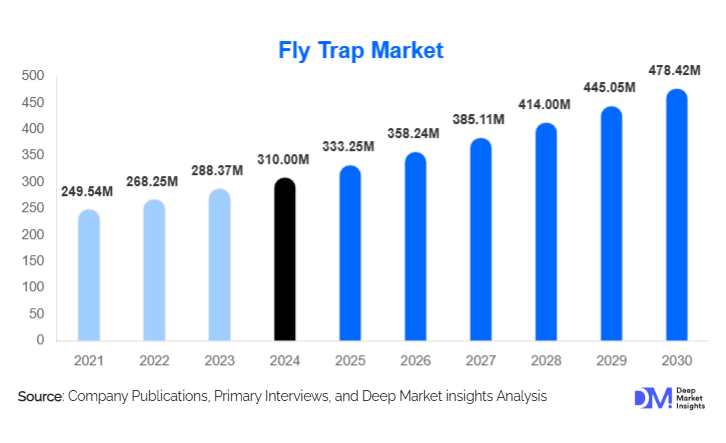

According to Deep Market Insights, the global fly trap market size was valued at USD 310 million in 2024 and is projected to grow from USD 333.25 million in 2025 to reach approximately USD 478.42 million by 2030, expanding at a CAGR of 7.5% during the forecast period (2025–2030). The fly trap market growth is driven by rising hygiene awareness, expanding food-safety regulations, and increased adoption of chemical-free pest control solutions across residential, agricultural, commercial, and industrial environments.

Key Market Insights

- Demand for chemical-free and eco-friendly pest control solutions is rapidly increasing, positioning fly traps as essential tools within Integrated Pest Management (IPM) programs.

- Electric and UV-light fly traps are gaining traction across commercial and industrial sectors due to high efficiency and compliance with food-safety standards.

- Asia-Pacific represents the fastest-growing regional market, driven by expanding greenhouse agriculture, food processing, and rising hygiene standards in developing economies.

- Europe maintains a strong market share due to regulatory restrictions on chemical pesticides and robust adoption of sustainable pest control technologies.

- E-commerce is emerging as a dominant distribution channel, especially in residential and SME markets, driven by convenience, product variety, and competitive pricing.

- Technological innovation, including UV-LED, hybrid systems, smart sensors, and IoT-enabled traps, is reshaping product development and expanding premium segments.

What are the latest trends in the fly trap market?

Shift Toward Non-Chemical and Sustainable Pest Control

Growing regulatory pressure to minimize pesticide residue in food products and reduce chemical exposure in residential and commercial spaces is accelerating the transition to mechanical fly traps. Sticky, UV-light, and bait-based traps are being incorporated into IPM programs as frontline controls. Manufacturers are expanding organic-certified and chemical-free trap offerings tailored to greenhouses, livestock facilities, and food processing plants. This trend aligns directly with sustainability initiatives, which encourage the adoption of environmentally friendly pest management tools. Many producers now emphasize recyclable components, biodegradable glue boards, and energy-efficient lighting systems to appeal to eco-conscious businesses and consumers.

Adoption of Smart and Hybrid Fly Traps

Technological innovation is playing a major role in the evolution of fly traps. Smart traps equipped with sensors, camera monitoring, and IoT connectivity are entering the market, especially for industrial and agricultural environments. These devices provide real-time monitoring, automated pest-count analytics, and predictive infestation alerts. UV-LED lighting is replacing fluorescent bulbs, offering longer life spans and lower energy consumption. Hybrid traps that combine UV attraction, sticky boards, electric grids, and pheromone lures are gaining attention for improving multi-environment efficacy. These innovations are expected to shape the premium and professional fly trap segments over the next decade.

What are the key drivers in the fly trap market?

Stringent Food-Safety and Hygiene Regulations

Commercial kitchens, hospitality venues, food processing plants, and healthcare facilities face strict hygiene requirements that limit chemical pesticide usage. Fly traps offer an effective, safe, and compliant alternative for controlling fly populations. Regulatory bodies across Europe, North America, and parts of Asia-Pacific increasingly recommend or mandate mechanical fly traps for pest management. As global food exports rise, especially from Asia and Latin America, residue-free pest control is becoming a necessity, driving rapid adoption of fly traps across agriculture and processing sectors.

Growing Consumer Preference for Chemical-Free Pest Solutions

Awareness of health risks associated with chemical insecticides is steering both residential and commercial users toward non-toxic alternatives. Sticky traps, UV traps, and bait-based systems eliminate chemical exposure while providing continuous pest control. This trend is particularly strong in households, organic farms, greenhouses, and livestock operations. As sustainability becomes a key purchasing criterion, manufacturers are promoting eco-friendly designs, recyclable components, solar-powered traps, and organic attractants, strengthening consumer trust and market growth.

What are the restraints for the global market?

High Initial Costs for Advanced Fly Traps

Advanced electric, hybrid, and smart fly traps involve significant upfront costs, which can be a barrier for small businesses, smallholder farmers, and low-income consumers. While long-term operational costs may be lower than chemical alternatives, price sensitivity in developing markets limits penetration of premium devices. Replacement components such as glue boards, UV bulbs, and lures add to recurring costs, further restraining adoption in cost-sensitive regions.

Perception of Lower Effectiveness Compared to Chemical Insecticides

Despite growing adoption, some users still perceive mechanical traps as slower or less effective for the rapid knockdown of large infestations. This perception is especially common in agricultural and industrial environments where immediate pest suppression is desired. Limited awareness, poor trap placement, and lack of maintenance further reduce performance, reinforcing misconceptions. Manufacturers and pest-control professionals must invest in education, training, and product demonstrations to bridge this perception gap.

What are the key opportunities in the fly trap market?

Expansion of IoT-Enabled and Smart Monitoring Systems

The integration of sensors, wireless connectivity, and data analytics into fly traps represents a major growth frontier. Smart fly traps offer automatic pest counting, activity mapping, and early-warning notifications, drastically reducing manual monitoring costs. This technology aligns with the digital transformation of agricultural, commercial, and industrial facilities. As smart farms and connected factories expand, demand for intelligent pest control systems is expected to surge, creating opportunities for subscription-based monitoring services and high-margin hardware.

Growth of Agricultural and Greenhouse Applications

Greenhouses, high-value crops, and livestock farms are facing increasing pressure to reduce chemical pesticide usage while maintaining productivity. Fly traps, especially sticky cards and UV systems, are being incorporated into IPM strategies to monitor and control pests in environmentally sensitive operations. Government-backed biological pest control subsidies in Europe and Asia-Pacific strengthen demand. As global food export markets impose stricter residue limits, fly traps are becoming essential tools across fruit, vegetable, and floriculture production.

Product Type Insights

Sticky and glue traps dominate the market, accounting for the largest share due to low cost, ease of use, and effectiveness across multiple environments. These traps are highly favored in greenhouses, warehouses, and residential homes. Electric and UV-light fly traps represent the fastest-growing product category, particularly in commercial applications such as restaurants, hotels, and industrial food processing facilities, where hygiene compliance is paramount. Baited traps and disposable bag traps maintain steady demand in agricultural and outdoor settings, while hybrid traps are emerging as a premium category offering improved versatility and performance. Smart and sensor-based traps, though currently niche, are expected to expand significantly in industrial and agricultural markets.

Application Insights

Commercial applications lead the fly trap market, driven by stringent sanitation regulations in food service, hospitality, retail, and healthcare. Industrial applications, including food and beverage manufacturing, rely heavily on UV light and electric traps to maintain pest-free environments. Agricultural usage is expanding rapidly as growers adopt sticky cards and bait traps for crop monitoring and fly suppression in livestock facilities. Residential adoption continues to grow due to rising hygiene awareness and demand for chemical-free solutions. Monitoring and surveillance applications are also gaining momentum as smart traps enable early detection and precision pest management.

Distribution Channel Insights

E-commerce has become a dominant sales channel, especially for residential and SME buyers who benefit from wide product selection, competitive pricing, and direct-to-consumer delivery. Specialty pest-control stores and industrial distributors remain the primary channels for commercial and agricultural customers seeking professional-grade solutions. Direct B2B sales by manufacturers and pest-management service providers are expanding through bundled solutions that include installation, servicing, and monitoring. Supermarkets and hardware stores continue to play a notable role in the consumer market, particularly for low- and mid-priced traps.

End-User Insights

The commercial sector, including restaurants, hotels, hospitals, and office buildings, accounts for the largest share of fly trap demand. Food processing plants and industrial facilities form the second-largest segment, with high adoption of UV and electric systems. Agricultural users, including greenhouses and livestock farms, represent a rapidly growing segment as IPM adoption increases globally. Residential users prefer low-cost sticky traps and disposable solutions, though electric traps are gaining popularity due to improved safety and affordability.

| By Product Type | By Trap Mechanism | By End Use | By Distribution Channel | By Technology |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America represents one of the largest regional markets for fly traps due to strict food-safety compliance, widespread IPM implementation, and strong consumer awareness. The U.S. leads demand across commercial kitchens, food processing plants, and residential sectors. High adoption of electric and UV-based traps is driven by efficiency, regulatory alignment, and widespread availability through e-commerce and retail chains.

Europe

Europe remains a leading market with approximately one-third of global revenue, supported by stringent pesticide regulations and a strong emphasis on sustainable pest control. Countries such as Germany, the U.K., and the Netherlands favor energy-efficient UV-LED traps, biodegradable glue boards, and organic attractants. The region’s mature greenhouse horticulture industry further contributes to substantial demand for sticky cards and agricultural monitoring traps.

Asia-Pacific

Asia-Pacific is the fastest-growing region, fueled by expanding agriculture, rapid urbanization, and rising hygiene standards. China and India are major growth engines, supported by large-scale food processing, greenhouse farming, and government-driven sustainability initiatives. Southeast Asia sees increasing demand from the hospitality and public-health sectors, while Japan and South Korea represent mature markets for high-end UV traps.

Latin America

The Latin American market is growing steadily, led by Brazil, Mexico, and Argentina. Agricultural demand is strong due to high-value fruit and vegetable production aimed at export markets. Commercial and residential adoption is increasing as awareness of non-chemical pest control rises. Economic constraints limit the rapid adoption of premium electric traps but support the growth of sticky and bait-based traps.

Middle East & Africa

The Middle East & Africa region is emerging as a significant market, driven by expanding hospitality sectors, large-scale food distribution industries, and growing greenhouse agriculture. Africa’s agricultural sector, especially in Kenya, South Africa, and Nigeria, is rapidly integrating fly traps into IPM practices. The Middle East shows rising demand for premium electric traps in commercial and residential settings.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Fly Trap Market

- SC Johnson

- Rentokil Initial plc

- Koppert Biological Systems

- ISCA Technologies

- Suterra

- Catchmaster

- BioFirst Group

- Alpha Scents

- Trécé Inc.

- Eclectic Products Inc.

Recent Developments

- In March 2025, Koppert Biological Systems expanded its IPM product line with new organic-certified sticky traps designed for high-humidity greenhouse environments.

- In January 2025, Rentokil Initial announced the launch of an IoT-enabled commercial fly trap integrating automated pest counting and cloud-based monitoring dashboards.

- In November 2024, ISCA Technologies introduced a solar-powered hybrid trap for fruit farms, combining pheromone lures with UV-LED technology to support sustainable pest management.